EvgeniyShkolenko/iStock via Getty Images

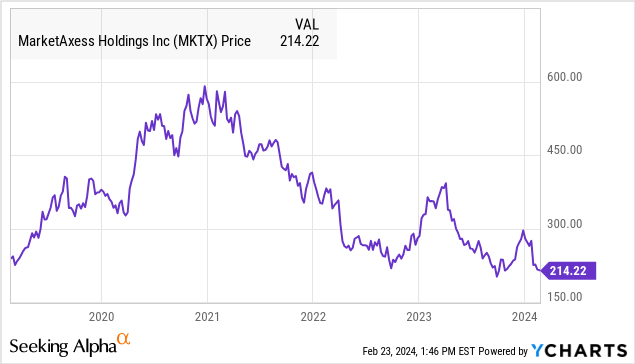

MarketAxess Holdings Inc. (NASDAQ: MKTX)’s fourth-quarter earnings beat expectations, but it was not enough to stop a sharp sell-off in its stock price, which has fallen more than 25% year to date and is now near a five-year low.

We last reported on the stock in early 2022, citing what was then expected to be a “transition year” for growth, which seemed to expose some deeper structural challenges. As we’ve seen, the institutional-grade fixed income trading platform story has been resetting expectations compared to what was possible during the pandemic-era boom.

Recent data showed a decline in market share and weak profitability, which has weighed on the stock’s sentiment.We think the problem with MKTX is that the stock is in a gray area and unable to deliver superior growth It also lacks compelling value. We expect volatility to continue.

MKTX Earnings Review

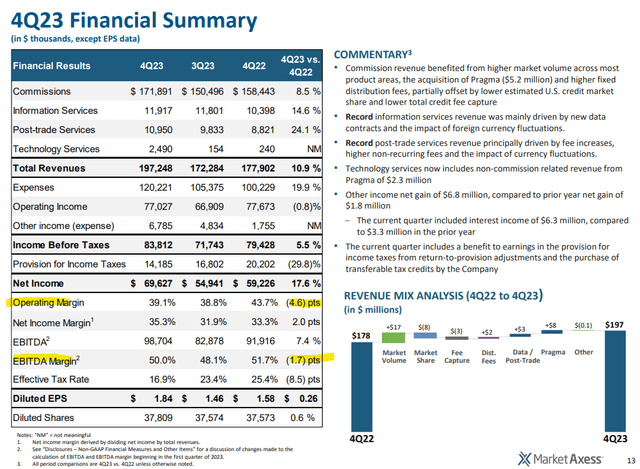

MKTX’s fourth-quarter earnings per share were $1.84, $0.12 higher than market expectations and an annual increase of 16%. Revenues reached $197 million, up 11% year over year, driven by continued international expansion and momentum in smaller segments such as information services, post-trade analytics and technology groups.

On the other hand, core transaction fee revenue grew 8.5% in the fourth quarter and 3.4% for the full year, in sharp contrast to the peak growth of 37% in 2020.

Keep in mind that this quarter’s results also included an $8 million revenue contribution from Acquisition in 2023 “Pragma” serves as an execution solution driven by algorithmic trading and artificial intelligence. By that measure, “organic” growth for the quarter was nearly 6%.

Source: Company IR

So although Top line momentum Compared with a weak 2022, there has at least been a rebound, but on the other hand, total spending continues to increase, with an annual increase of 20% in the fourth quarter.

Operating margin fell to 39.1% in the fourth quarter, down from 43.7% in the same period last year, reflecting efforts to achieve growth, including increasing headcount and research and development. Likewise, EBITDA margins are lower.

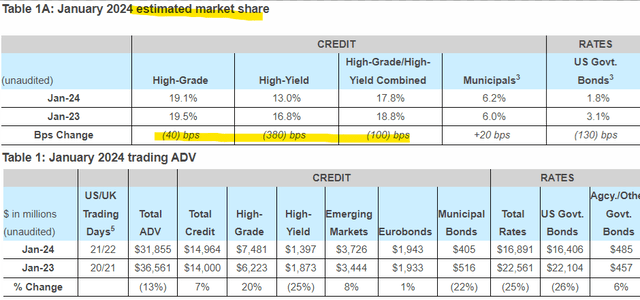

In trying to understand the ongoing share price weakness, the metric that stands out to us is the decline in market share January updated monthly By the first quarter of 2024, the economy continued to contract. In credit trading, high-grade and high-yield combined have a market share of 17.8%, down from 18.8% in the same period last year.

Management focused more on “record” average daily trading volumes in the key segment of credit, which reached $15 billion, up 6.9%, even as average daily trading volumes declined in other segments.

Source: Company IR

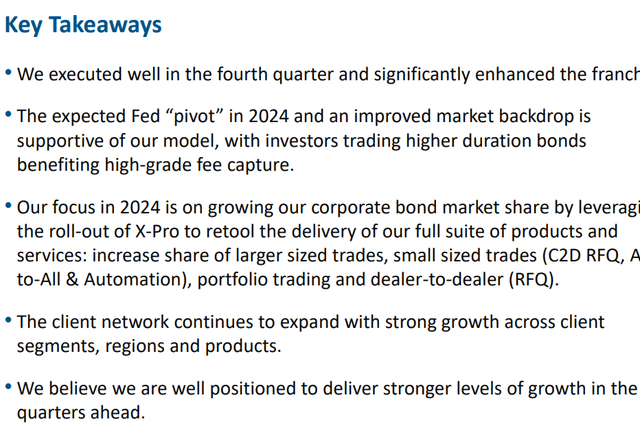

The company believes that tighter credit spreads and lower overall market volatility are partly responsible for the decline, and it expects an eventual rate cut by the Federal Reserve to help improve the market backdrop.

For 2024 guidance, MarketAxess is targeting full-year 2024 revenue growth of around 12%, including “mid-single-digit” contribution from Prama. Total spending is expected to be around $490 million in 2024, which, if confirmed, would be a 12% year-over-year increase, implying otherwise flat margins compared to similar growth.

Source: Company IR

What’s next for MKTX?

Our conclusion in reviewing MKTX is that the company is fundamentally sound and that the recent operational and financial turbulence more or less reflects the growing pains of this still-fast-growing segment.

Meanwhile, it’s worth recalling that when the stock was trading as high as $600 in late 2020, the platform was considered “disruptive” or a “game changer” compared to the bond market. , loans and credit securities have traditionally been traded over the phone.

For context, January data showed the total market value of credit transactions at 17.8%, down from 19.5% in 2020. Any expectations that the company will reach above 30% or higher in the foreseeable future look increasingly unlikely. There is also a sense that the competitive landscape is putting pressure on expenses and adversely affecting profitability.

Players in this space include Tradeweb Markets Inc. (TW), Bloomberg and S&P Global Inc. (SPGI), each of which has its own strengths and weaknesses in certain categories. Our interpretation is that the industry has started implementing many of the features that made MarketAxess stand out four to five years ago.

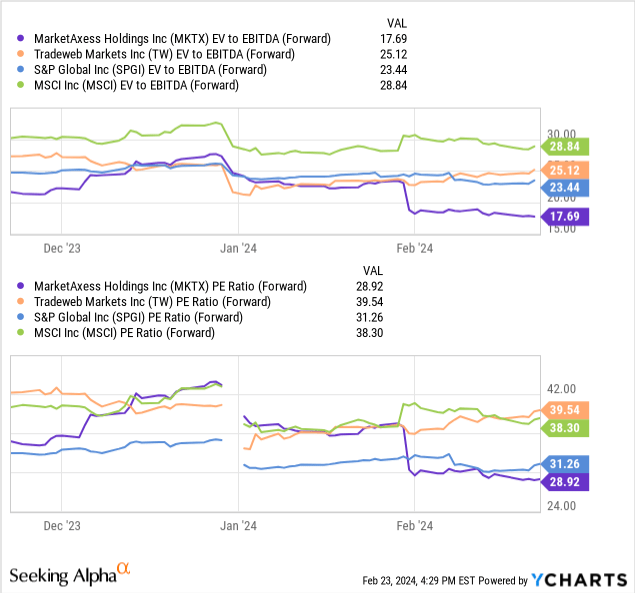

As a financial data leader, the stock trades at a discount to Tradeweb and SPGI at 18x EV forward EBITDA multiple or 29x forward P/E, which we think is reasonable given recent trends.

The reason for optimism for MKTX is that the company can reaccelerate organic growth while also showing signs of stabilizing or gaining market share. The risk is that the numbers continue to underperform and the stock could face repricing lower as the market reassesses the long-term opportunity.

final thoughts

2024 will be a critical year for MarketAxess to achieve a turnaround, focusing on financial efficiency and greater operational momentum. The good news is that the company remains profitable and has solid free cash flow, which at least buys the platform time to operate.

While leaning bearish, we rate the stock a Hold, balancing what we see as ongoing challenges while also recognizing that the sharp selloff may have contained a number of negative factors. A share price drop below $200 would signal a worsening outlook, and shareholders should pay close attention. Our base case forecast is that volatility will continue.