Pictures of Jet City

The stock market no longer works like it used to, and 3M Company (NYSE:MMM) is my latest evidence.This is why, as the title of this article states, I firmly believe that having a buy, sell, or hold rating on a stock is helpful though In some ways, it’s easy to be misunderstood. When I was an investment advisor, I was somewhat limited in my ability to express myself on many topics, so I had to keep those opinions to myself. And, while they are just my opinions, I won’t back down now.

Specifically, I think 3M is a stock that goes beyond the bottom line view. As discussed below, I have three conclusions about the condition of this Dow component:

- It’s not a permanent part of my long-term stock watch list, but Very close. I’ve always viewed Dow stocks as high-flying stocks compared to companies that essentially can’t extricate themselves from trouble. Because that’s usually the case. This is the business cycle.

- MMM is clearly in trouble, with the stagnation of some of its mature business lines, some legal issues, the spin-off of its healthcare unit, new leadership and, oh yeah, the fact that it’s a staid Dow Industries, not a FAANG stock. But I’m not valuing this stock based on its current problems, but rather their ability to withstand when things don’t go their way. I suspect savvy Seeking Alpha readers will know what I mean when I say I’m not the first investor to see opportunities in out-of-favor companies.

- The way I manage my stock portfolio involves identifying a core group of 40 stocks, slowly replacing them as needed, but by being willing to increase or decrease position sizes in the range of 1% to 5% for those 40 stocks. Driving total return stocks. It’s not an index, but it has some guardrails that have helped indexes become the most managed equity asset over my 30-plus year career.

Therefore, in the current environment, I can call MMM a buy, a hold, and a sell at the same time. I’ll leave this report alone simply because it reflects my view that MMM is not as attractive as several other stocks in my basket, but is reaching an extreme downside that I would like to have in my portfolio. I do this with the expectation that, as the dust settles, my target position size will be higher in 6-12 months than it is now.

My approach to stock research: Leave it on a random sticky note

My stock research involves three things. First, look for companies with long-term quality by relying on sources like quantitative ratings from Seeking Alpha. Next, I use a proprietary method I created and described in a recent article called Yield at Fair Prices (YARP), which looks at the history of a stock’s dividend yield in the same way that fundamental analysts look at the history of price-to-earnings ratios, P/ S and other metrics serve as valuation and risk measures for stocks. On top of that, I’ve been a chart analyst since I was 16, “only” 44 years ago. I base it on price trends and volume, which is my bread and butter if you will. Frankly, the combination of Seeking Alpha Quantitative Ratings and my non-fundamental skill set (YARP dividend analysis and charting) has become a solid system that I use for my own asset base now and then. While MMM is not my favorite stock “right now,” I would put it in the “never ignore it or rule it out” category.

Seeking Alpha’s pages are filled with trenchant analysis of the fundamentals and operating details of large-cap stocks like this one. So, since I admit that I’m not a fundamental analyst, I won’t try to add value in this way. Because it won’t! That said, I’ve somehow survived as a professional investor since the 1990s, managing 3 mutual funds and a 9-figure client asset base using this approach. So I certainly understand and expect that the more classic balance sheet/income statement crowd will challenge my point. I welcome that because that’s what the market is made of.

So, using MMM as an example, here’s an overview of one of America’s great businesses from St. Paul, Minnesota, which has now been in business for 123 years. MMM’s 4 main sectors are Security and Industrial, Transportation and Electronics, Consumer Products and the aforementioned lame duck, Healthcare.

This incomplete list of products and solutions leads me to believe that this company has the flexibility and brand reputation that few can achieve, which is a sustainable competitive advantage, albeit at a slower growth rate than in the past:

Abrasives and finishing for metalworking, auto body repair, closure systems for personal hygiene products, masking materials (like we are using during the pandemic), packaging materials, electrical products for construction companies, structural adhesives and tapes, Such as iconic sticky notes and Scotch tape, ceramic solutions, adhesion/adhesive products, semiconductor production materials; data center solutions, highway reflective signage, vehicle safety, consumer bandages, stents, stents and consumer respirators, home Cleaning products, paint accessories, picture hanging and stationery products.

I just have a hard time believing that a company with so many ways to win could lose money so frequently that the stock doesn’t deserve to be at least in my top 40 stocks. Currently yielding over 5.5% and selling for half the price from three years ago, MMM shows me some signs of a great company at a very reasonable price. I’ll turn to my primary stock indicators in a moment, but I’ll conclude my defense of the blue-chip stocks of the Dow Jones Industrial Average by saying that I’m proud to represent those who can emulate highway billboards that read “We Buy Ugliness” House of”. My summary position in this case is “I buy ugly stocks… I just don’t give them much weight until their price becomes a catalyst that signals to me that the market is ready Good to rediscover it. That’s what happened to many industrial stocks after 3 years of FAANG dominance.

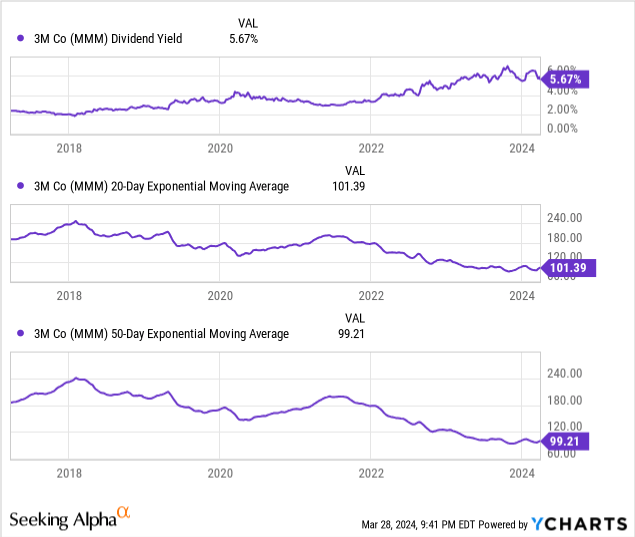

MMM’s YARP analysis

MMM is in what I call “higher risk but very high potential reward” territory. The dividend yield is near its upper limit over the past 7 years, and the trend suggests to me that the stock has not really made the “turn” I need to take a larger position. But it has fallen far enough that I would like it to be on my list of 40 stocks, which would force me to hold at least a 1% position, but certainly well below my maximum position of 5% at cost any stock.

The 20- and 50-day moving averages are low, suggesting a bottom, but the stock’s recent trading activity has been chaotic. There is clearly a bull-bear/trader-investor situation here, and while it may not be resolved next month, I think things will be different 6-12 months from now, especially outside of this time frame . This being the stock market, even fortress-like businesses can see their prices drop 30%-50% while they still continue to run their businesses in the long term. Just like the stocks in my portfolio, there’s a trade-off here. I’m looking for a mix that usually has some recent “losers” like this one.

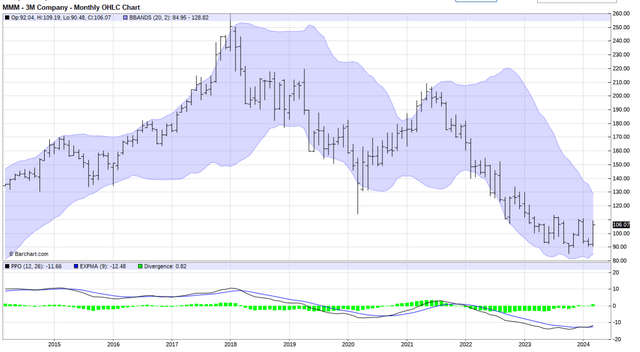

MMM Technology Price Chart: Long Undervalued. Very underrated.

I don’t want to screen for recent volatile trading action because this is a stock I bought at the low end of the position size spectrum. But here’s the monthly price chart below, and in the lower half of the chart, the PPO indicator (similar to MACD, but expressed in percentages instead of dollars) tells me: There’s at least 100% upside potential here, but measured in a group Maybe there are still 4-5 years of ups and downs. Alternatively, it only takes a bumpy 6-12 months for most of the current woes to fade from investors’ radar, as has been the case for many blue-chip stocks historically.

Bar chart website

So far, I’ve put into words the “quality” aspects of MMM that lead me to place it among the top 40 stocks in which I hold at least a small position as part of my total portfolio (which consists of three stocks) Some ETF-based strategies, a lot of Treasuries, and some marginal options for tail risk protection and return enhancement.

Think of the entire portfolio like a multi-manager hedge fund, except I am 100% the manager. And, it’s built and rotated based on my decades of learning and perspective on how modern investing markets should be navigated. In other words, nothing like the past.

MMM: 50 cents on the dollar, really?

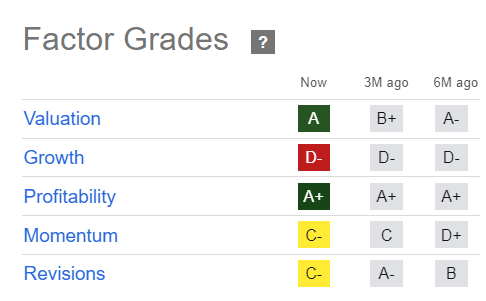

I have found these following alpha quantification factor levels to be a good guide. One of my main uses for this system is to reduce my list of hundreds of potential stocks to one, eliminating “rogues,” which I define as companies with poor profitability. As shown below, MMM’s recent troubles have not resulted in a change in this rating. Its valuation of A, equivalent to 11 times trailing 12 months earnings, makes MMM worth taking a moderate stance here. This is not a growth business right now, nor has it been a high-growth stock for decades. However, I think this is a trade-off for higher yields and the upside that comes with excessive downside on the price side. The stock fell 50% in 3 years, giving rise to the Wall Street proverb “trying to buy a dollar for 50 cents.” For some, this is a phrase they heard when they were young in the investing industry. For me, this is something I learned in my 20s and will never forget. It’s right in front of me, one of the 30 stocks in the Dow Jones Industrial Average.

Seeking Alpha

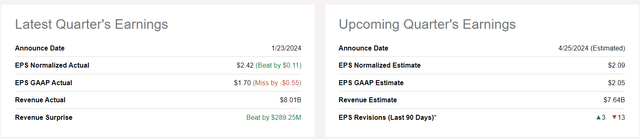

Here’s a snapshot of earnings and the next announcement in about 4 weeks. The key figure for me is the 13 analyst EPS downward revisions. For some, bad news means selling. I? I moved closer. But according to the risk management approach, holding around 1% of stocks is acceptable, but now holding 4-5% of my YARP stock portfolio in MMM is not possible. At every fork in the road I take the conservative path. But imagine what impact even a slight improvement in earnings and a better-than-expected outlook would have on this situation?

Seeking Alpha

Final Thoughts: Yes, they are unusual!

It’s been a while since I’ve held MMM, but I’m stepping in here on a “small scale,” so I’m officially rating it a Hold, not a Buy. As noted at the top of this report, here’s the picture: A contrarian blue-chip name, out of favor with many of Wall Street’s movers and shakers, but showing early signs through my YARP approach that only modest price increases from here could make it a good buy for me. Say it’s more important.

All of this makes me glad that I view equity investing as a portfolio construction exercise, rather than akin to sports betting or horse racing handicaps, as many do these days. Buy, sell or hold? For MMM, in a way, it’s all three. Because, if I’m happy with the process, then the label doesn’t matter.