Here’s a deal that delivered a 1,500% return on investment in five years: In 2018, Staple Street Capital paid $38.8 million for a majority stake in Dominion Voting Systems, a Denver-based technology company. Two years later, some Republican-leaning outlets amplified baseless accusations that the company’s election machines fraudulently altered votes in the presidential election.

On the eve of the defamation lawsuit, Fox News agreed to pay Dominion a settlement of $787.5 million. Staple Street expects to cut $598.5 million, more than half the total value of its existing portfolio! (Fox News, Dominion settlement delivers 1,500% return for private equity firm – Bloomberg)

It’s the financial home run that private equity dealmakers dream of. But was this factored into the analysis of the Staple Street pros who designed the 2018 deal? never. This is a black swan event that is logically unpredictable. While acquiring Dominion may have been a smart move in 2018, it’s safe to say that without the lawsuit and settlement, the deal wouldn’t have had an ROI close to 1,500%.

This begs the question of how private equity firms can generate legitimate returns of the non-black swan variety. Generally speaking, they come from three sources: rising earnings, the deleveraging process, and higher exit multiples. So let’s discuss these sources in more detail and dive into how their relative importance has evolved over time and in today’s market environment.

1. Increase income

The primary goal of almost all private equity transactions is to increase the earnings of the acquired company. This is sometimes referred to as operational value creation and may involve cost reduction, revenue growth or both. Regardless of how they are generated, increased revenue can help drive higher returns in a variety of ways. In addition to the direct benefit of higher earnings on exit, they drive two other streams of returns by generating cash flow to pay down debt (deleveraging), while in some cases also enabling the business to reach new scale and/or The profit level can increase the exit multiple.

2. Deleveraging process

Archimedes said that as long as he had a long enough lever, he could move the world. It’s also the case that with enough financial leverage, a private equity firm can execute almost any deal, no matter how much dry powder it has. Anyone who has studied basic LBO (Value Drivers in LBO Models | Simple Model) knows that higher upfront leverage can increase returns as long as interest rates are below the cost of equity capital. In other words, leverage allows a small amount of equity to control a large amount of revenue and earnings (an example of leverage creating/destroying value). Over time, with healthy cash flow and earnings growth, private equity firms can pay down debt and deleverage the business, driving higher returns. But on the front end of trading, higher leverage also means higher risk, and it becomes harder to rely on leverage when interest rates rise, as they have recently.

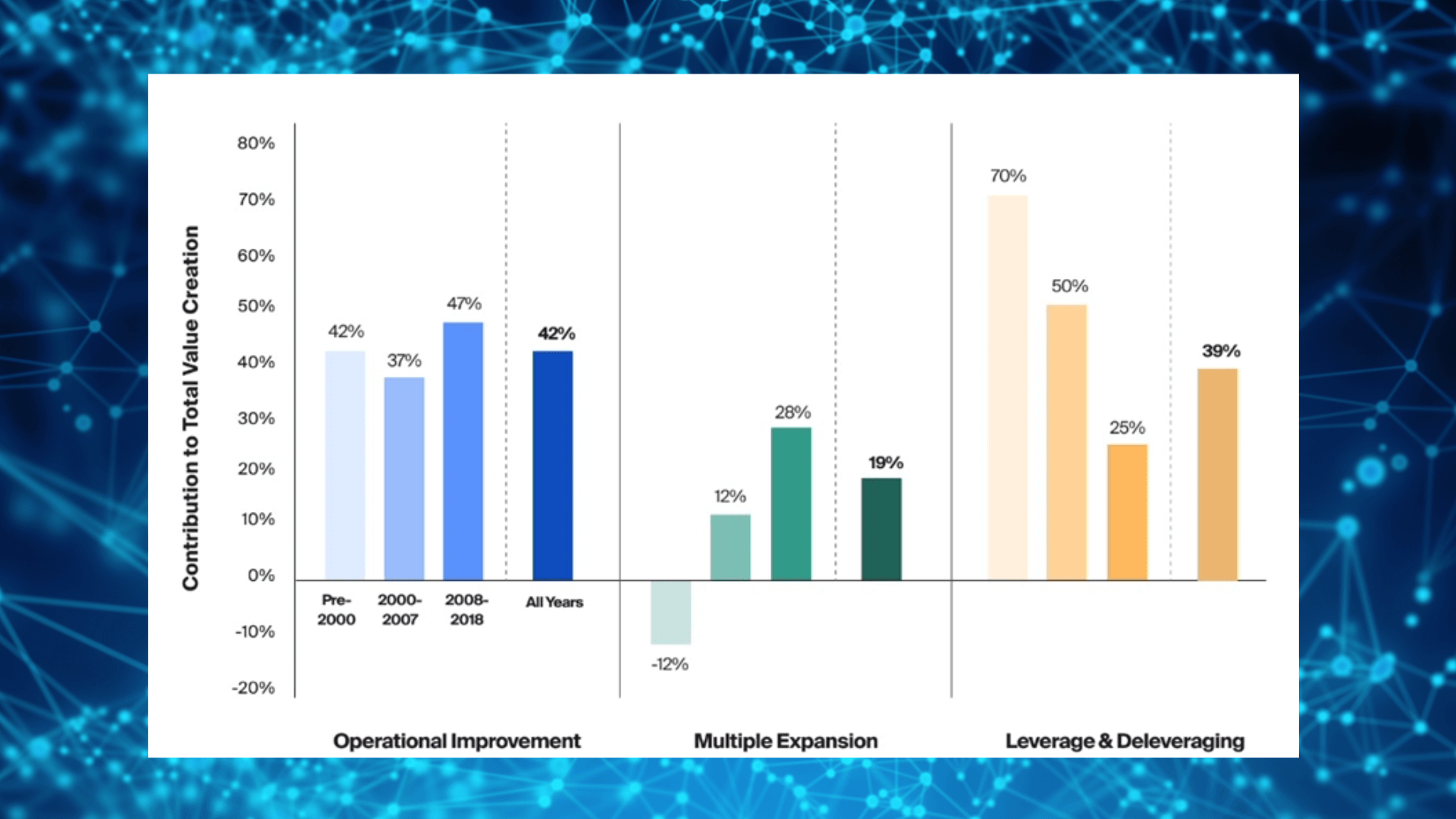

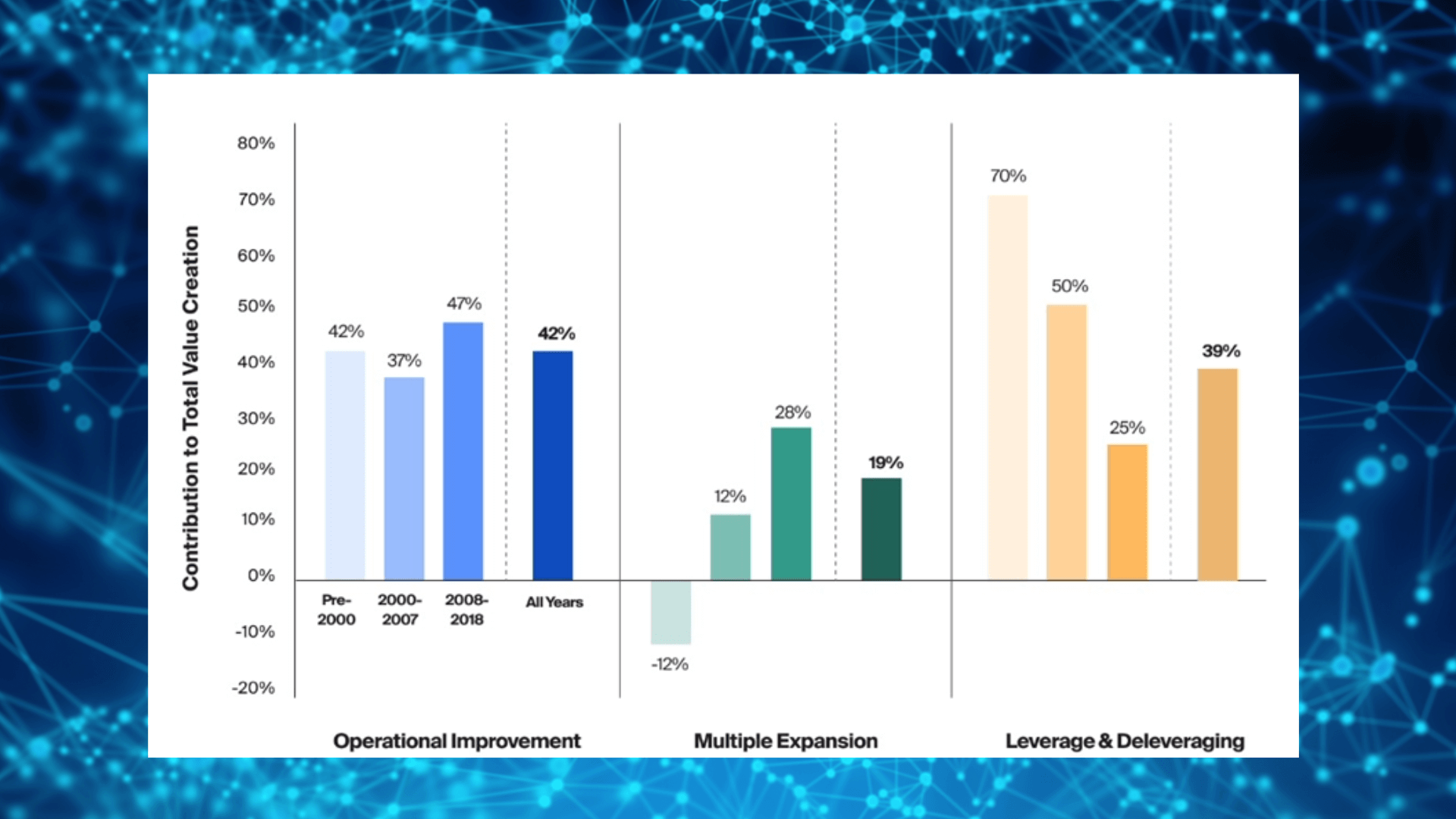

Figure 1 below shows that prior to 2000, deleveraging processes accounted for a higher share of total value creation (70%) than either operational improvements (42%) or multiple expansions (-12%). But in the most recent period of the chart (2008-2018), its share fell to just 25%. Aggregated data for recent years is not readily available, but my sense is that in the current environment the share of returns from what the chart categorizes as “operational improvements” is growing, but at the expense of deleveraging and/or multiplex expansion.

Figure 1. PE value creation evolves over time (Source: The Changing Drivers of Private Equity Value Creation – CAIS (caisgroup.com))

(Background added)

3.Exit multiples

Exit multiples can be significantly affected by factors such as market conditions and interest rates, which are beyond the control of private equity firms and their managing partners. In fact, I call exit multiples the most difficult variable to predict in private equity investing (Private Equity in a Recession | Simple Model). Therefore, experienced investors are extremely cautious about multiple expansion forecasts in their early investment cases. When I was a young newbie to investing, I used to inflate the exit multiples in my models without good reason. Let’s just say the partner I reported to didn’t buy into this aspect of the model and wasn’t shy about letting me know it.

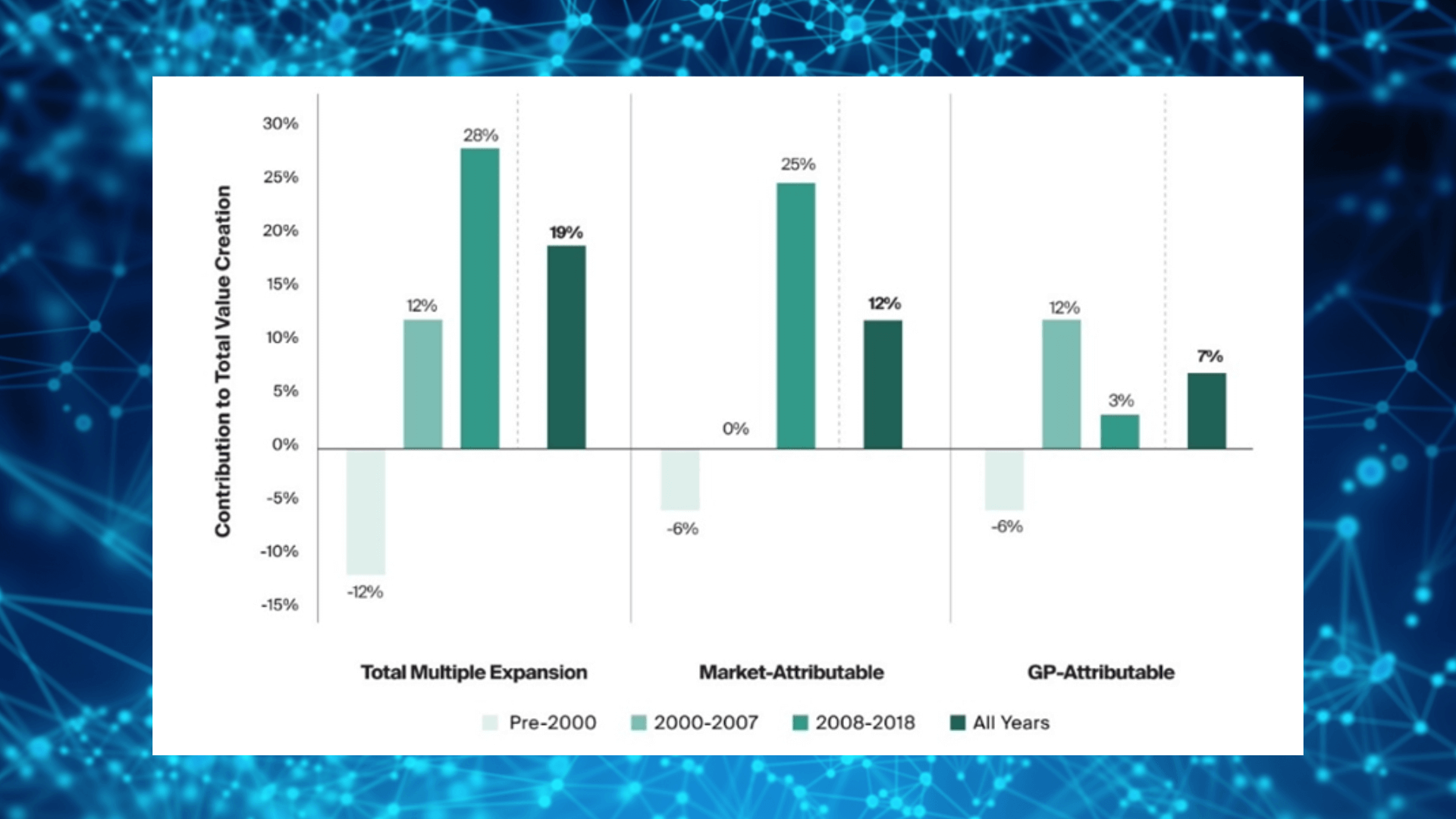

That being said, there are actions within a company’s control that can in some cases increase a company’s P/E ratio over time, such as significantly increasing the scale of the business, increasing the share of high-margin or technology-enabled products or diversifying its customers and/or or product portfolio. Figure 2 shows not only how multiple expansions have accounted for an increasing share of PE value creation in recent decades (similar to the trend shown in Figure 1), but also what portion of multiple expansions is attributable to market forces versus The efforts of G.P. However, it is worth noting that over time, in recent times, market forces have exceeded GP efforts by a ratio of more than 8:1.

Figure 2. Multiple expansion: market and partner attributable (Source: https://www.caisgroup.com/articles/evolving-drivers-of-private-equity-value-creation)

(Background added)

The role of holding period in generating returns

The length of time a private equity firm plans to hold a business can affect the returns a deal is expected to generate. Private equity is known for moving quickly – acquiring targets, implementing value creation strategies and selling quickly. This agility is a key advantage that private equity firms have over public companies and other large strategy firms, which often must clear time-consuming regulatory and bureaucratic hurdles to integrate.

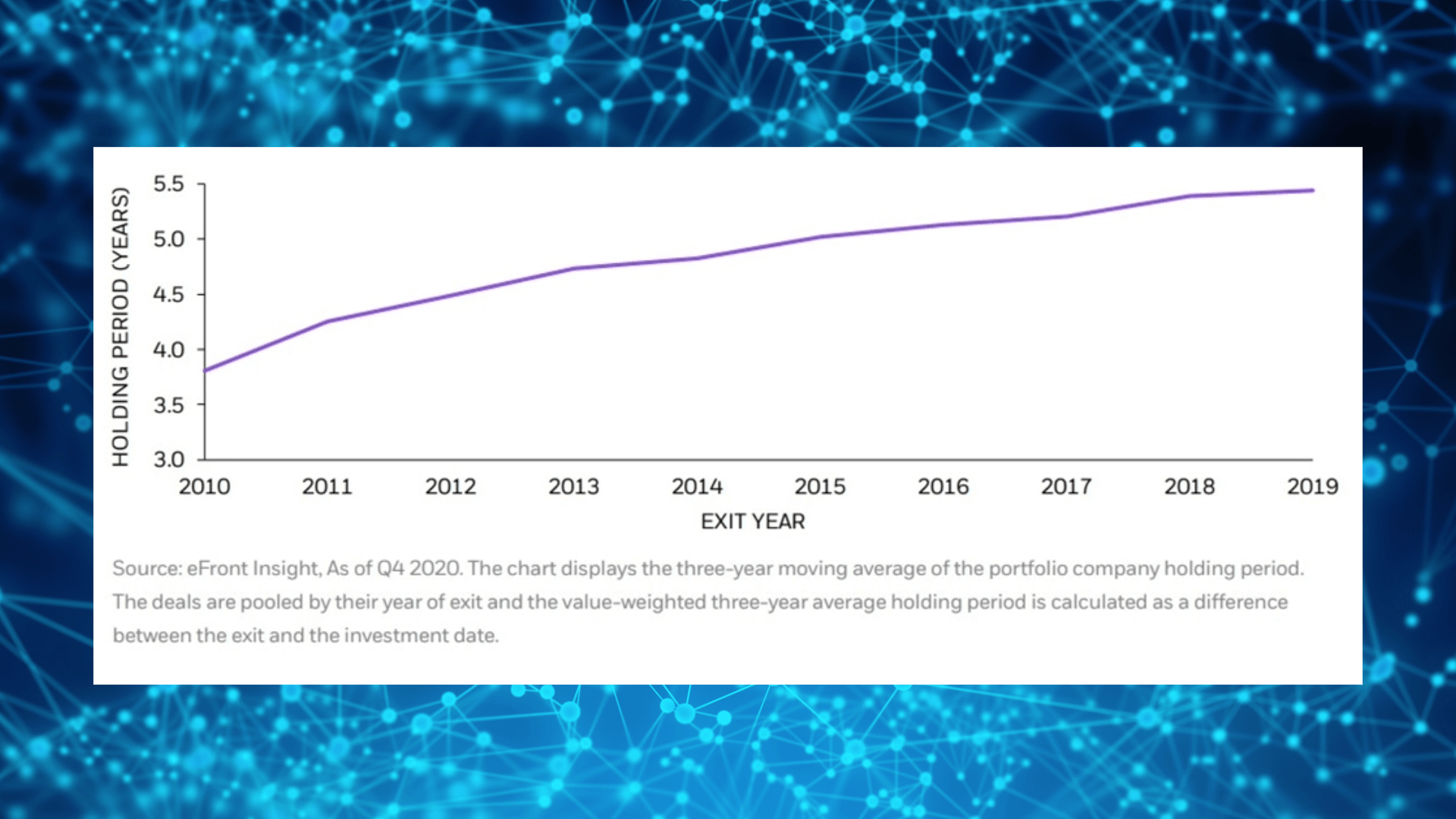

But that’s changing. While most private equity deals are still financed through loans that must be repaid or refinanced in no more than 5-7 years, holding periods have been steadily lengthening since 2010, as shown in Figure 3. Economic slowdown and uncertainty may be one of the reasons.

But in many cases it’s just a changing strategic focus. Some fund managers see the potential for further growth in deleveraging companies and will recapitalize them and distribute cash dividends before restarting the deleveraging process, especially if exit conditions are less than ideal. Additionally, as private equity funds evolve and managers increasingly pursue larger, more “specialized” goals, achieving profitable growth and business improvement may require more than it did decades ago when funds first began acquiring founder-run businesses. For small businesses, it takes longer.

Figure 3. Private equity holding periods continue to lengthen as capital becomes more patient (Source: Exit environment and holding period evolution in 2020 | Egypt)

(Background added)

However, a longer holding period could mean larger interest payments and a more uncertain exit multiple if the sales environment evolves in unforeseen ways. This will make the source of returns over which private equity firms have the most control—traditional earnings growth—increasingly important as holding periods lengthen.

Conclusion: A winning move that pays off

Interest rates are likely to remain high for the foreseeable future, certainly relative to the cheap money investors have become accustomed to since the financial crisis. Private equity firms need to adapt—modify or reformulate strategies that generate return on investment. The rewards are still there, but they may not be as easy as before. Operational improvements within a fund’s control to improve returns will be critical, and having a focus on this and having the infrastructure to match (e.g. stable operating partners, internal and cross-portfolio best practice tools Packages, etc.) companies may be in the lead. advantages in the coming years.

There may also be an increasing advantage in purchasing companies that have not previously been owned by private equity firms, making it more likely that there is still ample room for operational improvement. This logic applies not only to private equity funds looking for targets, but also to independent sponsors looking to acquire businesses, and even to senior executives deciding to acquire a company during uncertain times. Focusing on businesses with substantial operating improvement levers and developing a plan to implement them can be a winning move, rather than taking short-term gambles on multiple improvements in leverage and markets.

Related: Value Drivers in Leveraged Buyout Models

Learn more about private equity transactions with ASM’s private equity training courses. ASimpleModel.com’s private equity training courses are developed by industry professionals. The following content goes beyond the leveraged buyout model to explain how private equity professionals find, structure and close deals.