Maddie Meyer

Modena Corporation (NASDAQ: MRNAVaccine prices have begun to move higher as the market turns its focus to Spikevax’s pipeline and higher market share.The biotech company faces a tough 2024 with another revenue decline, efficacy data Doubts about the pipeline sales potential of their new respiratory vaccine.mine investment thesis Still bearish on mRNA stocks as losses mount and the leading vaccine may struggle to hit sales targets.

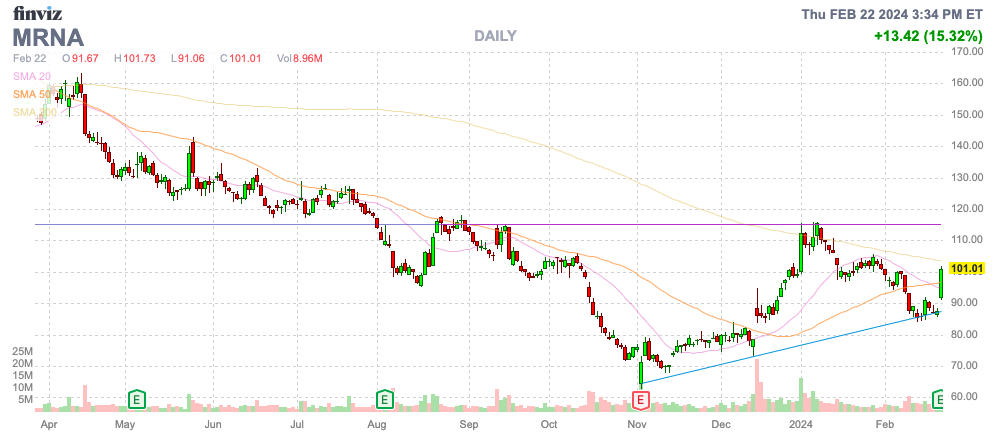

Source: Finviz

All about the RSV vaccine

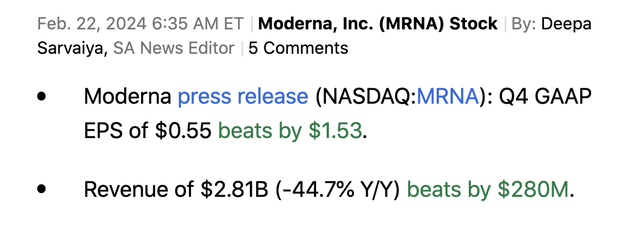

Ahead of Thursday’s open, Moderna reported the following Q4’23 numbers:

Source: Seeking Alpha

The biotech ended 2023 on a strong note with better-than-expected Covid-19 vaccine sales, driven by market share gains as retail market share rose to 48% from 37%. Moderna reported that sales were still down 45% compared with the previous quarter.

Sales forecasts see vaccine sales falling to just $4 billion by 2024, down sharply from the $6.8 billion reported last year. After deducting $600 million in deferred revenue related to Gavi, sales were just $6.2 billion.

The key, though, is where Moderna’s RSV vaccine sales will go by 2025. The company expects mRNA-1345 to receive regulatory approval by the middle of this year, but the biggest issue is that the vaccine is late to market and may not match the efficacy of similar drugs already on the market during the 2023 RSV season.

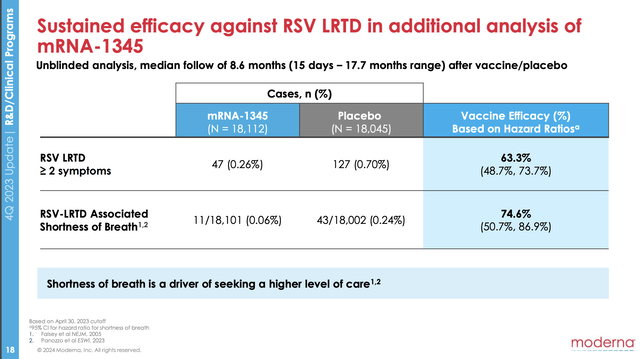

Moderna recently reported key Phase 3 data showing the vaccine met the primary and secondary goals of the drug trial. The company expects to receive regulatory approval this year and launch commercially in major markets by the end of the year.

Source: Moderna Q4’23 presentation

Many promising pipeline market prospects depend entirely on the success of Covid and RSV vaccines. If COVID-19 vaccine demand continues to decline and the RSV vaccine is deemed less effective than those already on the market, Moderna will no longer have a best-in-class product pipeline.

Analysts at TD Cowen and UBS said the RSV vaccine did not match the efficacy levels of drugs that have been on the market since 2017. GSK (GSK) and Pfizer (PFE). As shown in the slide above, the mRNA-1345 vaccine against both symptoms of RSV dropped from 84% to about 63% in about eight months. The efficacy of the GlaxoSmithKline vaccine fell from 83% to 77% over 14 months, while the effectiveness of the Pfizer vaccine against three symptoms fell from 89% to 79% over 17 months. Both numbers are much higher than the Moderna vaccine.

RSV sales surge to $2.5 billion during 2023 RSV vaccine season, with Arexvy offers $1.5 billion Abrysvo provides $900 million. Over time, the market is expected to reach $10 billion, and GSK expects Arexvy sales to peak at $3.8 billion. Opportunities for a third RSV vaccine with comparative efficacy issues appear to be limited.

Moderna promotes the concept that the vaccine is a prefilled syringe (“PFS”) only. While PFS may be preferable, the purpose of the RSV vaccine is to save lives, and proven more effective drugs will always supersede convenience.

Another difficult year

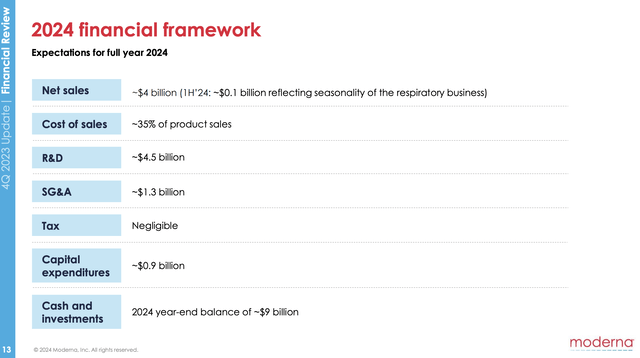

Moderna faces another tough year in 2024. The company expects sales of $4 billion, down from an adjusted $6.2 billion in 2023.

Source: Moderna Q4’23 presentation

The company does not expect the $2.1 billion in pre-order agreement sales in the first half of 2023 to be repeated in 2024. The sales have been postponed from 2022 as the market shifts from advance pricing arrangements to retail sales.

Moderna needs sales of an RSV vaccine or other approved drugs to improve its financials. The company expects COGS to be 35% and gross profit to reach $2.6 billion by 2024.

The biotech company has forecast R&D spending to be well above gross profit. On top of this, Moderna SG&A will reach $1.3 billion, resulting in an operating loss of $3.2 billion.

The company will spend another $900 million on capital expenditures, resulting in massive negative cash flow this year. Management forecasts a cash balance of $13.3 billion at the end of 2023, which will fall to about $9 billion by the end of 2024 as free cash flow was negative $4.3 billion for the year.

Moderna expects sales to grow in 2025, but the biotech company will need to grow significantly to eliminate operating losses. At a COGS level of 35%, sales would have to be close to $7 billion to meet current R&D levels, but we believe RSV sales will not materialize as expected because GlaxoSmithKline and Pfizer already control the market.

The stock has rebounded to $100, bringing its market capitalization back to nearly $40 billion, with a diluted share count of 395 million shares. Moderna’s costs are too high due to issues with vaccine sales and pipeline quality, as well as ongoing huge losses.

take away

The main takeaway for investors is that investors should take advantage of the recent rally to sell Moderna stock. The data doesn’t point to any improvement in sales next year, forcing the biotech company to restructure its business before its focus turns to next-generation vaccines. pipeline.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.