Justin Sullivan

Systemic versus company-specific

The broad stock market, represented by the S&P 500 Index (SP500), is affected by two forces.

First, there are systemic risks associated with the business cycle (growth, unemployment, inflation), usually managed by the Federal Reserve.

Second, company-specific or industry-specific events typically affect only a small number of stocks, and if these are heavily weighted stocks in the broader market, the impact through sentiment on other (largely unaffected) stocks can be significant. What’s more, company-specific events can contradict systemic events (the first variable) and distort efficient market pricing.

Latest correction attempt rejected

In fact, that’s exactly what’s happening in the market right now. As I will explain in more detail, the macro environment based on systemic events is unfavorable for stocks, requiring a significant correction in the S&P 500.

However, the GenAI theme (a specific industry) continues to drive the market higher through a handful of affected stocks, which are heavily weighted in the S&P 500, notably NVIDIA (NVDA) and Meta (META).

First, the S&P 500’s attempt to correct after the hawkish Fed meeting on January 31 (a systemic event) was negated by the 20%+ surge in Meta (GenAI theme) the day after Meta’s earnings release Correction. Meta is currently the sixth-largest stock in the S&P 500 Index (SPY).

Secondly, after the “hot” CPI and PPI inflation reports (systemic events), the S&P 500 attempted a correction again on February 13 and February 16, but the correction was again rejected due to expectations of Nvidia’s earnings report.

Finally, after falling 2.5%, the S&P 500 hit a record high after Nvidia reported earnings on February 21, with Nvidia’s stock price soaring 16-17%. Note that Nvidia is currently the third-largest stock in the S&P 500, with a weight of nearly 5%.

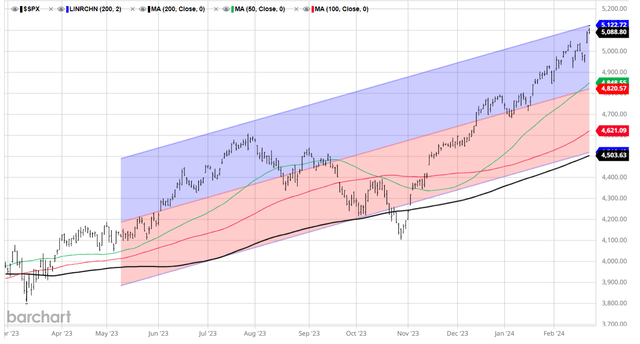

bar chart

The macro situation calls for substantial adjustments

Overall, the economy is facing an inverted yield curve (high probability of recession) and a 2025 refinancing term wall (high probability of a credit crunch).

The macro picture (systemic risk) in the short term is also very negative – it calls for a sharp correction in the S&P 500.

The S&P 500 chart above shows that the S&P 500 has had an almost parabolic rise since late October 2023, with the S&P 500 having posted a record 14 positive weeks out of 15 and is currently higher than the previous 17 weeks. Up 15 weeks, still historic. So, what are the triggers for this rally?

The Fed made a dovish turn at its December meeting, which had been hinted at in early October. Specifically, the Federal Reserve gave up its “long-term interest rate hike” policy and hinted at three interest rate cuts in 2024.

The market interprets this dovish shift as the Federal Reserve’s determination to avoid an economic recession in 2024 and to significantly cut interest rates before the “maturity wall” arrives in 2025, thus pricing in 6-7 interest rate cuts in 2024.

The market’s reaction to the Fed’s dovish stance resulted in a significant easing of financial conditions, with short- and long-term interest rates falling, the dollar weakening, and stock markets surging.

However, the key assumption is that inflation will fall quickly, allowing the Fed to cut interest rates. Unfortunately, the deflation process appears to have stalled at levels above 3% (based on January core CPI), and based on some key indicators (such as sticky inflation minus housing), inflation is likely to rise.

Therefore, the Federal Reserve has been trying to reverse its dovish trend since December and ruled out the possibility of a near-term interest rate cut at its January meeting.

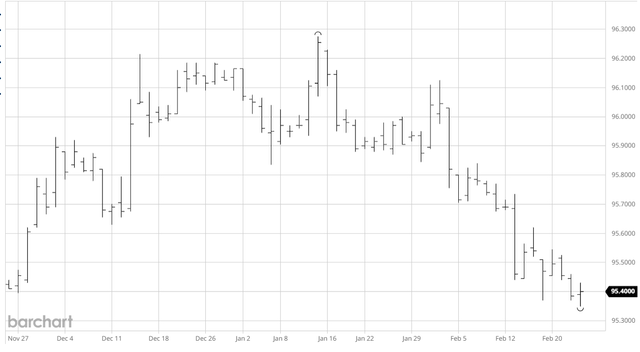

As a result, the market has repriced the Fed’s 2024 policy path from the December 2024 federal funds rate of 3.7% expected on January 12 to the current 4.6%, which is exactly what the Fed signaled in December. The chart below shows December Fed Funds futures, with an implied Fed Funds rate of exactly 4.6% (price 95.4).

December FF Futures (bar chart)

As a result, the 2-year yield rose to 4.70%, the (US2Y) (SHY) 10-year yield (US10Y) (TLT) rose to 4.3%, the real yield rose to 2%, and the U.S. dollar (UUP) generally rose strengthened. Financial conditions tightened. Even the Russell 2000 (IWM), an economically sensitive small-cap index that peaked in December, is still down year-to-date.

However, overall stock market indexes remained defiant and continued to climb, led by company-specific factors and some large-cap tech stocks, notably Nvidia.

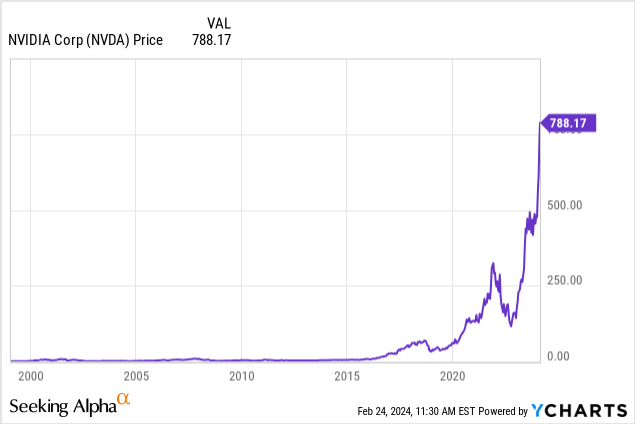

Nvidia’s collapse

Here’s a chart of Nvidia stock that says it all – the surge from 500 to 800 has been over the past 7 weeks year-to-date in 2024. It is the third largest stock in the S&P 500 Index.

So, what’s driving Nvidia higher?

The image above reflects the temporary situation GenAI chip shortage calculate. This trend was sparked by Microsoft’s (MSFT) investment in OpenAI and ChatGPT GenAI technology in January 2023.This incident triggered a wave of investment in GenAI technology by large technology companies Amazon (AMZN), Meta, Tesla (TSLA) and Alphabet (GOOG).

However, Nvidia appears to be the only chip manufacturer currently able to supply GenAI-enabled chips, with about 90% of the market share. So it’s clear that Nvidia’s revenue and profits grew rapidly last year.

But obviously, this is only a temporary situation, as other chip manufacturers will develop their own GenAI-enabled chips, and eventually there will be a surplus of these chips.

Therefore, Nvidia’s bubble will burst, which will have a negative impact on the entire stock market given Nvidia’s size.

Influence

Currently, the market and the Federal Reserve have reached an agreement on three interest rate cuts in 2024. However, the market has begun to price in less than three rate cuts, with December Fed Funds futures falling below the 95.4 level (i.e. an implied rate of 4.6%).

In fact, given the recent 1) stronger-than-expected January labor report and 2) stronger-than-expected January CPI report, the Fed may hint at fewer than three interest rate cuts in 2024 in its March SEP forecast. This will lead to further tightening in financial markets and trigger another correction in the S&P 500. We did get some signs of a hawkish correction from the January FOMC minutes.

Will the correction be rejected by Nvidia again? If it’s a bubble, yes, it’s definitely possible. But the key question here is what the connection is between systemic risk and the GenAI theme.

Meta is one of the largest buyers Nvidia chips, but Meta’s R&D budget depends on profits, and Meta’s profits depend on advertising revenue, which depends on the economy. So, here’s the connection – if the Fed can’t prevent a recession, Meta’s earnings will plummet, its R&D budget will fall, and so will Nvidia’s sales.

The point is, systemic risk variables are likely to start to dominate the market, and GenAI is unlikely to continue to deny a deeper pullback.

However, given that we’re talking about a bubble that’s still rising, my S&P 500 rating remains a Hold, although my overall position is turning bearish.