Douglas Rising

In keeping with my ongoing commentary on bonds, I wanted to write an article focusing on Treasury bonds. Since I wrote about Treasuries last year, returns have been mediocre as yields have risen.Looking ahead, the Fed may cut interest rates Yields are under pressure, which could result in some short-term capital gains on Treasury bonds but lower long-term total returns.

On a net basis, I believe Treasuries are a stronger and more reasonable investment opportunity than they were last year. Deciding on a Hold rating because I think there are better investments out there, including high-quality CLO ETFs like the Janus Henderson AAA CLO ETF (NYSEARCA: JAAA) and the Alpha Architect 1-3 Month Box ETF (BATS: BOXX).

I’ll focus on the iShares 7-10 Year Treasury Bond ETF (NASDAQ: NASDAQ: IEF) for the rest of this article, but everything should apply to other treasury funds and Treasury bonds as an asset class have about the same ratio.

Treasury Bonds – Analysis

Dividends and Yields

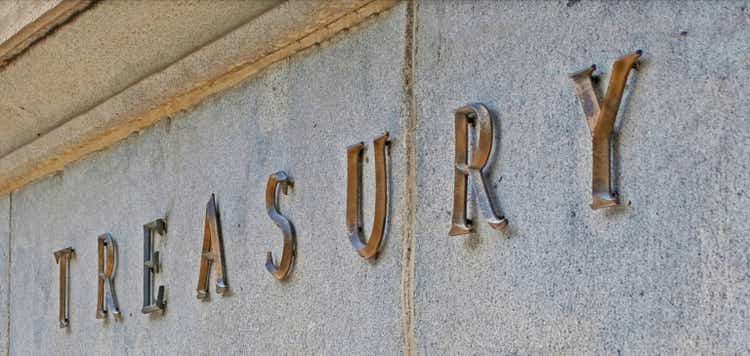

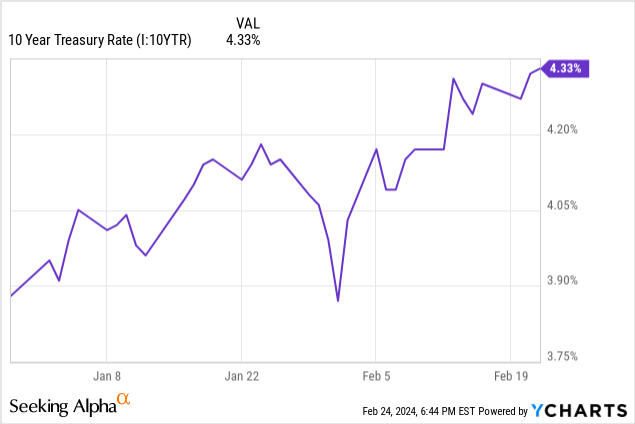

Since the beginning of 2023, Treasury yields have continued to rise, with the benchmark 10-year Treasury note rate rising from 3.9% to 4.2%. Yields have risen due to higher and longer expectations that the Fed will raise interest rates and that some kind of restrictive policy will be adopted in the future.

Data comes from YCharts

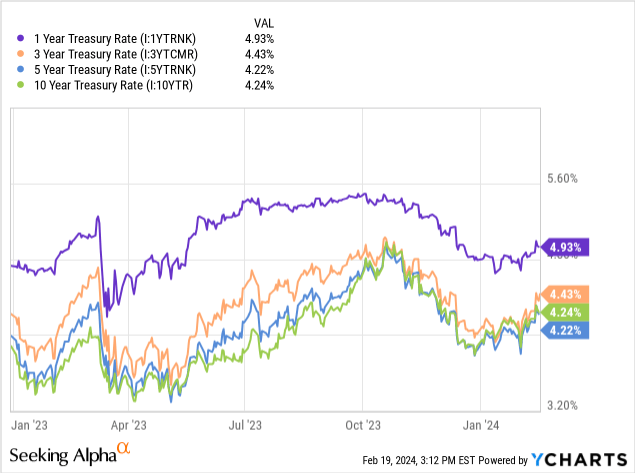

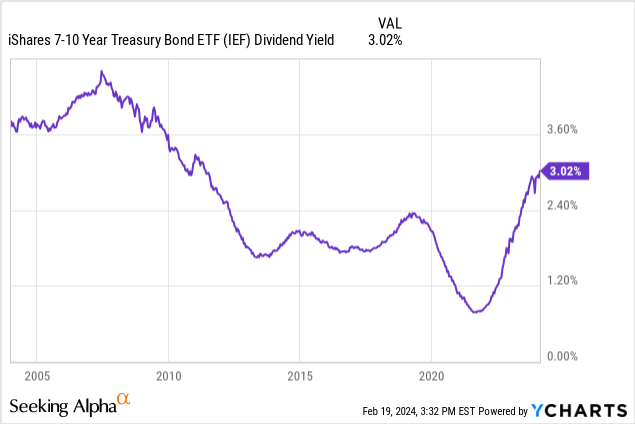

The yield on IEF itself increased from 2.0% to 3.0%.

Data comes from YCharts

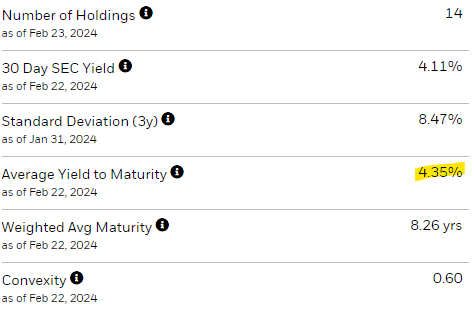

The IEF’s yield is still lower than Treasury rates because the fund still contains some older Treasuries with much lower coupon rates. These bonds are less expensive, so the expected total return (including potential capital gains on a Treasury bond maturing at par) is higher and similar to the return on the Treasury bond itself. As expected, the IEF’s yield to maturity is 4.4%, which is comparable to prevailing Treasury rates.

isoelectric focusing

U.S. Treasury yields are at their highest levels since the financial crisis/housing bubble, but have generally been higher over the past few decades. Economic conditions have changed significantly since then, so focusing on the last few years seems appropriate.

IEF yields are also the highest since the financial crisis, but were slightly higher in the 2000s.

Data comes from YCharts

Higher Treasury yields will almost certainly lead to higher long-term Treasury returns, which is an important and immediate benefit for investors. The IEF itself is also a stronger investment opportunity now than it was last year.

The Fed may cut interest rates

Federal Reserve Guiding three interest rate cuts this year. Although a rate cut is uncertain, it seems very likely, with most investors and analysts expecting it to happen. The Fed’s interest rate cut should put pressure on Treasury yields and have two important impacts.

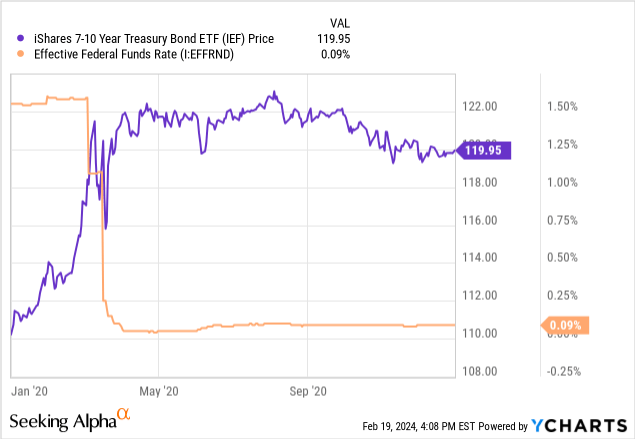

First, the Fed’s rate cut should lead to higher Prices of short-term Treasury bills.Remember, Treasury bonds are fixed-rate investments, so the Fed’s policy No Impact on existing Treasury bond coupon rates.If rates fall, current Treasury yields should continue to be +4.0% and these rates will start to look Very Once the Fed rate approaches 2.0-3.0%, it will become attractive. Demand for these older, high-yield Treasuries should surge, causing Treasury prices to rise. So should the IEF. For example, IEF’s stock price rose from $110 to $120 in 2020 as the Federal Reserve slashed interest rates due to the epidemic.

Data comes from YCharts

Keep in mind that the above scenario depends on the magnitude and speed of any potential rate cuts.I predict that the 0.25% interest rate cut in the later period will not lead to an increase in the price of government bonds. In 2025, I meeting expected If interest rates are slashed as they were during the pandemic. Realistically, I expect a rate cut to be somewhere between these two extremes, so the potential for higher Treasury bond prices is somewhat uncertain. remains an important factor.

The second impact of the Fed’s interest rate cut is a decline in the long-term rate of return on the treasury. Interest rates fall, yields fall, returns fall. Seems simple, but again worth mentioning. To the extent that this possibility or concern exists, investors should tend to invest in longer-term Treasury bonds to lock in interest rates.

I think rates are likely to remain higher for longer, at least relative to market expectations and prices.Therefore, I don’t think Treasury bond prices will significantly In the coming months, potential returns will increase, but potential returns will not decrease either.

Ministry of Finance peer comparison

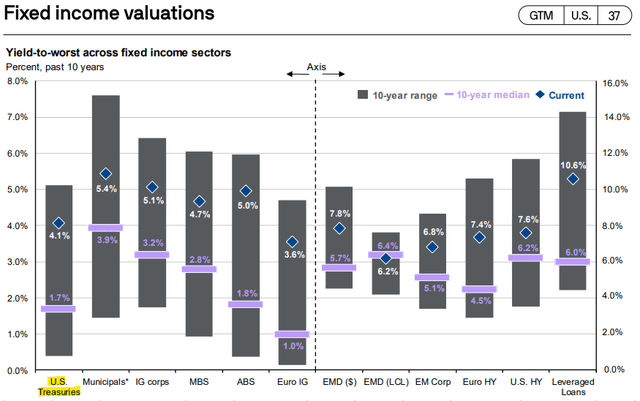

Yields have increased across most bonds and bond sub-asset classes due to the recent rate hikes by the Federal Reserve. Treasury bonds are not special in this regard, although Treasury yields are slightly above average, especially compared to other investment-grade securities such as municipal bonds and MBS.

JP Morgan Market Guide

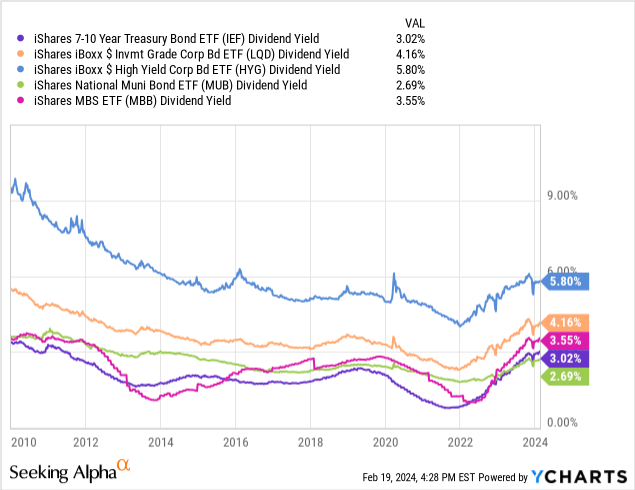

That’s generally the case for bond funds, where yields on most bonds have risen to multi-decade highs. The iShares iBoxx $ High Yield Corporate Bond ETF (HYG) seems to be the exception, and I’m generally not sure why.Taking into account the characteristics of high-yield bonds, the fund should Trading yields are well above average. Dividends have been rising since at least the beginning of 2022.

Data comes from YCharts

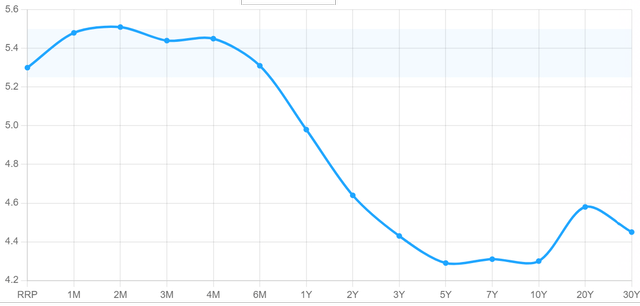

Due to recent interest rate cut expectations and the guidance of the Federal Reserve, the yield curve is inverted, and the yields of short-term securities are generally lower than those of long-term securities. For example, the Treasury bond yield is currently 5.3%, while the 10-year Treasury bond yield is 4.3%.

U.S. Treasury yield curve

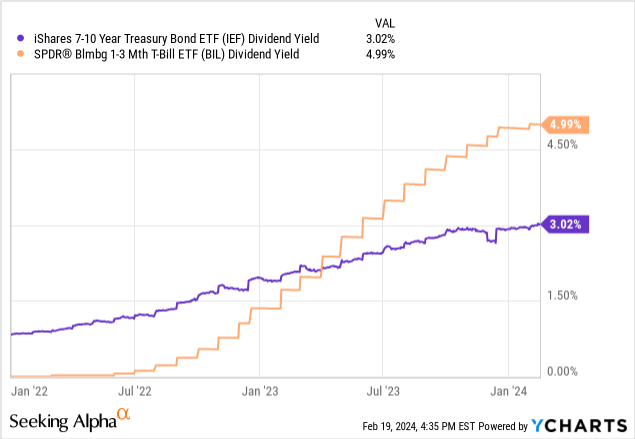

The same goes for IEFs and Treasury bill funds.

Data comes from YCharts

As a result, the investment opportunity is much stronger now than in the past for Treasuries, but so are most bonds and bond sub-asset classes. Some of them also appear to be stronger than Treasury bonds, offering higher yields or other benefits.

BOXX achieves Treasury-bond-like returns through options, providing investors with some potential tax benefits.

JAAA invests in high-quality CLO debt. Risk and volatility are extremely low, and the fund yields 6.2%.

BOXX is a short-term fund, while the underlying assets of JAAA are variable-rate, so unlike IEFs or Treasury bonds, neither can be used to lock in interest rates. I still prefer this pair to the IEF, but it’s an important distinction.

look back

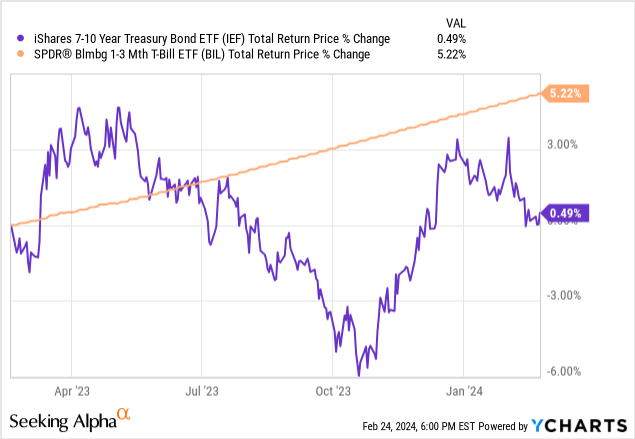

In my last article on Treasury bonds, I argued that Treasuries are a stronger investment opportunity because they offer higher yields and lower interest rate risk. Since then, Treasuries have performed better than expected and in line with expectations.

Data comes from YCharts

Since then, Treasury yields have risen, inflation has eased, and the Federal Reserve appears ready to begin cutting interest rates.Therefore, Treasury bills appear a lot of Investment opportunities are stronger now than in the past.

in conclusion

IEF’s dividend yield has increased, which is an important benefit for the fund and its shareholders. Lower interest rates may have some short-term benefits, but the long-term effects are almost certainly negative. While IEF is a stronger investment now than before, other options look stronger, including JAAA and BOXX.