Richard Drury

This week, we have three to six new dividend increases, including Dividend King Colgate-Palmolive! They continued their 61-year growth streak with 4.2% growth. The average increase was 10.6%, and the median was 4.2%.

As a concerned investor As a dividend growth strategy, I’m always happy to receive dividend payments, especially when the dividend increases. I’ve noticed that companies that regularly increase their dividends perform much better than companies that don’t. As such, I follow these companies closely and can confidently share my insights on upcoming dividend increases. I’ve compiled a list of the top stocks expected to grow their dividends in the week ahead. You can use this list to build your portfolio and make timely purchases with certainty.

How I create my list

The following information is the result of merging two sources Data: “U.S. Dividend Champions” spreadsheet and Nasdaq’s upcoming dividend data from select websites. The process combines data from companies with a history of consistent dividend growth with future dividend payments. It’s important to understand that all of the companies included in this list have been increasing their dividends consistently for at least five years.

Companies must have a higher total annual dividend to be included on this list. Therefore, a company may not increase its dividend every calendar year, but the total annual dividend can still grow.

What is the ex-dividend date?

The ex-dividend date is the last day you can purchase a stock to qualify for an upcoming dividend or distribution. To qualify, you must have purchased shares by the end of the previous business day. For example, if the ex-dividend date is Tuesday, you must purchase the stock before the market closes on Monday. If the ex-dividend date is a Monday (or the Tuesday after the Monday holiday), you must purchase the stock before the previous Friday.

Continuous Dividend Category

Below are the definitions of the stripe categories, which I will use throughout this article.

- King: Over 50 years.

- Champion/Aristocrat: 25+ years.

- Competitors: 10-24 years old.

- Challenger: 5+ years.

| category | counting |

| king | 1 |

| champion | 1 |

| competitor | 1 |

| challenger | 0 |

Dividend increase list

The data is sorted by ex-dividend date (ascending), then by stripe (descending):

| Name | stock ticker | stripe | forward rate of return | ex-dividend date | increase percentage | Streak Category |

| McGrath Rentals | (MGRC) | 32 | 1.61 | April 15, 24 | 2.15% | champion |

| Williams-Sonoma Corporation Common Stock | (WSM) | 18 | 1.54 | April 18, 24 | 25.56% | competitor |

| Colgate-Palmolive Company | (CL) | 61 | 2.31 | April 19, 24 | 4.17% | king |

Field definition

stripe: Multi-year dividend growth history from the American Dividend Champions spreadsheet.

forward rate of return: The payout ratio is calculated by dividing the new dividend rate by the current share price.

ex-dividend date: This is the date you need to own the stock.

increase percentage: Percent increase.

Streak Category: Here’s a breakdown of the company’s overall dividend history.

take out the money

Here is a table mapping the new rates to the old rates. It also reiterated the percentage increase. The table is sorted in a similar way to the first table (ex-dividend date ascending, dividends consecutive descending).

| stock ticker | old rate | new interest rate | increase percentage |

| MGRC | 0.465 | 0.475 | 2.15% |

| WSM | 0.9 | 1.13 | 25.56% |

| Chemiluminescence | 0.48 | 0.5 | 4.17% |

Additional indicators

Some of the different metrics associated with these companies include annual pricing behavior and price-to-earnings ratios. The table is sorted in the same way as the table above.

| stock ticker | current price | 52-week low | 52-week high | P/E ratio | low discount | high discount |

| MGRC | 117.97 | 83.63 | 130.86 | 16.47 | 41% low discount | 10% discount on high prices |

| WSM | 293.07 | 107.61 | 319.78 | 15.65 | 172% off discount | 8% high discount |

| Chemiluminescence | 86.56 | 66.78 | 90.37 | 27.27 | 30% off discount | 4% discount on high prices |

Stock symbols by production and growth rates

I’ve arranged the table in descending order so investors can prioritize current yields. As a bonus, the table also shows some historical dividend growth rates. Additionally, I include the “chowder rule,” which is the sum of the current yield and the five-year dividend growth rate.

| stock ticker | yield | 1 United Kingdom | 3 UK | 5 UK | 10 UK | chowder rules |

| Chemiluminescence | 2.31 | 2.1 | 3 | 2.7 | 3.5 | 5 |

| MGRC | 1.61 | 2.2 | 3.5 | 6.5 | 6.8 | 8.1 |

| WSM | 1.54 | 15.4 | 21.3 | 15.9 | 11.3 | 17.4 |

historical returns

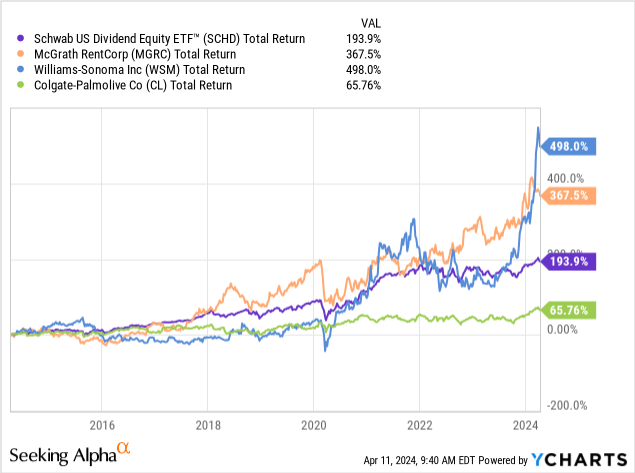

My investing strategy focuses on finding stocks that have consistently outperformed the market while growing their dividend payments. I use the Charles Schwab U.S. Dividend Stock ETF (SCHD) as a benchmark for comparing individual stock performance. SCHD has a strong track record of long-term outperformance, higher yields than the S&P 500, and dividend growth. If a stock cannot outperform the benchmark, I prefer investing in ETFs. Based on this analysis, I have included several companies in my personal portfolio. Additionally, I rely on this analysis to make timely additional purchases for my portfolio.

Ten-year dividend growth is one of the four main factors behind the SCHD index. It is also a proxy for success, although it is not a perfect predictor. Stock prices tend to follow strong dividend growth over the long term. Here’s how SCHD compares to everyone on the list.

SCHD’s performance total return rate over the past ten years is 194%. However, the performance of individual stocks within a portfolio varies widely.

WSM was the top performer with a return of 498%, but most of its returns were achieved during the COVID-19 pandemic. Before 2020, WSM’s performance lagged SCHD significantly.

On the other hand, MGRC ranks second with an astonishing total return of 368%. They generally outperformed CHD over most time frames. In my opinion, this is no more surprising than WSM’s performance.

Finally, CL’s performance has been quite disappointing, with a total return of just 66% over the decade. Even for a dividend king, that’s not a good thing.

Please conduct due diligence before making any investment decision.