Press M for inventory

Late last year, on November 12th, I finally wrote an article in which I revisited Satellite Corporation Iridium Communications (NASDAQ:IRDM). I’ve been a big fan of this company for years.In fact, the first article I wrote about the company for Seeking Alpha in July 2015. At the time, I rated the company a Buy because I thought it offered potential. From then on, everything went smoothly. Shares rose 263.4%, while the S&P 500 rose only 135.3%. But that doesn’t mean I’m always bullish on the company.

I ultimately downgraded the company to “Hold” in August 2022 after seeing the stock surge. Since then, I have taken a fairly neutral stance on the business.Easy money has been made, further room for growth is My point is, it’s unlikely. Earlier this year, management released full financial results for fiscal 2023, along with detailed guidance for 2024.This has also been helpful since I last posted article The company’s shares fell 18.2%, while the S&P 500 gained 12.9%.This trend is driven in part by a sad fact: The company ended up Qualcomm (Qualcomm) decided to terminate the cooperative relationship with the satellite company. Part of the reason for the decline may be because the stock looks very expensive.

Fast forward to today and I’d say I’m starting to be impressed. Although net income has only risen slightly year over year, the overall trend for the company is positive. Management is working to pay down debt and buy back stock in the process. Paying dividends has become the norm for companies, and the pullback in the company’s share price makes it look attractively priced. However, I wasn’t ready to pull the trigger just yet. While the company has a lot going for it and the stock is cheap, its overall growth potential may be hampered, and my own discount analysis doesn’t show the kind of upside I’m looking for in the company. Therefore, I decided to temporarily maintain the company’s rating of “hold.” But if the share price gets cheaper, or profits improve further, I could easily become bullish on the business.

not ready yet

One of the hardest things about being an investor is that it can be a real challenge to separate companies you’re passionate about from those worth buying. Iridium Communications is one of my favorite companies for many reasons, not the least of which is my love of space. Because of this, I want to buy it. But ultimately, investing is not collecting. Rather, it’s about buying quality companies to protect capital and, ideally, capture upside opportunities.

Author – SEC EDGAR Data

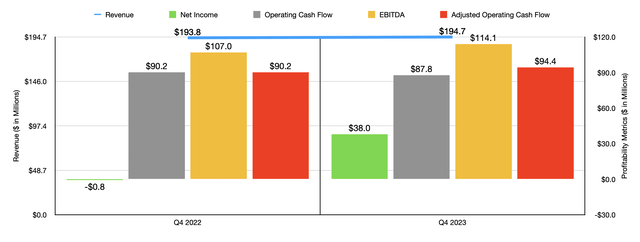

From a revenue and profit perspective, there’s no denying that Iridium Communications itself is doing well.consider last quarter The company just reported fiscal 2023. Revenue for the same period was $194.7 million. Compared with $193.8 million a year ago, this was an increase of 0.5%. The sales growth was driven by an increase in the company’s billed subscriber base.

Iridium Communications

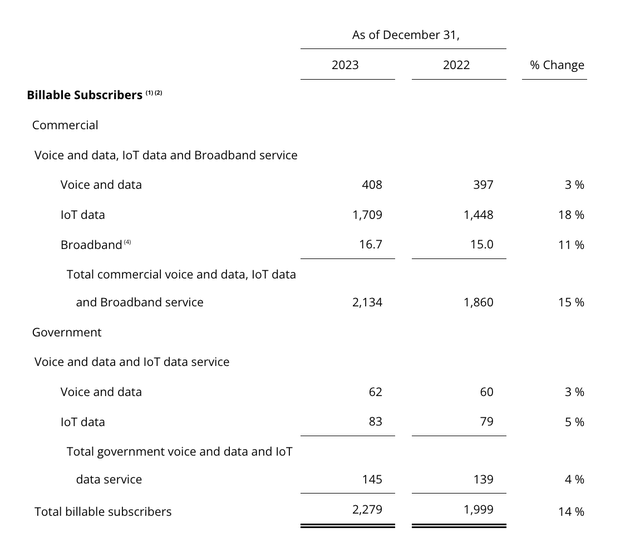

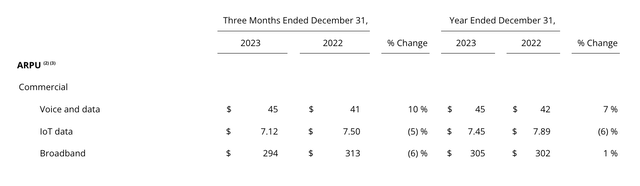

As of the end of 2023, the company had 2.13 million paying subscribers on the business side. That’s a 14.7% increase from the company’s 1.86 million employees a year ago. On the government side, the number of subscribers increased from 139,000 to 145,000. Unfortunately, these increases were offset by two major factors. First, the ARPU generated by the company on IoT data and broadband services deteriorated despite an increase in the number of billed users. For IoT data, the cost drops from $7.50 per month to $7.12 per month. Broadband costs dropped from $313 per month to $294 per month.

Iridium Communications

Another issue involves the degradation of user devices. Revenue related to user devices plummeted from $39.3 million in the final quarter of 2022 to $15.7 million in the same period of fiscal 2023. In this regard, management said this was due to lower demand related to short-burst data equipment, L-band transceivers and mobile phones. To make matters worse, the company expects device sales in 2024 to be even lower than in 2023.

Author – SEC EDGAR Data

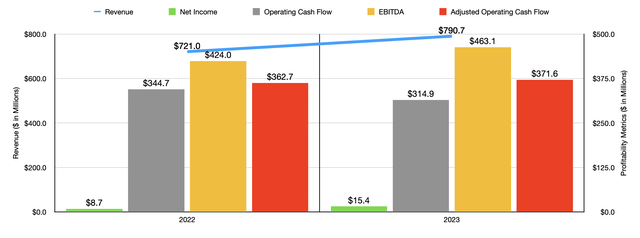

Despite these negative factors, the company’s earnings are still performing well. It went from a net loss of about $800,000 to a profit of $38 million. Indeed, operating cash flow fell from $90.2 million to $87.8 million. But if we adjust for changes in working capital, our funding would increase from $90.2 million to $94.4 million. Finally, the company’s EBITDA increased from $107 million to $114.1 million. In the chart above, you can see the overall results for fiscal 2023 compared to fiscal 2022. Revenue, profit and two of three cash flow measures all grew this year. All the same factors are at play here, as is the case with the season itself.

All things considered, 2023 is a good year for the company. By fiscal 2024, management expects services revenue to grow 4% to 6%. That would bring the figure to $607.9 million to $619.6 million, compared with a 2023 total of $584.5 million. Meanwhile, EBITDA should be between $460 million and $470 million. The midpoint is $465 million, just above the $463.1 million generated in 2023. By my own estimates, this should translate into adjusted operating cash flow of approximately $373.1 million.

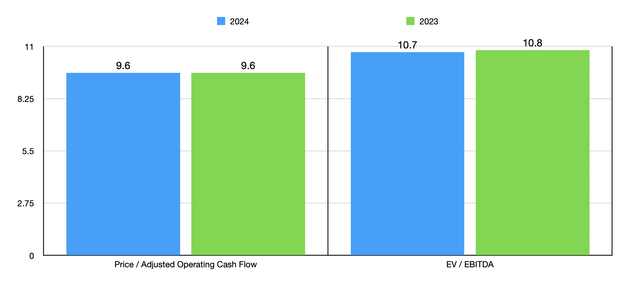

Author – SEC EDGAR Data

Using these results, I was able to value the company, as shown in the chart above. On its own, this pricing makes the company look quite attractive. This is especially true for a company like Iridium Communications that generates excess cash. Keep in mind that capital expenditures are modest, only $73.5 million last year. That leaves a lot of excess cash flow to enjoy. But that’s not all we have. When it comes to the future, we actually have a more concrete path to that. You see, last year, management said they still believed the company would hit $1 billion in annual revenue by 2030. If we assume margins remain constant during this time, it’s easy to figure out what kind of upside exists for the company for long-term investors.

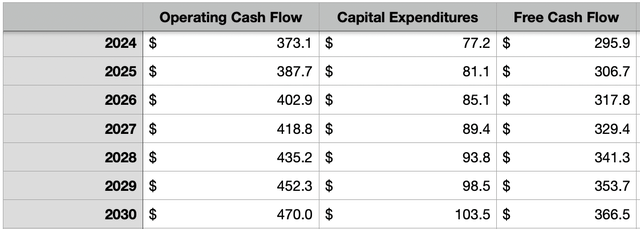

Author – SEC EDGAR Data

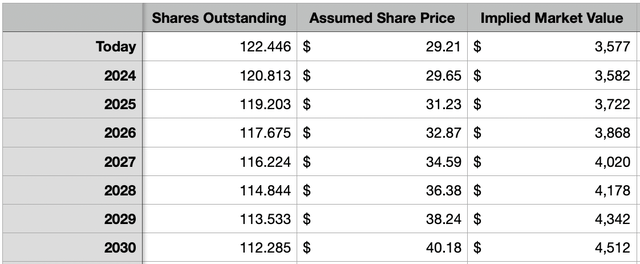

In the chart above, you can see that I’ve forecast not only operating cash flow, but also enterprise free cash flow between now and 2030. But let’s remember something different. First, management did say that they plan to reduce the company’s net leverage to below 2.0 by 2030. That compares with 3.1 at the end of 2023. If my operating cash flow assumptions are accurate, EBITDA should be approximately $585.7 million. This means the company should reduce net debt by approximately $297.8 million by that time window. The company also said the assumption was based on allocating remaining funds from its $334 million stock repurchase program to repurchasing shares. Unfortunately, we don’t know at what price this will happen. But if we assume that the stock repurchase price is the same as the company’s adjusted operating cash flow multiple, and that management repurchases stock in equal amounts each year, then the end result would be as shown in the chart below.

Author – SEC EDGAR Data

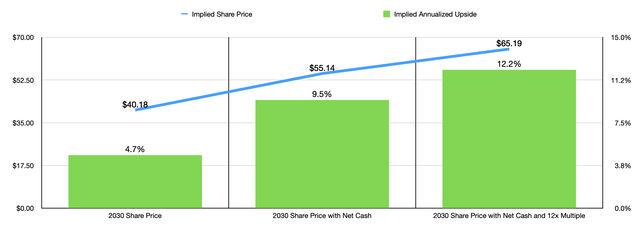

Assuming multiple hold trades, the company should be worth approximately $40.18 per share by 2030. However, when we do the math and look at all of the free cash flow the company should generate between now and then, we end up with an additional $1.68 billion in cash above and beyond what was used to pay down debt and repurchase stock. Yes, the company is paying distributions at this time. Last year, the company distributed more than $60 million in dividends. But because we don’t know when potential dividend increases will occur or what management might do with the money, I just add the cash to the company value through the end of 2030, which gives me an implied share price of $55.14. But honestly, I think an operating cash flow multiple of around 12 is more realistic for such a high-quality cash cow, even one that’s growing so slowly. This would lift the stock price to $65.19 per share, representing an annualized return of 12.2%. That’s a solid return, but considering the market averages between 11% and 12% per year, it doesn’t leave us with much wiggle room.

Author – SEC EDGAR Data

take away

I’m a big fan of Iridium Communications, and I doubt that’s going to change anytime soon. But that doesn’t necessarily mean I need to be bullish on the business from an investment perspective. The stock has gotten a lot cheaper recently, but in my own assessment, the stock is still a little too high to justify. I don’t think the outlook is bad at this level. But for those looking for market-beating returns and a good margin of safety, there are other opportunities. Therefore, I decided to maintain my “Hold” rating on the stock. But this could change depending on what happens in the future.