Ryan J. Lane

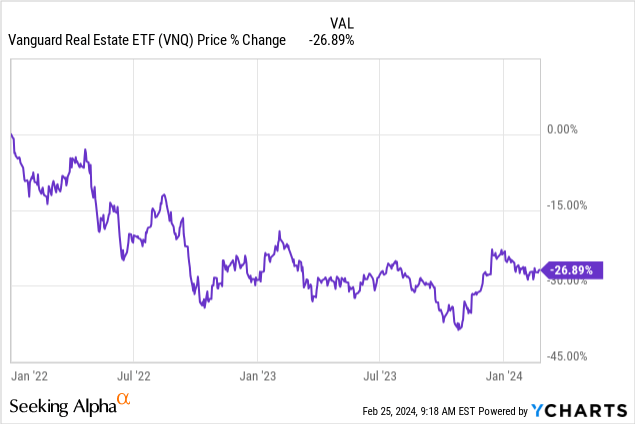

While most REITs have been growing cash flow and increasing dividends over the past two years, their stock prices have fallen sharply.

As a result, REIT dividend yields are currently at all-time highs.

This is It’s not uncommon to find quality REITs yielding around 8%, and many of them pay you monthly.

As a result, building a substantial income stream through REIT investments is now more achievable than it was just a few years ago.

In today’s article, I want to highlight 5 high-yield REITs that generate over $1,000 in income for me every month.

Their average blended dividend yield is about 7%, and it’s all paid monthly. This means that if you invest around $170,000, you can earn $1,000 per month in these REITs.

EPR features (EPR)

EPR Properties is an investment-grade REIT specializing in experiential net lease properties such as golf courses, water parks, movie theaters and ski resorts:

Characteristics of ethylene propylene rubber Characteristics of ethylene propylene rubber

Most of its investments are what we call triple net lease investments. This type of property differs from traditional real estate investments in that its rental structure is very beneficial to the landlord:

- The lease term is long, over 10 years.

- Rent automatically increases by approximately 2% each year, regardless of economic conditions.

- Tenants are responsible for all property expenses, even maintenance costs.

As a result, this is generally a very reliable business that generates highly consistent and predictable cash flow. Realty Income (O), the world’s largest net lease REIT, has grown its dividends for nearly 30 years in a row, despite facing a huge financial crisis, COVID-19, and many other crises.

But EPR trades at a steep discount, currently trading at just 8.4 times its cash flow and with a dividend yield of 7.7%.

The reason its valuation is so low is because it took a huge hit during the pandemic, and it’s still hurting market sentiment to this day. For experiential hotels, the epidemic may be the worst crisis because under all the restrictions, they cannot make a profit and many hotels have to temporarily close, causing EPR to miss many rent payments.

But the good news is that the epidemic has long passed and EPR’s cash flow has returned to pre-epidemic levels. Even its weakest property (movie theaters) has recovered strongly, with its rental coverage now at similar levels to 2019. The rest of the portfolio is performing better, so its overall rental coverage is now well above pre-pandemic levels.

Characteristics of ethylene propylene rubber

The market seems concerned that EPR will suffer if we get into a recession, but as we noted before, EPR is a triple net lease owner and its rents will continue to grow regardless. Today, its leases average 12 years, with annual rent increases of 2%, and strong rent coverage provides a good margin of safety.

The low payout ratio of about 70% is well covered by a monthly dividend yield of about 8%, which leaves EPR with plenty of cash flow to reinvest in growth and acquire additional properties. As a result, we think the dividend is safe and even expect it to grow in the coming years.

As EPRs continue to prove the market wrong and interest rates eventually return to lower levels, we expect the stock to reprice to a dividend yield closer to 6%, unlocking ~30% upside for shareholders.

Northview Residential REIT is a new REIT that pays a monthly dividend yield of 7.8%.

It owns most of its apartment communities in Canada’s smaller secondary markets, and it’s offering such high yields because it’s currently priced at a steep 35% discount to its net asset value.

This is the lowest valuation among Canadian apartment REITs.

Northview Residential Real Estate Investment Trust

We believe there are two reasons for this discount.

First, REIT’s leverage ratio is higher than that of its peers, and the recent surge in interest rates has caused market concerns. Its LTV seems to be particularly high at 65%. But it’s worth noting that the LTV is so high largely because Northview Residential REIT focuses on higher capitalization rate properties in the secondary market. Its cash flow-based leverage is actually very similar to its peers. In addition, the REIT retains about 30% of its cash flow to pay down debt over time, and rents are rising. Therefore, we think debt is manageable and interest rate cuts will also help them.

The second reason is that, until recently, Northview Residential REIT was a much smaller, externally managed CEF that was overleveraged and paid an unsustainable dividend, putting the company at risk. Understandably, there was little interest. But the company then underwent a transformation. It internalized management, reorganized into a real estate investment trust, and conducted recapitalization transactions, significantly increased its size, reduced leverage, and adjusted its dividend.

Northview Residential Real Estate Investment Trust

The market seems to have missed this shift, and as a result, it continues to trade at very low valuations and high dividend yields.

It will take time for perceptions to change, but as the REIT continues to deleverage its balance sheet, we expect it to eventually reprice in line with its peers and closer to its NAV, which has the potential to unlock 30-50% from now room for growth.

While you wait, you can earn a dividend yield of nearly 8%, paid monthly.

Gladstone Commercial Series O Preferred Stock (GOODO)

Gladstone Commercial is a small-cap net lease REIT that owns primarily industrial properties:

glaston business

REITs are discounted today and offer good value to investors, but I’m not interested in common stocks for three reasons:

1) REITs are managed externally, which can be a source of conflicts of interest. Management has a good track record and they are involved, which aligns their interests well, but I would still like them to manage it in-house.

2) About 35% of their revenue comes from single-tenant office buildings, and the net asset values of these properties have declined significantly in recent years and I think will continue to face challenges.

3) Given this, their leverage is a bit too high for me to feel comfortable owning the common stock.

However, I think the REIT’s preferred stock is interesting because it is currently priced at a 23% discount to its par value and offers a 7.8% dividend yield paid monthly.

The market is heavily discounting both the Regular and Preferred models, but I think the Preferred model is pretty good. It has seniority over common shares, which have a large cushion/margin of safety to absorb potential losses.

I think preferred stock dividends are safe and there may be some upside as REITs continue to deleverage their balance sheets, sell off office assets and interest rates return to lower levels.

This is the lowest yielding REIT on the list, offering a 4.5% dividend yield, but the reason the yield is so low is because they have lower cap rates/faster growing assets and retain nearly 40% of their cash flow to repurchase shares.

BSR is an apartment REIT that is unique in that it invests almost entirely in the Texas Triangle:

BSR Real Estate Investment Trust

These markets are currently facing oversupply causing rents to stagnate, but historically these markets have performed very well and we expect strong rental growth over the long term as the ratio of rents to income remains very low relative to the national average And these markets attract a lot of people.

Still, the stock is currently priced at a nearly 40% discount to its NAV due to recent challenges, and management is busy buying back shares at such low levels to create value for long-term shareholders.

The 4.6% dividend yield, paid monthly, has historically been classified as a “return of capital,” making it more tax efficient for shareholders.

The last monthly paying REIT I want to highlight is called Canadian Net REIT.

It is essentially a smaller version of real estate income operating in Canada.

The company has built a portfolio of net lease properties with a focus on defensive categories such as grocery stores, convenience stores and quick-service restaurants.

Most of its tenants are investment-grade rated and enjoy CPI rent adjustments in their leases.

Canada Net REITs

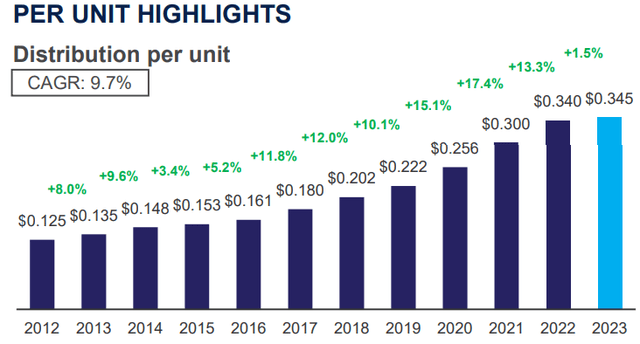

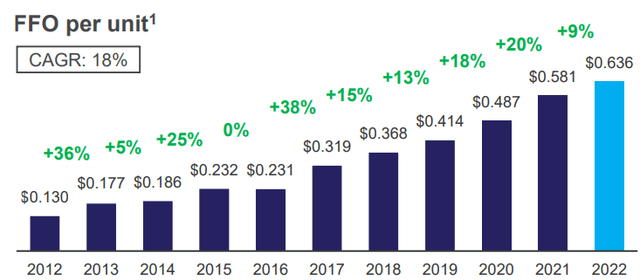

What’s more, this REIT has one of the best performance records of any REIT, with both FFO per share and dividends per share growing at a breakneck pace:

Canada Net REITs Canada Net REITs

Nonetheless, the stock is currently discounted, trading at just 8x FFO and yielding a monthly dividend yield of 6.7%, which we believe is sustainable.

The dividend payout ratio is only 54%, leaving ample cash flow for the REIT to reinvest in purchasing more properties, while rents continue to grow.

Conclusion

The REIT market is awash with high-yield opportunities today, as most REITs have seen their stock prices plummet even as they continue to increase their dividends.

Even better, many of our REITs pay us monthly.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.