The Future of Publishing/Getty Images The Future of Publishing

investment thesis

Optoelectronics (NASDAQ:PLAB) The recently announced 1Q24 results disappointed investors as EPS and revenue missed, but also provided soft guidance.The stock price plummeted that day, so I wanted to see How the company has performed since I last covered it August. PLAB has performed relatively well over the last year, so the overreaction to the results is, in my opinion, a blessing for those hoping to start taking positions at prices not seen since August last year, as the long thesis is still intact. The company is performing well and should recover over the next 3-5 years and reward patient shareholders; therefore, I reiterate Buy.

Financial Brief

As of 1Q24, the company had approximately $521 million in cash and equivalents, while Only $2 million in debt. Like many of the semiconductor companies I cover, its financials are flawless. The lack of debt means cash flow can be used to grow the company, which will reward shareholders in the long run. Additionally, debt has decreased by $15 million since Q4’23; even so, this is a negligible amount. If this debt stays on their books forever, that’s not a problem for me. It’s safe to say that the company is still not at risk of bankruptcy and should be able to weather further declines in the semiconductor industry and the overall macro economy.

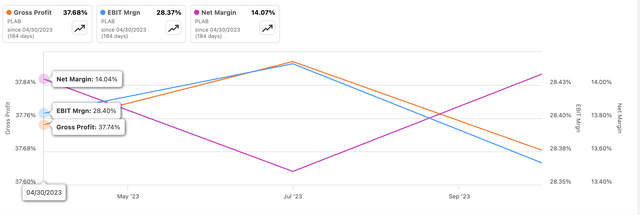

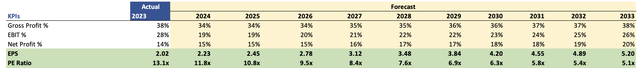

Let’s see how the company’s efficiency and profitability fare at the end of fiscal 2023. PLAB’s profit margins have been relatively stable over the last year, and although they appear to be volatile, these fluctuations are only a few percentage points. Comparing year-end margins with the most recent quarter’s gross margins of 36.6% and EBIT margins of 26.6%, while net margins were around 18%, we can see that gross margins and EBIT margins declined slightly, while Net profit margin declined slightly. All a little higher. Margins were much higher in the fourth quarter than in the previous quarter, but that’s understandable since management said the first quarter is always worse than the fourth quarter.

margin (exist)

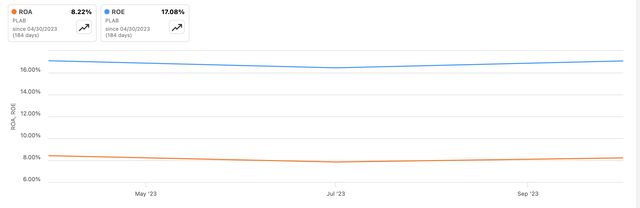

The company’s ROA and ROE have been relatively stable over the past year, which isn’t a bad thing considering their high levels. The company continues to utilize its assets and shareholder capital quite efficiently and should create value.

Return on assets and return on equity (exist)

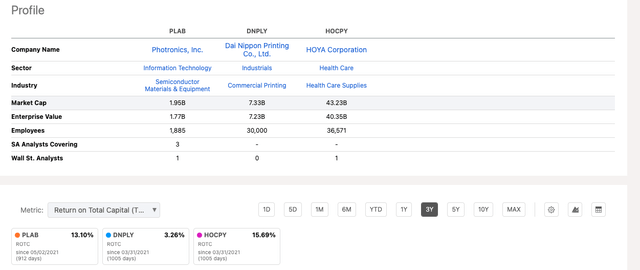

Judging from the competitive landscape and advantages, it is difficult to find companies that will go public, but many companies in China, Taiwan, and Japan provide similar services and products to PLAB, so don’t consider it on my peer list. Found out comparing PLAB to exhaustive, because it certainly isn’t. In my opinion, the company’s ROTC is still very good and above the 10% minimum I set. Additionally, it’s unfair in terms of existing competition because the companies below are much larger and have a lot of business in many different industries.

ROTC vs. Peers (exist)

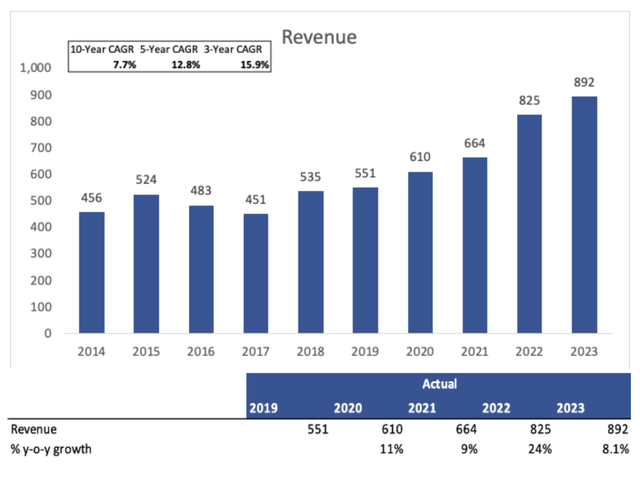

In terms of revenue, the company is seeing some growth, albeit not as strong as in previous years, but still growing even in the tough market we’re experiencing in the 2023 cycle. Additionally, we can see that compound annual growth rates have accelerated in recent years, but can this growth be sustained? The annual growth rate in the first quarter of 2024 was only 2.5%, which is quite slow. I don’t usually pay too much attention to quarterly reports as they tend to fluctuate and I prefer to see the big picture.

revenue growth (author)

Overall, the company has performed quite well over the past year, with margins and revenue holding steady. The company is as efficient as it was at the beginning of last year and revenue is still growing, albeit at a slower pace than before, but I think that’s just temporary.

What happened in Season 1?

The company reported Q1’24 numbers, but they missed expectations on both revenue and EPS. Revenue grew only 2.5% from the same period last year, which was $3.67 million less, while non-GAAP earnings per share were lower than the same period last year, at $0.48, or 1 cent. IC revenue grew 1%, while FPD revenue increased 8% year-on-year, but fell 7% quarter-on-quarter. These results are already not great, but I don’t think that warrants the share price plummeting as much as it did (down 14% as of this writing). I think what happened was poor guidance from the company. The company’s guidance for 2Q24 EPS is very wide, ranging from $0.50 to $0.58 per share, with a midpoint of $0.54, compared with analysts’ expectations of $0.56; the midpoint of revenue is $231 million, compared with Analysts expected $1 million higher. consensus. So, my view on this is that the market is overreacting. Sure, the miss wasn’t huge, but the guidance wasn’t too bad either, in my opinion, and the results and guidance combined don’t justify 14% of the company’s value being wiped off in one day. As I mentioned before, quarterly reports are very volatile, and I believe this overreaction is a good opportunity to start a long-term position or accumulate a full position if you’re already invested.

Outlook’s comments

I believe the company’s long-term prospects remain intact, and I view this share price drop as a good opportunity to build a position. Longer term, management is still sticking to the company’s 38% gross margin, which is a good sign that the team can manage costs to continue improving efficiency and higher profitability. The team expects margins to improve in the first quarter.

I think the company will achieve great success in the AMOLED field in the future. The demand for AMOLED continues to grow steadily, and the expected growth rate is considerable. Compound annual growth rate 11.85% From ’24 to ’31. This growth should translate into improved revenue growth for the company, with CEO Frank Lee mentioning in the latest note that the company hopes to focus more on the AMOLED field in the future.

We all know that the smartphone and PC markets are experiencing weak years in 2022 and 2023, when both markets Saw 12% and down 15%respectively, in 2022, while the smartphone market is expected to down 5% In 2023, the PC market was relatively stable. When growth starts to appear in these two markets, I expect the company’s revenue to pick up, and seeing that the decline isn’t as severe as before, the bottom may have already been reached, and cautious optimism is warranted.

Overall, the outlook for semiconductors is also positive.Negative sentiment and cyclicality are shifting into positive territory, analysts expect growth to return, forecast range From 9% to up to 20%Percentage for 2024 and beyond. In the long run, demand for semiconductors remains unchanged. Thanks to constant technological advancements, digitization, and more and more devices being connected to the Internet, there won’t be a year that goes by without semiconductors. Furthermore, the company hasn’t even mentioned the buzzword of artificial intelligence! I joke that companies certainly don’t need to follow suit.

Valuation

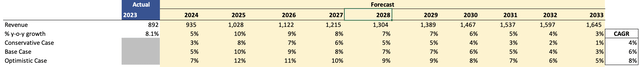

For the valuation model, I reviewed my previous assumptions, which were already conservative, and decided to be more conservative this time. This way, I can lower the company’s outlook further, which will serve as a stress test to see how low the company can go and still be a good buy. The first time, I chose a base case CAGR of 8%, now I have decided to lower it to around 6% CAGR over the next ten years, and the optimistic case will be the base case in the first article .Furthermore, the conservative case is real I think conservative. The following are these assumptions.

Revenue Assumptions (author)

In terms of margins and EPS, I decided to once again lower gross margin by about 400 basis points and lower EBIT margin by about 900 basis points in fiscal 2023. These will gradually improve to close to FY23 numbers, while net margins will improve 600 basis points over the next decade. Below are estimates compared to fiscal 2023.

Margin and EPS Assumptions (author)

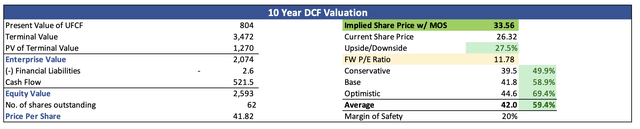

For the DCF model, I choose the company’s WACC of 10.6% as my discount rate and a terminal growth rate of 2.5%. Additionally, I added an additional 20% discount to the final calculation just to give myself more room for error in the above estimate. That being said, PLAB’s intrinsic value is $33.56 per share, which means that even with such conservative estimates, the company is still trading below its fair value, and the recent plunge in the share price provides a good opportunity.

Intrinsic Value (author)

risk

As I mentioned in my first post, the same risks still exist. The company derives most of its revenue from China and Taiwan, which, as we all know, are geopolitical risks that no one wants to touch right now. I do think the risk is overstated, and I doubt anything will happen anytime soon. I think the company’s revenue is safe.

Weakness in key end markets is likely to continue to worsen the company’s top-line growth potential, which will further impact the company’s share price, as we saw in the latest report, however, as the cycle ends, the company will see its top-line growth revitalize . Maybe not in the next few quarters, but certainly in the long run. I prefer to look at this from a long-term perspective, and short-term issues like this will provide a good buying opportunity.

Conclusion

I believe the company’s problems will be short-lived and a pullback of this magnitude should be viewed as a good entry point to start or accumulate a full position in a company that, in my opinion, will last a while. The company’s perfect balance sheet will protect it from further economic downturns and its industry-specific problems, but considering the worst is over, the downside risks are minimal at this time and only irrational market sentiment could pull it further. Lower the stock. Has nothing to do with company fundamentals. These are still solid; therefore, I stand by my previous buy rating and may have to upgrade my rating and go full position in the future if the company’s share price continues to fall and the bullish thesis remains unchanged.