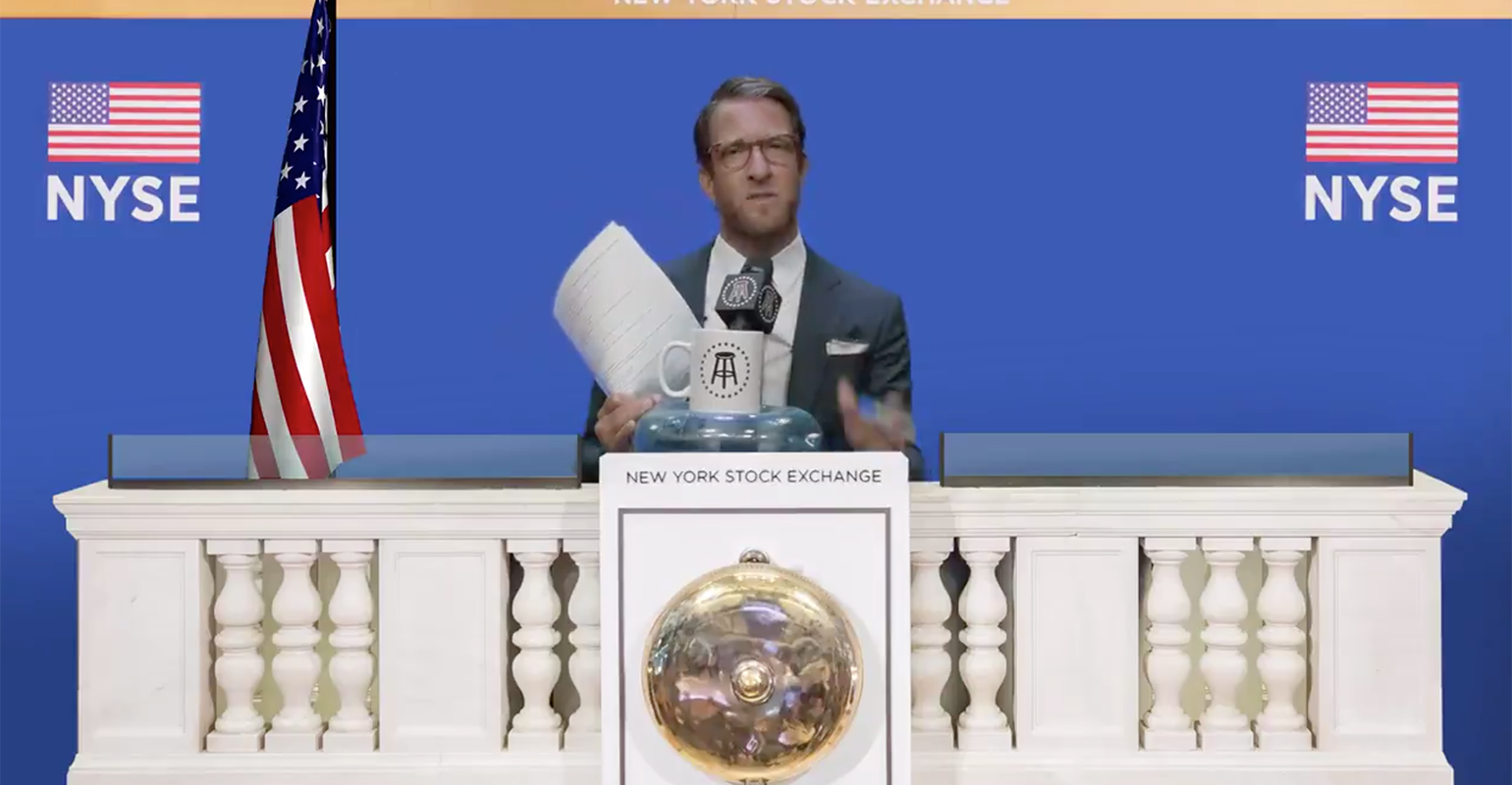

Van Eck Associates, the company behind the project Social Sentiment ETF (BUZZ), will pay a $1.75 million civil penalty to settle charges that it failed to disclose the role played by social media influencers in the ETF launch. The SEC order did not mention the influencer by name, but influencer and Barstool Sports founder Dave Portnoy promoted the ETF when it launched in 2021.

VanEck, an asset management company owned by Van Eck Associates, launched the BUZZ ETF in March 2021 to track the BUZZ NextGen AI U.S. Sentiment Leaders Index, which analyzes social media platforms, news articles, blog posts and other content from online sources. The interaction between stocks measures sentiment for a particular stock. The fund invests in 75 of the most popular large-cap stocks. The portfolio is constantly rotated based on the most positive sentiment. The fund’s expense ratio is 75 basis points.

Currently ranked companies include Palantir, MicroStrategy Inc., NVIDIA, Meta, AMD, Marathon Digital Holdings, Amazon, Coinbase, SoFi and Apple.

but SEC Order It claims the index provider told VanEck it plans to use influencers to promote the index and will pay them a licensing fee tied to fund size. As the fund grows, the index provider will receive a larger share of the management fees the fund pays Van Eck. However, Van Eck did not disclose influencer participation or the sliding fee structure to the ETF board.

“Fund boards rely on advisers to provide accurate disclosures, particularly when it comes to issues that may affect advisory contracts, the so-called 15( c) Process.”. “Van Eck Associates’ disclosure failure in this high-profile fund offering limited the board’s ability to consider the economic impact of the licensing arrangement and the involvement of high-profile social media influencers when evaluating Van Eck Associates’ fund advisory contracts.”

A spokesman for Van Eyck declined to comment.

As of February 16, the ETF had nearly $76 million in assets under management. The ETF experienced $13.1 million in net outflows last year, according to YCharts.com. The ETF’s total return increased by 31.5%, beating the S&P 500’s total return of 23.2% during the same period. Up 7.2% so far in 2024.

In an article following the ETF’s launch, ETFAction.com editor-in-chief Lara Crigger questioned why Portnoy was allowed to promote the ETF in the way he did.Krieger noted that most ETF issuers likely won’t get such an opportunity video Go through their compliance department.

She concluded that the film had an indexer vulnerability; in fact, indexers are not regulated by FINRA or the SEC, so they are not subject to compliance departments. Indexes are considered intellectual property, she said: “Indexers have broad latitude to say whatever they want about their intellectual property as long as it is not blatantly fraudulent or defamatory.”

She also wrote that she believed the SEC would soon crack down on index companies to close these loopholes.