Financial advisors see a disconnect between the economy and the stock market.

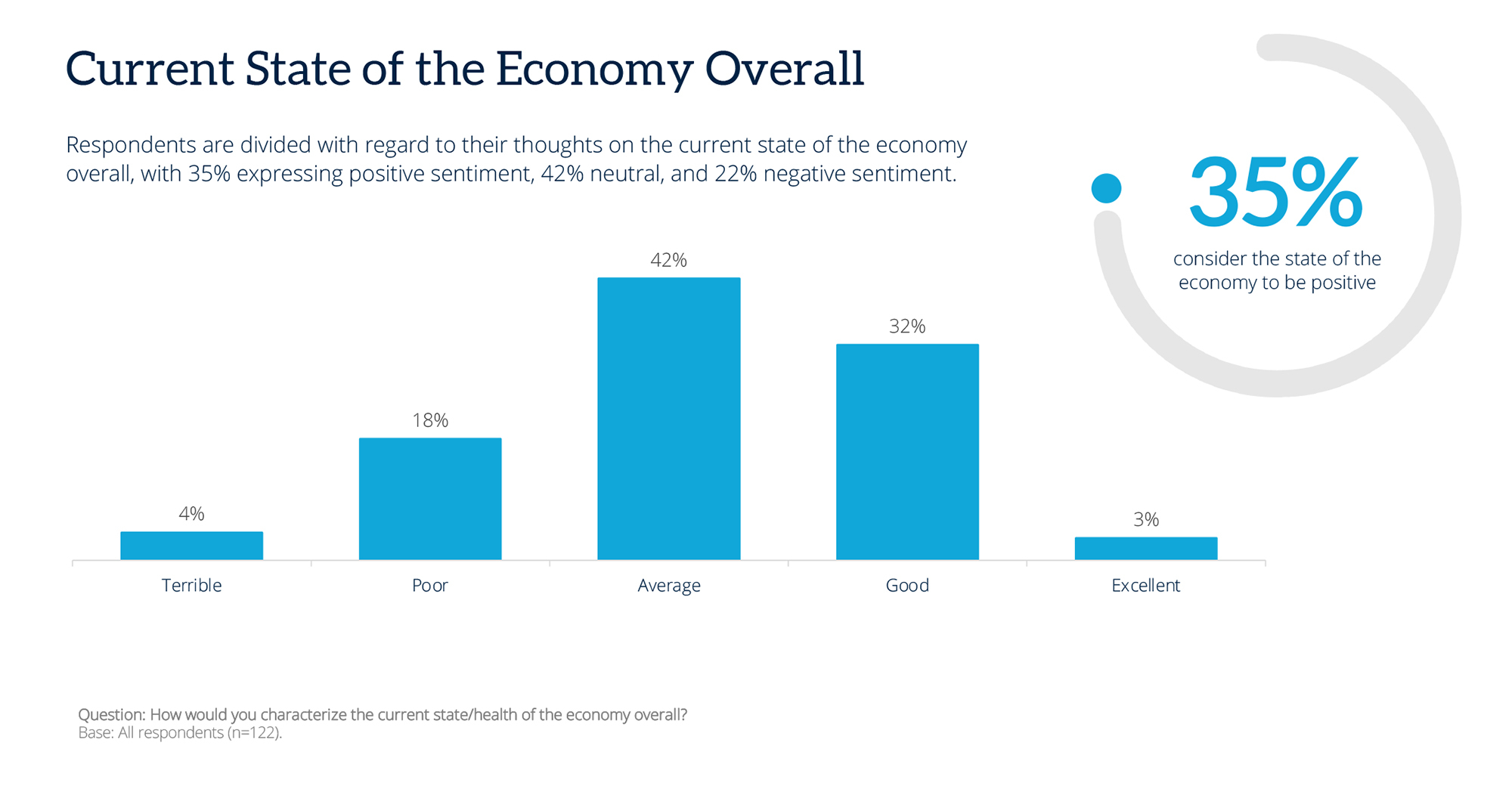

The January RIA Edge Advisor Sentiment Index found that only 35% of retail financial advisors said they had a positive view of current economic conditions. Meanwhile, nearly twice that number (62%) of advisors say they have a positive view of the stock market.

The Advisor Sentiment Index is a monthly poll that measures financial advisors’ current views on the state of the economy and stock market, and where they think both are heading over the next six months and this time next year.

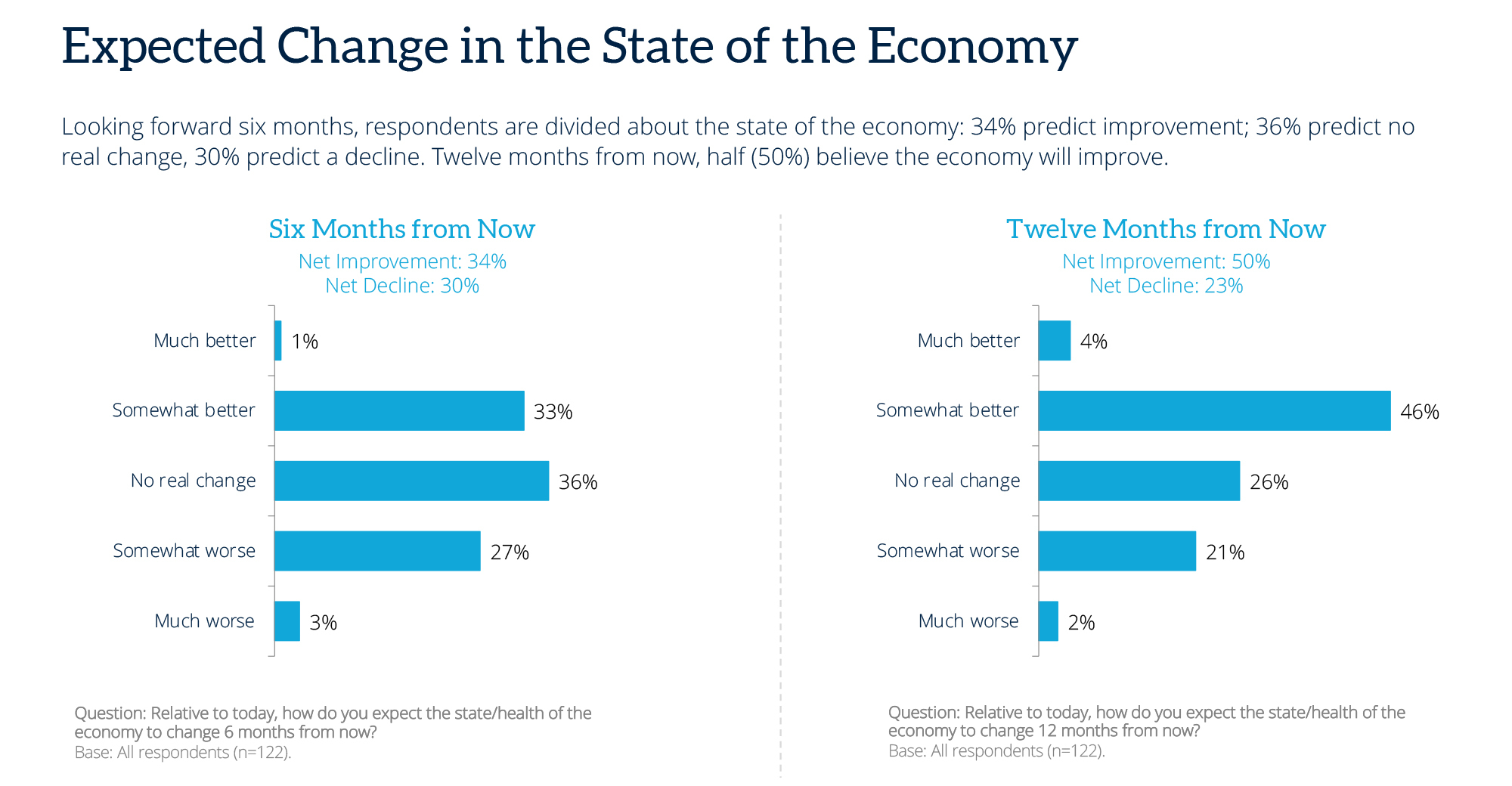

In the January poll, most advisers seemed to think the economy would eventually settle into the market: Over the next six months, advisers varied on whether they saw themselves as more or less optimistic about the economy.

But looking ahead to this time next year, the numbers will improve. Half (50%) of advisors surveyed think the economy is somewhat (46%) or much better (4%) than it is now.

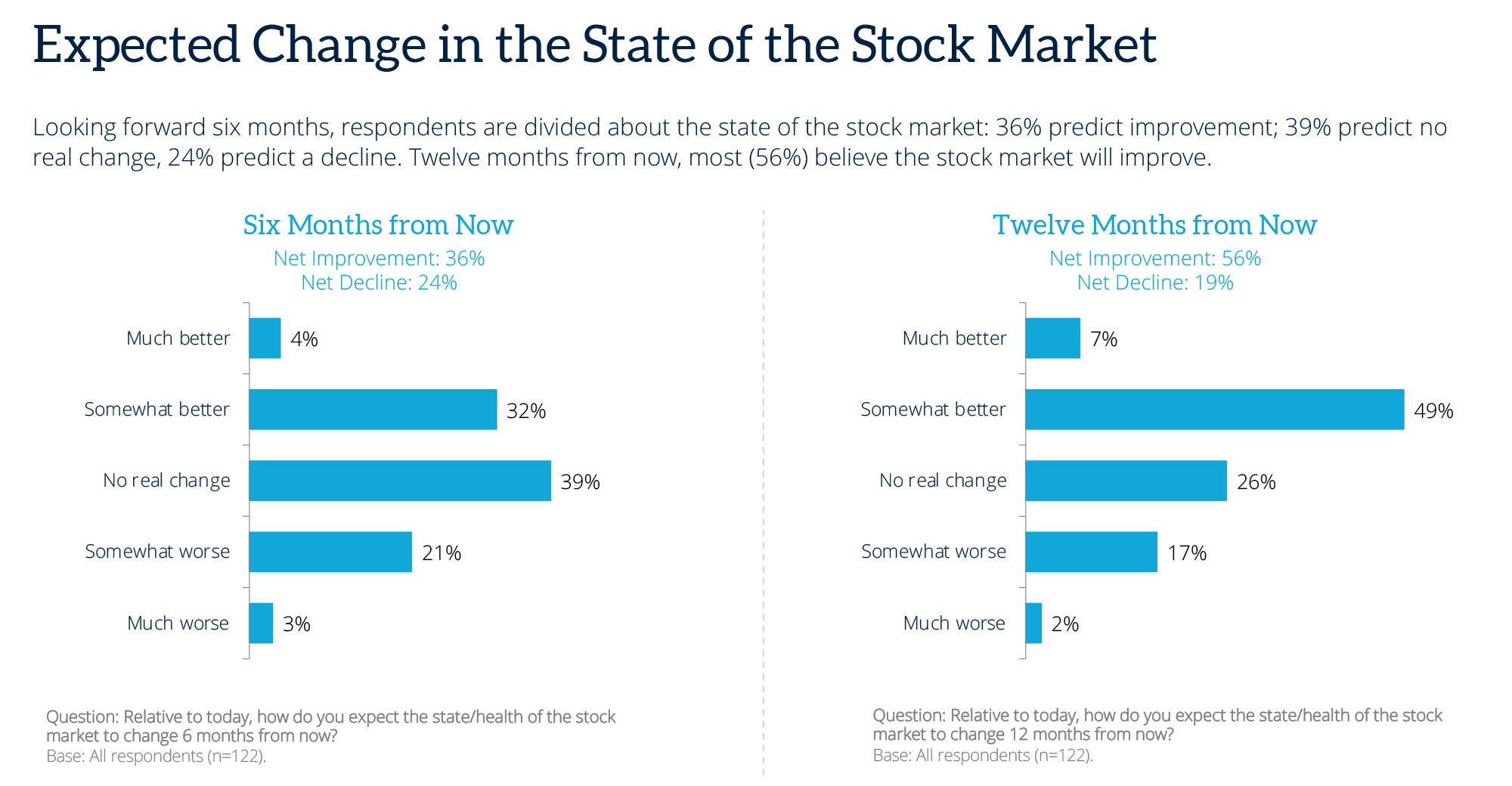

The same goes for the stock market: Looking ahead to the next six months, respondents are divided: 36% expect improvement, 39% expect no real change and 24% expect a decline. Twelve months from now, a majority (56%) believe the stock market will improve.

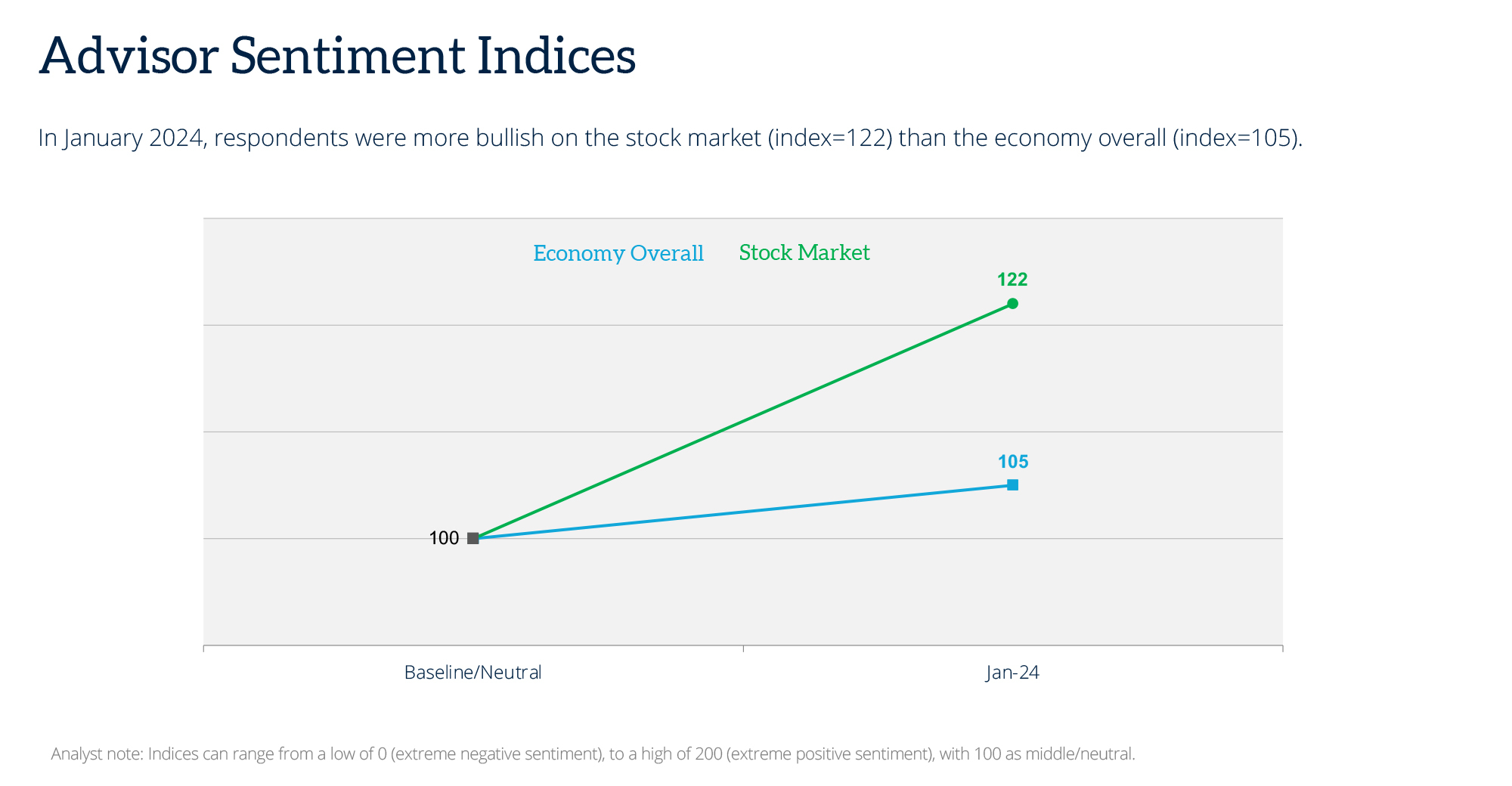

When responses are weighted and placed on a scale from 0 (extremely negative sentiment) to 200 (extremely positive sentiment) (with 100 being neutral), the Advisor Sentiment Index for Stock Market Conditions is 122, which is quite optimistic, while the Advisor Sentiment Index for Stock Market Conditions is 105. Economical, or slightly above neutral.

Methodology, data collection and analysis by WealthManagement.com and Informa Engage.Data collected from January 22 to 29, 2024. The methodology is consistent with accepted marketing research methods, practices and procedures. Beginning in January 2024, WealthManagement.com will begin rolling out short monthly surveys to active users. Data will be collected during the last 10 days of each month, targeting a minimum of 100 financial advisor respondents per month. Respondents were asked about their views on the economy and stock market now, six months and one year from now. Responses are weighted and used to create an index relative to a neutral value of 100. Over time, ASI will provide targeted sentiment for retail-facing financial advisors.