AdShooter/E+ via Getty Images

introduce

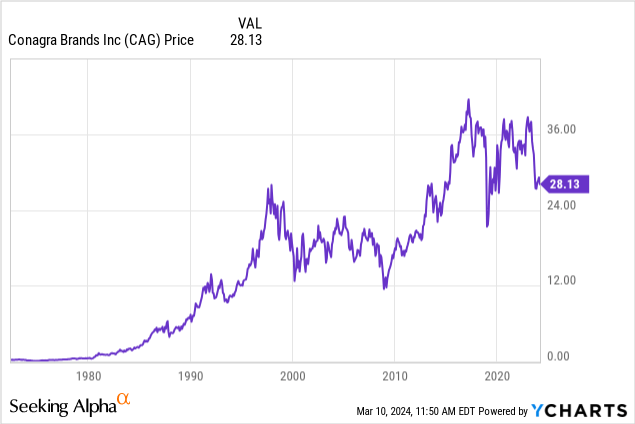

It’s time to talk about one of the casualties of rising inflation.that company is ConAgra Brands, Inc. (NYSE:CAG)a packaged food giant that I’ve become very fond of since last year.

my latest articles The article about this stock was written on November 20, and my headline at the time was “Why ConAgra is a Top Value Play in 2024 and Beyond.”

Since then, the share price has returned 1.3%, which pales in comparison to the S&P 500’s 12.7% return.

However, this was just the beginning as the stock price finally stopped falling.

The company faces limited pricing power and poor consumer confidence as inflation surges due to massive fiscal and monetary stimulus in 2020 and 2021.

As I often say, Conagra doesn’t have that pricing power Companies like PepsiCo (PEP) and The Coca-Cola Company (yes) have.

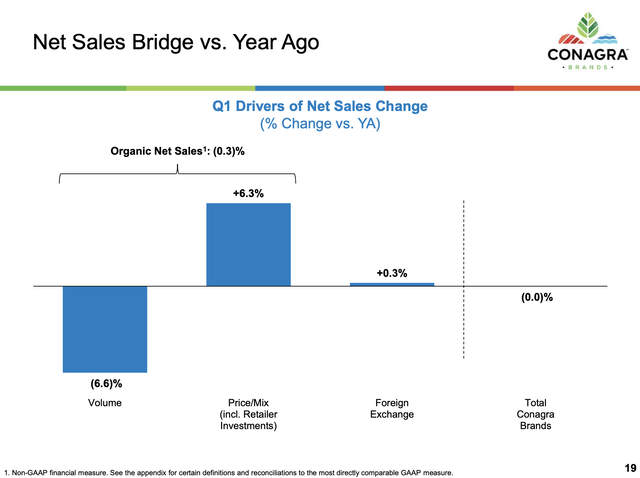

So in my November article, I included a very ugly chart showing that despite a 6.3% (!) increase in pricing, the company was unable to offset a 6.6% decline in sales.

conagra brand

In this article, I will update my bull case view as Conagra continues to make progress despite facing headwinds.

As its share price suggests, we’re still in the early stages of its recovery.

However, if successful, I believe the stock can generate higher returns over the long term.

So, let’s get into the details!

ConAgra continues to grow where it matters most

Last month, the company presented at the Consumer Analytics Group New York 2024, also known as CAGNY.

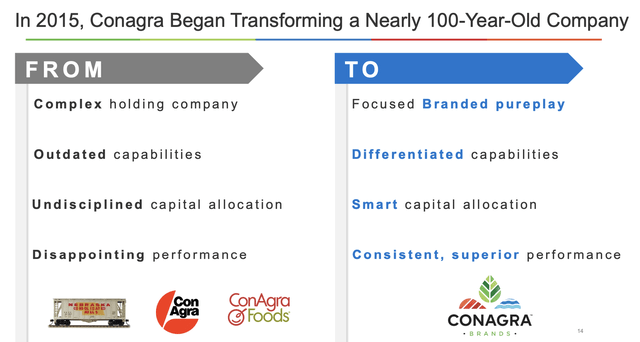

One of the most interesting things about ConAgra is its transformation.

This is what I wrote last July (emphasis added):

The aim is to transform the company into a modern food company with top-quality products that offer stronger demand, higher margins and (relatedly) better pricing power.

Especially in the current market environment of high inflation and weak consumption, we see that the strongest consumer companies are those with strong brands and pricing capabilities.

conagra brand

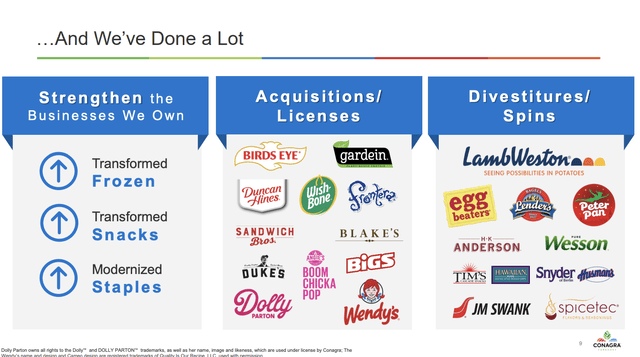

The company also elaborated on this during CAGNY, saying it transforms key segments including frozen products, snacks and staples. It also includes spin-off companies such as Lamb Weston Holdings, Inc. (LW), which produces a variety of French fries.

Currently, approximately 80% of its products are ranked #1 or #2 in the categories they serve!

conagra brand

It is now the fourth largest food company in the United States. Only PepsiCo, Kraft Heinz Co. (KHC) and General Mills Co. (GIS) are larger.

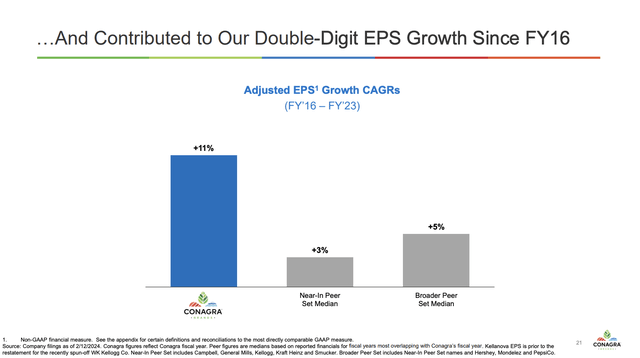

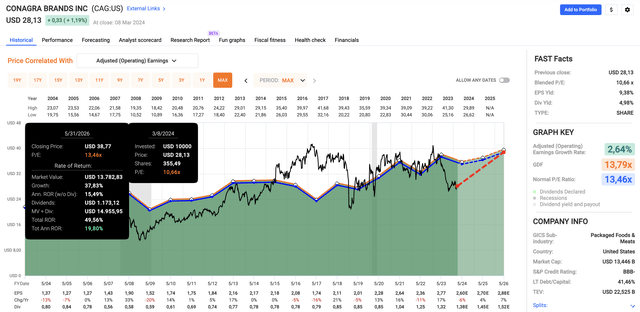

That said, while its share price may not reflect this, the company has delivered consistent earnings growth, with earnings growing at an impressive 11% CAGR since fiscal 2016.

conagra brand

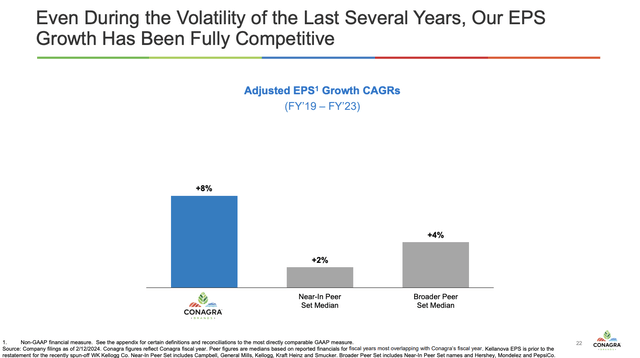

Even during a challenging period from fiscal 2019 to fiscal 2023, the company performed surprisingly well, growing adjusted earnings per share at a compound annual rate of approximately 8%.

Take a look at the chart below, it’s far ahead of its peers.

conagra brand

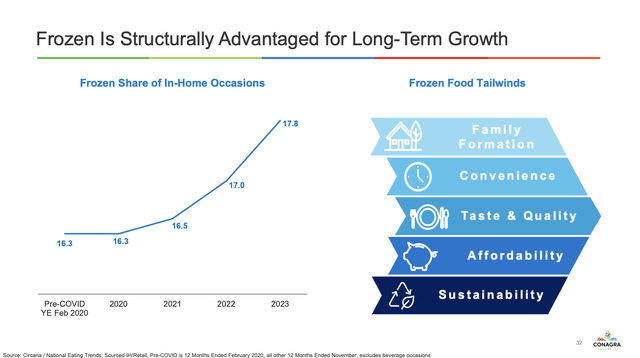

Returning to my market leadership comments, as we see below, the company expanded its market share in key segments such as frozen foods in the wake of the pandemic.

While I’m not a fan of processed food (I try to cook everything from scratch), I love this market because convenience is key for so many people. Providing the right products can go a long way in this industry.

conagra brand

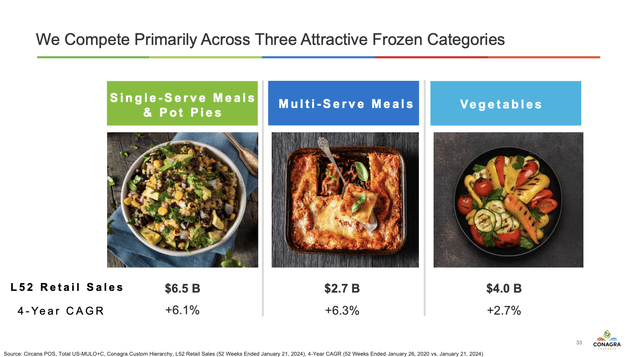

As a result, the company’s single-serve and multi-serve meal businesses have grown rapidly over the past four years, with vegetable sales growing at a compound rate of 2.7%. The compound annual growth rate of both single-service and multi-service categories exceeds 6.0%.

conagra brand

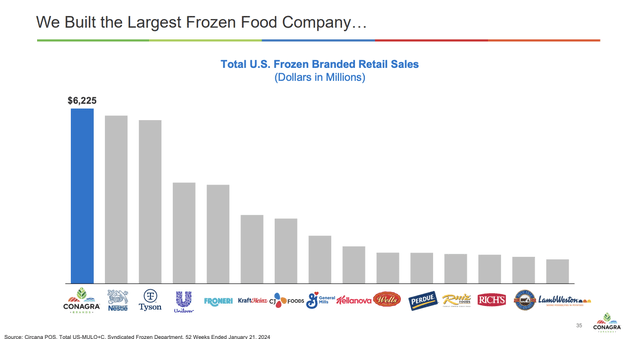

ConAgra has thus become the largest frozen food company in the world!

conagra brand

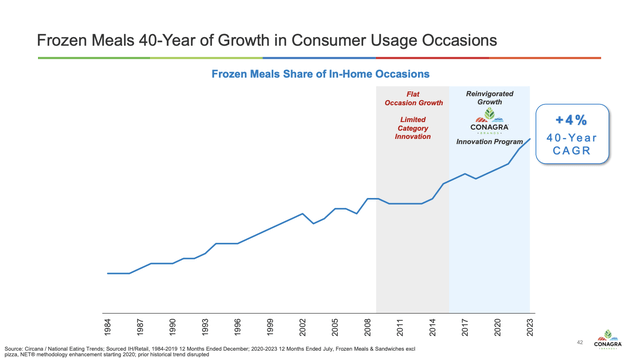

On top of that, let me also share with you the chart below. As we’ve seen, after a disappointing few years following the financial crisis, the company’s “innovation program” clearly led to higher market share, especially since it ended decades of market share expansion.

Now, the company is back on track.

conagra brand

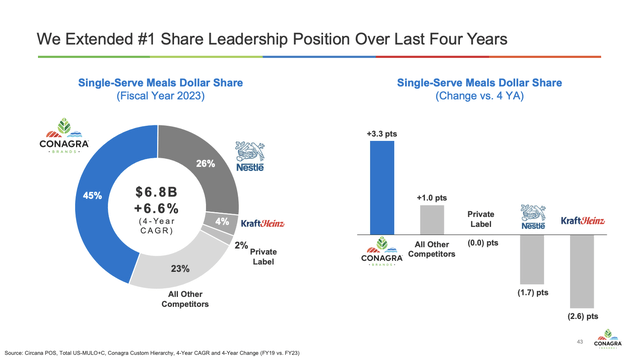

The company currently has a 45% market share in the single-serve meal category, significantly ahead of its largest peers in expanding its business footprint in this area.

conagra brand

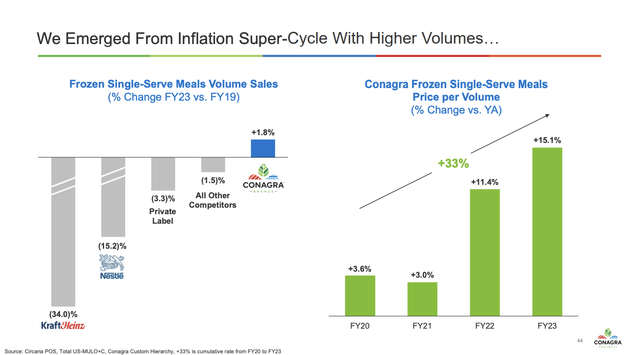

The frozen single-serve segment has also withstood inflationary pressures, growing 33% since 2020.

conagra brand

With all of this in mind, let’s take a closer look at the recent results.

Is ConAgra Hitting Bottom?

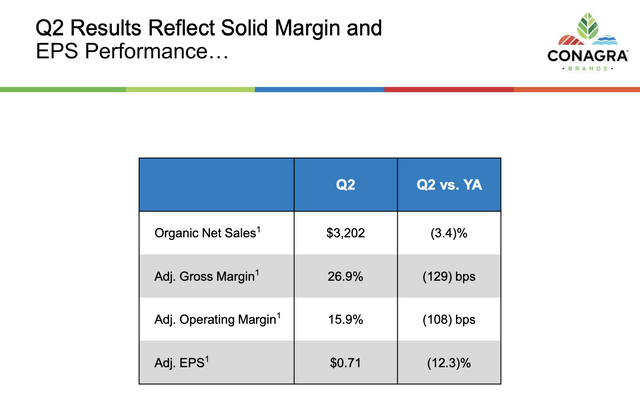

In the second quarter of fiscal 2024, the company’s net sales were $3.2 billion. Organic decline was 3.4% (adjusted for acquisitions and foreign exchange rates).

conagra brand

Total sales fell 3.2%.

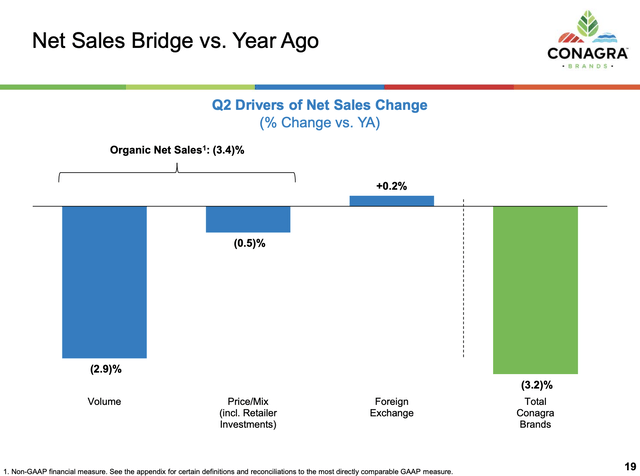

As shown in the figure below, declining sales are the main reason for this phenomenon, with sales falling by 2.9% compared with the same period last year.

Not even pricing can save the day.

conagra brand

The company noted on the call that while the quarter continued to be impacted by consumer weakness, it had seen some signs of recovery.

From a macro level, the industry-wide shift in U.S. consumer behavior that we discussed in last quarter’s call continued into the second quarter. These shifts in behavior continue to put pressure on volume and mixing. However, while consumers are still adopting some value-seeking strategies when shopping, we are seeing clear progress in sales recovery. – CAG 2Q24 Earnings Conference Call

Overall, it’s not all bad.

Despite the challenges, the company has made progress in some areas.

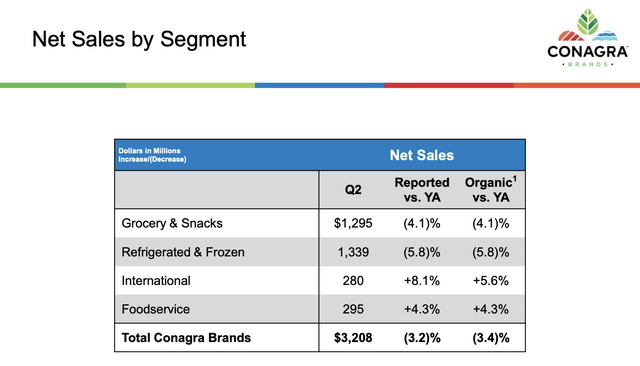

For example, international net sales grew 5.6% organically, driven by strong performance in key markets such as Mexico and Canada.

According to the company, drivers came from increased brand activation, point-of-sale performance, innovation (such as new and improved products) and improved distribution capabilities.

By the way, I may write an article about food distribution industry stocks and how to capitalize on important trends in the near future.

conagra brand

In foodservice, organic net sales grew 4.3%. This is primarily due to favorable price/mix and better distribution within the Frozen portfolio.

Unfortunately, snacks and frozen foods underperformed, primarily due to rising inflation and its impact on consumers.

However, the company made strategic investments to drive growth, including targeted investments in brand-building initiatives.

The main focus here is frozen foods, which we discussed in the first part of this article.

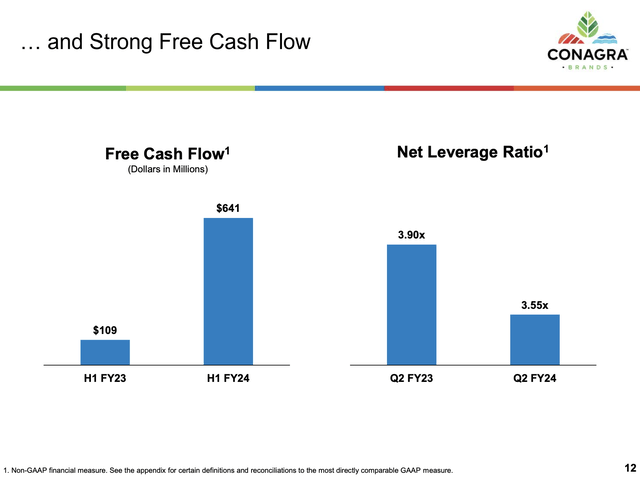

It’s also worth pointing out that the company has done a tremendous job growing free cash flow and lowering debt.

This is important to shareholders and will allow the company to increase its dividend in the future.

Looking at the data below, we see that free cash flow in the first half of fiscal 2024 was approximately 6 times higher than the previous year’s results.

conagra brand

Meanwhile, $500 million worth of debt was repaid in the past 12 months, reducing net leverage to 3.55x.

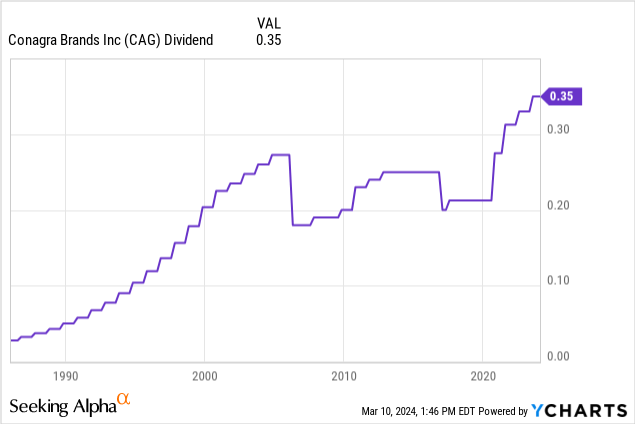

As for dividends, CAG currently pays $0.35 per share quarterly. This represents a yield of 5.0%.

The dividend is protected by a 54% payout ratio through 2024 and a healthier balance sheet with an investment-grade credit rating of BBB-.

Its most recent dividend increase was 6.1% on July 27, 2023. The five-year dividend compound annual growth rate is 10.1%, which is very high for a company with a 5.0% yield.

Also, note that CAG is not a dividend cutter. The chart below shows two major declines. These are spin-offs, just like the company parted ways with Lamb Weston.

So, what about valuation?

Guidance and Valuation

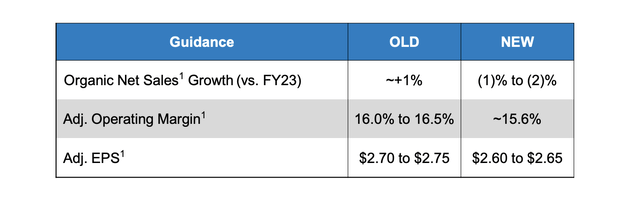

As shown below, the company revised its guidance for the remaining two quarters of fiscal 2024.

Full-year organic sales are now expected to decline.

We are updating our fiscal ’24 guidance to reflect the consumer environment and additional brand investments in the second half. Our new guidance includes organic net sales declines of 1% to 2% compared to fiscal ’23, adjusted operating margin of approximately 15.6%, and adjusted EPS in the range of $2.60 to $2.65. – CAG Second Quarter 2024 Earnings Conference Call.

conagra brand

Additionally, as we can see in the quote above, the company expects operating margin and adjusted earnings per share to be lower by $2.60 to $2.65.

As previously stated, we are updating our FY24 guidance to reflect our year-to-date performance, expectations for a slower volume recovery and additional brand investments in the second half. – CAG Second Quarter 2024 Earnings Conference Call.

With that in mind, analysts agree with the company, predicting earnings of $2.60 per share this year.

The good news is that analysts expect growth investments to pay off, with growth of 4% in 2025 and 7% in 2027.

quick chart

Furthermore, CAG’s current blended P/E ratio is only 10.7x, well below the long-term normalized ratio of 13.5x.

While I believe recovery will take time, as I don’t expect the fight against inflation to be won anytime soon, I very much like CAG’s valuation and expect a gradual recovery to $39 per share over the next few years.

This amounts to an underestimation of approximately 40%.

On top of that, it has a well-protected 5.0% dividend, well-positioned to enjoy mid-single-digit annual growth.

For investors looking for undervalued high-yield investments, I believe CAG may be the right choice.

take away

ConAgra faces headwinds from inflation and shifts in consumer behavior, which have negatively impacted its recent financial numbers.

However, its strategic transformation and brand investment show bright prospects for future growth.

At the same time, with strong free cash flow, debt reduction, and stable dividends, CAG presents an undervalued opportunity for investors seeking dividend income and potential capital gains.

While near-term challenges appear to be very persistent, the company’s long-term outlook remains positive, making it an excellent deep-value high-yield play in the defensive consumer space.

Advantages Disadvantages

advantage:

- Long term transformation: ConAgra is undergoing a strategic transformation focused on streamlining its product portfolio, increasing sales and profit growth.

- Market leader: CAG has a large market share in key segments such as frozen foods and is positioned as an industry leader.

- Financial health: Despite some headwinds, the company’s strong free cash flow generation and debt reduction efforts bode well for future shareholder returns.

- Dividend Stability: CAG offers a well-protected dividend, currently yielding 5%.

shortcoming:

- Inflation impact: Rising inflation and weak consumers have led to very low sales.

- Guidelines revised: CAG’s revised 2024 guidance showed lower expectations for sales and profits due to poor consumer confidence.

- Competitive landscape: Although CAG has a strong market position, competition from peers is always a risk.