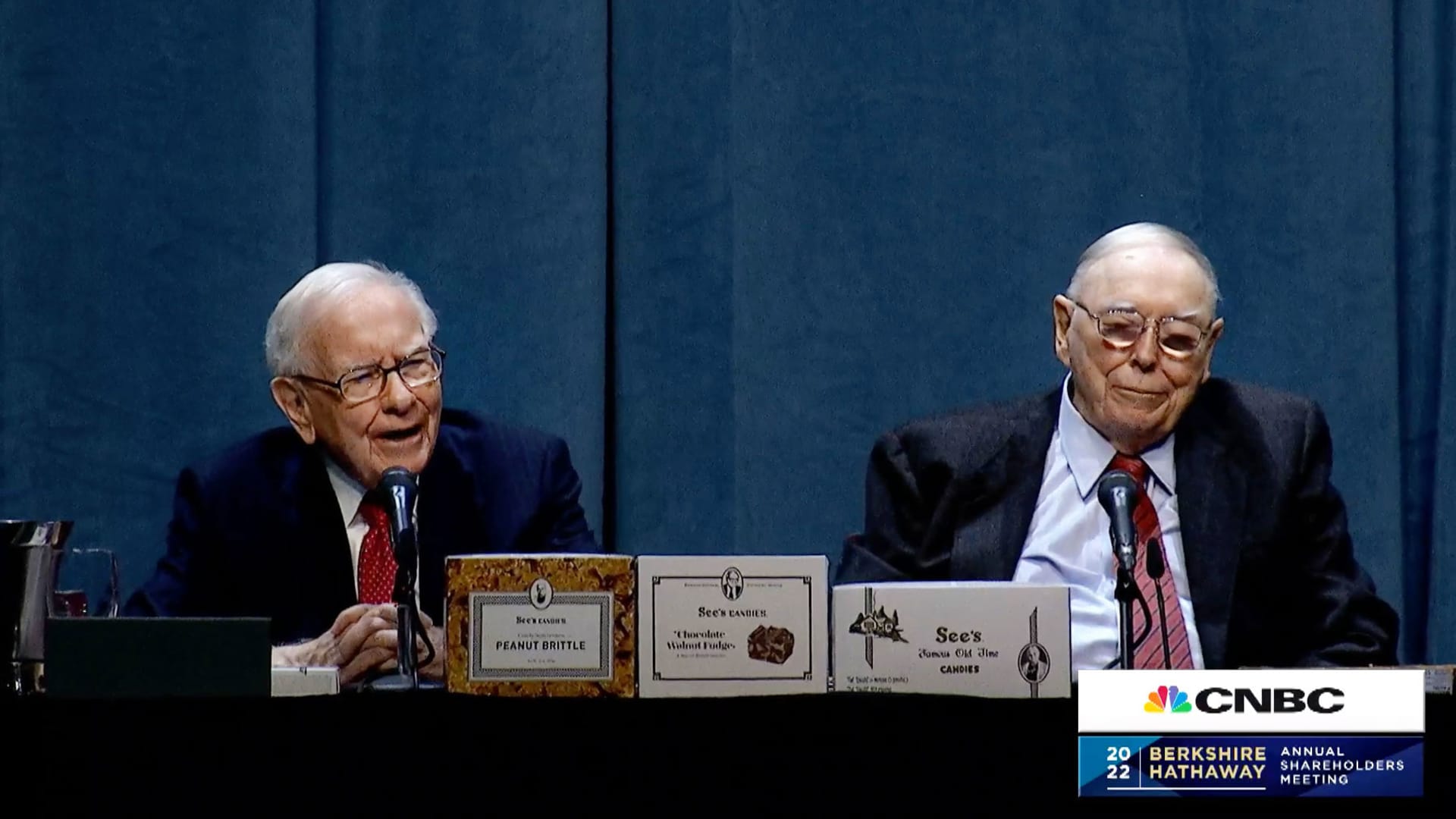

Warren Buffett and Charlie Monger attend a press conference during the Berkshire Hathaway shareholder meeting on April 30, 2022 in Omaha, Nebraska.

CNBC

Berkshire HathawayWarren Buffett said his vast conglomerate is likely to perform only slightly better than the average for U.S. companies due to its sheer size and lack of buying opportunities that could make an impact.

The Omaha-based giant, which owns everything from the BNSF railroad to Dairy Queen and holds a 6% stake in Apple, has by far the largest net worth of any U.S. business on record, Buffett said in a 2017 report. It accounts for 6% of the total number of S&P 500 companies. His annual letter was released on Saturday.

“There are only a handful of companies in this country that can truly drive Berkshire’s growth, and we and others continually select them,” Buffett wrote. “Some we can value; some we can’t. And, if we can, they The price must be attractive.”

The last big deal Berkshire Hathaway completed was the $11.6 billion acquisition of Alleghany, an insurance company and conglomerate, in 2022. “Oracle of Omaha” also acquired 28% of the energy giant’s shares occidental petroleum corp., while ruling out the possibility of acquiring the entire company. Although these measures are significant, they do not meet the expectations of the “big picture-sized” goal that Buffett has been trying to achieve for many years.

Berkshire Hathaway held a record $167.6 billion in cash in the fourth quarter.

Buffett said: “There are basically no candidates outside the United States that can be meaningful choices for Berkshire’s capital allocation. All in all, it is impossible for us to achieve jaw-dropping results.”

Berkshire Hathaway does hold 9% of the shares of five Japanese trading companies – Itochu Corporation, Marubeni Corporation, Mitsubishi Corporation, Mitsui & Co., Ltd. and Sumitomo Corporation, and Buffett intends to do so in the long term own these companies.

The 93-year-old Buffett said that Berkshire’s diversified, high-quality conglomerate should provide “slightly better” results than the average American company, but that anything else is unlikely.

Buffett said, “As far as our current business portfolio is concerned, Berkshire should do better than the average American company, and more importantly, the risk of permanent loss of capital during operations should also be greatly reduced.” Wishful thinking. “

Berkshire Hathaway has recently hit record highs in a row, with its Class A shares trading at more than $620,000 and a market value of more than $900 billion.

The group’s shares are up about 16% in 2024, more than double the S&P 500’s return, after rising 16% for all of 2023.