sweet bread factory

NASDAQ: FTXLThe First Trust Nasdaq Semiconductor ETF is a passively managed equity exchange-traded fund designed to track the performance of the Nasdaq U.S. Smart Semiconductor Index. The fund provides investment opportunities in companies in the semiconductor and production technology equipment industries.

The fund invests 96% in U.S. companies, investing primarily in giant to large companies, but also includes allocations to mid-sized and small companies. The index uses modified factor weights to rank securities based on trailing 12-month return on assets and total income. It also looks at momentum, ranking price appreciation over 3-month, 6-month, 9-month and 12-month windows.

Overall, we do not support FTXL as a way to gain exposure to the semiconductor industry compared to other semiconductor ETFs such as SOXX, iShares Semiconductor ETF, and others.We think funds allocating more capital to larger companies will continue These companies are able to outperform the market because of their advantages over smaller companies. The fund’s higher fees and shorter track record further reduce our interest, and overall, there’s nothing about the fund that particularly stands out from its competitors.

Semiconductor market analysis

Compared to SOXX, FTXL has far fewer investments in the largest semiconductor companies, with roughly 19% of the giant’s market capitalization allocated to SOXX’s 37%. This underweighting of large-cap stocks moves more assets into large-cap stocks and 10% of assets into small-cap stocks, with SOXX having an allocation of zero.

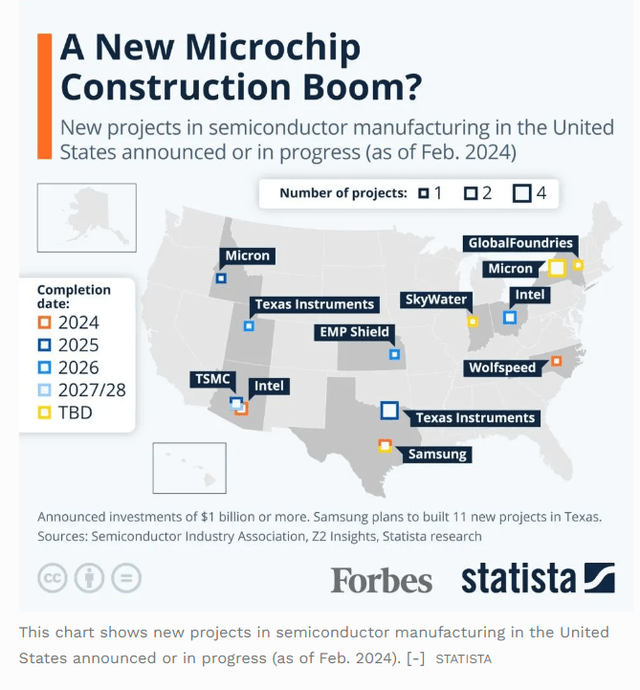

A big determinant of who will be the winners and losers in the U.S. semiconductor industry is the Creating Conducive Incentives for U.S. Production of Semiconductors Act, better known as the CHIPS Act. The CHIPS Act invests $280 billion in semiconductor production, research and development, creating high-tech centers and expanding the STEM workforce. The question on the investment side is which companies will benefit most from the CHIPS Act.

Social Mobile founder Robert Morcos wrote in an article wealth, the CHIPS Act is unlikely to succeed unless funds are allocated appropriately, especially to ensure small companies get their fair share. He went on to say that with the level of competitiveness in the semiconductor industry, small businesses will not be able to survive without structural support.

other Research Supporting this, point out that semiconductor companies have ongoing economies of scale, meaning that the larger a company becomes, the more difficult they are to make it harder for new entrants to compete and continue to increase profits.

So far, little funding has been provided, but not much positive progress has been made by smaller companies. GlobalFoundries (GFS), a large company with a market capitalization of approximately $29 billion Received $1.5 billion in CHIPS funding. also, Bloomberg recently reported Intel (INTC) is a fringe giant in talks to secure $10 billion in financing. Large-cap Taiwan Semiconductor Manufacturing Co. ( TSM ) and large-cap Micron Technology ( MU ) may also receive funding.

Speaking of small businesses, U.S. Commerce Secretary Gina Raimondo said: explain “We spend a lot of time focusing on the largest companies, you know, Intel and others, and that’s important, but the reality is that the majority of the upstream supply chain and the semiconductor industry are small companies across the country.” While this sounds encouraging, monetary support has been minimal. Only $500 million is set aside for small businesses and projects, less than 1% of the $53 billion allocated to businesses.

The following shows new semiconductor manufacturing projects underway or announced in the U.S. None of these companies are small caps, and only one, SkyWater (SKYT), is a mid-cap stock.

Forbes, Politician

Risks of Investing in Semiconductors

Regulatory risk is important when talking about semiconductor investments. While regulations can benefit the industry (such as the CHIPS Act), other regulations can harm the industry. Semiconductors are considered important to national security and are required by nearly all the electronic devices we use. If countries pass regulations to limit their own semiconductor production, like the U.S.’s Chip Act, revenue could fall as it becomes more difficult for companies to sell in foreign markets.

Here are the top 10 holdings of FTXL and SOXX

|

FTXL |

Saxophone |

||

|

Keep |

weight(%) |

Keep |

weight(%) |

|

Broadcom Corporation |

9.38% |

NVIDIA Corporation |

10.67 |

|

Qualcomm |

8.96% |

Advanced Micro Components Corporation |

9.54 |

|

Applied Materials |

8.67% |

Broadcom Corporation |

8.96 |

|

Intel Corporation |

8.12% |

Qualcomm |

6.12 |

|

Texas Instruments |

6.53% |

Intel Corporation |

4.91 |

|

AMD |

5.71% |

Applied Materials |

4.24 |

|

NVIDIA Corporation |

5.28% |

Lam Research Corporation |

4.19 |

|

Kelan Company |

4.52% |

Kelan Company |

3.99 |

|

Lam Research Corporation |

4.46% |

Maiwei Technology Co., Ltd. |

3.98 |

|

Micron Technology Corporation |

4.07% |

ASML Holdings ADR represents NV |

3.97 |

While many of these top 10 stocks are the same, the biggest difference is that SOXX has a much larger allocation to NVIDIA (NVDA) and Advanced Micro Devices (AMD), at just under double FTXL’s. That’s a bit worrying considering both of these names have had incredible returns over the past few years, but at the same time, it’s hard to find inexpensive stocks in this space. Ultimately, we believe NVIDIA and AMD will continue to be the two largest leaders in semiconductors.

|

symbol |

FTXL |

Saxophone |

|

Date of establishment |

September 20, 2016 |

July 10, 2001 |

|

Total assets under management |

$1,333,636,832 USD |

$11,702,537,543 USD |

|

Quantity held |

33 |

36 |

|

Weighted average market capitalization |

$95,359 |

$138,842 |

|

weighted average price to earnings ratio |

26 |

29.5 |

|

cash flow weighted average price |

18 |

21.2 |

|

weighted average debt to capital ratio |

32.7 |

31.3 |

|

Weighted Median Return on Equity |

30.90% |

32.90% |

|

weighted median return on assets |

13.60% |

14.80% |

|

Forecast dividend rate |

1.30% |

1.20% |

|

dividend frequency |

quarterly |

quarterly |

|

expense ratio |

0.60% |

0.35% |

The two funds compare very closely on most metrics, with the notable exceptions of founding date, AUM, fees, weighted average market cap, and some multiple valuations. SOXX has advantages in terms of date of inception, fees and AUM. This fund allows us to see a longer track record and will have higher liquidity, although FTXL’s liquidity is not an issue. FTXL has an advantage in terms of valuation, which has to do with owning more smaller companies with lower valuations. We are satisfied with this because our paper is based on the importance of scale in the semiconductor industry.

in conclusion

Ultimately, we believe scale is important to success in the semiconductor industry, so we want to select ETFs that emphasize this. We give FTXL a Sell rating due to its smaller size and disadvantages on several other factors compared to SOXX.