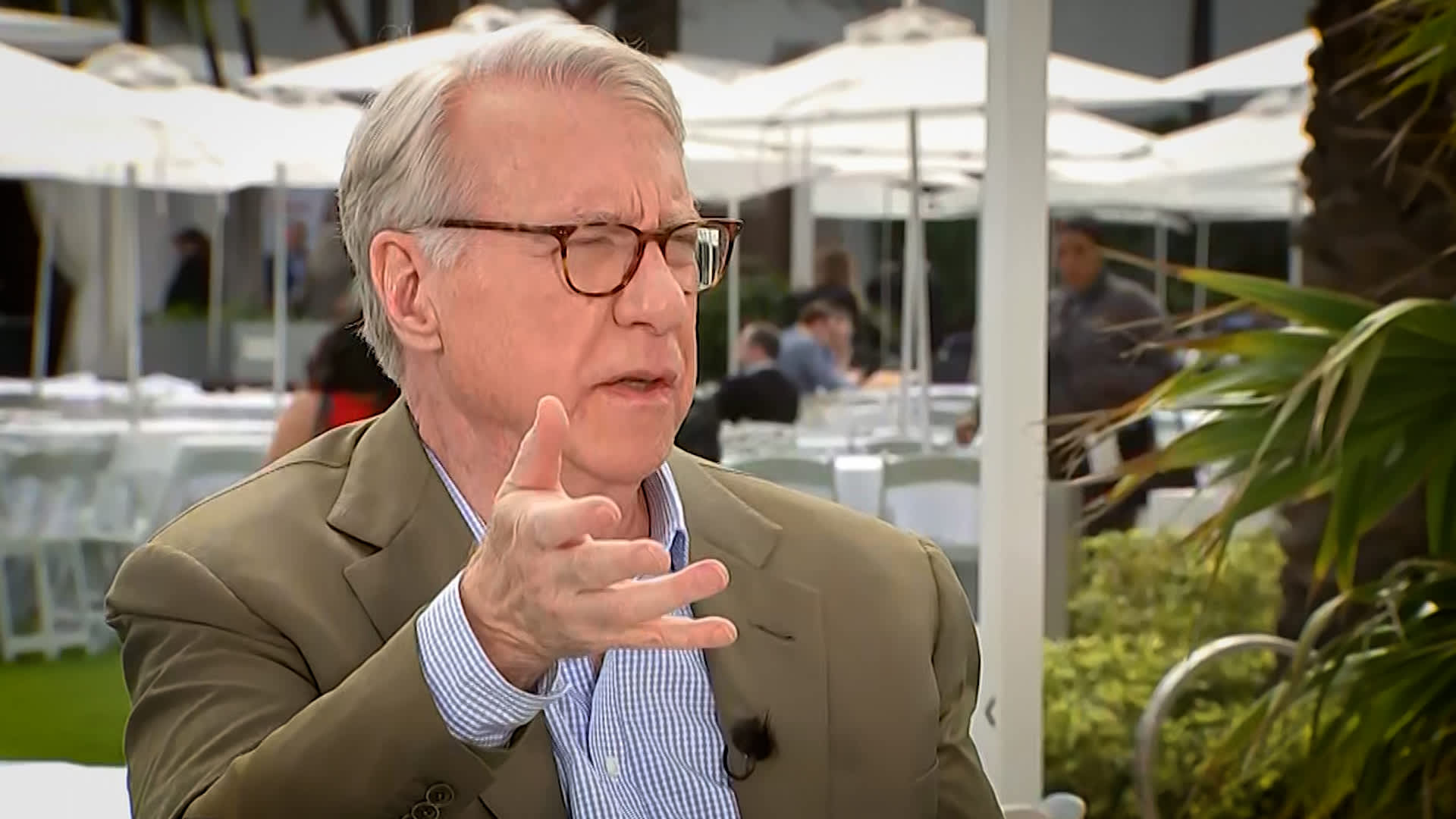

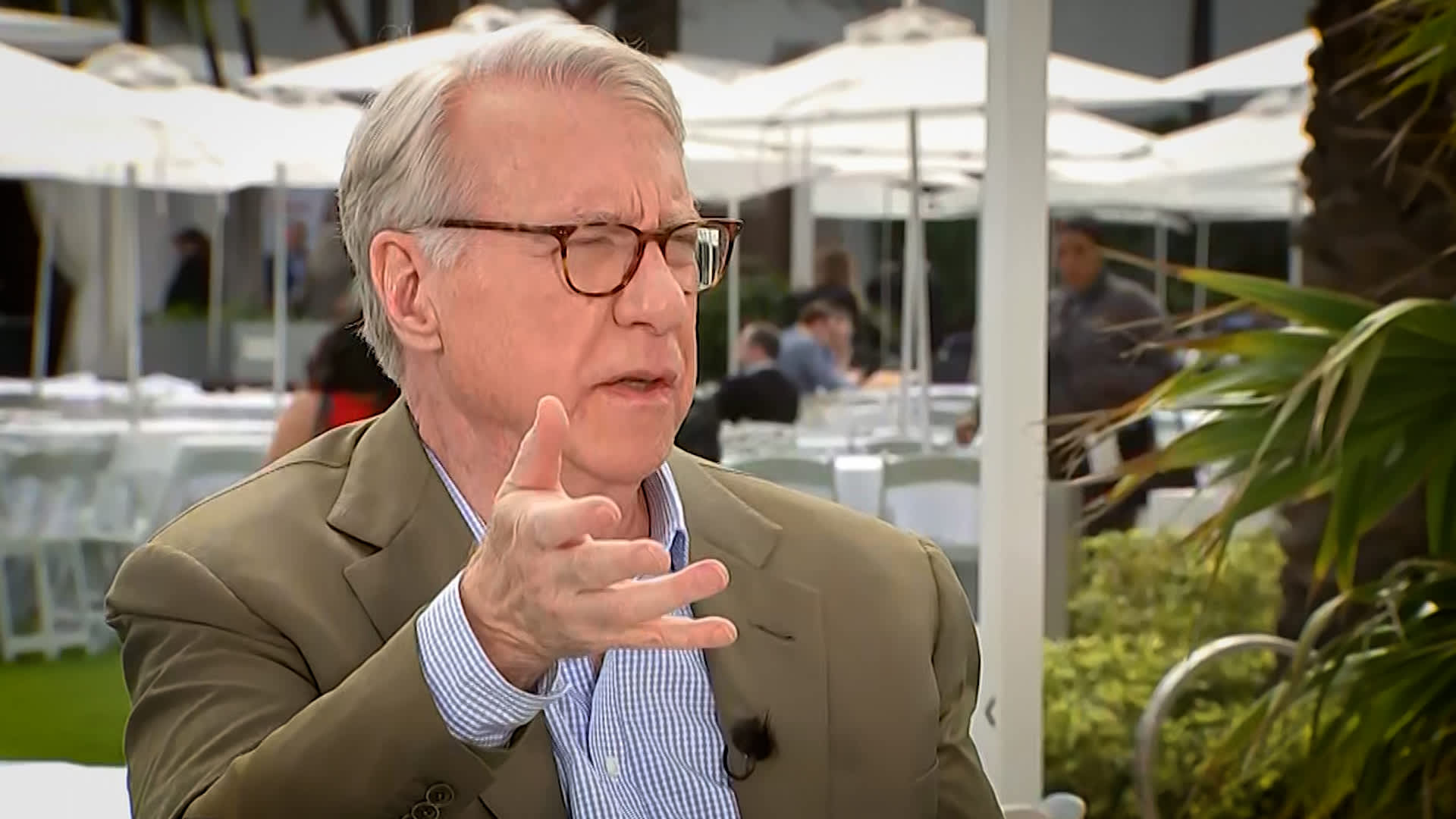

Short seller Jim Chanos is famous for declaring the collapse of Enron, then the world’s largest energy trading company. He is widely credited with being the first person to discover that Enron was a house of cards. “As the internet age evolves, people are really starting to accept more and more stories that are not exactly tech companies,” Chanos said on the latest episode of CNBC’s “The Art of the Deal.” “It gives investors confidence that they’re getting Disrupting existing businesses like energy. For an aggressive company like this, now is the perfect time to sell this story to investors.” Enron’s unprofitable business model and questionable accounting practices led to Chanos Made a short bet on the company in late 2000 and continued to add to its position after news of massive insider selling and executive departures. “We’ve increased a lot…almost all the way down,” he said. “Because the news keeps getting worse, and worse, and each incremental piece of bad news is worse than what we’ve experienced.” One thing that might surprise people: Enron wasn’t Chanos’ part of the story. The only stock that was shorted during the event and profited from. At the end of 2001, with Anlong’s stock price falling rapidly, its competitor Dynegy made a life-saving offer to acquire Anlong. The news boosted shares of Enron and Dynegy. However, Chanos saw a big red flag in Dynegy, which led him to short the stock, which ended up plunging 90%. Monday marks the 20th anniversary of the U.S. Securities and Exchange Commission charging former Enron CEO Jeffrey Skilling with fraud and other crimes related to the energy trader’s collapse. Watch the full video above to learn about Chanos’ legendary Enron bet. Don’t miss these stories from CNBC PRO: Warren Buffett’s Berkshire Hathaway is keeping new stock picks secret again. That’s what it means for Michael Burry of “The Big Short” fame to buy Amazon, Alphabet and a dozen other new stocks, leaving Nvidia behind.There’s a New Hot Artificial Intelligence Stock That’s Soared 960% in the Past Year Morgan Stanley’s Slimon Lists 3 Stocks to Buy Now: ‘This Will Be a Good Year for Stocks’ This Little-Known Stock of banks are offering one of the highest CD rates