Hector Retamal/AFP via Getty Images

Li Auto Co., Ltd. (NASDAQ: LI), through its subsidiaries, designs, develops, manufactures and sells new energy vehicles in the People’s Republic of China.

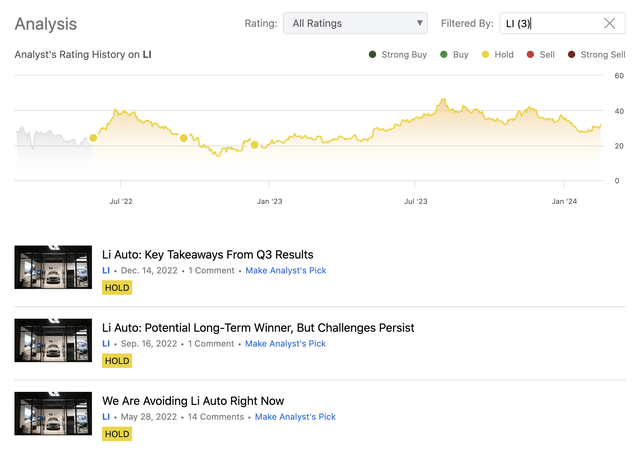

We have published three articles about the company so far, namely:

Ideal Car: Key Points Judging from the results of the third quarter

Li Auto: Potential long-term winner, but challenges remain

We’re avoiding ideal cars right now

Analytical History (Author)

In each article, we pointed to the company’s attractive long-term potential, but each time we believed that the uncertainty about the company itself, China, and the global macroeconomic environment was too high, so we ultimately never gave Li a Bullish rating .

Now, more than a year has passed, and the company and the macroeconomic environment have undergone major changes. We have decided to re-examine Li Auto and give us reader and update the view.

At the beginning of the article, we will focus on the company itself. We’ll look at profitability and efficiency metrics and how they’ve changed over the past year. In addition, we will comment on the wider economic environment and its likely impact on these measures. Finally, we take a look at how the company’s valuation has developed over the past year.

delivery

Let’s first take a look at the year-on-year change in delivery numbers. According to the latest data released in early February, vehicle delivery volume in January reached 31,165 vehicles, an increase of 105.8% compared with the same period last year. The company’s positive growth is reflected not only in the number of vehicles delivered, but also in its ambitions to expand its model range and sales network.

2024 will be an unprecedented year of growth for us, as we build a portfolio of eight competitive models, (…) A comprehensive upgrade of our sales and service network is also underway, with the goal of establishing more than 800 By the end of 2024, the number of Li Auto authorized body and paint shops will reach 500.

All in all, we believe Li Auto is taking the right steps to capture market share and expand its customer base. But just like a year ago, external market forces have created significant headwinds not just for Great Wall Motors but for most Chinese EV makers. We must highlight here concerns about deflationary forces in China, price wars among its biggest competitors, and apparent overcapacity among EV manufacturers. All of these factors could have a significant impact on Li Shufu’s revenue and profits in the coming quarters.

For these reasons, we remain unconfident in allocating a meaningful proportion of our assets to Lee’s stock based solely on aggressive growth and expansion.

Profitability

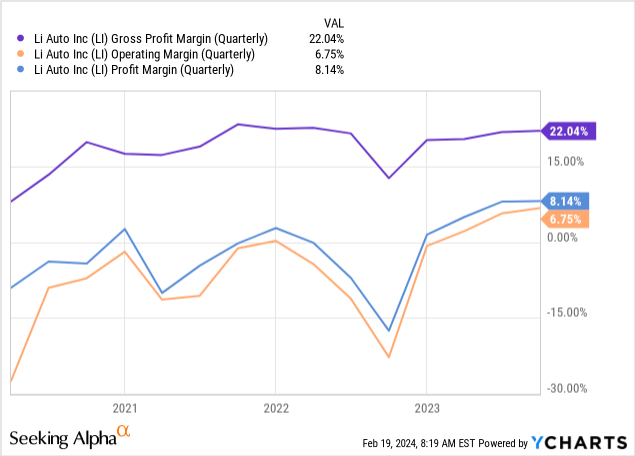

The three most widely used profitability metrics are gross profit margin, operating profit margin, and net profit margin. The chart below depicts how these profits have evolved over the past few years.

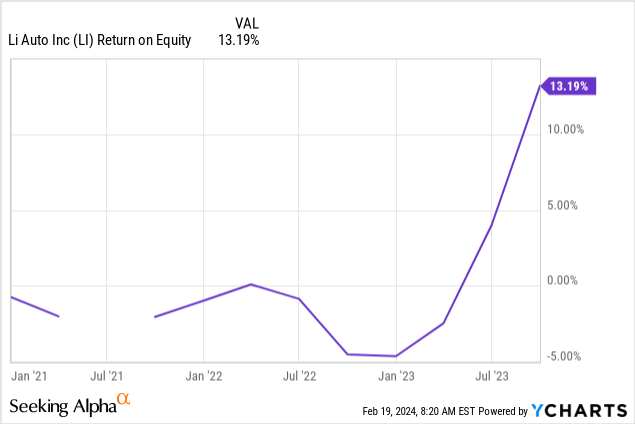

Despite a decline in profitability around the end of 2022, Li Auto’s profitability has continued to improve over the past four quarters. As a result, the company’s ROE also started to improve significantly.

In its latest quarterly earnings report, the company detailed margin expansion:

Gross profit margin in the third quarter of 2023 was 22.0%, compared with 12.7% in the third quarter of 2022 and 21.8% in the second quarter of 2023. The increase in gross profit margin compared to the third quarter of 2022 is primarily attributable to vehicle deposits.

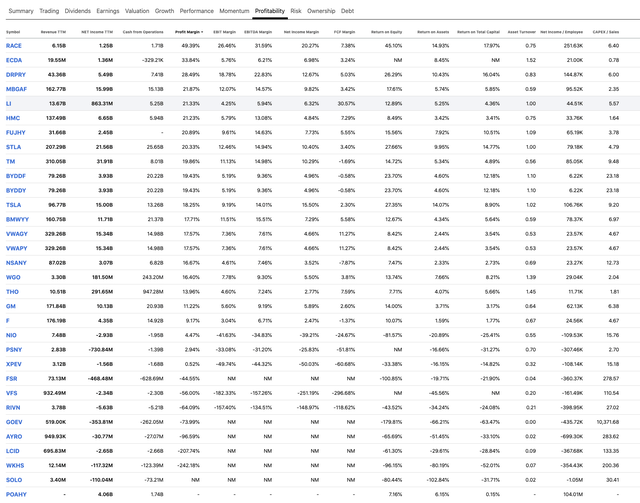

The table below shows how LI’s profitability metrics compare to those of companies in the same industry.

Compare (seeking alpha)

All in all, we are pleased with the significant margin expansion and improved profitability. However, as mentioned earlier, a price war between the largest rivals and apparent overcapacity among Chinese EV makers could quickly change that. At this time, we believe it is difficult to assess the likelihood of government intervention to alleviate overcapacity, so despite strong and steadily improving profitability indicators, we cannot predict with certainty margin developments in the near term.

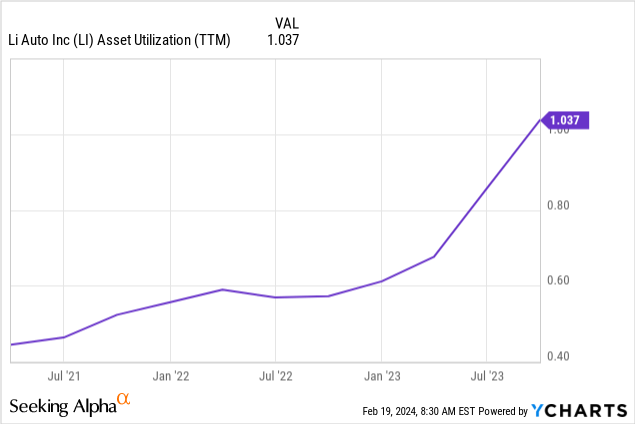

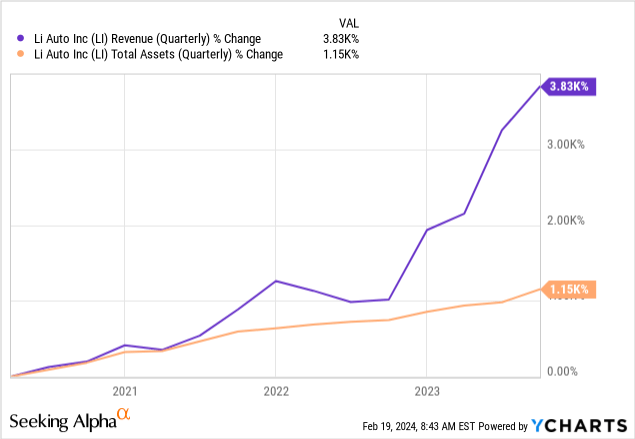

efficiency

One of the most popular efficiency measures is asset turnover/asset utilization. It is defined as sales divided by total assets. The two charts below show how asset turnover has developed over the past few years, and how sales growth has significantly outpaced total asset growth.

Just like from a profitability perspective, we are also optimistic about the company’s development and progress from an efficiency perspective.

Valuation

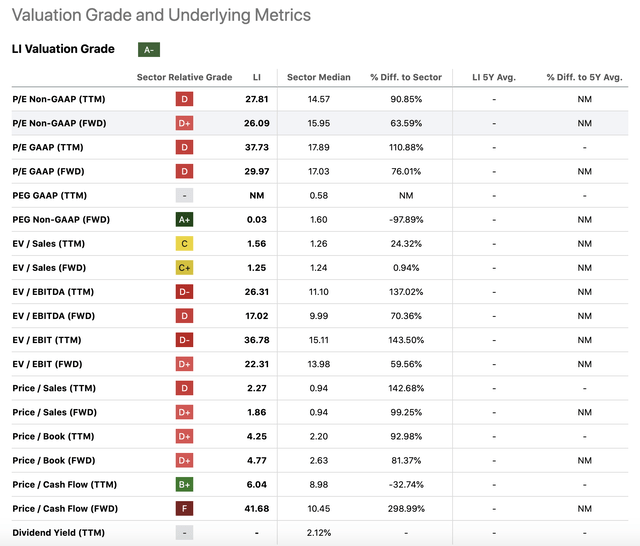

Today, we’ll use a traditional set of price multiples to determine whether the current share price is an attractive entry point. The table below summarizes these metrics.

Valuation (seeking alpha)

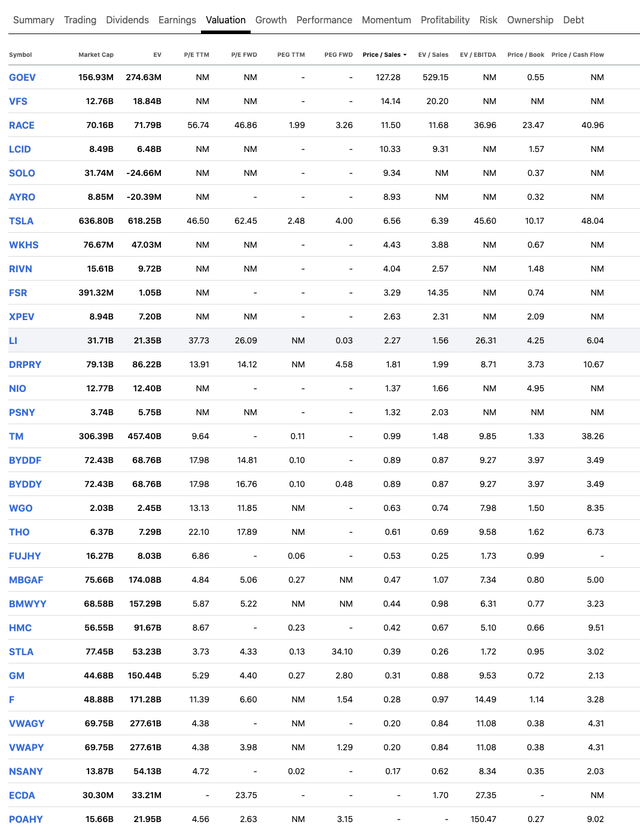

When first looking at the table, one might think that Lee’s stock is significantly overvalued. However, before jumping to conclusions too quickly, we must understand that comparison to the Consumer Discretionary industry median may not be the most appropriate choice, as it contains companies whose businesses differ significantly from LI’s. Therefore, it is important to narrow our peer group to the automotive manufacturing industry. The table below summarizes the valuations of companies in the industry.

Valuation (seeking alpha)

Since many EV manufacturers are not yet profitable, we decided to rank the companies by price-to-sales ratio. Based on this list, LI appears to be priced more attractively than most of its direct competitors, including Tesla (TSLA), Lucid (LCID), or Rivian (RIVN).

Considering the company’s rapid growth, outstanding profitability and rapidly improving efficiency, we believe the valuation is reasonable and reasonable. On the other hand, despite attractive valuations, we will only speculate lightly due to the high degree of uncertainty in China’s macroeconomic environment.

in conclusion

The company remains committed to its aggressive growth strategy, resulting in a significant increase in deliveries compared to the same period last year.

The company’s profitability, as measured by asset turnover, also improved significantly.

The company’s valuation appears reasonable and reasonable relative to the valuations of its direct competitors.

China’s macroeconomic conditions, including deflation, overcapacity among electric vehicle manufacturers and price wars among rivals, could create headwinds and potential downward pressure on profits in the coming quarters.

For these reasons, we are reluctant to increase our previously established ratings. We maintain “Hold”.