SDI Productions

Over the past year, I have discovered some interesting players in the banking industry. Some of these were businesses that I was very bullish on, and they went on to post some pretty meaningful gains.other opportunities Didn’t meet expectations. There were also companies that I didn’t have high hopes for but ended up achieving the mediocre results I expected.In the last category, companies I can give examples of are independent banking group (NASDAQ: IBTX).

With a market capitalization of $1.87 billion as of this writing, Independent Bank Group is not a particularly large regional bank. But it’s not small either. Back in August 2023, I decided to give this business a try and found it to be an interesting opportunity as the stock price had not fully recovered from the crash. They lived through the banking crisis that began in March. However, I find that this stock probably shouldn’t be trading much higher than it is now. The good news for shareholders is that fundamentals are starting to improve after some weakness on things like deposits. But nonetheless, the share price looks quite expensive, and the significant weakness in profits has me taking a more cautious approach to the business.

As a result, I ultimately rate the bank a Hold to reflect my view that the stock is unlikely to outperform the market in the foreseeable future. From that point on, I was mostly right. Since the article was published, the S&P 500 has gained a solid 12.7%, while shares of Independent Bank Group have gained just over half, to 6.7%. In some cases, one might say extra patience is required. But when you consider other factors, such as the overall health of the business, it’s hard to see what extra patience will get you other than continued mediocre returns.

There are still better opportunities out there

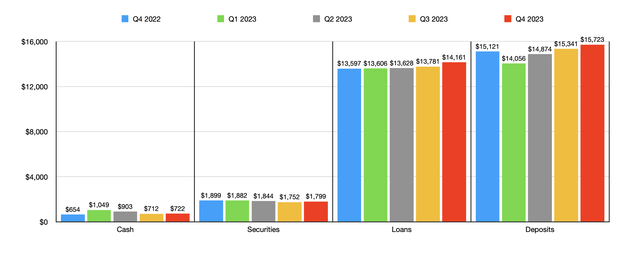

When I wrote about Independent Bank Group in August 2023, we had data covering the second quarter of that fiscal year.Today, that data has expanded to Last quarter of 2023. First, we should talk about some good news. This involves deposits with the institution. You see, Independent Bank Group had deposits valued at $15.12 billion at the end of fiscal 2022. But in the first quarter of 2023, deposits plummeted to $14.06 billion. This is not terribly surprising given the banking crisis that has occurred and the high interest rate environment we have to deal with.

Author – SEC EDGAR Data

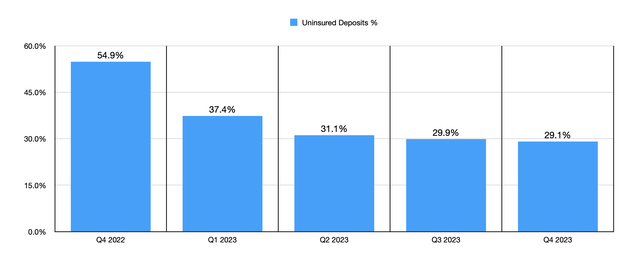

The good news for shareholders is that the bank began to recover almost immediately. As of the end of fiscal 2024, deposits reached US$15.72 billion, a multi-year high. That’s an increase of $601.6 million compared to the company’s revenue at the end of 2022. It’s also important to note that approximately 29.1% of the company’s deposits are uninsured. This is slightly lower than the 30% maximum threshold I tend to choose. This is a significant improvement from 54.9% at the end of 2022 and 37.4% at the end of last year’s first quarter. In fact, insured deposit risk has declined every quarter from the last quarter of 2024 to now.

Author – SEC EDGAR Data

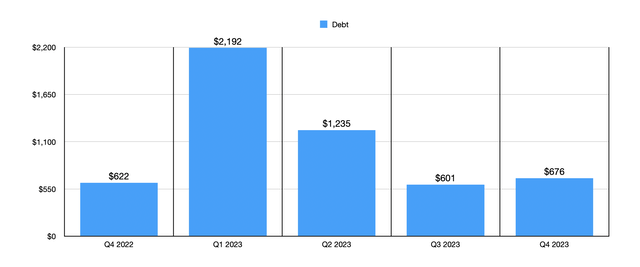

There’s some other good news. For example, the value of loans also continues to rise. Unlike deposits, there was no decline in any quarter. From the end of 2022 to the end of 2023, the value of loans increases from $13.6 billion to $14.16 billion. Cash on hand also increased significantly, from $654.3 million to $722 million. The only declines we saw during this period involved securities. These amounts fell slightly from $1.9 billion to $1.8 billion. Obviously, we should also talk briefly about debt. Debt soared from $621.5 million at the end of 2022 to $2.19 billion in the first quarter of last year and has been declining since then. It did bottom out in the third quarter at $601.3 million, but deteriorated slightly at the end of 2023 to $676.4 million.

Author – SEC EDGAR Data

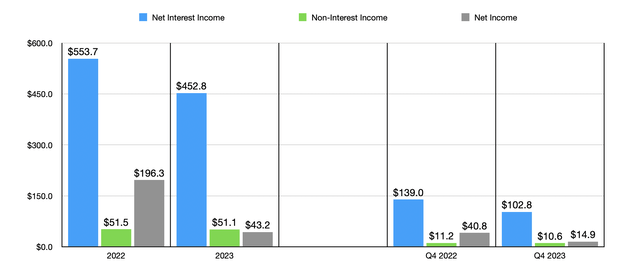

All of this is largely positive. The biggest negative impact, however, was lower revenue and profits. For example, in the chart below, you can see net interest income for the final quarter of fiscal 2023. The total was $102.8 million, well below the $139 million reported a year ago. The reason for this phenomenon is that the bank’s net interest margin dropped significantly from 3.49% to 2.49%. The fact that deposits have grown more than loans, securities and cash combined is also a problem. Although people want to have deposits, when interest rates rise, so does the amount management has to pay to keep those deposits. Noninterest income decreased slightly to $10.6 million from $11.2 million. Coupled with the aforementioned decline in net interest income, net income fell from $40.8 million to $14.9 million.

Author – SEC EDGAR Data

In the same chart, you can see the results for 2023 relative to 2022. Overall, the situation looks very similar to what we saw in the last quarter. I think we need to bring up one thing here. It then touches upon several entries from the company’s full 2023 income statement. During the year, the company set aside $5.2 million in impairment losses on some properties. In addition, it incurred $102.5 million in litigation costs. I then calculated adjusted earnings for the year using the 2023 effective tax rate. The result was $132.1 million, compared with $196.3 million reported a year ago and official 2023 revenue of $43.2 million.

Author – SEC EDGAR Data

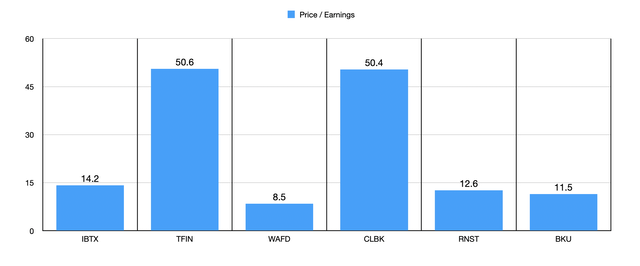

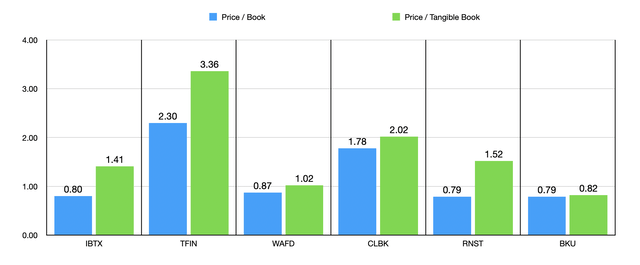

Using these results, I was able to value the company based on its price-to-earnings ratio and compare it to five similar companies shown in the chart above. Even using adjusted earnings, a price-to-earnings ratio of 14.2 is quite high. Three of the five companies I compared it to ended up being cheaper. Then, in the chart below, I performed the same type of analysis using price to booking multiple and price to tangible booking multiple. When it comes to booking price multiples, two of the five companies are below it, and the same is true when it comes to tangible bookings price method.

Author – SEC EDGAR Data

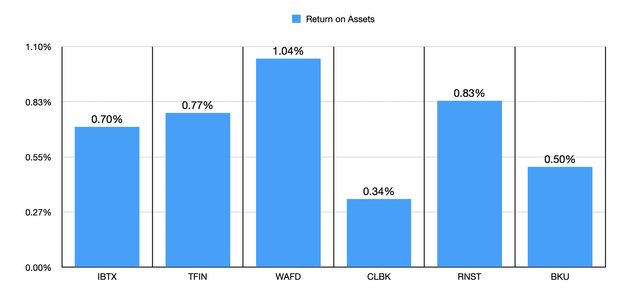

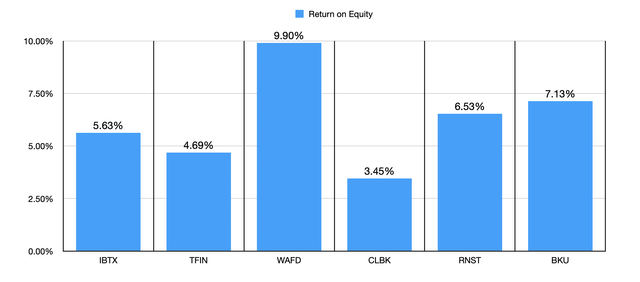

The institutions we have are showing signs of improvement despite some difficulties with profitability. However, while the shares may not be priced outrageously high compared to similar companies, both the P/E and tangible book P/E ratios are higher than I’d like. Of course, if earnings quality justifies it, so be it. But I don’t think that’s necessarily the case. For example, in the first chart below, you can see Independent Bank Group’s ROA. Two of the five companies ended up below that level, while three of the five ended up above it. Then I did the same thing in the table below, involving return on equity. In this case, two of the five companies are again worse than our candidates.

Author – SEC EDGAR Data Author – SEC EDGAR Data

take away

Based on the data before me, Independent Bank Group is not a very good candidate. But it’s not a terrible thing either. The company is average on most things and shows improvement where it matters. However, as a value investor looking for market-beating returns, this makes the company a mediocre opportunity. Therefore, I decided to temporarily maintain the rating of “Hold” on this business.