An ASM subscriber asked me how to negotiate an equity position when they don’t have a private equity background. For the purposes of this article, and to preserve his anonymity, I will call him Emilio.

Emilio, who was in his mid-twenties and lacked a private equity background, had spent years helping a friend with capital build a single-location car wash business. Both parties mutually decided it was time to appropriately restructure their business investments. As Emilio describes it, he found himself sitting across the table from partner counsel, trying to figure out the best path forward. I proposed four steps to help him find the answer.

Note: I have received this question many times, which is why I decided to record a video on this topic. Surprisingly, in terms of the popularity of investing in the car wash space, several of these emails/calls/conversations covered the same space.

Improve conversations

First, if you want to know what kind of investment partner you have, prioritize the conversation over financial models and term sheets. Ask your future partners how they think the economy should work under several hypothetical scenarios. But even before you develop these options, ask the following questions about your partners’ investment goals:

- Are they planning to sell the company? If you plan to sell, how soon will it be sold?

- Are they going to distribute it?

- If it’s a long-term hold, are they open to a package that would allow you to sell the stock back to the company at some point?

With this information, you can develop the scenario. For example: If a partner invests $10 million and the company sells for $15 million 5 years later, how much money will you receive? How about exiting at $20 million and $30 million?

If exiting is not a consideration, seek a mechanism that allows you to achieve liquidity. One method is a valuation formula that allows you to sell the stock back to the company.

If the controlling investor intends to take distributions, ask how you will participate in those distributions as cash flow increases.

They may want to run the numbers and get back to you, but this will give you an idea of who you’re working with. You need to explore your partner’s intentions and whether they are aligned with you and your own success. You always want to work with people who want to see you succeed, if they succeed.

Note: I receive questions for single location businesses and business plans considering establishing a new location or acquiring a new location. For investments considering new build or acquisition, it is important to also ask whether the structure contains multiple entities. If so, you will want to negotiate participation in a structure that holds all of your individual investments.

Modeling

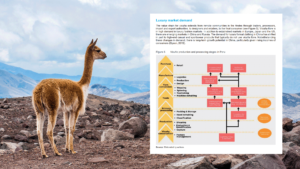

Ask controlling investors to summarize their offers in a term sheet and use this as a basis to build your own model and predict the value of your equity (see Allocation Waterfall). These numbers may surprise you.

We provide a number of templates and examples on ASM to help you complete this exercise. There are also video examples that guide you through the mechanics through simple illustrations.

In Emilio’s case, he explained that the controlling investors proposed an 8% preferred rate of return on invested capital, and they were surprised to see how difficult this made it to create equity value above the preferred rate of return. While this probably applies to most private equity deals, I’m not surprised by this scenario. This is a huge hurdle to overcome for a profitable single-location car wash. This goes to show you that just because the terms presented are “marketplaces” elsewhere, it doesn’t mean they should apply in every situation.

That’s the beauty of having a model that you can share. Once the model is built, bring it back to the table and ask if you correctly captured what was communicated. Iterate this process until both parties reach an agreement. This is a private equity negotiation.

Confirm your findings

If you like the structure, confirm it. If you’re on a budget, you don’t have to hire a consultant right away, but if you have no experience (or even if you do), hire a professional to review the work you’ve done and any documents you have that have been presented. Think of it as an investment to protect your future. Remind yourself that this could be 3 to 10 years of your career.

Diligent your partner

Unless you know your partner very, very well, ask for a list of contacts they have had previous dealings with and reach out to them. Learn about their history of working with others. In any process, one thing is certain: unpredictable things will happen. Hope it’s positive. But if there is a negative outcome, a good partner will come back to the table to update you on your financial status, especially if you are adding value to the business.

in conclusion

Equity compensation is an incredible way to create wealth. If this sounds like too much work, take some time to learn about economics. Given the right opportunity, the results could surprise you (or even change your life). Also, if equity compensation is offered, don’t put off the conversation. I often hear people say “they can fix this later”. When you look back in hindsight, you may realize that the opportunity has been lost. What do you negotiate for?

related: Getting Started with Private Equity Stock Options

related: Equity incentive compensation

Learn more about private equity transactions with ASM’s private equity training courses. ASimpleModel.com’s private equity training courses are developed by industry professionals. The following content goes beyond the leveraged buyout model to explain how private equity professionals find, structure and close deals.