Peter Nichols/Getty Images News

British bank Lloyds Bank shares (NYSE:EQ) The company continues to look attractive after releasing fourth-quarter results on Thursday (February 22).In my last article I highlighted the bank’s compelling capital return potential, Lloyds is essentially Being able to distribute all of its near/mid-term capital generation to shareholders equates to annual total shareholder return potential of approximately 13-15% based on then market capitalization. The stock also seemed modestly valued relative to the bank’s profitability, as the price at the time was roughly double tangible book value per share (“TBVPS”), and management’s mid-term target was tangible book value per share (“TBVPS”). The return on equity is in the mid-teens (“rote learning”).

Lloyd’s fourth-quarter results were a surprise, but overall, the company performed in line with expectations. On a positive note, the bank maintained its near- and medium-term profit targets despite some peers lowering their targets.Lloyds shares are currently trading at At a slight discount to TBVPS, the capital return potential and overall investment case remain compelling, and I upgrade the stock to a “Strong Buy.”

Investment case review

Lloyds Bank is the UK’s largest purely domestic bank, with total assets of £880 billion (approximately US$1.1 trillion). In addition to its namesake bank, the group also owns other British banking brands including Halifax and Bank of Scotland.

Lloyds is basically an NII bank, with net interest income accounting for over 70% of total revenue. To recap, my overall investment case basically boils down to the following two points:

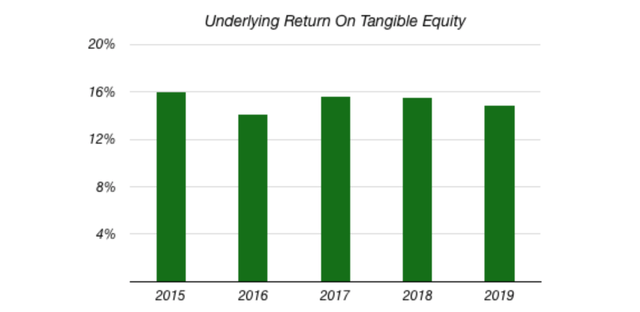

- The UK banking market is highly concentrated, and Lloyds’ leading position gives it an attractive deposit base, including over £100 billion in zero-cost retail current accounts. Despite lacking a substantial fee income line, Lloyds’ capital position ultimately helped the bank generate attractive double-digit returns on tangible equity (“ROTE”), even as UK interest rates averaged around This is also true in 0.5% of cases.

- Despite higher interest rates, attractive capital return potential and an excess capital position, Lloyds shares are trading at around 1x TBVPS as previously reported, which essentially means strong growth through dividends and buybacks alone double-digit annualized returns.

Fourth-quarter results surprise

Lloyds Bank’s key revenue drivers are in full view ahead of fourth-quarter results, with trends already established in previous quarters and supported by peers such as National Westminster Bank (NWG), which recently reported a fourth quarter Confirmation of quarterly results.

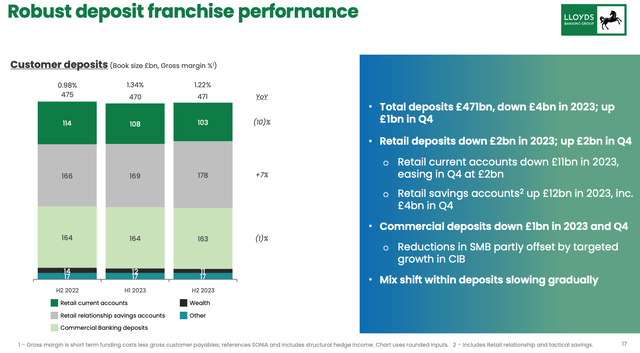

As a result, net interest income of 3.317 billion pounds fell by approximately 4% from the previous quarter, but the gap with market expectations was within 2%, while the banking industry’s net interest margin (“NIM”) was 2.98%, which was also close to pre-performance expectations ( about 3 basis points). Like its peers, Lloyds’ deposit trends continue to be stable, with mixed transfers still evident but easing. The retail current account balance fell further by 1.9 billion pounds, or about 2%, to 102.7 billion pounds in the fourth quarter, which was an improvement from the 3% decrease in the third quarter. The net interest margin in the fourth quarter decreased by approximately 10 basis points quarter-on-quarter and approximately 22 basis points compared with the same period last year.

Source: Lloyds Banking Group 2023 fourth quarter results presentation

The bank’s mortgage business has also faced some significant headwinds recently. Firstly, 2023 is the first year since the early 1990s that UK households have paid back as much mortgage debt as they have taken on, which is obviously not great for numbers. Lloyds’ retail mortgage lending at the end of the year was about £307 billion, about £5 billion less than at the same time last year. Note that these loans account for around 68% of the bank’s total loan portfolio of £450 billion.

Secondly, the business’s loan margins have been under pressure due to the competitive environment in the wider UK mortgage market, with the decline in more profitable older loans hurting the bank’s overall margins:

Our market share has demonstrated resilience in a down market environment. Group margins continue to be affected by the difference between new mortgage spreads and maturing mortgage spreads. While pricing remained competitive in the fourth quarter, the market strengthened slightly. Completion margin was approximately 60 basis points, slightly above third quarter levels.

William Chalmers, Lloyds Banking Group financial officer, fourth quarter earnings call

There were surprises elsewhere, including a £450m allegation related to potential wrongdoing in the UK car finance market. Now, the country’s financial regulator is still investigating the matter, so the extent to which Lloyds needed insurance – if indeed it did – remains unclear. Still, it’s worth noting and keeping in mind given the bank’s position in the auto finance market.

Elsewhere, the release of £540m of credit, about £670m ahead of consensus, helped drive overall earnings growth, driven by significant write-backs and an upgraded macro outlook. While this “low-quality” beat naturally rarely wins market praise, credit quality remains a surprising bright spot for European banks, including Lloyds. The ratio of mortgages more than 90 days delinquent at the end of 2023 was only about 30 basis points higher than in 2022, while overall second- and third-stage loan ratios improved both sequentially and year-over-year.

Confirm profit target

On a positive note, Lloyd’s management maintained its broad profit target for 2024-2026. This is despite peer NatWest significantly lowering its own ROTE target for 2024-2026 based on fairly common factors such as inflation, deposit behavior and future interest rate expectations. To clarify, this means Lloyds management still expects the bank to generate ROTE of around 13% in 2024, rising to over 15% in 2026. Capital generation targets of 175 basis points (2024) and over 200 basis points (2026) were also confirmed.

While management does expect lower net interest margin next year (guiding greater than 290 basis points), I would point out that there are multiple moving parts in medium-term profitability that could offset the impact of potentially lower interest rates, currently on the forward curve Pointing to about 175 basis points of cuts through management’s target for the period.

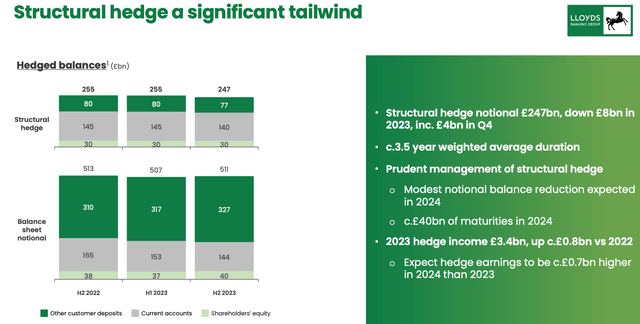

One of these is Lloyds Bank’s £247 billion structural hedge, which functions like a portfolio of fixed-income securities providing spread income.

Source: Lloyds Banking Group 2023 fourth quarter results presentation

Despite the Bank of England raising interest rates to 5.25%, Lloyds’ deposit spreads will only be around 120 basis points in the second half of 2023. While hedging revenue rose sharply to around £3.2bn last year, the implied yield remains relatively low as hedging benefits have not yet been fully realized. Repricing to a higher interest rate environment. Even/when the Bank of England starts cutting interest rates, this ongoing process will be a tailwind for the nation’s information infrastructure over the next few years. As noted above, an easing of negative dynamics in the mortgage business will also be a modest tailwind for Lloyds.

Stocks remain attractive

As I said last time, the extent of Lloyds Bank’s overall shareholder yield potential (i.e. dividend + buyback yield) means it has the ability to fall significantly below target and still deliver attractive returns to investors of more than 10% return. In other words, the stock has a sizable margin of safety.

This is still true today. As I type, Lloyds Bank’s ADS are trading at $2.28, which is about 0.9 times Q4 2023 TBVPS, making the stock slightly cheaper on that metric than previously reported. Valuations here still imply either full-cycle profitability significantly below current consensus and guidance, a cost of equity significantly higher than investors demand (typically 9-10%), or both. As noted above and in previous reporting, even in periods of very low interest rates such as the late 2010s, Lloyds’ underlying profitability was solid, easily supporting a TBVPS premium at a cost of equity of around 10%.

Source: Lloyds Banking Group Annual Report

Compared to comparable peers, Lloyds is structurally more profitable than its closest counterpart, National Westminster, and based on reasonable medium-term ROTE assumptions (around 10%), I think its fair value is around 1x TBVPS. That should be good enough for at least a 20% premium or a 1.2x TBVPS multiple, which by itself still means ROTE is below consensus and management’s targets. A 1.2x TBVPS multiple would drive ~35% upside to ~$3.10 per ADS.

Meanwhile, capital return potential remains attractive, with management planning to return 175 basis points of capital in 2024 and 2025, rising to over 200 basis points in 2026. A quick calculation shows that the return is about £12 billion, or about 45% of the bank’s current market capitalization, paid back through current dividends and buybacks. As this continues to provide investors with a significant margin of safety, I upgrade my rating on Lloyds to Strong Buy.