Robert Lake/Photo Library via Getty Images

As virtually all academic research confirms, it’s difficult to beat a passive cap-weighted benchmark through stock picking, but that doesn’t mean some people won’t try. Invesco Russell 1000 Dynamic Multi-Factor ETF (Bat: OMFL) is a fund that aims to do things differently, but with mixed results. Maybe it’s a function of the cycle we’re in, but it’s worth looking at what the fund does to really determine whether it’s a better choice for a core holding in a portfolio.

OMFL was established in 2017 and is managed by Invesco Capital Management LLC, a strong player in the ETF field. OMFL is unique in its dynamic management approach that is closely tied to the economic cycle.The Fund invests at least 80% of its total assets in the securities that make up the Russell 1000 Index, except For all Russell 1000 companies, allocations are not proportional to market capitalization.

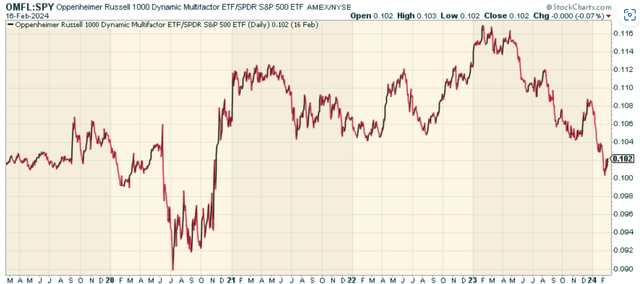

The fund’s strategy revolves around identifying four scenarios – recovery, expansion, slowdown and contraction – based on various macroeconomic indicators such as manufacturing business surveys, monetary conditions and housing activity. Each stage focuses on a different type of stock, making the fund’s composition diverse and dynamic. This unique approach allows OMFL to deliver strong returns, but over a multi-year period, returns remain broadly in line with the passive S&P 500 on a price-ratio basis compared to 5 years ago.

stockcharts.com

ETF Holdings: A Closer Look

OMFL has 377 securities in its portfolio. The top 10 holdings account for only about 8% of the fund, reflecting its diversified nature. The fund’s allocations are not based on the market capitalization of all Russell 1000 companies, and no positions account for more than 1.08% of the fund.

Holding companies include:

- Builders first source: A premier provider of construction products, prefabricated components and value-added services to the specialty markets of new home construction, repair and remodeling.

- Marathon Oil Company: American petroleum refining, marketing and transportation company headquartered in Findlay, Ohio. It is the largest direct descendant of John D. Rockefeller’s Standard Oil Company.

- Pulte Group: One of the largest homebuilders in the United States, with operations in approximately 50 markets across the country.

- Jabil: A manufacturing solutions provider offering comprehensive design, manufacturing, supply chain and product management services.

It is worth noting that the composition of the fund may change based on the economic cycle, resulting in higher turnover rates.

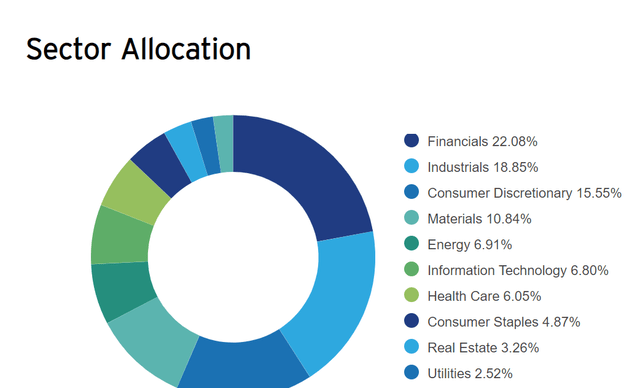

Industry composition and weight

A key feature of the fund is its industry composition. The fund’s largest investment areas are financials, followed by industrials and consumer discretionary. This sectoral allocation is dynamic and can change based on economic cycles.

invesco.com

Earlier I mentioned that cycles are not conducive to this approach and we can see why here. Financial stocks have the largest weighting, with technology stocks (which have been the source of all the momentum over the past year) accounting for just 6.05%. That’s probably a good thing in the long run, assuming the industries don’t change in terms of their approach until that mix of industries really starts to play out.

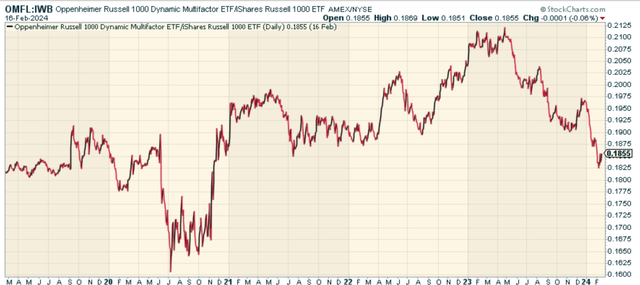

Comparison with other similar ETF peers

When investing in ETFs, it’s a good idea to consider how a specific fund compares to similar funds. In the case of OMFL, it’s worth comparing it to the iShares Russell 1000 ETF (IWB). While both OMFL and IWB invest in the Russell 1000 Index, IWB is passive while OMFL is dynamic. There has been no real alpha relative to the Russell 1000 over the past 5 years, mostly due to technical weighting and what happened in the last year.

stockcharts.com

In-depth analysis of investment themes

The main investment themes tracked by OMFL are closely related to economic cycles. By adjusting the investment portfolio according to the stage of the economic cycle, the fund aims to capture growth opportunities and reduce the risks associated with different economic conditions. The fund’s focus on value, momentum and low-volatility stocks allows it to provide a balanced portfolio that delivers solid returns over the long term.

However, it’s worth noting that this strategy comes with its own risks. Given the Fund’s high turnover rate and the dynamic nature of its investment strategy, the Fund’s performance may be materially affected by changes in economic conditions. In addition, a fund’s returns may not always align with broader market trends, which can lead to periods of underperformance, as we are seeing now.

Conclusion: To invest or not to invest?

The fund’s dynamic management approach is tied to economic cycles, allowing it to adapt to changing market conditions and capture growth opportunities across various industries. Sounds good on paper, but the performance isn’t really as strong as the reasons to buy the fund. I prefer passive to this, although it’s still an interesting approach.