RA2 studio

UK-based private equity firm 3i Group (OTCPK: TGOPF) had a very good year last year, with shares up 83%. But its rise isn’t just a feature of the past year.past five years Years, it has grown 3 times. That’s not all. It also pays dividends. Last year alone, the total return was 88%, 5 percentage points higher than the price return.

The obvious question now is whether its price gains can continue, especially given its huge exposure to the consumer sector, which is discussed in more detail here.

Key investments in the consumer sector

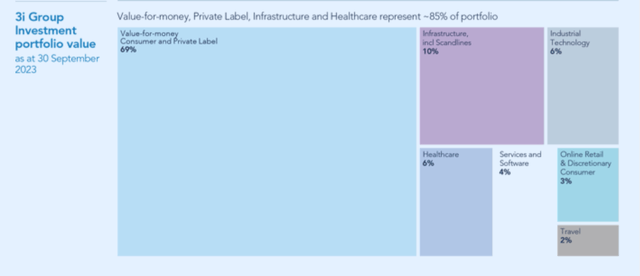

In principle, the fund invests in companies across industries. However, what cannot be ignored is that as of September 30, 2023, 69% of its investments were in the consumer sector.The Dutch say most of the investment is in action Non-food discount retailers held a 63.5% share during the same period. It also has a strong appetite for infrastructure investment (see chart below).

Source: 3i Group

Financial performance remains resilient

Performance-wise, the 3i is basically in good shape.in its introduction business update The company described Action’s strong financial position in its latest report released last week, adding that “the remainder of the 3i portfolio continues to demonstrate overall resilience, with most companies showing good momentum into 2024.”

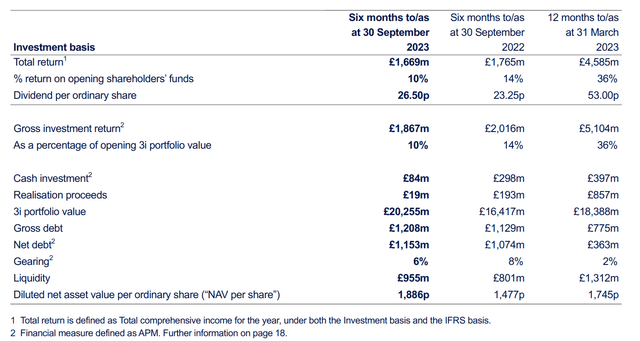

So this is Last updated results Applicable to the half year ending September 30, 2023 (first half of fiscal year 2024). Total return, or net profit as a percentage of shareholders’ funds, continues to be in the double digits at 10%, albeit at a slower pace than last year (see chart below). At first glance, the 5.4% year-over-year decline in net profit might seem concerning, but it turns out that this was due to foreign exchange translation rather than any underlying cause.

The portfolio value also grew a healthy 23.4% compared to the same period last year. The gearing ratio, or the company’s net debt to assets ratio, also improved to 6% from an already healthy 8% in the first half of fiscal 2023.

Key financial data for the first half of fiscal year 2024 (Image source: 3i Group)

Amazing growth in action

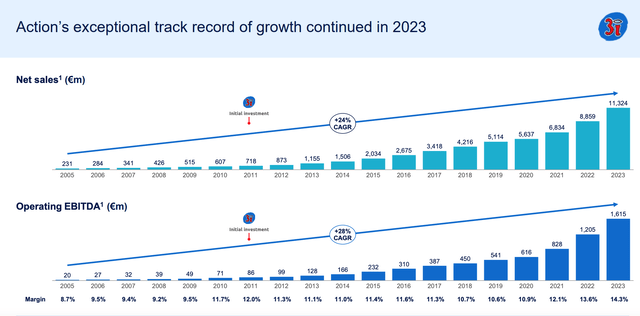

To better understand what’s next for 3i, it’s worth taking a closer look at Action’s performance, as it relies heavily on it. Retailers have no reason to worry either. Between 2005 and 2023, its net sales compound annual growth rate (CAGR) was 24%. In addition, its average net sales growth over the past five years has been 22%, far exceeding the industry average of 12%. It’s also off to a strong start in 2024, with sales up 21% year over year in the first 11 weeks of the year.

The company’s operating EBITDA has also been growing since 2005, with a CAGR of 28% through 2023. Margins expanded to 14.3% from 8.7% in 2005 as operating EBITDA grew faster compared to net sales. It also improved from 10.7%. Even five years ago (see image below). Action also expects profit margins to reach 15% by 2026.

Source: 3i Group

Consider cost dividend rate

With solid performance in the first half of FY24, the company also increased its dividend by 14% compared to the same period last year. While the full-year outlook also looks good, even growing at the same rate for the full year of fiscal 2024, the dividend yield would still be a bit flat at 1.9%. This is slightly lower than the 2% TTM yield. But as noted at the outset, the modest dividend yield masks the impact of the stock’s passive income over time.

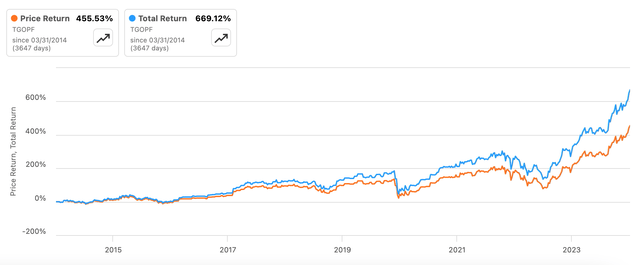

Think about this. An investment in 3i five years ago had a yield on cost of 5.25%, while an investment in 3i 10 years ago had a yield on cost of 10.4%. Furthermore, over the past decade, stocks’ total returns have exceeded pure price returns by 214 percentage points, which is pretty good in itself (see chart below).

Price and total return, 10 years (Source: Seeking Alpha)

market multiple

Additionally, the stock’s price-to-earnings ratio looks good. Assuming that foreign exchange trends remain unfavorable for the full year of FY2024, as they were for the first half of FY2024, net profit will decline. However, the forward GAAP price-to-earnings (P/E) ratio is still at a low level of 6.2x, which compares well with its peers.

For example, the corresponding ratio for Blackstone (BX), the largest publicly traded private equity fund by market capitalization, is 25.6x. But even funds with a smaller market capitalization than 3i, such as TPG ( TPG ), have a much higher forward P/E ratio of 22.1 times. This shows that 3i still has significant upside potential.

Meanwhile, the net asset value per share is also worth considering. If the figure continues to grow by 27.7% year-on-year for the full year of FY24 (the same as for the first half of FY24), the figure will reach £22.3. However, 3i shares trade at a 26% premium to where they are listed on the London Stock Exchange. This typically creates risk for its price, but the stock hasn’t been held back by that lately. In fact, it has been trading above NAV over the past year.

Blockbuster action investments bring macro risks

What really poses potential risk is its investment in action. 3i has performed very well in the past, but its large exposure also makes the fund vulnerable. Risks arise from challenges to Europe’s macroeconomic health. While it has interests in big European countries such as France and Germany, in addition to the Netherlands, which can balance its performance, weak growth in the euro zone cannot be ignored. GDP will barely grow in the last quarter of 2024 Year-on-year growth of only 0.1%.

According to the European Commission, an improvement is expected in 2024, reaching 0.8%, but even then the growth will be quite low. Growth is not expected to increase above 1% until 2025. With inflation falling sharply to 2.7% this year from 5.4% last year, there may be more breathing room. But the key here is that the economy is not out of the woods yet. As a consumer products company, Action faces the risk of being impacted. By extension, the same goes for the 3i.

What’s next?

But it must be acknowledged that the risks of action in 2024 are lower than last year. That means it’s likely to continue to perform well this year, as sales in the first 11 weeks of the year have proven. This bodes well for 3i, which also posted good total returns in 1H FY24, although its net profit contracted slightly from last year due to unfavorable currency dynamics.

Even if full-year net income continues to decline at the same rate as in the first half of fiscal 2024, the stock’s forward GAAP P/E ratio still looks good compared to its peers. Additionally, its dividend has increased significantly over time, although its continued price appreciation has kept its dividend yield low. Happily, the stock typically trades at a premium to NAV per share, as it does now.

All in all, I think the benefits of the 3i outweigh the risks. I give it a buy rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.