Barry Lewis/Getty Images

This issue of “Where Fundamentals Meets Technology” explores the unpopular energy industry.

We combine my fundamental analysis with technical analysis from Zac Mannes and Garrett Patten in these genres report to find the intersection between the two disciplines. Sometimes we also make an item public, like this one.

Lin Alden

I think the energy industry is one of the most interesting sectors in the market right now for several reasons. First, it fell out of favor. Secondly, the price is cheap and the profit is huge. Third, the economy is showing signs of accelerating again. Fourth, it can hedge the right tail risk of a portfolio.

Reason 1) Unpopular

The energy sector had a stellar performance in 2022, then a lackluster performance in 2023, and now in 2024 it has fallen off the radar of most investors, even though it Showing signs of life. Today’s topic is instead AI; it’s where everyone wants to invest, and mostly for good reasons.

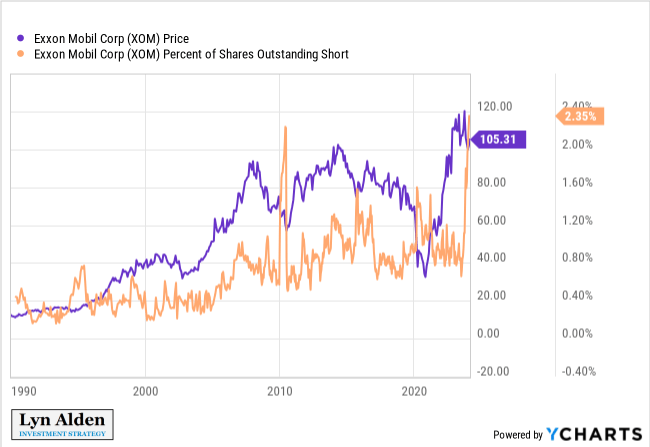

Short interest in several large-cap energy stocks, including Exxon Mobil (XOM), is at an all-time high. In absolute terms, this ratio is low and therefore not enough to cause any kind of mechanical short squeeze, but it can give us an idea of what the market sentiment is like.

Y chart

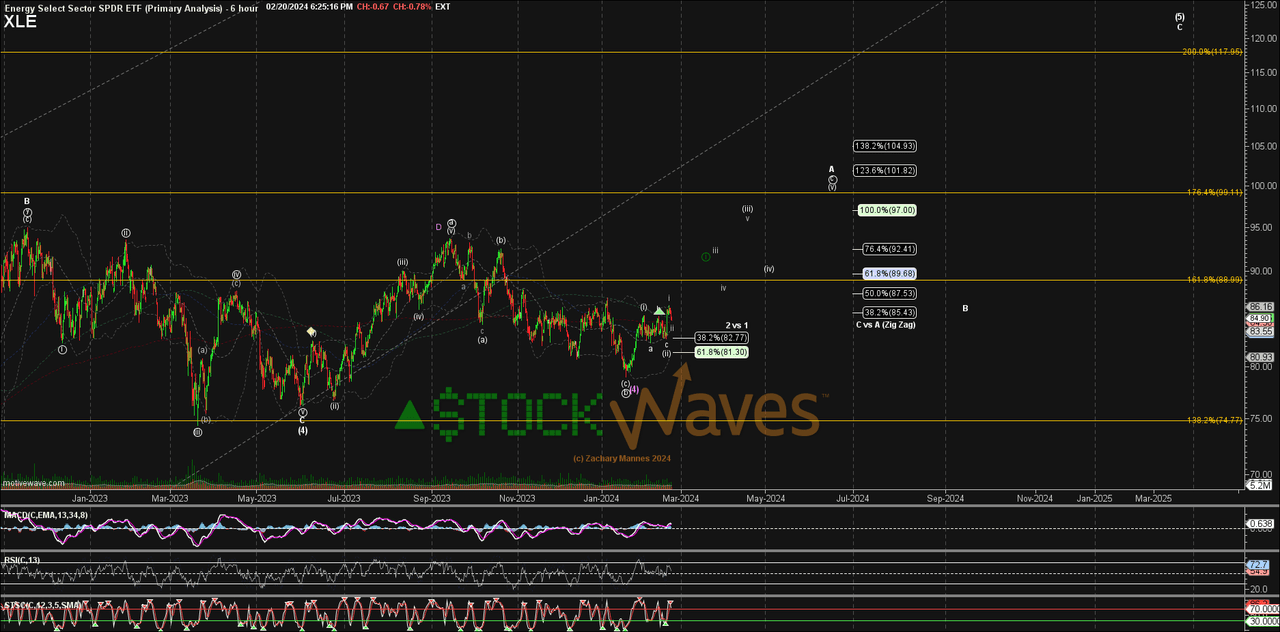

Technically speaking, Zac Mannes thinks the energy industry may have hit bottom (NYSE:XLE), potentially indicating good performance next year. I like owning a variety of energy stocks because it spreads risk among different regions.

Zach Mannes, Stock Waves

Now, since I focus on fundamentals rather than technicals, I don’t really have a firm view on how it will perform over any given 6-12 month period. This mostly depends on market sentiment and human decision-making. But from a trading perspective, this is a good stop loss point. If the XLE ETF falls firmly below the recent lows of $80, it may be time to pause and reassess the long-term thesis until price action improves again.

Reason 2) Cheap and profitable

Fundamentals for large energy producers with long-term reserves are generally in good shape. Large companies like Exxon Mobil and Chevron (CVX) have very high credit ratings, which indicates that their balance sheets are very strong.

They lock in low interest rates on long-dated corporate debt and hold large amounts of cash equivalents whose rates adjust upward as the Fed raises rates, putting them in the opposite duration mismatch to typical banks.

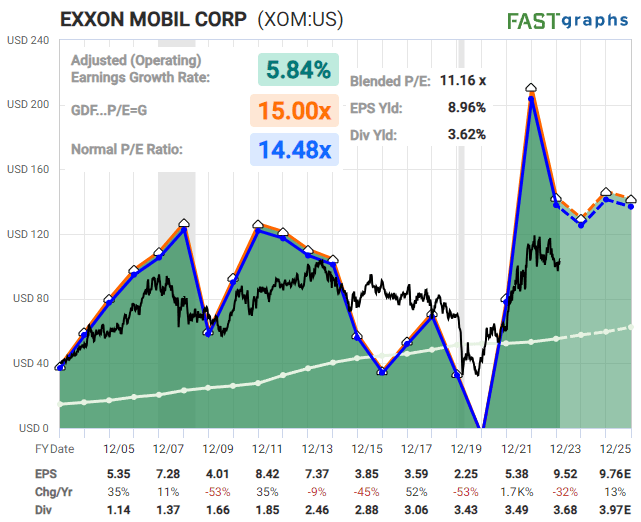

The top U.S. energy giants trade at price-to-earnings ratios below 12 times. They boast above-average dividend yields, safe payout ratios, and decades of consistent annual dividend growth. Investors willing to buy Canadian or European energy giants will typically find their price-to-earnings ratios are well below 10 times.

quick chart

Reason 3) The economy shows signs of accelerating again

The U.S. economy has been decelerating by many measures over the past two years.This means that although growth is still positive, the growth rate has slowsome industries have shrunk completely.

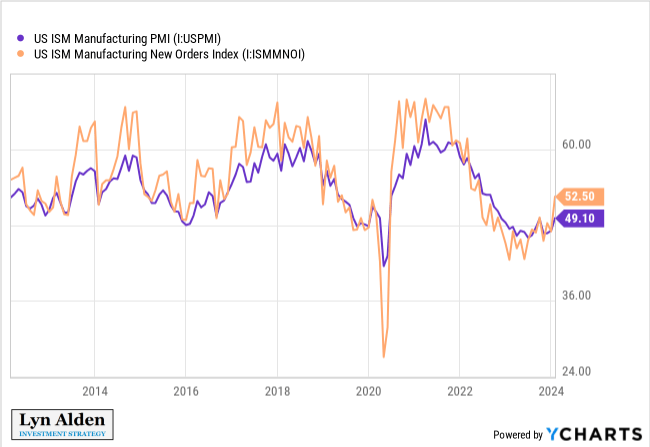

The problems in the commercial real estate industry are well known, but manufacturing is also in a downturn. However, early signs of stabilization and possible reacceleration are beginning to emerge and should be monitored closely.

Y chart

Like anything else, energy prices are determined by supply and demand. The supply side depends on industry trends, OPEC+ decisions and occasional supply disruptions. The demand side is primarily driven by global economic conditions, particularly in terms of rates of change.

Recently, demand has been dampened by real estate deleveraging in China, deindustrialization in Europe, weakness in U.S. manufacturing, and currency crises in several frontier markets. If these trends begin to stabilize and re-accelerate, as U.S. manufacturing PMIs rise and China’s fiscal stimulus and asset price support intensifies, then the market may find itself very unbalanced in its low-energy positioning.

Reason 4) Can hedge right tail risk

Throughout the past four decades of structural deflation and growth, the 60/40 portfolio has been the ideal choice for many investors. During economic expansions, stocks do well, and during economic contractions, bonds do well.

However, during periods of inflation that are less common in history, this type of portfolio does not work well, and there may be long periods of time when stocks or bonds actually perform poorly. In these environments, energy and other commodities tend to be among the few that perform strongly.

That’s because in a deflationary era, most risks are “left tail” risks, meaning recessions and high debt levels can weigh heavily on the economy. On the other hand, during periods of inflation, there are more “right tail” risks, meaning the economy could overheat sharply, causing input costs and interest rates to be higher than expected.

When we imagine that stocks could experience a year or two of weakness and want to protect against this risk, we can think of a few main scenarios.

The first scenario comes from the left tail, meaning the Fed’s current hawkishness, combined with weakness in the commercial real estate sector, could put enough pressure on the economy and lead to a weak labor market that could lead to a recession. Holding large amounts of cash equivalents (BIL) or U.S. dollar exposure (UUP) can protect against this.

The second scenario comes from the right tail, which means that continued fiscal deficits may keep the economy higher than expected, energy prices and wage prices may rise, and the Fed may maintain higher levels for a longer period of time.Ironically, by remaining at higher levels for longer periods of time, they move into even bigger Fiscal deficits lead to higher spending on public benefits. In addition, given the ongoing global geopolitical tensions, the risk of supply disruptions always exists, which may trigger right-tail risks. Owning some energy producers provides protection against such risks.

Overall, in addition to companies in the energy industry offering good fundamentals themselves from a value investing perspective, I currently view them as a form of active arbitrage against emerging right-tail risks. Energy giants are profitable at current oil prices and pay you to own them, but they could also surge if energy prices rise significantly and threaten other portfolio assets.