Suchada Tansirimas/iStock via Getty Images

Flexsteel Industrial (Nasdaq ticker: FLXS) is an American furniture manufacturer that specializes in medium-sized sofas.

Last year, I wrote an article about the company with a Hold rating. The reason is that there were problems with restructuring during the epidemic and insufficient capital allocation before the epidemic. The pandemic, excessive sales and administrative expenses, and what I consider to be high multiples on average earnings for the cycle.

The stock remained largely flat for nearly a year after my article was published, but has gained nearly 100% since January 2024. The underlying reasons are record profitability in recent quarters, exciting 2024 guidance, and announced property sales that could provide one-time gains.There may also be technical reasons, such as higher yields

During this review, I found that the company’s margin improvements were shared with the industry.I also realize that the new management is performing well ideas that can lead the company to new levels. I analyzed the potential value of the manufacturing facility for sale and compared the company’s aftermarket electric vehicles to its profit potential.

While Flexsteel has a bright future (mainly if its management can deliver on its promises), I think the stock is too expensive at its current price. I’d rather wait for better prices and a better understanding of its management.

a wonderful year

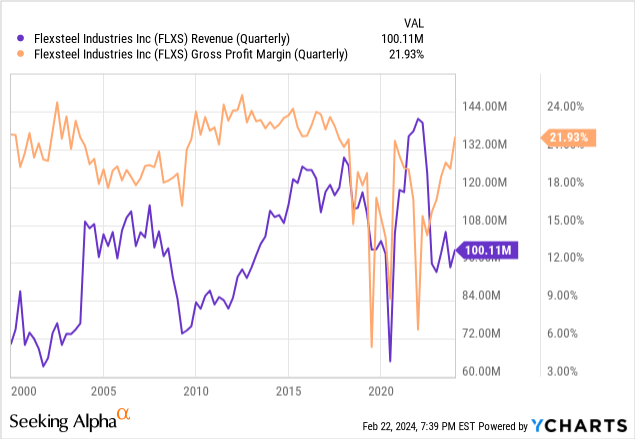

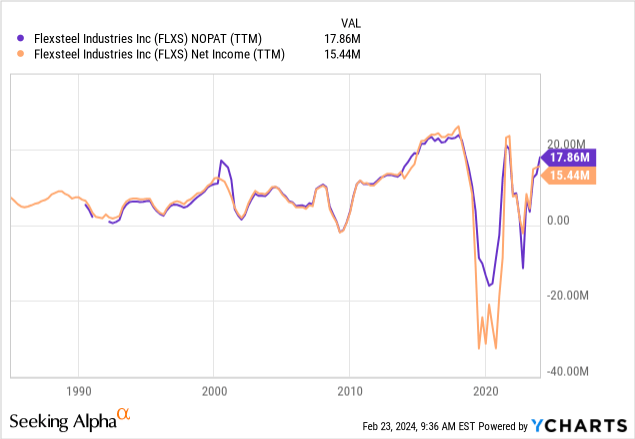

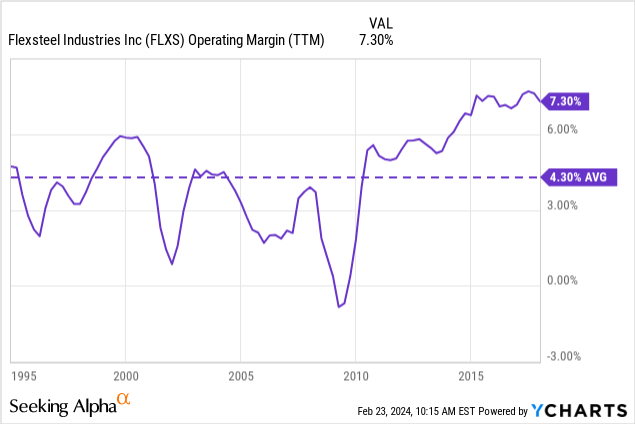

Compared with the pandemic furniture boom, Flexsteel’s 2023 revenue won’t be impressive. The company’s sales are still 30/40% lower than during the epidemic and even before the epidemic. However, as shown below, the company’s profit margins recovered significantly.

For a low operating margin business like Flexsteel, a 500 basis point recovery in gross margin almost completely translates into profit, thereby increasing operating margin and bottom line.

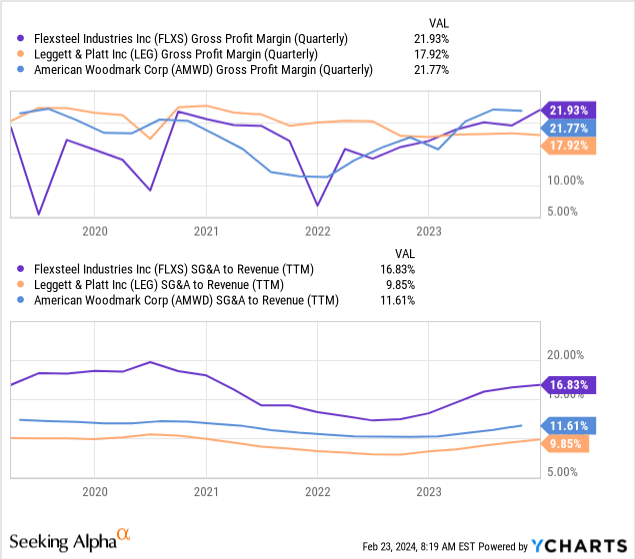

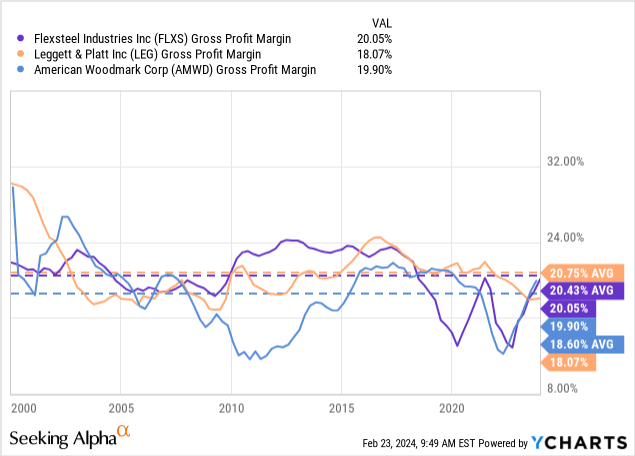

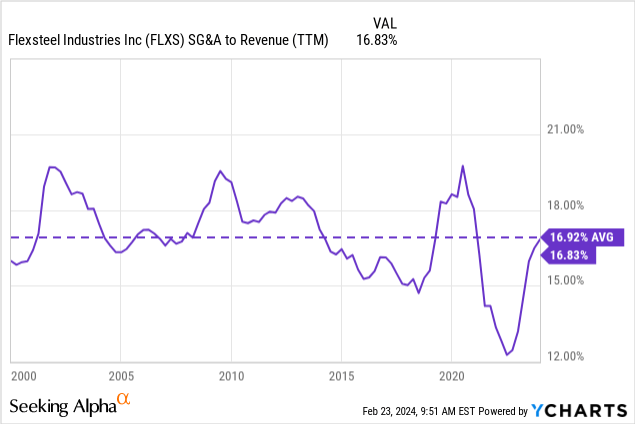

Part of the credit for the recovery belongs to the company and its management, but also to industry forces, as shown below, comparing Flexsteel to some of its peers. The chart below also shows my main concern in last year’s article, which was that Flexsteel’s SG&A structures are much more expensive than other furniture manufacturers, even though most of them are wholesalers.

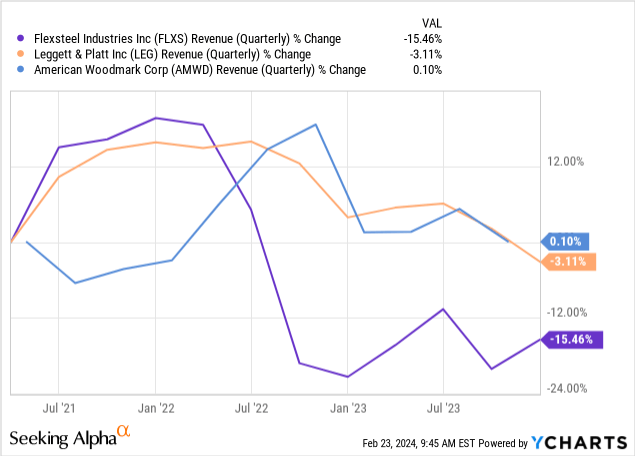

On the other hand, Flexsteel appears to be more resilient than its peers in recent quarters since September 2022, although this trend is too short-lived to represent a meaningful reading. Perhaps it’s because of the introduction of new product lines (more on that below).

management and change

In 2018, the company brought in a new CEO and began a company-wide restructuring that continues today.

Together with the CEO, a new management team was introduced to take charge of production, logistics sales and IT, and new areas such as retail and customer experience were created.Most Flexsteel current manager It was introduced after 2019.

Most managers have extensive furniture manufacturing experience in large companies. For example, the CEO has 17 years of experience in HNI Corporation and another 10 years in Hon Company.

I like what I’m hearing from management so far about the strategy and its implementation. In terms of strategy, the company defines three areas:

- Demographics expand from Baby Boomers and Generation X to Millennials

- Horizontally expand to other product lines beyond the living room (basically beyond sofas, armchairs, recliners, etc.)

- Expand sales channels beyond independent retailers.

In terms of execution, I found several good indicators.

For new sales pipelines, companies reopen There is a showroom in Las Vegas and a showroom in High Point, two important wholesale furniture markets.It created the homestyles e-commerce brand (the brand existed, but the website was dormant until 2020), selling third-party products and Enter slowly Outdoor furniture market. Since its launch, website According to Semrush, the site’s organic traffic continues to increase and currently has about 12,000 visitors per month. It also creates its own DTC Flexsteel store website, focusing on two product lines: modular products and recliners.company Add to Vice President of Retail and Customer Experience, expanded the retail sales team by 10%, installed Salesforce as a CRM, and increased investment in digital assets (beautiful images and videos of products, etc.).

In terms of products, this year the company launched a modular product line Flex, can be assembled in the house, which increases logistical convenience and is more suitable for smaller houses or apartments with stairs.it is also roll out Its first recliner is called the Zecliner. It’s a power recliner that comes with a remote control, heat and air, and a programmable smartphone app. This product is clearly aimed at older adults, especially those who have difficulty getting in and out of bed due to difficulty standing. Management said new products launched in the past three years have accounted for 25% of sales.

For the younger generation, better online displays and the Flex unassembled product line can meet the needs of the younger generation.Flexible steel also roll out A less expensive brand called Charisma costs about $1,000 a piece, while Flexsteel costs $2,000.

Overall, I like that the company is moving in a certain direction and not stagnant. Time will tell if everything goes in the right direction, but the first step is to try. Focusing on the end customer by launching more convenient products, better prices and improving its online presence seems to be the right direction. Outdoor is a great adjacent category to begin expanding horizontally.

SG&A Issues

As mentioned above, Flexsteel’s selling, management and administrative expenses (SG&A) to revenue ratio is higher than that of its peers. The company’s profitability fell by 5 to 8 percentage points. This aspect has not improved under new management.

While companies must invest in SG&A to launch new brands and expand their sales force; I generally find that when a company’s SG&A expenses are high and out of control, it’s usually because of inefficiencies rather than investment.

One sign of this is high executive compensation. The company’s proxy statement for fiscal 2023 shows compensation for the board of directors and three top executives is nearly $6 million. Most of that is focused on the chief executive ($3 million). If we extrapolate the compensation of the VP of Business Development to the company’s other 6 VPs, the total executive compensation would be over $10 million. Call me old-fashioned, but I don’t believe the management team should earn more than the shareholders.

The company’s compensation structure is also not ideal. Bonuses are based on revenue and adjusted EBIT, which can be amplified without taking into account the more critical profitability, margins and return on capital.

While I generally like the company’s new direction, I believe improvements in this area would help.

property value

In its latest quarterly results, Flexsteel also announced that it will close and sell its factory in Dublin, Georgia, with severance pay of $3 million and subsequent savings of $4 million per year. The company has closed a factory in Starkville, Mississippi, and is selling the property.

Between those two properties, they added about 600,000 square feet of manufacturing facility, so they represent some value that can be returned to shareholders or reduce the company’s EV.

this Starkville Facilities The listing price online is $6 million, or $20 per square foot. The facility was built in 1997 and is located in a small town not far from the state capital. The Dublin, Ga., plant is in a similar situation, although it’s closer to the North Carolina Furniture Center. It was built in 1983, which means higher discounts. Similar properties List prices in nearby Georgia towns range from $30 to $40 per square foot, indicating a value of $9 to $12 million. After taxes (the properties’ book values are likely to be very low given their age), the two properties generate about $10 million in cash for the company.

Valuations and expectations

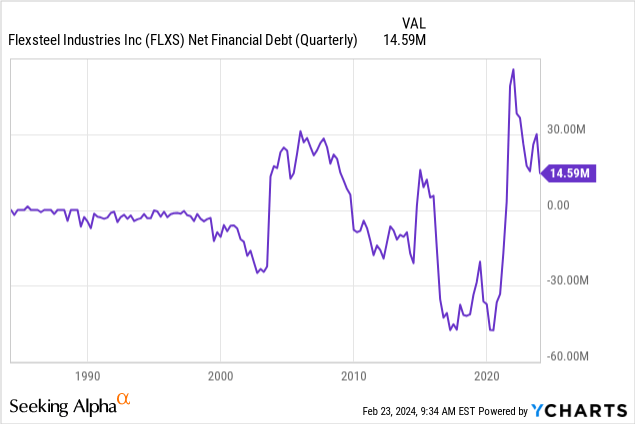

After sharp gains in January and February, Flexsteel’s market capitalization reached $170 million. The company’s net debt is low, and management said it plans to reach zero by the end of its fiscal year in August 2024.

Taking into account the underlying after-tax value of the properties for sale, the company’s EV is essentially the same as its market capitalization. This distinction is not important because low debt levels mean NOPAT and net income are very similar.

Compared to the current net profit of $17 million, a market cap of $170 million doesn’t seem excessive, especially if the company is improving under new management. However, we must take into account that margins are variable and are currently at mid-term tops. I believe it would be better to use an average of Flexsteel history and its peer history. In this case, we can consider the gross profit margin to be around 20%.

Then there’s SG&A. As mentioned, I believe the company has a lot of room to grow in this area, but current trends don’t show any improvement. If we also use the company’s long-term average here, we come up with roughly 17% of revenue going to SG&A.

They’re not necessarily correlated (as SG&A scales with revenue, gross margin may decline simultaneously), but we can consider a long-term average operating margin of 3%. That’s not far off from the 4.3% average operating margin before 2018 (which became more volatile after 2018 due to restructuring charges and the pandemic).

To achieve a 10% yield (including 25% corporate tax) on a market capitalization of $170 million, the company would need an operating profit of about $22 million, or nearly $755 million in revenue at an operating margin of 3%.

Of course, that’s still far from current revenue of $400 million or the $430 million cap of management’s fiscal 2025 guidance. This is because profit margins are so low that a “small” change (1% or 2%) can be enough to double or halve earnings.

By comparison, if the company achieves fiscal 2025 guidance of 6% operating margin, it would generate $26 million in operating profit and would generate a price-to-earnings ratio of 8.8x at its current market cap.

However, caution must be exercised, especially in an industry as discretionary and competitive as furniture. If Flexsteel performs as expected, it’s an opportunity at current prices, but that’s an optimistic argument.

Consider that a mix of fundamental and optimistic arguments can still produce an overpriced price. Furthermore, if one buys a stock at a price that is pessimistic or justified by fundamental views, then price risk is lower, whereas one is primarily exposed to operational risk. However, when buying under optimistic assumptions, one is exposed to both operating risk (the risk that operations do not perform as expected) and price risk of disappointed short-term investors selling the stock.

Therefore, I prefer to wait for Flexsteel. I like the management of the company and follow the company and the stock.