miodrag ignjatovic/E+ via Getty Images

before usAbbott Laboratories (NYSE:NYSE:ABT) as a Buy in October 2023, discusses Ozempic/Mounjaro as drivers Adoption of ABT’s blood glucose monitoring device, FreeStyle Libre, continues to increase.

The same was observed with the company’s diabetes medical devices The Nutrition unit’s performance over the past few quarters further fueled its earnings growth trend in that time.

ABT has clearly beaten expectations so far, with the stock up 22% and outperforming the market by 20%, further helped by management’s promising fiscal 2024 guidance and growing margins.

We maintain our Buy rating on ABT stock due to the dual prospects of capital appreciation and dividend income.

Diabetes CGM investment thesis remains strong

Currently, ABT reports revenue of $10.24B (+0.9% QoQ) on its FQ4’23 earnings call/ +1.5% YoY) and adjusted EPS of $1.19 (+4.3% YoY / +15.5% YoY), with fiscal 2023 numbers at $40.1B (-8.1% YoY) and $4.44 (-16.8% YoY) respectively.

Much of its recent momentum has been attributed to growing demand for medical devices, particularly diabetes care, which saw sales of $1.55B in the latest quarter (+5.4% QoQ/+22% YoY), increasingly driving company revenue growth of 15.1% (a month-on-month increase of 0.7 points/a year-on-year increase of 2.6 points).

This is not surprising, as ABT’s Freestyle Libre (continuous glucose monitoring system) currently has more than 5 million users worldwide (up 25% from 4 million users in FQ4’21), 2 million of which are concentrated in the United States (up from 4 million users in FQ4’21) 21 million users increased by 100%)).

With annual recurring revenue per user of $1,000, we can understand why the market is growing excited about the company’s long-term prospects, especially since Libre is increasingly being reviewed positivelye best value option by the patient.

According to estimates by the World Health Organization (WHO) There are 422 million people with diabetes worldwide and estimates from the Centers for Disease Control and Prevention (CDC) 38.4 million people with diabetes In the US, we can understand why ABT is leading a growth year in 2024, as Libre 3 is fully “unleashed”.

With Libre’s FY2023 sales already at $5.3B (up 24% year-over-year), we agree with management’s ambitious overall FY2024 revenue guidance of 9% year-over-year growth (excluding COVID-19 testing) of approximately $41.96B , adjusted earnings per share were $4.60 (annual growth of 3.6%).

The figure represents accelerated growth in its core portfolio, driven primarily by diabetes care, compared with +4.8% CAGR in FY19 and total revenue of $31.9B in FY23 excluding COVID-19 Total revenue after that was $38.5B.

Readers must also note that ABT’s investments in U.S. pediatric nutritional products and growing pipeline/approvals in vascular, structural heart and electrophysiology have been highly successful on a sequential and year-over-year basis, further boosting its outlook.

It’s clear from these numbers that ABT is likely to shake off the normalizing effects of COVID-19 diagnostic testing, as sales fell to $1.6B in fiscal 2023 (-80.9% year-over-year).

Additionally, management has taken prudent steps to adjust operating expenses closer to pre-pandemic average levels, despite increased R&D efforts/partnerships in laboratory automation systems, medical devices, and biosimilars.

This will naturally lead to its operating profit margin expanding to 20.1% in 4Q23 (+2.7 points QoQ/+2.8 points YOY/+5.2 points from the level of 14.9% in FY2019).

Meanwhile, ABT has prioritized deleveraging its balance sheet, which as of the most recent quarter had long-term debt of $13.59B (-7.1% QoQ/ -6.4% YoY/ -18.4% from FY19 levels of $16.66B).

$2.6B maturing by 2025 is also not an issue, thanks to $7.27B in cash/investments (+3.2% QoQ/-28.5% YoY) and the strong outlook as mentioned above.

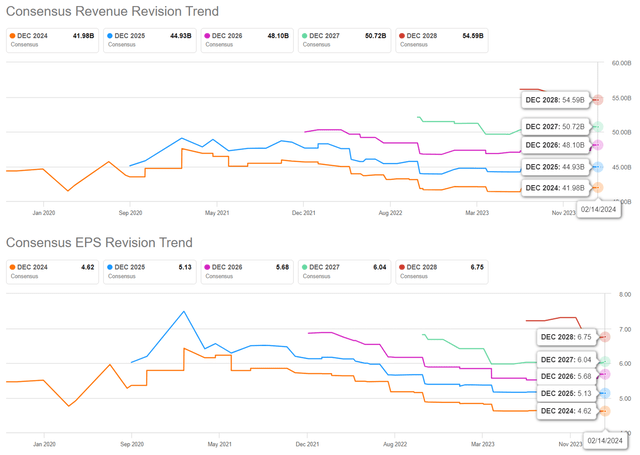

Consensus forward estimate

Seeking Alpha

Perhaps that’s why the consensus modestly increased their forward forecasts, with ABT forecasting top-line/bottom-line expansion by FY2026 at a CAGR of +6.2%/+8.6%.

This compares with the previous forecast of +5.3%/+7.7% and is close to the historical trend of +9.8%/+10.6% during FY16 and FY23 respectively.

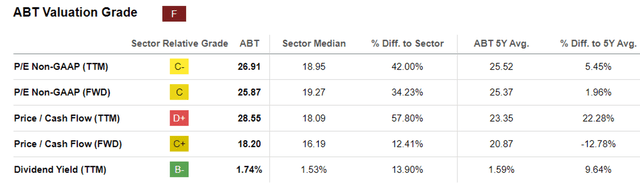

ABT Valuation

Seeking Alpha

This is why ABT’s FWD P/E valuation is 25.87 times, FWD price/cash flow is 18.20 times, while the 1-year average is 23.33 times/22.40 times, the 3-year average is 21.40 times/19.40 times, and the industry median 19.27 times/16.19 times respectively.

The premium also seems somewhat reasonable, especially compared to medical monitoring equipment peers such as Medtronic Inc. (MDT)’s 16.49x/16x and DexCom, Inc. (DXCM)’s 66.84x/41.30x, which are expected to trade at the top of the same period. / Bottom line expansion is +4.9%/+7% and +18.8%/+22% respectively.

Clearly, as diabetes drugs gain momentum, ABT’s valuations have seen a similar boost due to their complementary effects on overall patient care.

However, we would like to issue a warning here.

It is important for readers to distinguish between the obesity and diabetes market opportunities, although the two are currently inexplicably related to each other.

While obesity drugs are expected to surpass $100B in annual sales by 2023, growing at a CAGR of +59.3%, it’s uncertain how much of a spillover effect ABT’s continuous glucose monitoring devices and nutritional products might have, though Certain literature support.

Since ABT’s inherently premium valuation comes with higher expectations, readers must expect greater volatility if consensus expectations are not met and growth decelerates.

So, is ABT stock a buy?sell, or hold?

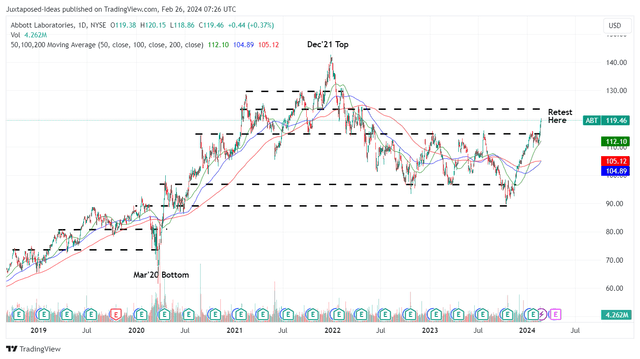

ABT 5-year stock price

trading ideas

Currently, ABT has broken above the 50-day moving average while quickly breaking through the previous resistance level of $115.

Based on fiscal 2023 adjusted EPS of $4.44 and a FWD P/E ratio of 25.87x, the stock appears to be trading in line with our fair value estimate of $114.80.

Based on consensus forecasts of $5.68 adjusted EPS in fiscal 2026, our long-term price target of $146.90 appears to have substantial upside potential of +22.9%.

At the same time, ABT’s dividend investment thesis is still good, with a TTM interest coverage ratio of 11.33 times and a TTM dividend coverage ratio of 2.11 times, while the industry medians are 7.67 times and 3.75 times respectively.

In addition, the 5-year dividend growth rate is as high as +12.39%, far exceeding the industry median of +6.31%, and the annualized dividend of US$2.20 per share has almost doubled from the 2018 level of US$1.12.

We maintain our Buy rating on ABT stock due to the (expected) twin-pronged returns through capital appreciation and dividends.

Readers may want to watch the stock move for a while before making a modest pullback to increase the margin of safety, preferably within the previous trading range between $100 and $110.