Editor’s note: Seeking Alpha is proud to welcome Asia Equity Analyst as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also have free access to SA Premium. Please click here to learn more”

Miniso shares soar on its growth story Peter Dazeli/Getty Images News

MINISO (NYSE:MNSO) presents a compelling investment opportunity based on its strong growth and leadership position in the branded assortment retail market, which has demonstrated resilience to e-commerce and economic downturns. The company’s strategic “711 Concept”, efficient supply chain and innovative retailer partner model give it a competitive advantage in launching new products and maintaining high profitability for itself and its retail partners. In addition, as a growth stock, Miniso has a lot of room for expansion both domestically and internationally.Despite risks such as geopolitical tensions, increased competition, and global economic uncertainty The partnership, Miniso’s current valuation relative to its peers, coupled with its broad growth potential, make the stock an attractive opportunity for investors looking to invest in the retail sector.

The branded grocery retail market is growing steadily and is resilient

The branded grocery market is an industry characterized by retailers offering a variety of well-designed, high-quality and affordable lifestyle products. A distinctive feature is the retailer’s focus on selling private label products.

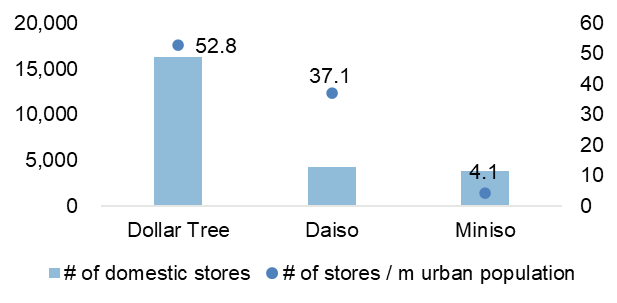

estimate Frost & Sullivan predicts that China’s branded grocery retail market will grow at a compound annual growth rate of 14.2% from 2022 to 2026, reaching RMB 189.5 billion. As the largest player, Miniso accounted for 11.4% of the market share, much higher than the 7.2% combined for the other top five players. Compared with developed markets, the penetration rate of the Chinese market is low, indicating considerable room for growth. For example, Dollar Tree (US) and Daiso (Japan) have significantly more stores per million urban population than Miniso, indicating huge expansion opportunities.

SEC Filings

Globally, the branded variety retail market Expected The compound annual growth rate from 2022 to 2026 will reach 12.6%, reaching US$86.8 billion. Miniso has a global market share of 6.7%, followed by Japanese brands Daiso and Muji.

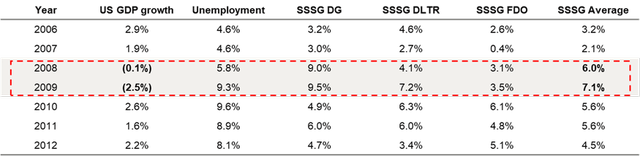

This market is defensive against the intrusion of e-commerce for the following reasons: (1) The scale of customer transactions is small, resulting in poor economics of e-commerce; (2) The adoption of digitalization by low-income groups is slow; (3) Low income groups Income groups are unwilling to bear the potentially higher costs of e-commerce due to small order amounts or minimal shipping; (4) The high density of physical stores promotes convenience and impulse purchase decisions. Resilience to recessions is reflected in consumers’ shift to value-for-money products when income levels fall, as evidenced by strong same-store sales growth (SSSG) during the 2008-2009 global financial crisis.

U.S. Bureau of Economic Analysis, SEC Filings

The competitive moat of Miniso

Miniso’s success stems from its strategic products, efficient supply chain and innovative retailer partner model.

For the financial year ending June 30, 2023, Miniso’s categories have expanded to approximately 9,700 core SKUs in 11 major categories. The brand’s unique “711 Concept” requires 100 new SKUs to be selected from 10,000 potential products every seven days, demonstrating the strength of its design and product teams. Miniso ensures competitive pricing in line with local alternatives, with an average selling price of RMB 13.1 and an average ticket price of RMB 37.6 in China.

An effective supply chain enables Miniso to maintain a high pace of new product launches and provide consistent quality and novel designs at competitive prices. This can be achieved by leveraging China’s extensive upstream production capabilities, centralized purchasing volumes, and investing in digitally advanced supply chain management systems.

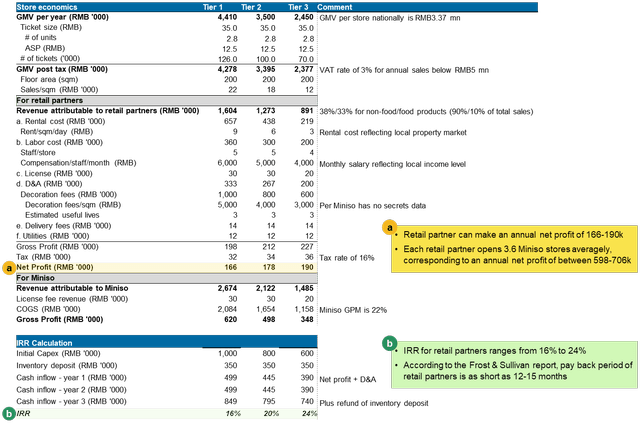

The retailer partner model facilitates rapid, high-quality network expansion, benefiting Miniso and its retail partners: 1) Minimizing inventory risk and operational knowledge requirements on them, which was once traditional The main pain points of the franchise model; 2) Attractive investment return conditions and strong operational support are attractive to partners. On average, 3.6 Miniso stores are operated, with annual net profits ranging from 598,000 yuan to 706,000 yuan. time (see the table below for details); 3) Compared with other offline brands, Miniso’s flexible expansion prospects are more attractive, because other offline brands are still going through a difficult period for e-commerce to capture market share.

Proprietary Analytics, Capital IQ, Bloomberg

Miniso stores have great potential for expansion

As of September 30, 2023, Miniso has 6,115 stores around the world, with an annual turnover of 11.4 billion yuan and a net profit of more than 1.8 billion yuan.

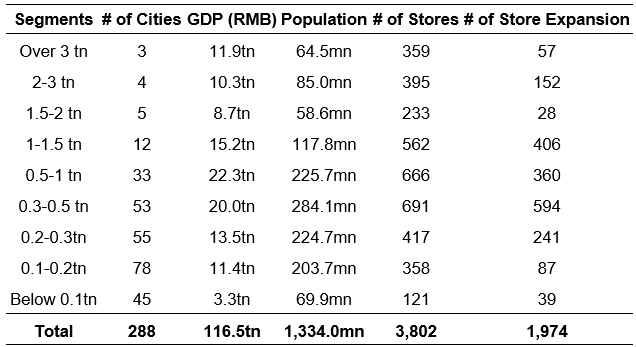

When envisioning Miniso’s expansion potential, we considered the economic size of Chinese cities and their ability to accommodate Miniso stores in relation to their populations. Although the number of Miniso stores is still increasing in most cities, we can assert that the stores per million population indicator of the best-performing cities serves as a viable benchmark for all cities within the corresponding GDP segment. We estimate the potential of 1,579 to 2,369 stores in China by applying a tolerance range of -20% to +20% to adjust for any over- or underestimation. The base case scenario points to the possibility of opening 1,974 new stores.

National Bureau of Statistics of China, GeoHey

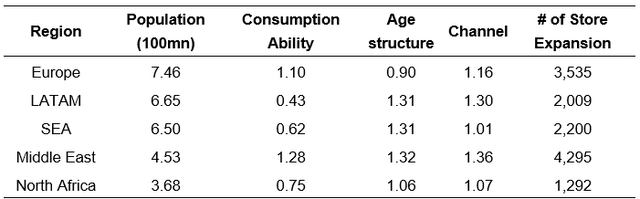

For overseas markets, we use the number of stores per million people in China as the benchmark and make adjustments based on factors such as spending power, age structure, and access. The analysis highlights Miniso’s huge potential for international market expansion and is consistent with its goal of opening approximately 400 new stores overseas each year. Since the population of developed markets is close to that of China, there is huge room for expansion of Miniso’s store network.

WTO.world bank

Valuation discussion

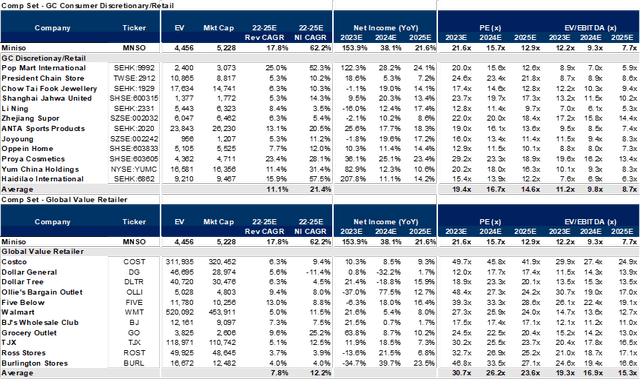

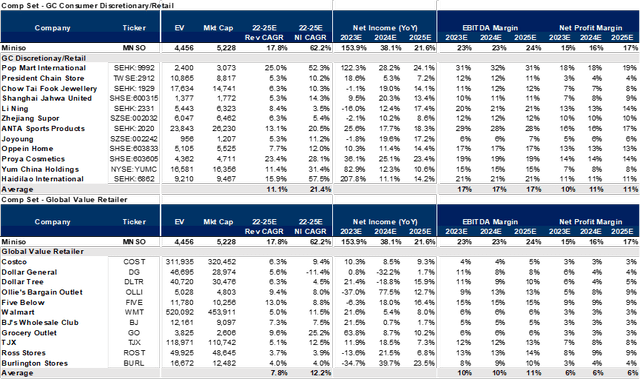

We use the price-to-earnings ratio to derive Miniso’s target price. This approach is suitable for capturing a company’s growth prospects and is consistent with the approach most investors take on most Chinese consumer stocks. EV/EBITDA is used to triangulate conclusions drawn from the P/E ratio. We use FY24E as the base year. Miniso’s FY24 P/E ratio is 15.7x, which is a discount compared to similar companies. In comparison, global and Chinese peers trade at 26.2x and 16.7x, respectively. In addition, Miniso’s FY2024 EV/EBITDA is 9.3 times, which is also lower than global peers (16.9 times) and Chinese peers (9.8 times).

Capital IQ

In terms of operations, Miniso has demonstrated good growth momentum and profitability. Miniso’s estimated revenue CAGR and net asset CAGR for FY22-25 are 17.8% and 62.2% respectively, ahead of its peers. During the same period, the growth rates of Chinese and global competitors are expected to be 11.1% and 21.4%, 7.8% and 12.2% respectively. In addition, EBITDA profit margin and NPM are expected to be 23% and 16% respectively in fiscal year 2024. Miniso’s profitability is better than that of its peers. EBITDA margins in China and global peers are expected to be 17% and 10% respectively; NPM is 11% and 6% respectively.

Capital IQ

Compared with its Chinese and global peers, Miniso’s revenue and net profit growth have exceeded those of its Chinese and global peers, and it has excellent profitability, with EBITDA and NPM increasing significantly. Therefore, the recent sell-off in Miniso provides a good opportunity to go long. Our target price is US$23.11, based on 22.0x FY2024 P/E, which is a discount to the current trading average of global peers but a premium to Chinese peers. Due to its strong growth and profitability, Miniso’s price-to-earnings ratio is likely to be between that of its Chinese and global peers, and while this may justify its premium over regional peers, it may not yet be fully in line with its broader Mature global entities with operations generally command higher valuations. Market influence and recognition. On the contrary, its P/E ratio exceeds that of other Chinese companies as Miniso demonstrates superior operating efficiency and profitability metrics, suggesting a more robust business model and a more favorable valuation relative to its domestic market competitors. high. The target share price is US$23.11, which represents a 40.12% upside potential from the current market price of US$16.49.

Risks worth considering

Nonetheless, some risks must be considered. Escalating geopolitical tensions between China and the United States pose a threat, especially in the wake of the Belt and Road Initiative. potential tariffs If Trump is elected, he will discuss Chinese imports. The news affected Chinese stock markets including Miniso. However, the multinational nature of Miniso’s business provides a certain degree of risk mitigation. Furthermore, strategic adjustments, such as moving supply chains to unaffected regions, can circumvent these policy challenges.

Filing on the Hong Kong Stock Exchange of Miniso

In China, competition is intensifying. New entrants are attracted by the promise of strong returns and the huge market size, which may force Miniso to adjust its pricing strategy, potentially affecting revenue and profits.

In addition, the success of Miniso’s international development relies heavily on the quality of its partners and distributors. Lack of access to prime locations or skilled partners can hinder expansion efforts. For example, events in canada The alleged fraudulent distributor practices and subsequent bankruptcy in December 2018 prompted Miniso to assume direct operational control. Significant international growth is critical to Miniso’s future; however, if this growth is not sustained, Miniso’s narrative and investment appeal may weaken.

in conclusion

All in all, we believe Miniso offers an attractive buying opportunity now as it operates and leads in a growing and resilient market and has a solid business model that offers attractive products to customers , and provide high-quality returns for itself and its partners. Given Miniso’s superior growth prospects and above-average operating margins, Miniso’s valuation currently looks cheap compared to its peers, thus providing a good buying opportunity. But we still need to pay attention to geopolitical instability, increasing competition and the risks of overseas expansion discussed.