nablis

Allianz (OTCPK:ALIZY) reported positive financial data related to 2023 and increased its shareholder compensation policy, resulting in a strong annual dividend increase of 21%.With a dividend yield of 5.6% and a forward price-to-earnings ratio of 9.7, Allianz is an excellent company Income options in the European insurance industry.

Business overview

Allianz is a German-based insurance company and one of the largest players in the industry globally. Its business focuses on life and non-life insurance businesses, as well as asset management activities through Allianz Global Investors and Pimco.

Allianz currently has a market capitalization of approximately $106 billion and trades on the U.S. over-the-counter market, reflecting its massive size.Its closest competitors are other large European insurance companies operating in the life and non-life insurance sectors, such as AXA (OTCQX:AXAHY) or General (OTCPK:ARZGY).

Allianz Although P&C is the largest business as measured by operating profit, accounting for approximately 43% of total operating profit, its business is diversified into P&C (non-life), life/health insurance and asset management.

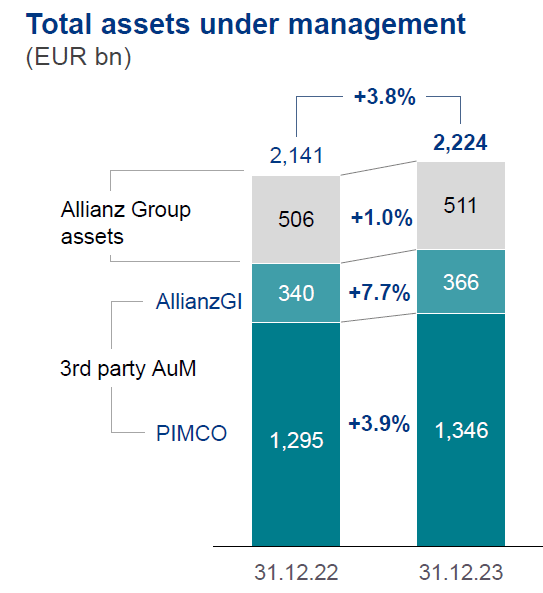

Due to its size and the relatively low long-term growth prospects of the insurance industry, Allianz relies mainly on its asset management business for its growth, even though it is already one of the global leaders in the industry. Its total assets under management (AuM) of approximately €2.2tn are mainly allocated to traditional fixed income investments, which is PIMCO’s main strength, while Allianz is driving the growth of alternative investments, with this asset class accounting for a large share of total assets under management. The proportion is small.

Asset Management Asset Management Scale (Allianz)

The fact that Allianz could continue to win some market share in asset classes where it currently has a smaller presence, such as equities or alternative investments, would give it better long-term growth prospects than the insurance space.

Allianz’s key financial targets point to somewhat bleak growth prospects for its business 2021-24 period Not particularly impressive. The targets were set out at a capital markets day in late 2021, with Allianz expected to update its strategy in December next year, although its business strategy is not expected to change much compared to recent history.

In terms of major financial goals, Allianz aims to achieve earnings per share growth of 5-7% per year, return on equity (ROE) of more than 13%, and debt solvency adequacy ratio of more than 180%. These targets are not much different from those set in the 2018 strategy update, which shows that it is not easy for large companies in the insurance industry to achieve significant business growth in a short period of time.

It also means that investors should view insurance companies as stable and recurring businesses within the financial industry that are less affected by economic activity than banks, so income is often the most attractive feature of their investment case. Allianz is no exception, and its main advantage lies in being a stable company rather than having strong long-term growth prospects.

Financial overview

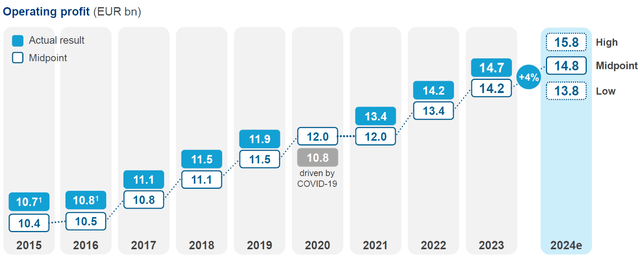

In terms of its financial performance, Allianz has been able to deliver positive operating results over the past few years, with the only exception being 2020 when its Life/Health business was negatively impacted by the pandemic.

Its business has performed quite well recently, with key financial metrics achieving mid-single-digit growth. indeed, 2023Allianz’s operating conditions are quite good, and the company’s annual operating profit has reached a new high.

This was due to strong revenue growth, with business volume increasing by 8% year-on-year to nearly 162 billion euros, of which the property and casualty insurance sector was the main growth driver (year-on-year growth of 11.2%), while the life/health business (year-on-year growth of 5.6% ) Growth in asset management (2.4% annual growth) was more modest.

On the other hand, the P&C division’s higher combined ratio due to higher claims costs resulted in operating profit growth of only 1.2% year-on-year, while the life/health division’s profitability grew strongly (up 23% year-on-year) as the business no longer Previous years were affected by pandemics and excessive mortality. The asset management segment’s operating profit was also lower, down 2.2% from the same period last year, due to rising costs and relatively weak capital inflows.

Overall, its operating profit of €14.7 billion was about 4% above the midpoint of the company’s guidance and up 6.7% from 2022. Although its operating profit guidance is lower than expected, Allianz still expects positive growth next year between 13.8 and 15.8 billion euros, which can be said to be a relatively large range for a stable business. Still, as the chart below shows, the company has a strong history of exceeding its own guidance, so its 2024 outlook can be considered conservative and Allianz will likely be able to report operating profits closer to the upper end of its guidance.

operating profit (Allianz)

Thanks to improvements in non-operating performance, Allianz’s core net profit increased by 30% year-on-year to more than 9 billion euros, and return on equity (ROE), a key measure of profitability in the insurance industry, increased to 16% in 2023. The profitability of the insurance industry is good. It is also above its own target of over 13% over the medium term, meaning Allianz is likely to raise its financial targets at its upcoming investor day as the group’s profitability is already well above its target.

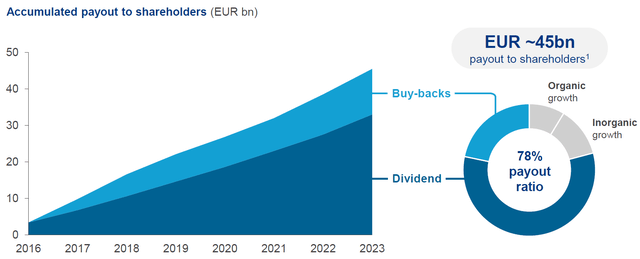

From the perspective of capital position, as of the end of 2023, its Solvency II ratio was 206%, increasing by 5 percentage points every year, and its capital position is good. In addition, the ratio is also well above its internal target of at least 180%, meaning Allianz does not need to retain much of its future earnings and can distribute most of its profits to shareholders.

In fact, this has been the company’s strategy for the past few years, distributing the majority of its annual earnings to shareholders through dividends and stock buybacks. As the chart below shows, Allianz has distributed about 78% of its earnings to shareholders in recent years, with the rest used to fund growth plans, thanks to its strong capital position and good organic cash generation.

return on capital (Allianz)

Given its excess capital position and positive business outlook, Allianz has raised its dividend policy and now aims to distribute 60% of annual earnings (previously 50%), using the previous year’s dividend level as a baseline and by Returning excess capital: stock buybacks.

Related to profits in 2023, Allianz increased its annual dividend to 13.80 euros per share, an increase of 21% from the same period last year due to higher profits and higher dividend payout ratio. The market expected a dividend of around €12 per share, so Allianz beat expectations by a wide margin, demonstrating a strong long-term management commitment to delivering a growing dividend.

Indeed, over the past eight years, 2020 has been the only year the company didn’t raise its annual dividend, which is clearly a very good dividend history. At the current share price, Allianz currently offers a forward dividend yield of 5.6%, which is quite attractive to income investors.

in conclusion

Allianz is an insurance company with good business fundamentals and good operating momentum that can generate long-term sustainable dividends. An increase in its payout ratio shows good confidence in its operating prospects over the next few years, which is quite positive for income investors.

In terms of its valuation, Allianz currently trades at a forward P/E ratio of 9.7 times, which is a discount to its peer group’s average P/E ratio of nearly 11 times, so Allianz is currently clearly attractive to long-term income investors due to its high dividend Power yield and low valuation.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.