In this article, we’ll explore the relationship between income statement profitability and cash flow by taking a closer look at working capital. I believe this is one of the most important relationships to understand because a healthy business with positive working capital should be able to meet some or all of its working capital needs through profits generated from the sale of its goods and services.

There are exceptions to this rule. If a company experiences strong revenue growth, it may be necessary to raise external capital to meet the associated increases in working capital ahead of that growth. But the company should be able to fund itself to some degree for growth. To show how this works, we’ll take a closer look at the relationship between the income statement and cash flow statement of a company that’s in the business of manufacturing and selling sailboats. More specifically, we’ll explore how working capital ties up liquidity and the risks that poor cash management can create.

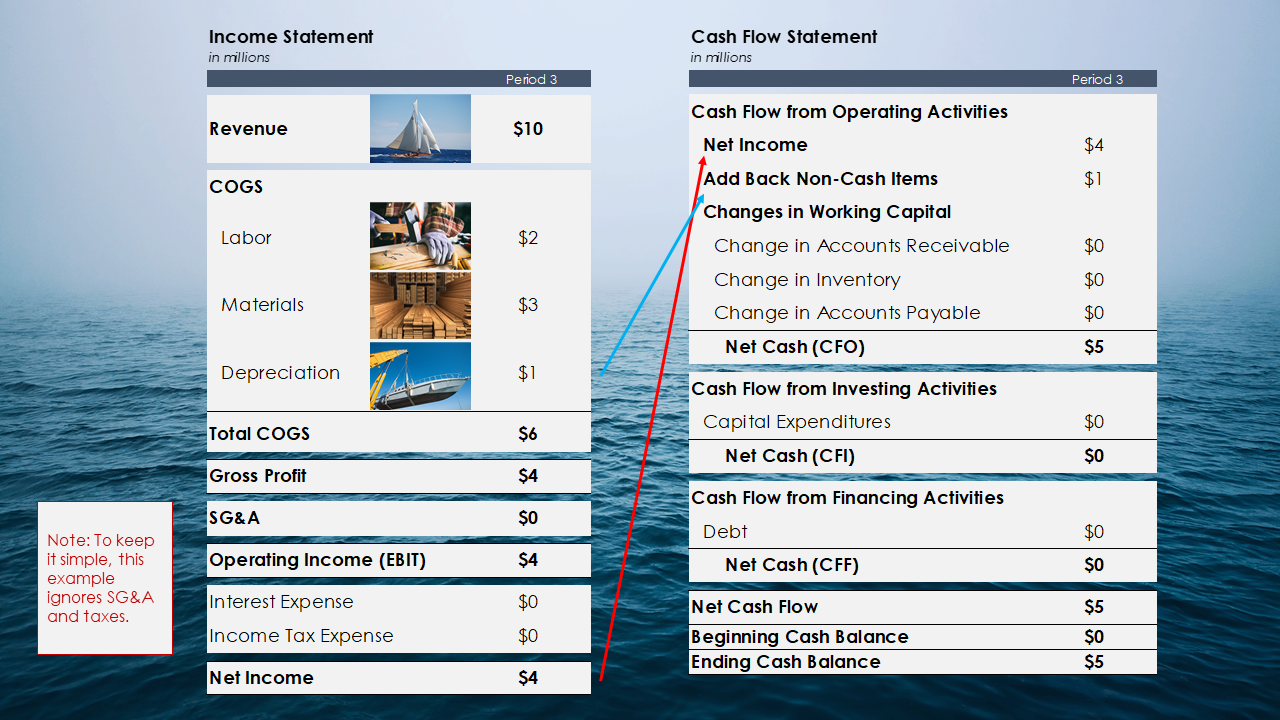

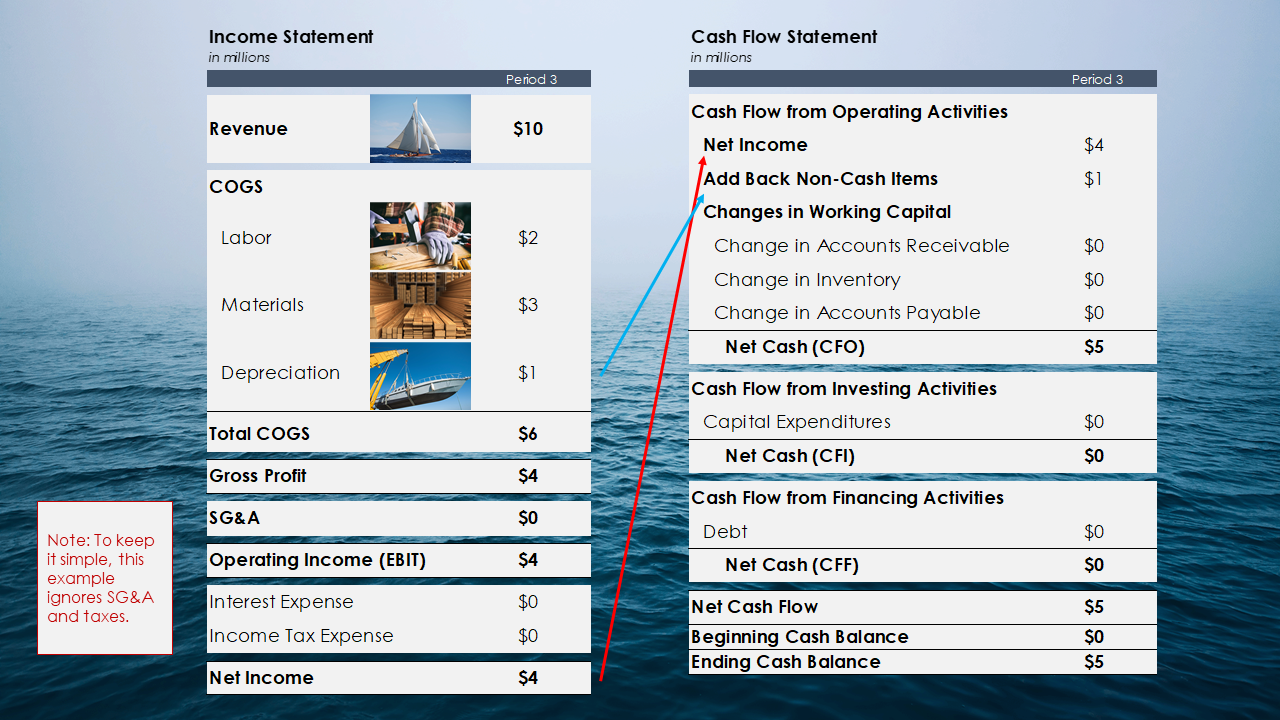

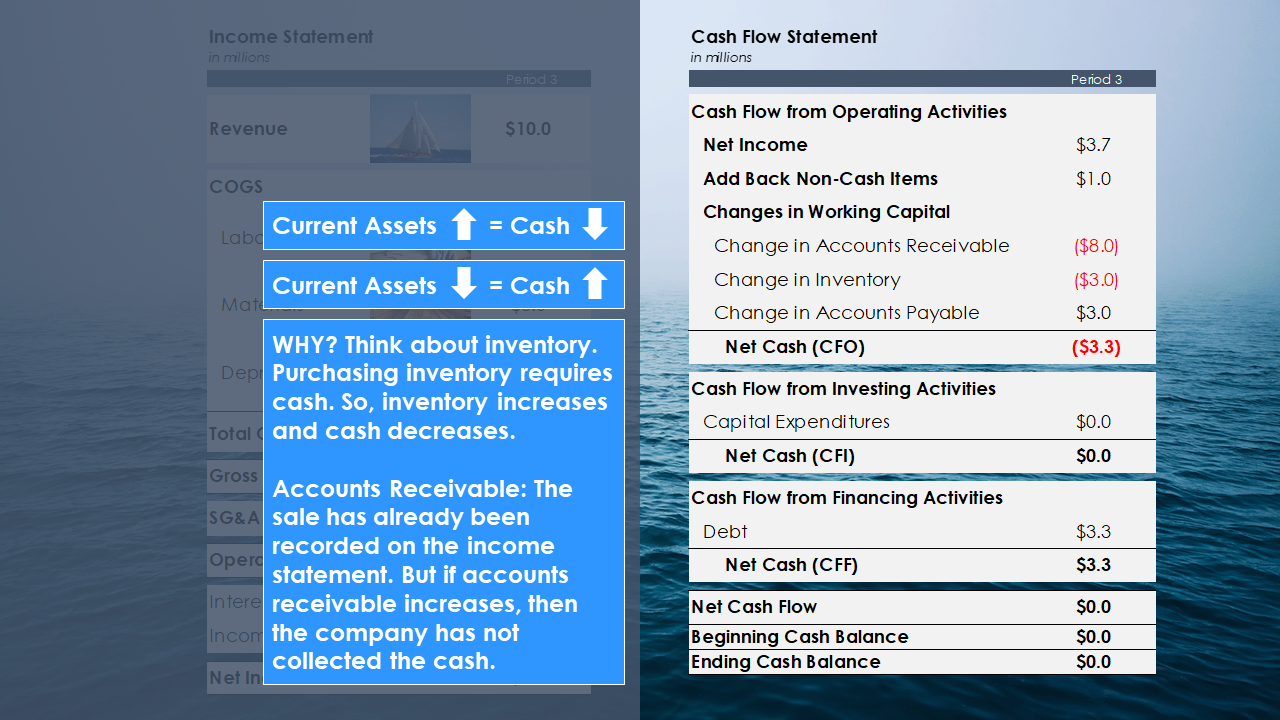

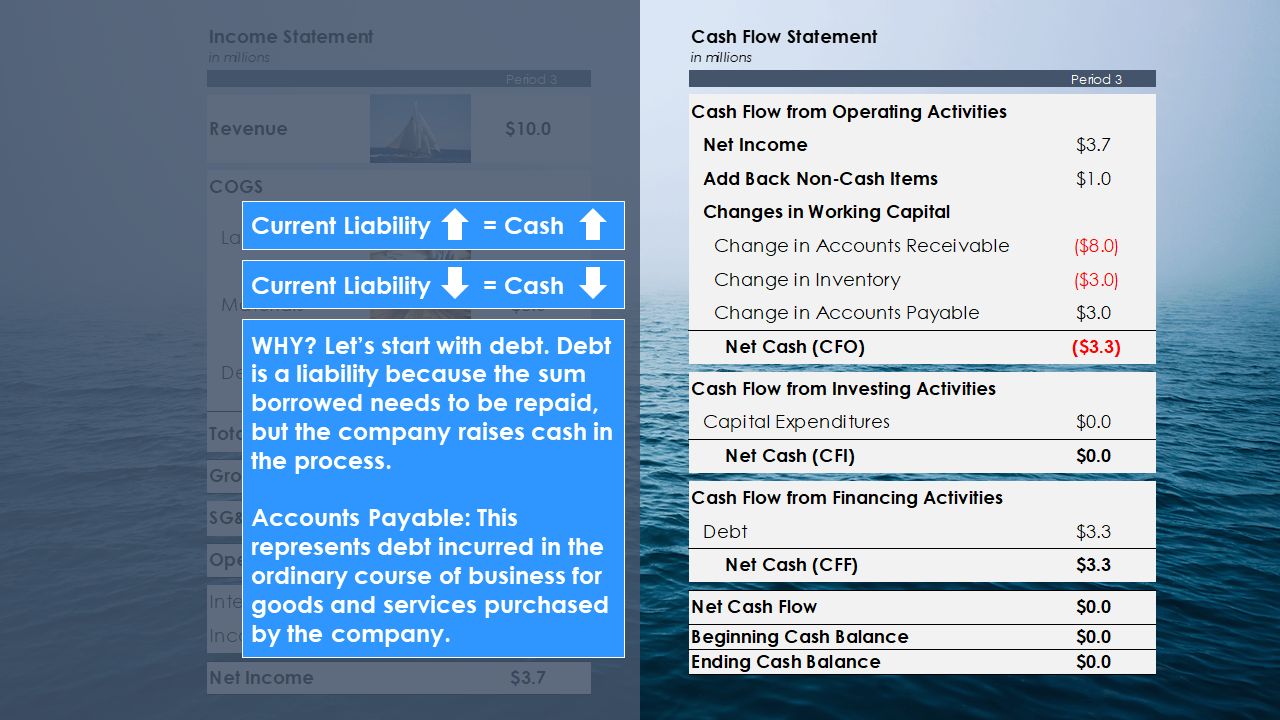

Working capital equals current assets minus current liabilities. Changes in this account are critical for converting net profits into cash, because when assets increase, cash outflows (due to purchasing assets), and when liabilities increase, cash inflows occur (for example, due to borrowing money). To illustrate this, assume that our sailing company sells a 40-foot sloop for $10 million.

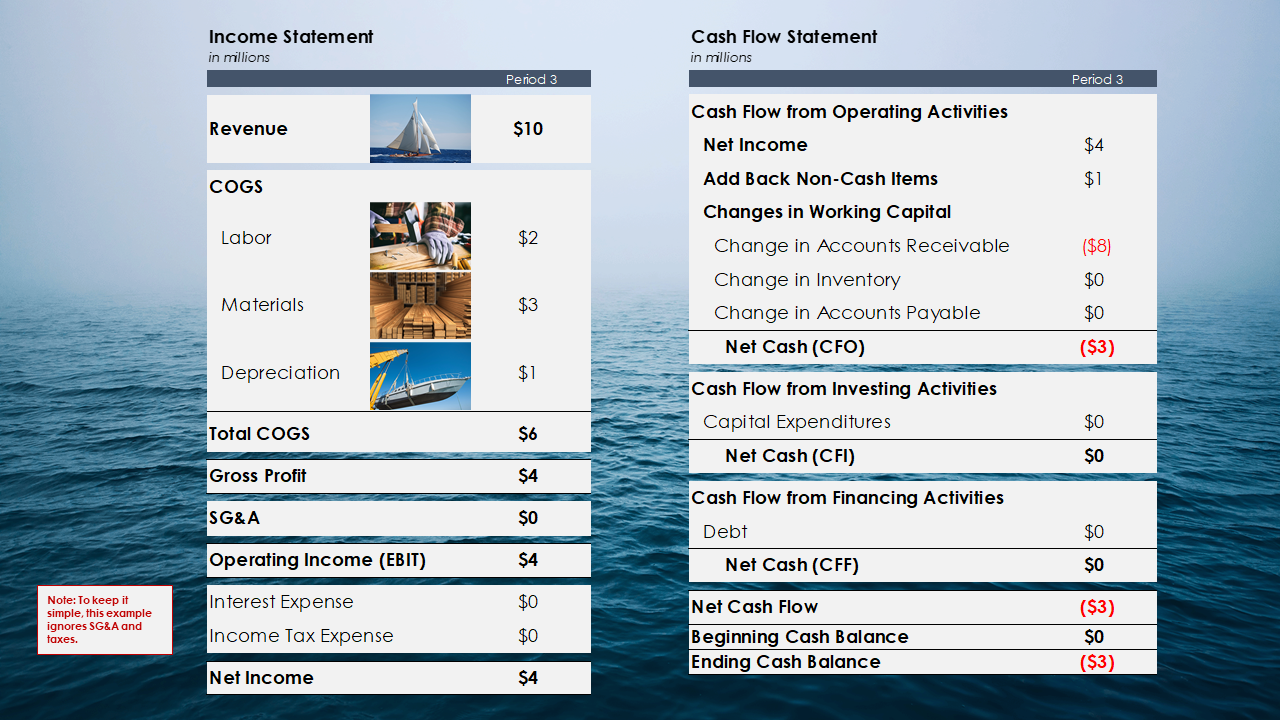

In the image above, you’ll see that the purchase of the sailboat is recorded on the income statement (for simplicity, the income statement ignores SG&A and taxes). The red arrow in the chart above shows the net income associated with the top of the cash flow statement, where we started with the same $4 million. Next, we add back non-cash items (the blue arrow in the image above), which in this case includes $1 million of depreciation expense. We assume that no additional capital expenditures are required and that depreciation per period equals $1 million.

With no changes to the working capital account, no additional capital expenditures, and no debt issuance, the company generated $5 million in cash flow during the period. We further assume that the company had a cash balance of zero in the previous period (the beginning cash balance in the figure) and an ending cash balance of $5 million.

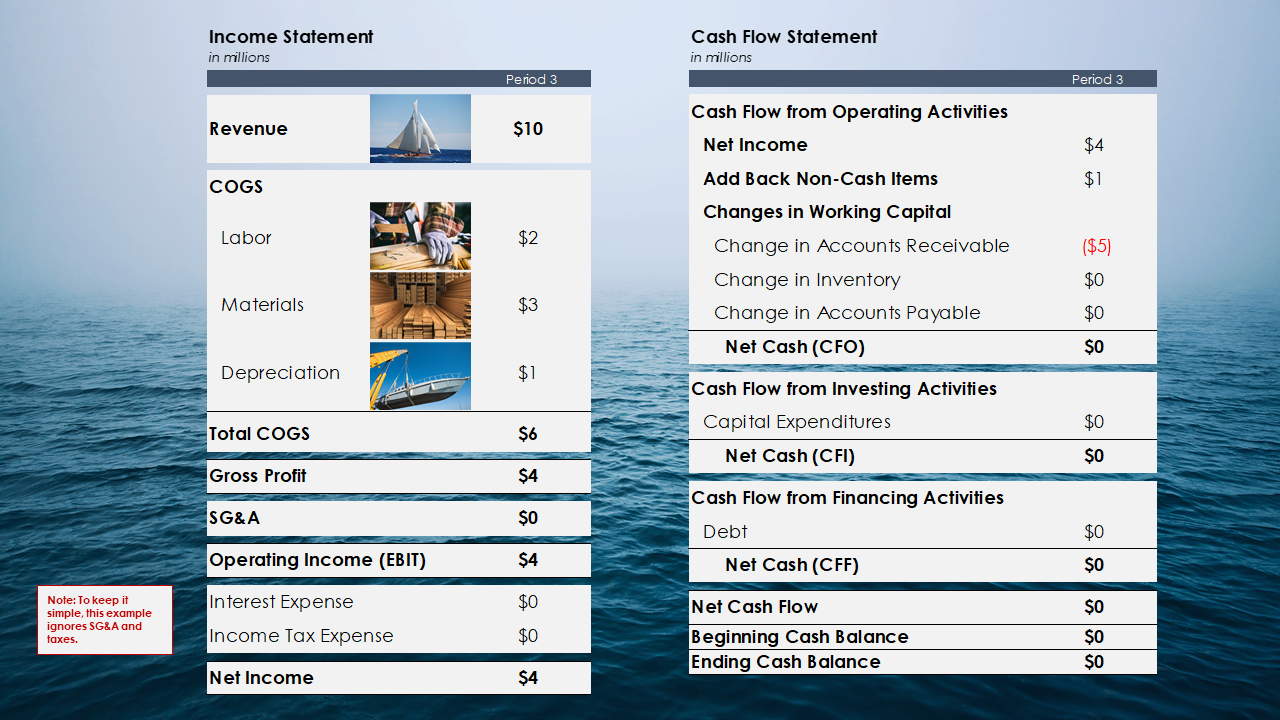

But let’s assume sales are slow and you want to encourage buyers to buy. As the founder of the business, you propose that the customer pay 50% of the purchase price in the next accounting period. This is an example of trade credit that allows a customer to purchase goods or services and pay the supplier at a later predetermined date.According to the explanation in Balance Sheet Video, this activity causes accounts receivable to increase by the unpaid amount. In the chart below, you’ll see that an increase in accounts receivable has a negative impact on cash.

By extending a $5 million trade credit to customers, the company no longer generates any cash from sales. However, you will notice that nothing has changed on the income statement. If the two scenarios represented two different companies, and only the income statements were provided for review, it would be easy to assume that both companies were equally successful. But the reality is that in the second scenario, the company doesn’t have any liquidity to fund growth. The relationship between the profits realized in the income statement, the amount of working capital required to generate sales, and the amount of cash generated in the cash flow statement is critical. In my opinion, it is grossly ignored or misunderstood by many businesses.

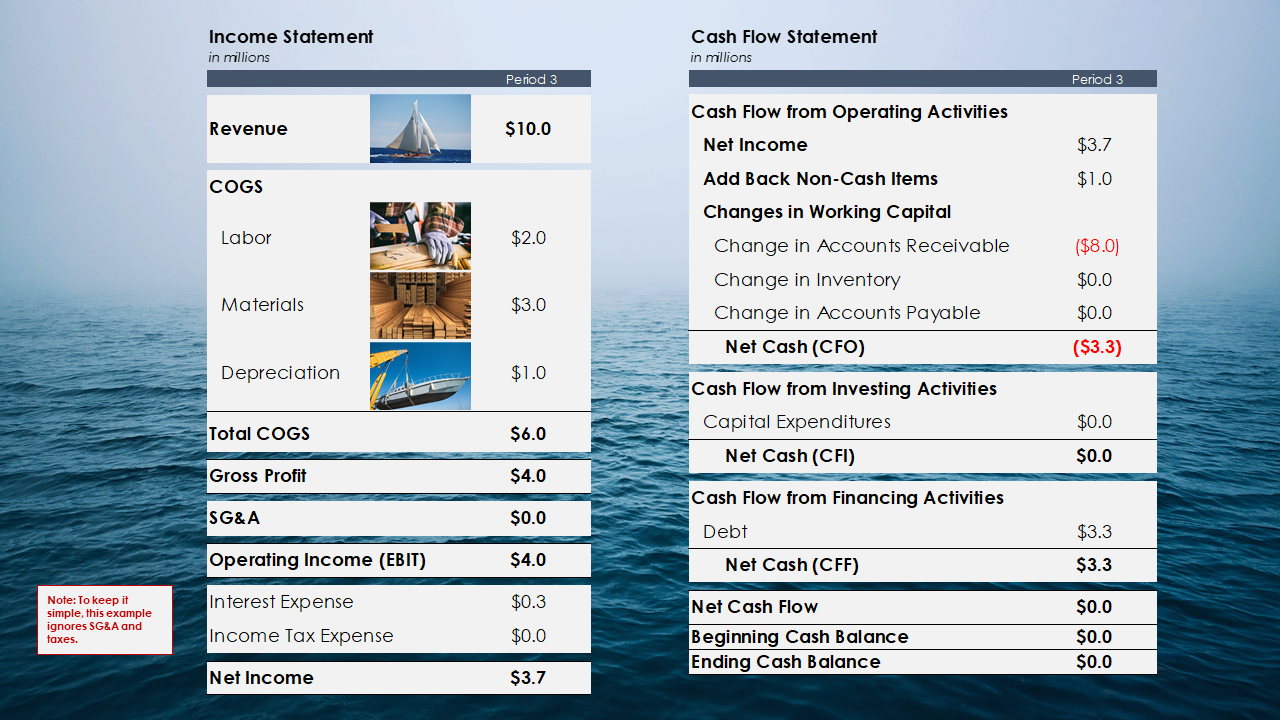

To understand why, let’s continue with the example and assume that the company extends a $8 million trade credit instead of a $5 million trade credit (note: this scenario is extremely unlikely, but the exaggerated scenario helps illustrate the purpose ). In the chart below, you’ll see that the business now has negative net cash flow of $3 million.

But a business cannot have a negative cash balance. Obligations must be met or the business will become insolvent. To compensate for this situation, the company typically borrows money to cover the shortfall by drawing down its credit line. If you guess that the company only needs to raise $3 million, you are not accounting for interest expense.

To make the math easier to understand, let’s assume that the business borrows money at an interest rate of 10% per period. Since there is no cash on the balance sheet in the previous period, the current period needs to make up for the current gap caused by the sale of ships and the current interest expenses payable. Now our income statement has changed, in the image above you will see that interest expense was $300,000, which reduced net income to $3.7 million. On the cash flow statement, you will see a cash inflow of $3.3 million from investing activities, returning net cash flow to a zero balance.

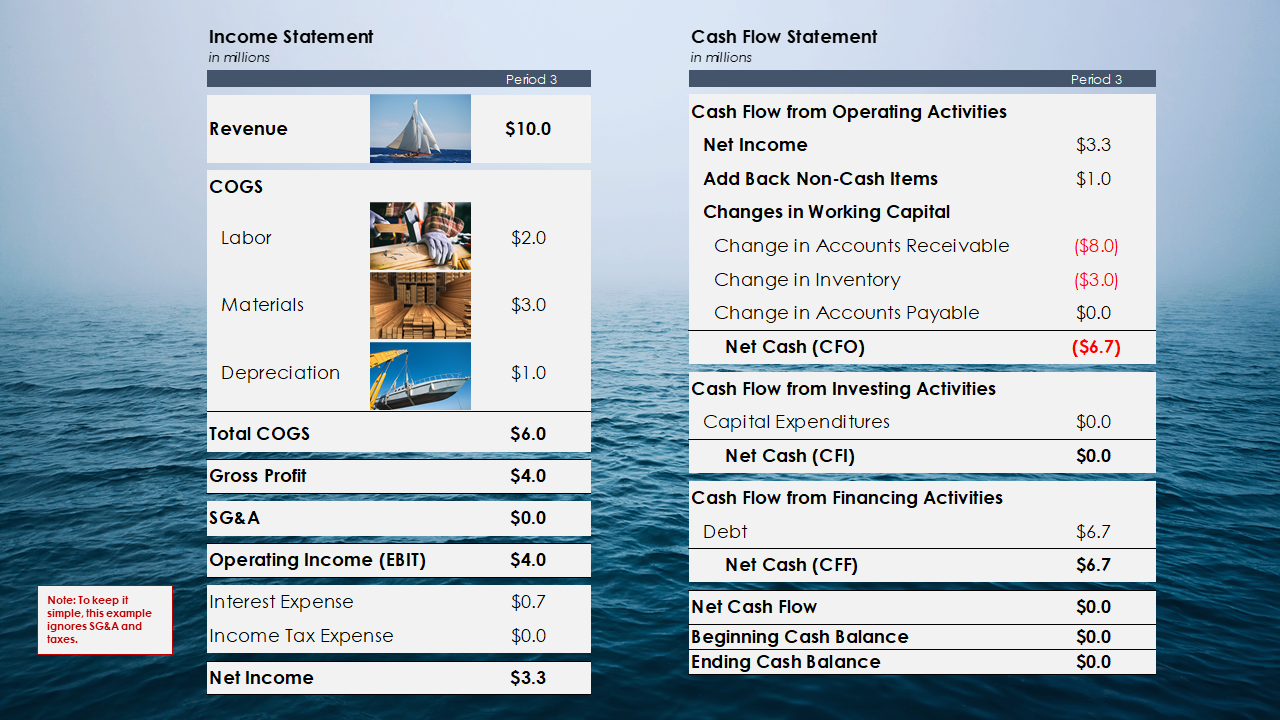

Now we have a different problem, the business doesn’t have any cash to pay for the raw materials to build another ship. Waiting for customers to pay means your operations grind to a halt, so the company raises more debt (usually through a line of credit) to fund the purchase of inventory.

On the income statement, interest expenses increased again and the company’s profit deteriorated further to $3.3 million. So what did we learn?

- Working capital ties up a company’s liquidity.

- If the profits generated from sales are insufficient to meet the company’s working capital needs, the company will have to raise cash through the issuance of debt.

- Debt affects the income statement by reducing profitability each period on interest charges owed.

In my opinion, if sales are not growing strongly, the decision to raise cash through debt issuance should be an option. A company should manage its profits and working capital so that profitability meets all or part of the company’s working capital needs. In this admittedly more extreme example, the company cannot operate without raising capital, which significantly increases business risk. Cash on your balance sheet is always your best defense.

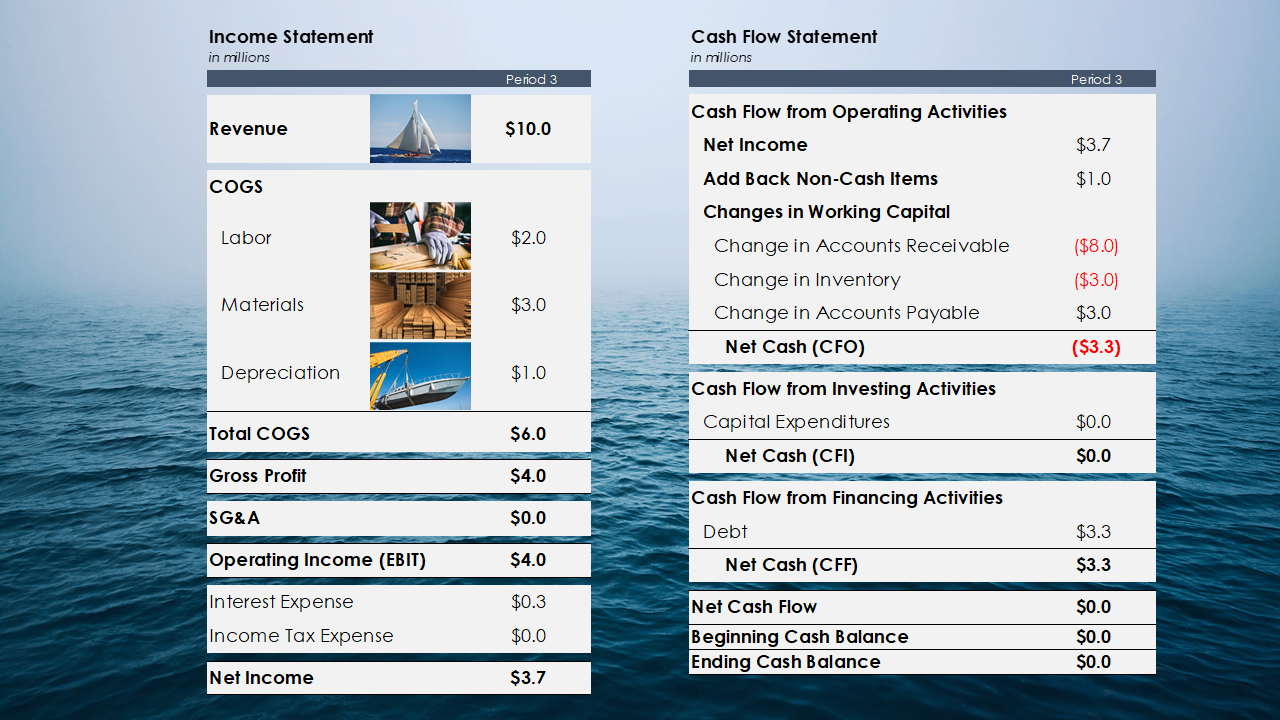

Fortunately, we didn’t cover accounts payable, which is the only current liability listed (recall that accounts receivable and inventory are both current assets). We assume that raw material suppliers also extend terms to the company when purchasing inventory.

Now you’ll see a reversal in performance. Operating cash flow improved as we deferred payments for purchased raw materials, which is visible under changes in accounts payable in the cash flow statement. Let’s explore what’s going on.

When current assets increase on the balance sheet, the change appears as a decrease in cash on the cash flow statement (and vice versa).

When current liabilities increase on the balance sheet, the change appears as an increase in cash on the cash flow statement (and vice versa).

In other words, changes in current assets are inversely related to cash flow, and changes in current liabilities are inversely related to cash flow.

But most importantly, how a business manages its working capital can have a huge impact on the company. As you can see in the chart above, positive working capital reflects real value as it consumes cash. If not managed well, companies tie up resources that could be put to better use. If managed properly, a business can easily generate profits and choose how to fund its growth.

It’s also important to note that this liquidity need is not visible on the income statement until interest expense is calculated. On the income statement, everything above (including EBIT) remains the same in each case. To properly measure the value of a sale, you need to evaluate how the sale affects cash flow. The conclusion is that even if sales guarantee the same profit, not all income is the same.