Scott Olson

generalize

Readers can find my previous reports through this link. My previous rating was Buy because I believed the headwinds for Shake Shack (NYSE: SHAK) The problems faced in 2Q23 have ended and the business is It is now on a good track to expand margins due to its margin improvement measures and lower construction costs. I reiterate my Buy rating on SHAK as Q4 2023 results prove that margin initiatives are working, which means more room for expansion, and as management ramps up marketing spend in FY24, I Same-store sales growth is expected to be in the mid-single digits.

Finance/Valuation

SHAK reported total revenue of $286.2 million for fiscal 2023, an increase of 20%, mainly driven by restaurant sales growth (annual growth of 19.9%). This resulted in a strong 26.3% increase in restaurant profits (RLP) from $43.24 million to $54.63 million.At the corporate level, adjusted earnings before interest and taxes (EBIT) grew 63% from $19.23 million to $31.41 million, meaning margins rose from $19.23 million to $31.41 million. 8.1% to 11%, an expansion of 290 basis points.

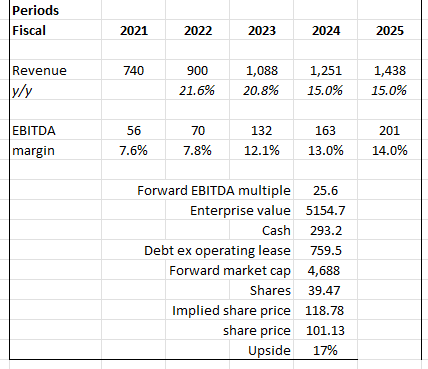

Based on the author’s own mathematical calculations

Based on my view of the business, SHAK still has attractive upside even after the share price rise. I expect the business to continue growing, at least in the mid-to-mid-digit percentage range (same-store sales growth of 5%, store unit growth of 10%). The 5% growth algorithm is described in the comments section below, and the 10% growth is based on my conservative view. Given that macroeconomic conditions in the U.S. and China remain weak, as well as the uncertainty surrounding the situation in the Middle East, I believe SHAK’s growth rate will be approximately half of its fiscal 2023 growth rate to reflect my cautious view. However, given SHAK’s performance in Q4 2023, my assumptions on margin expansion are more aggressive. I expect margins to expand 100 basis points annually, which will allow SHAK to gradually close the margin gap with other restaurant peers such as Wendy’s, Yum China, Dine Brands, Darden Restaurant, and others. As SHAK continues to prove that its margins can expand and revenue growth remains healthy in the mid-single digits (with upside potential if macro conditions recover), leading to strong EBITDA growth, I believe its stock valuation (based on forward EBITDA basis) will be maintained at this level, at a minimum.

Comment

SHAK’s solid performance saw the stock surge from about $80 pre-results to $102.82, and I believe the key to the strong share price performance is the margin expansion performance I expect. SHAK’s 4Q23 Adjusted EBITDA of $31.4 million was impressive not only because it was up 63% year over year, but also because its growth outpaced revenue growth of 43%, indicating that strong operating leverage means further margin expansion. This also shows that the margin improvement measures introduced have had a meaningful impact on RLP margins, which expanded 100 basis points to 19.8%. What’s more, SHAK has proven that its execution capabilities are still valid. Remember, margin improvement measures are not just due to price increases, but to granular efforts such as optimizing the supply chain (shipping and procurement), improving sales forecasting, and labor scheduling. All of these are structural cost improvements, which means we should see further margin expansion as SHAK scales its revenue. In fact, I think management’s fiscal 2024 RLP margin guidance of 20% to 21% is a clear message that more margin expansion is coming.

Our goal is for restaurant margin growth in the new year, and we are guiding shed-level operating margin to 20% to 21% as we focus on driving sales and delivering continued operational improvements.Source: 4Q23 Earnings

In addition to strong margin performance, underlying growth indicators also point to a positive outlook for fiscal 2024. For the quarter, SHAK’s same-store sales growth (SSSG) was 2.8%, 50% of which was driven by customer traffic (1.4%).It is worth noting that transportation accelerated The full quarter, which goes through February 2024; so that indicates a strong start to fiscal 2024. I believe full-year traffic is likely to improve as SHAK will increase marketing spend in fiscal 2024. For reference, SHAK spends only 1% of its sales on marketing, which means it has been underinvesting in marketing for some time, but same-store sales growth (SSSG) is still at a 2-year low. The final part of the SSSG equation is pricing. Pricing growth contribution in FY24 will also be positive, with management clearly guiding for 2.5%. So, all things considered and assuming no negative impact on the product mix, SHAK SSSG growth should be at least in the MSD (mid-single digit) percentage range, with the potential for an upside surprise.My imagination of the same-store sales growth formula is as follows: Q4 23: 1.4% traffic growth contribution as base + upward impact from increased marketing spending (assuming 1% revenue) + 2.5% pricing growth = ~5% Same store sales growth

The other part of the growth equation, store growth, is the worrying part. Based on management’s commentary, current developments are more focused on 2H24 than previously expected due to developments in the Middle East (ongoing conflict) and China (soft consumer spending environment), which poses potential risks to management’s growth objectives. Longer term, management still targets 40 corporate and authorized stores per region for FY24, but they expect more than 80% of authorized stores to open in 2H24 and about half in Q4 FY24 Open for business. Keep in mind that 40% of licensed units are located in the Middle East and China, making these regions very important to SHAK’s growth and management goals. Given the uncertainty in both regions, I’m concerned that SHAK may not be able to hit that target, and depending on the extent of the miss, it could overwhelm the entire margin expansion and same-store sales growth narrative, putting a lot of pressure on stock sentiment , especially after the stock price rose strongly, reflecting investors’ greater optimism and expectations.

in conclusion

I reiterate my Buy rating on SHAK as the company demonstrated successful margin improvement initiatives, evident in its impressive 4Q23 results. Adjusted EBITDA grew strongly by 63%, exceeding revenue growth by 43%, marking the effective implementation of operational improvements and structural cost optimization. SHAK’s focus on fine-grained work such as supply chain optimization and labor scheduling highlights its commitment to sustainable profit expansion. Management’s guidance for FY24 RLP margins of 20-21% also supports my view of further margin expansion going forward. While the surge in stock prices reflects optimism, I believe SHAK stock still has room to rise.