big country

In the short term, technology will no longer rule the world of momentum. In fact, I think we are very close and the long-awaited rotation from growth to value indexes will arrive.But if you disagree and Still looking to Nasdaq as an indicator of growth Fidelity Nasdaq Composite Index ETF (NASDAQ:ONEQ) is the right fund for you. ONEQ is a passively managed large-scale growth fund established on September 25, 2003. The fund’s primary objective is to replicate the investment results of the Nasdaq Index, a market capitalization-weighted index representing the performance of Nasdaq stocks.

The Fund uses statistical sampling techniques to provide broad diversification by investing at least 80% of its assets in common stocks included in the Nasdaq Composite Index (COMP.IND) There are many companies listed on NASDAQ. The fund manages more than RMB 5 billion in assets and holds more than 1,000 stocks. The fund’s expense ratio is a very competitive 0.21%.

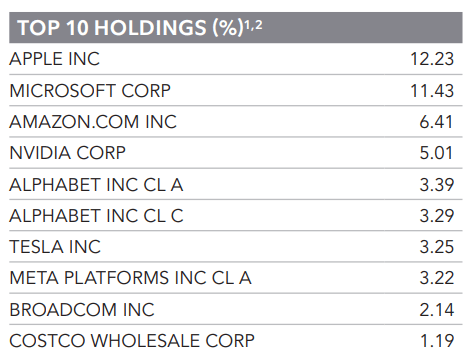

Top 5 holdings in ETFs

ONEQ’s top five holdings are the most influential and best-performing stocks in the technology industry. They’re the ones you hear all the time and have driven momentum for more than a year.

fidelity.com

Apple (AAPL) and Microsoft (MSFT) make up about 23% of the fund, so yes, this is very company specific/special in its composition. This is to be expected given the Nasdaq’s market capitalization weighting, but it’s worth keeping in mind if you’re nervous about concentrated holdings via ETFs.

The top 10 holdings account for just over 50% of the fund. Not as diverse as you might think.

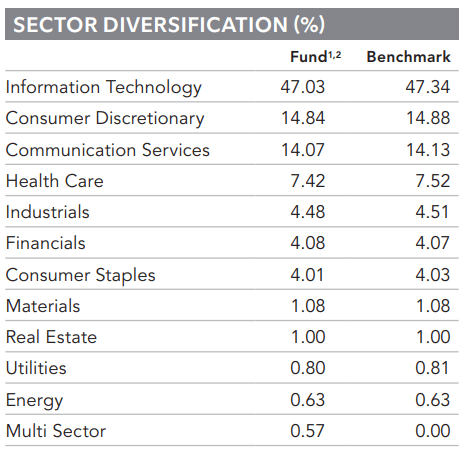

Industry composition and weight

ONEQ’s industry diversification is heavily skewed towards the information technology industry, which accounts for 47% of the fund’s total net assets. This is followed by consumer discretionary and communications services, accounting for 14.84% and 14.07% of the fund’s holdings respectively. Other industries include healthcare, industrials, financials and consumer staples. The weights match the benchmark very well.

fidelity.com

Comparison with peer ETFs

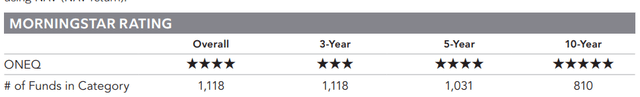

Compared to other similar ETFs, the Fidelity Nasdaq Composite Index ETF stands out for its low expense ratio, large holdings, and strong historical performance. According to Morningstar Rating™, the fund received an overall rating of four stars out of a total of 1,118 funds in the category, indicating that its risk-adjusted performance outperformed its peers.

fidelity.com

Pros and cons of investing in ONEQ

Investing in ONEQ comes with its own set of advantages and limitations. On the plus side, the fund offers broad exposure to the Nasdaq Composite Index, which includes a variety of large-cap growth stocks, primarily from the technology sector. The fund’s low expense ratio also makes it a cost-effective option for investors.

The downside is that the fund is highly concentrated in the technology sector, exposing it to industry-specific risks. Additionally, because it is passively managed, the fund does not have the flexibility to adapt to market changes as quickly as an actively managed fund. To be honest, I’m worried about this. Momentum works well when it works, but is also prone to factor collapse. Given that we’ve been in trouble for a long time, that makes allocations quite challenging from a timing perspective.

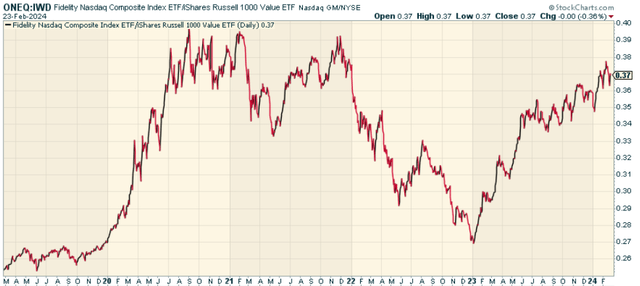

One thing worth noting is that the price ratio of ONEQ to the iShares Russell 1000 Value ETF (IWD) shows interestingly enough that value stocks overall have still outperformed the Nasdaq since 2020. The trend on the far right may have peaked, showing the Nasdaq turning lower in relative terms.

stockcharts.com

in conclusion

For investors looking for a diversified portfolio of Nasdaq-listed stocks, particularly in the technology sector, investing in the Fidelity Nasdaq Composite Index ETF could be a promising avenue. While this fund does carry some risk, its low expense ratio, strong historical performance, and broad market coverage make it a worthy consideration for a portfolio. Personally, I prefer to allocate stock funds with greater potential for new momentum. This one is a bit old now.