Grid Cube/iStock via Getty Images

Taiwan Foundation Overview

Taiwan Fund Company (NYSE:TWN) is a closed-end fund focused on actively managing a portfolio of stocks listed on the Taiwan Stock Exchange to achieve long-term capital growth.according to Fund websiteit will”Semiconductor industry investment accounts for more than 25% of total assets”.

The investment consultant is Nomura Securities, and Nomura Taiwan has a dedicated team dedicated to managing this fund. The investment team has continuous experience in managing Taiwan stock mandates since 1998. Its investment philosophy centers on bottom-up stock selection and is biased toward growth.

Investment managers Sky Chen and George Hsieh have 17 and 21 years of investment experience in Taiwan’s investment industry respectively.

Taiwan Foundation Overview

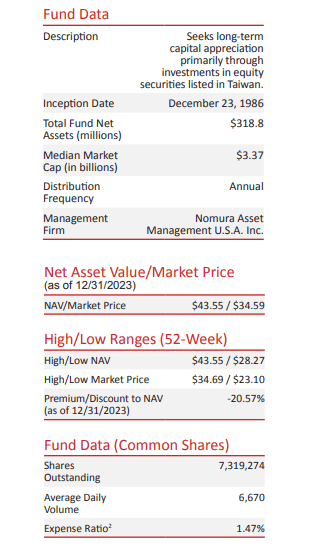

The Taiwan fund is of reasonable size, with assets of approximately US$330 million. Managed.

Distributions are typically paid annually, but investors should remember that the goal here is long-term capital growth.

The expense ratio is just under 1.5%. Such fees are not unusual for actively managed emerging market equity funds. Importantly, in this case, unlike many other funds, the Taiwanese fund appears to have sufficient performance to justify the fees it charges.

Below is an overview of the key facts about Taiwan Foundation.

Taiwan Fund Overview, December 31, 2023.

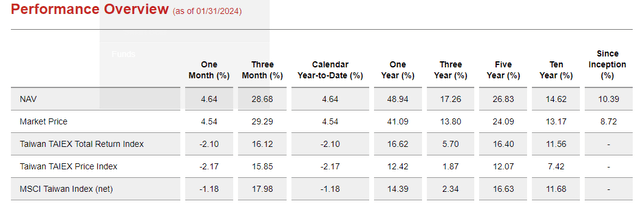

Taiwan Foundation’s Past Performance

Given the historical performance shown in the chart below, investors in Taiwanese funds may be pleased.

Taiwan Foundation website

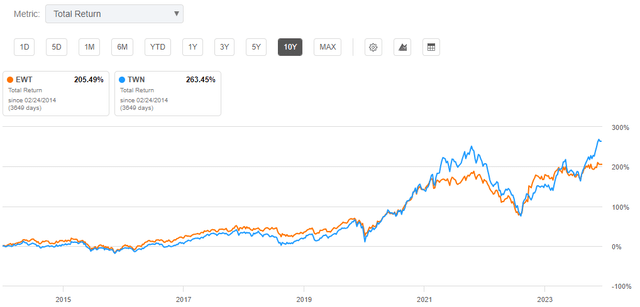

Taiwan foundation or ETF?

Although there is no guarantee that it will continue in the future; judging from the historical performance of Taiwan funds, its investors will perform better than ETFs.

Seeking Alpha TWN and EWT total returns for 10 years ending February 22, 2024

Active management has worked well in this situation for at least the past decade. One could make a case here that the prospects of this increased alpha continuing are favorable.

Many believe active management is more likely to work in emerging markets such as Taiwan than in developed equity markets. We can also take some comfort from their experienced portfolio management team in Taiwan.

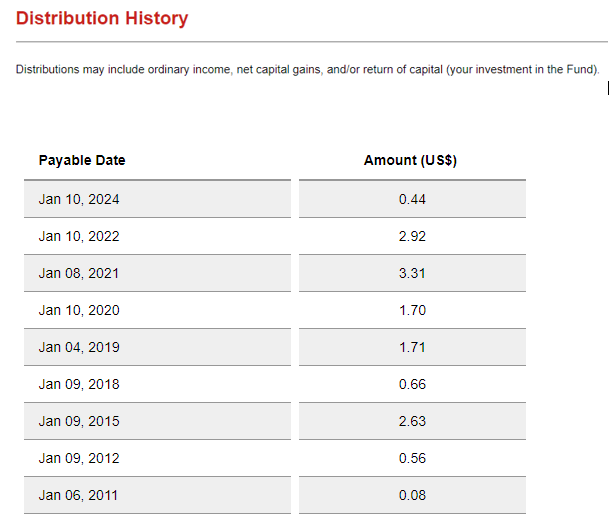

Taiwan Foundation Issuance History

The goal of Taiwan funds is not to provide stable distribution income, but to achieve long-term capital growth.

Below are the fund’s historical distributions over the past decade, typically paid on an annual basis.

Taiwan Foundation website

Is TSMC going to make Gorgeous 8?

Recently, a big driver of Taiwan fund performance has been Taiwan Semiconductor Manufacturing Company (TSM), which accounts for about 20% of the portfolio.

Recent reports from the Taiwan Foundation December Monthly Insightssomeone pointed out, “With the end of CSP inventory adjustment, new demand is expected to drive the recovery of the server market, and total AI server shipments will grow significantly in 2024. In addition to AI servers, other applications such as AI PCs and AI smartphones have also been introduced to the server market. market.We expect that the market penetration of artificial intelligence devices will continue to increase, bringing continued benefits to Taiwan’s supply chain”.

This view leaves Taiwanese funds still bullish on TSMC in 2024, although they believe U.S. interest rates are likely to remain high for some time.

Taiwan funds offer you an interesting way to gain exposure to TSMC, and its recent performance raises the question of whether this will soon make TMSC ranks among top 10 stocks in the world? To quote the linked article, “The surge in TSMC’s stock price reflects investors’ optimism about the future growth prospects of artificial intelligence technology. ” said Bloomberg Intelligence analyst Charles Shum. “The company is Nvidia’s most important supplier of artificial intelligence chips.,” he added.

If TSMC is attracted by new terms such as “magnificent 8” or “elite 8”, then they may gain more attention globally.Some believe that if we were to add an eighth company to the bundle, the easiest option would be “Magnificent 8” incorporated into TSMC.

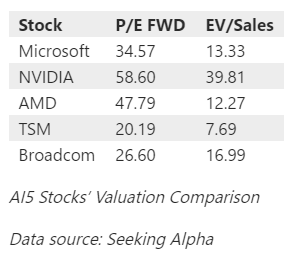

How to invest in the “AI 5” part?

Speaking of new buzzwords for the stock market, some are pushing for five specific stocks to be grouped together to form “AI 5.”If this gains further traction in 2024, we could make the case that TSMC is The Most Undervalued AI5 Stocks Now. This article mentioned a few days ago recorded some recent valuation indicators of AI5.

msn article using Seeking Alpha data on February 20, 2024

Note that it’s hard to keep up with Nvidia’s rising earnings estimates and falling valuation multiples, so the above is outdated in that regard.

However, my point is that it is not difficult to foresee that fund managers may turn to Taiwan Semiconductor Manufacturing Co., Ltd. in hopes of catching up.

Of course, TSMC makes up about 20% of Taiwan funds, so you’re not just investing in this theme here with Taiwan funds.

It’s worth mentioning that the fund has a heavy weight on TSMC because, interestingly, sentiment among Taiwanese funds has been poor.

On the other hand, sentiment is running high for the Magnificent 7 and AI5.

Why is there a bad mood toward the Taiwan Foundation?

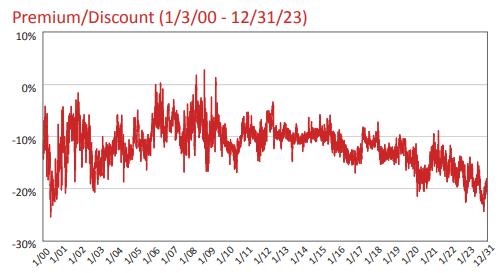

I have explicitly mentioned a number of key facts about Taiwan funds, but have not directly discussed discounts to NAV.

I think this might lead readers to think for themselves what the discount is. The fund appears to be achieving its long-term goals. Unlike many other CEFs, it has performed very well compared to similar ETFs. The investment team is experienced and has made large investments in currently popular industries.

The fund also has a potential tender offer policy to acquire 25% of the shares at a price close to NTA. This may come into play if the fund performs worse than the benchmark. That’s unlikely to play out by the end of next year, but there’s a good reason why this fund has far outperformed other funds in recent years.

I mention this only because it shows that the fund is willing to take steps to address the discount issue. It could also be a sign that activists have focused on the fund in the past and may continue to do so in the future.

Considering all of the above, I don’t necessarily think the discount to net worth will be very large.

Contrary to such expectations, we can observe from the long-term chart below that the discount to NAV at the end of the year was as high as 21%.

Taiwan Fund Overview, December 31, 2023.

Such large discounts to NAV are sometimes symptoms of a CEF severely underperforming and being hated by investors as a result.

In this case, however, the steep discount is likely because U.S. investors are shying away from the fund due to geopolitical risks. I’ll cover this further in this article.

At the moment, I would say the discounts appear to be substantial. After all, investors are happily plowing billions of dollars into U.S.-listed Taiwan ETFs despite the same geopolitical risks.

Taiwan Economic Outlook 2024

Consensus in Taiwan focuses on a year of GDP remaining unchanged Quite stable at around 3%. Given that most sectors of the economy are picking up, this could provide a good backdrop for Taiwan’s stock market as a whole. The improvement appears to be gradual, with inflation remaining modest below 2%.

this The Taiwan government is optimistic about While TSMC’s overseas plans have attracted widespread attention, its domestic expansion plans are a positive sign for the broader economy.

Its importance cannot be underestimated, and to quote the article linked above, “TSMC’s chips are widely used in everything from iPhones and cars to artificial intelligence and quantum computing applications. TSMC is a very important company to Taiwan’s trade-reliant economy and is widely known as the “Sacred Mountain that protects the country.”“

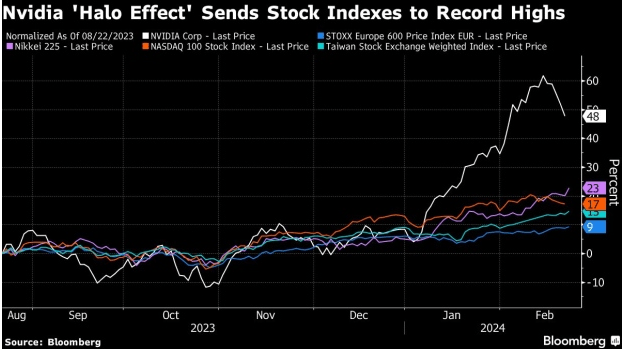

Is the Taiwan stock market still cheap?

Despite the market’s recent strength, the argument remains that there is room for further upside. With NVIDIA Corp. (NVDA) beating earnings estimates this week, analysts are starting to see correlations with trends in markets like Japan and Japan. Taiwan reaches new high .

The chart below shows that compared to the Nikkei and Nasdaq, the Taiwan market may still have some room to catch up.

Bloomberg

If one were to examine the long-term price-to-book ratio of Taiwanese stocks, although the price-to-book ratio increased last year, it does not seem too worrying.

Bloomberg

I recently looked at the chart above because I do believe Korean stocks are cheap, which I discussed here last week.

That being said, while the other markets mentioned above did much better last year, they weren’t as broad in my opinion. The above-mentioned positive adjustment in price-to-book ratio makes sense in the context of some favorable industry drivers facing Taiwan.

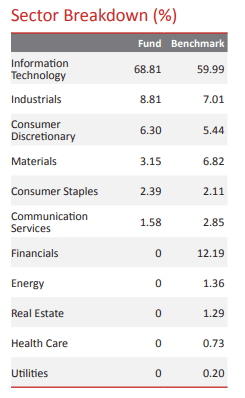

Taiwan fund industry allocation

Taiwan Fund Website December 2023 Monthly Insights.

Taiwan funds hold the most shares

Taiwan Fund Website December 2023 Monthly Insights.

Geopolitical risks, Taiwan fund discounts, Taiwan stock discounts

Some readers will no doubt say that the above discounts for Taiwanese funds and their holdings are entirely justified due to geopolitical risks.

The risk of China invading Taiwan would lead some investors to declare the Taiwanese market “uninvestable.”

First, this situation is disastrous for the Chinese economy. This alone means that most observers rationally view this as a tail risk and should not base portfolio strategies on it. Such an intrusion would put TSMC factories at risk, causing disruption to important global supply chains throughout the world. From this perspective, it is difficult to understand how China wins from this move.

More background to my last paragraph above can be explained here.This article explains how the microchip industry would collapse if China invaded Taiwan has a negative impact on everyone. To quote directly, “Taiwan alone produces more than 60% of the world’s semiconductors, and most importantly, 90% of the most advanced semiconductors”.

If Taiwan funds are avoiding Taiwan because of the possibility of China invading the island, they may be tempted to sell some U.S. tech stocks quickly. Big U.S. technology companies are clearly so dependent on Taiwanese manufacturing. However, the way they’ve bounced back recently, with such a high percentage of the S&P 500’s holdings, suggests investors clearly aren’t too worried.

Think of Taiwan funds as a way to avoid FOMO on the topic of artificial intelligence

Lately, as investors enthusiastically pile into the “Big Seven” stocks, we seem to hear less about “China risk.” At the same time, the Taiwan fund’s net asset value and its valuation are at a substantial discount, indicating that investors have paid sufficient attention to such risks in the fund.

This gives companies like TSMC and the broader Taiwan stock market a lot of room to be re-rated further aggressively on a relative basis compared to many large U.S. tech stocks.

Therefore, I think a Taiwan fund is an interesting idea to consider at least partially investing in the currently hot topic of artificial intelligence.

In fact, I’d describe it as “hot,” so I can’t label the Taiwan fund an immediate buy just yet.

However, this could be a smart, unusual way to ride the coattails of more artificial intelligence in 2024, and perhaps a good one for the watch list. If some of the current enthusiasm for artificial intelligence fades and we see a pullback, Taiwanese funds may be able to buy the dip in the coming months.