The three-statement framework is one of the most important to understand. It underlies most important financial decisions and ultimately determines how most people are compensated. If you understand it thoroughly, you have a distinct advantage in this world.

So, can you explain in 60 seconds how financial statements work together? This has been one of my favorite interview questions since I started working in private equity (besides the fact that I usually don’t impose a time limit, and that includes online attention spans). The confidence and detail with which candidates answer questions reveals a lot about their knowledge and way of thinking.

This is a example (Also available at Instagram and Tik Tok) How to answer this question in video format, with the images and text below for those who want to spend more time reading the material (Click on the image below to view the video description).

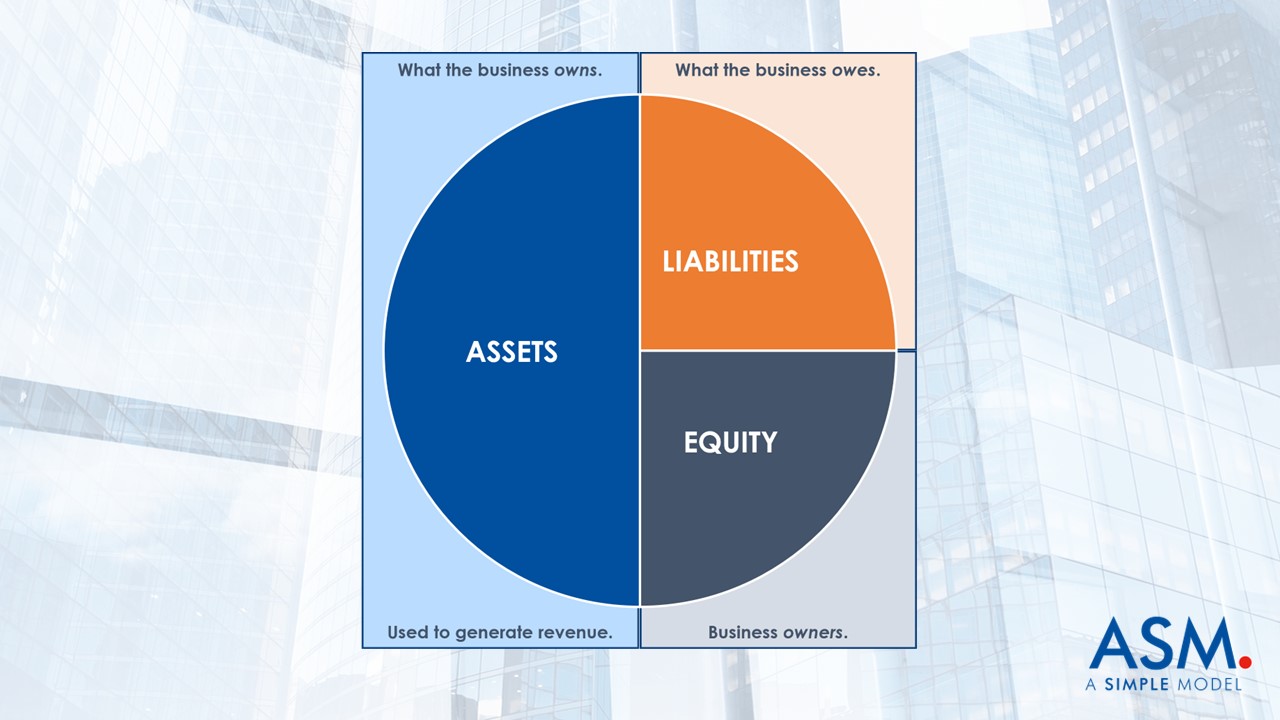

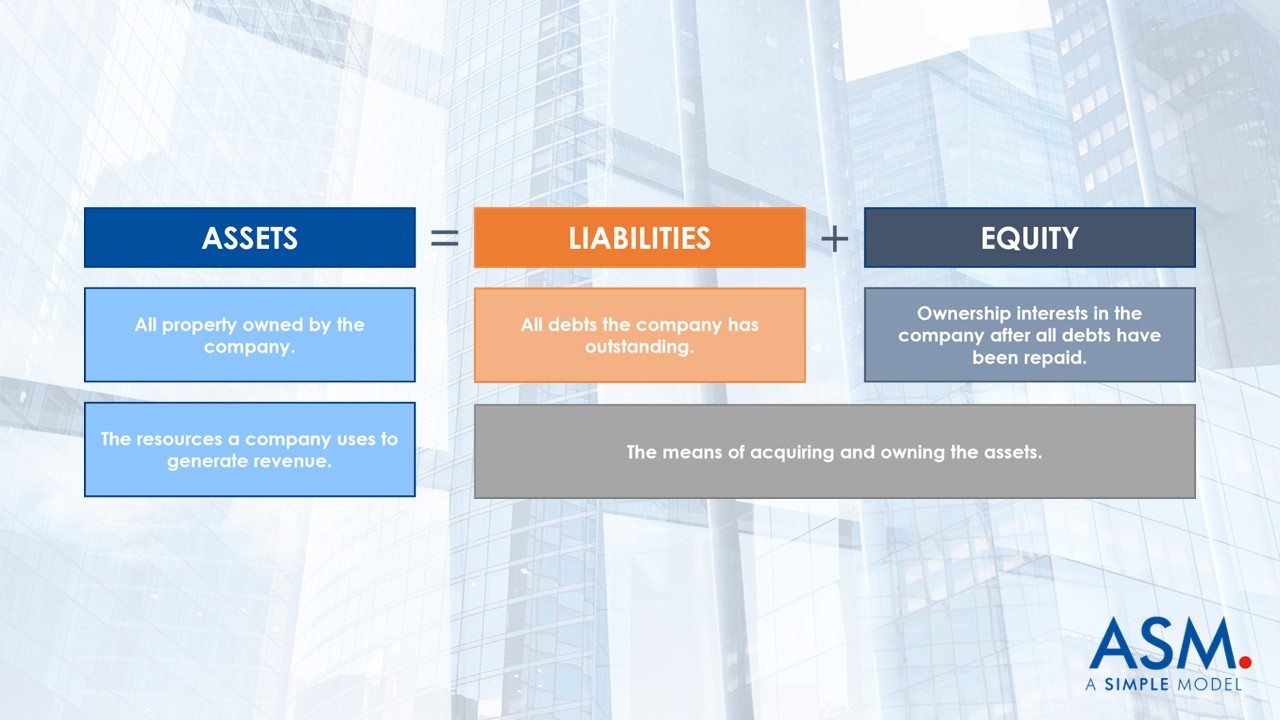

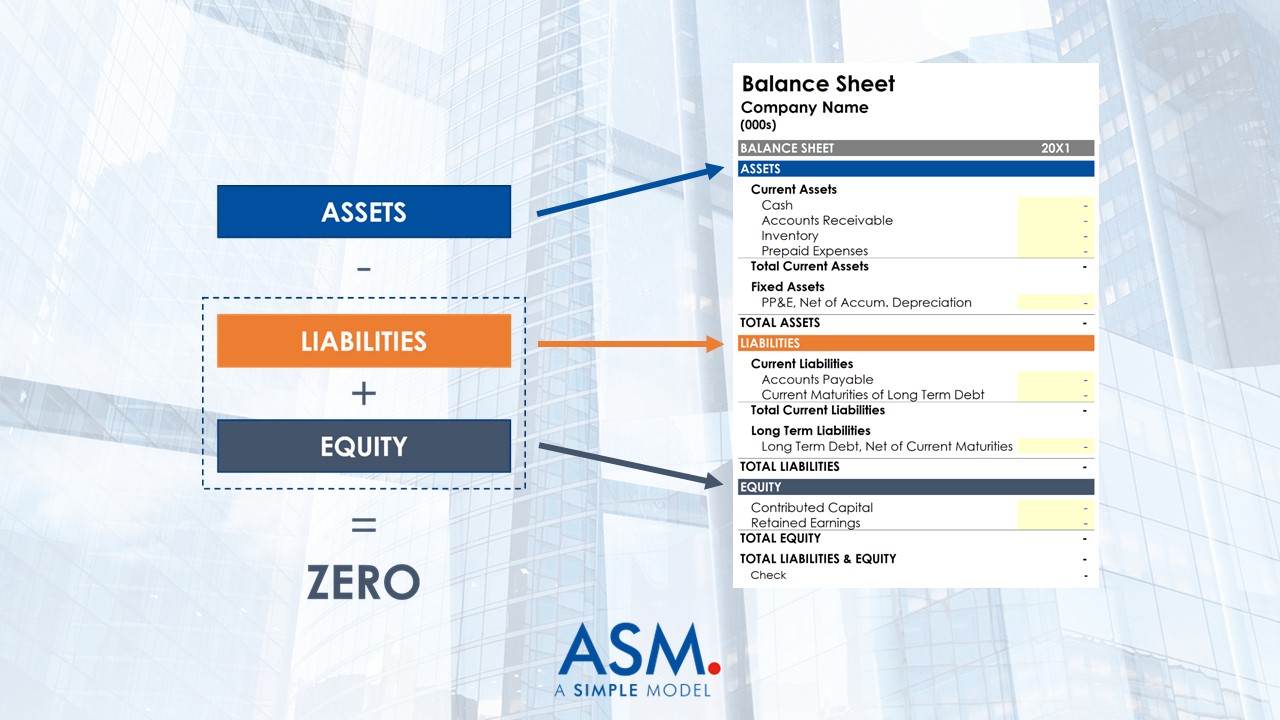

A balance sheet shows everything a business owns and owes, and a business uses the assets it owns to generate income. Let’s break down the following three categories in more detail:

- assets: Broadly speaking, assets are the resources a company uses to generate revenue. Assets that are expected to be liquidated, sold, or consumed within one year are classified as current assets. Fixed assets (also known as long-term assets) are expected to provide long-term benefits to the company. You can have both tangible and intangible assets.

- Liabilities: Liabilities of an enterprise refer to debts incurred in the ordinary course of business. Short-term liabilities include accounts payable and the company’s credit line. Long-term liabilities include more formal borrowings (such as bank loans).

- Shareholders’ Equity: This account reflects the ownership interest in the company. Under shareholders’ equity you can find contributed capital (the value of capital contributed by shareholders) and retained earnings (retained profits).

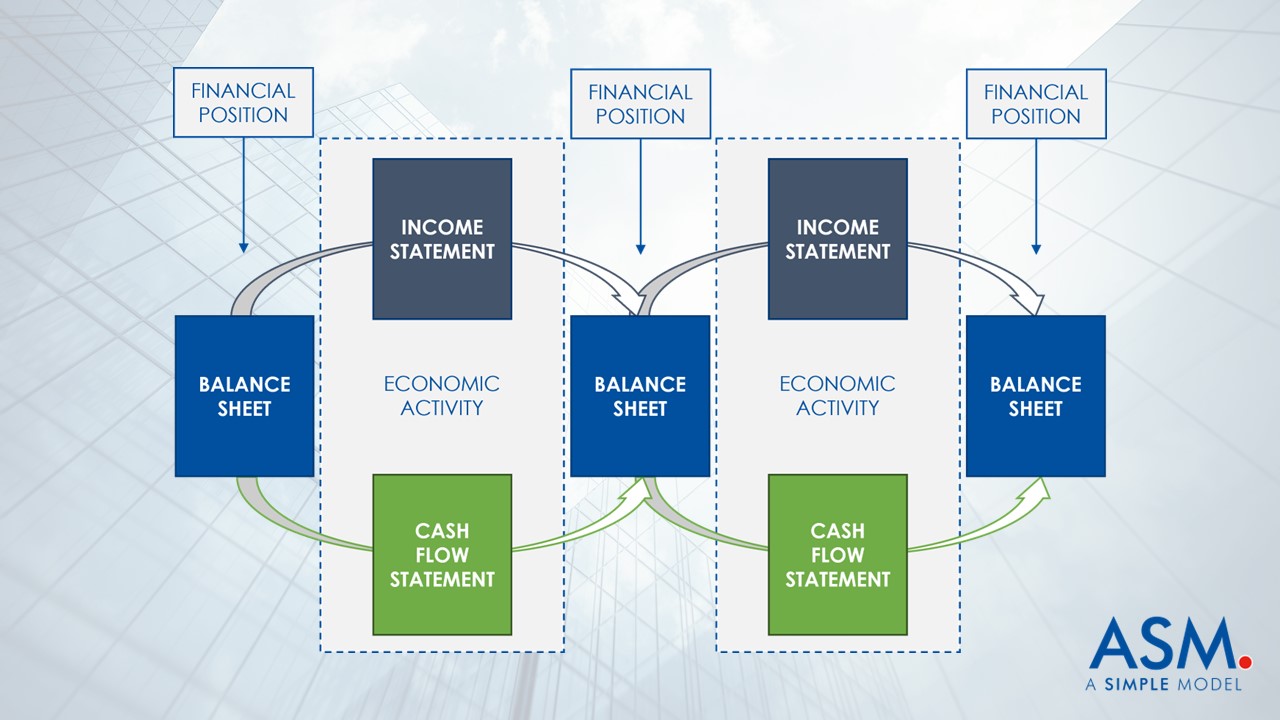

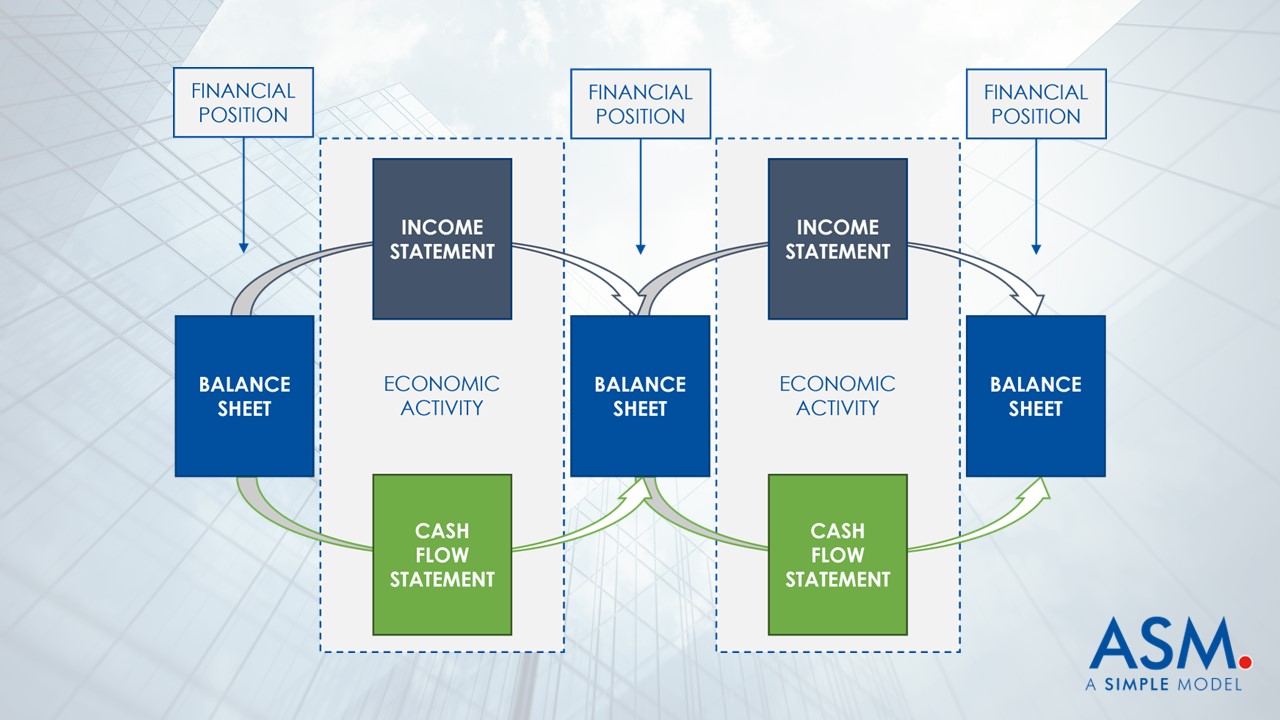

The income statement and cash flow statement both record sales, and they link successive balance sheets together, explaining the economic growth that occurs between them.

This means that both the cash flow statement and the income statement record the activities that occur during each accounting period. In other words, they represent activity over a period of time. The balance sheet, on the other hand, shows the financial position of the company at a specific moment.

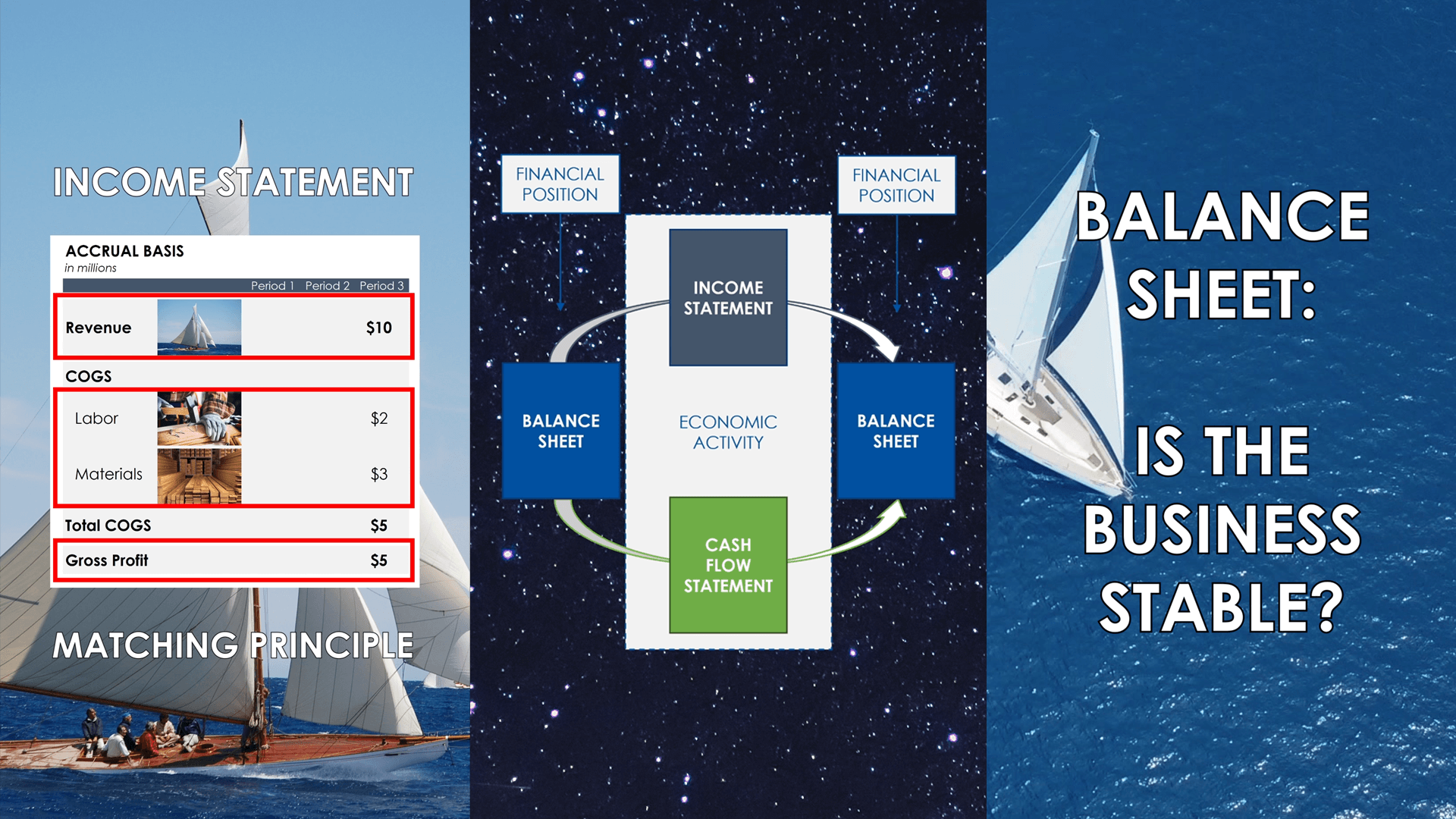

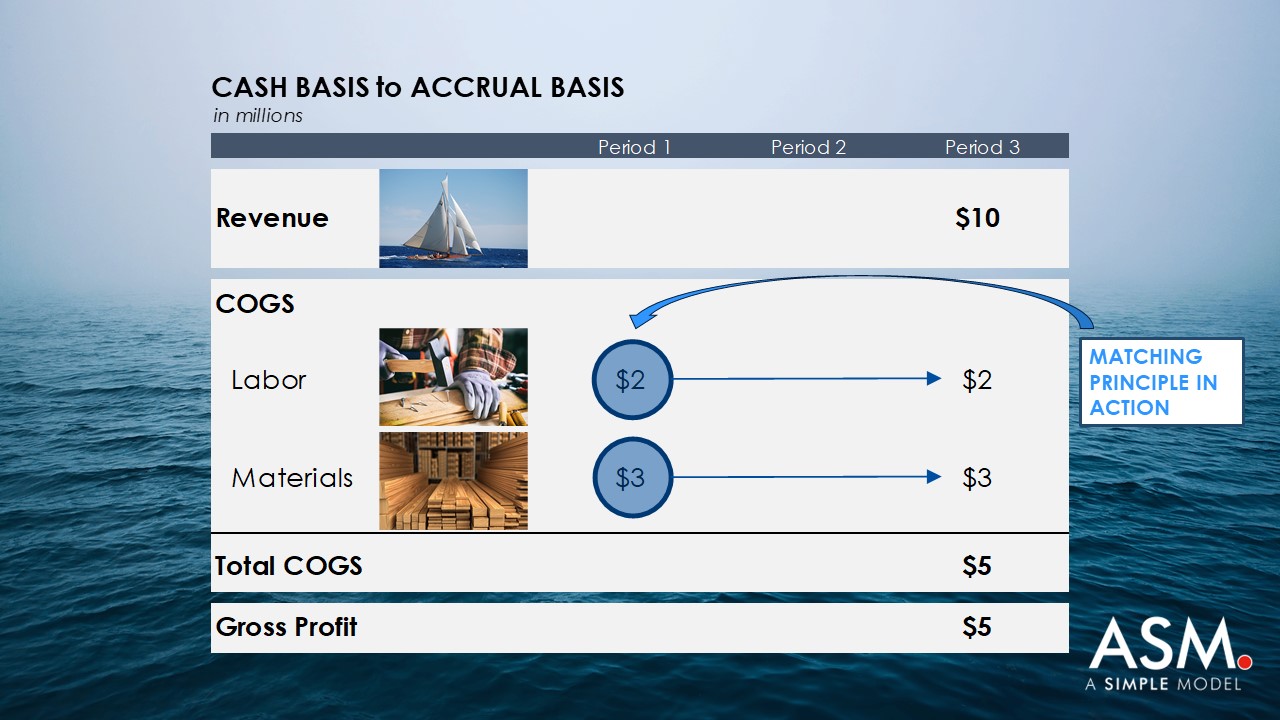

If you sell boats (as in the example in the video), the income statement will show how successful the company is on the matching principle. This means that sales of boats match the cost of building them. This makes it easier to determine the profit realized on the sale, which is the ultimate measure of success in selling a good or service.

The diagram below shows how the matching principle converts a company’s economic activities from the cash basis to the accrual basis of income statement accounting. Whenever the inputs required to build a vessel are purchased (Period 1 in the diagram below), the matching principle requires that the expense appear on the income statement in the period in which the vessel is sold (Period 3 in the diagram below).

Note: Depreciation is also included in Cost of Goods Sold (COGS). For more detailed instructions, see the related links at the bottom of this article.

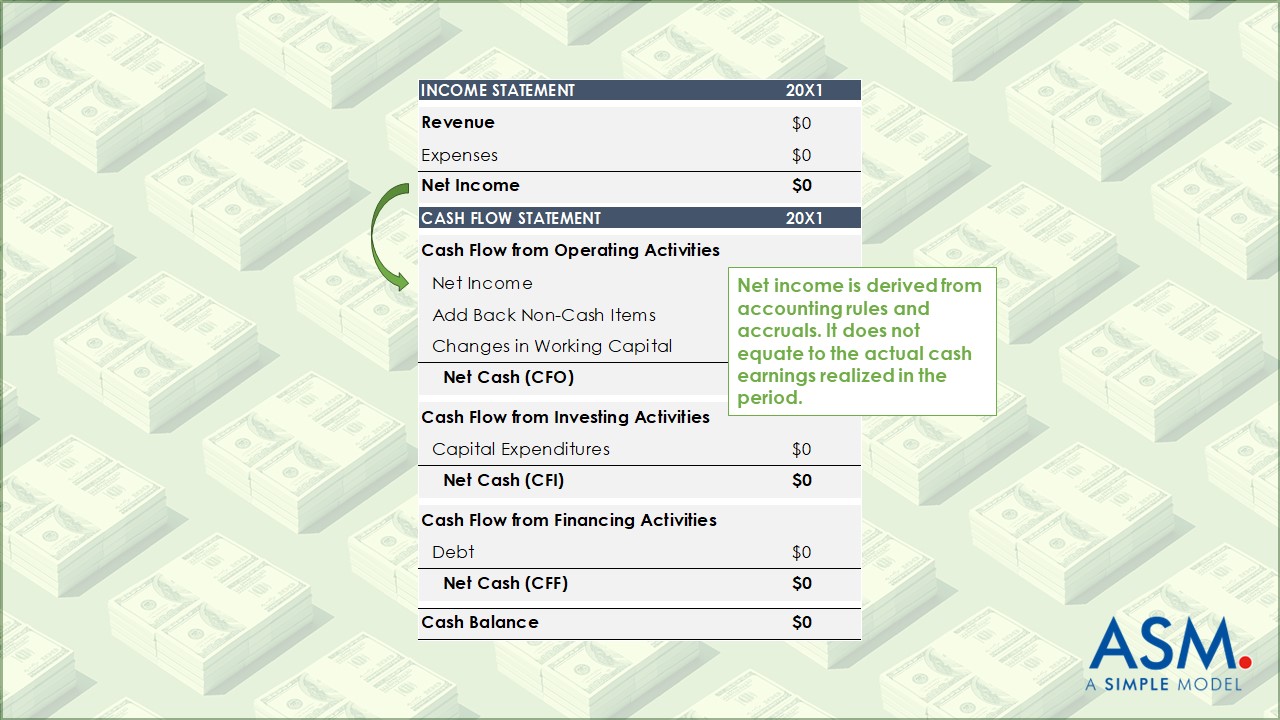

The cash flow statement tells you how likely it is to survive. This statement does not care when the product is sold. It only cares about when cash enters and leaves the business. When you purchase materials to build a boat and then sell the boat, the cash flow statement shows the cash outflows and inflows during the period that occurred.

The cash flow statement starts with net income and adjusts it to convert it to the ending cash balance of the period. In the image below, the green arrow shows how net income “jumps” from the income statement to the cash flow statement.

Cash is king. Some may argue that net income or earnings per share are more important (if that person is your professor, I suggest you agree – until final grades come in). But if I could only list two arguments to support my claim, I would emphasize the following: first, without cash, a business will fail; second, cash flow ultimately determines the value of the company.

Legendary CEO Jack Welch said that if he had to run a company on just three numbers, “those measures would be customer satisfaction, employee satisfaction and cash flow.” The only financial variables on Welch’s list It’s cash. This may be because unexpected declines in a company’s financial performance can often be absorbed if there is enough cash on the balance sheet. It also creates opportunities to explore strategies.

Finally, every transaction is captured so that your balance sheet remains balanced according to this equation. Assets equal liabilities plus stockholders’ equity.

Always remember that a balance sheet is simply a formal representation of the accounting equation. Both must balance, which is why the balance sheet contains a “check” on the bottom line (see image).

This is important because your assets must generate enough cash to maintain liabilities and keep shareholders happy.

In short:

- The balance sheet tells you whether a company is stable.

- The income statement tells you whether the company is making a profit.

- The cash flow statement tells you whether the company can survive.

Related links:

- accounting equation

- balance sheet

- Profit and loss statement

- Introduction to Cash Flow Statement

- How a cash flow statement balances a financial model