photography link

After ringing the bell on Wednesday, we received Fourth quarter results From AMC Entertainment (NYSE:AMC).While the overall numbers remain consistent and company CEOs talk about a lot of progress, the financial picture here remains grim. most. The stock price is likely to continue lower until the company significantly reduces its debt again and its theater business begins to improve significantly.

I last reported on this name in November, just after the company released its third-quarter report. Although overall results initially looked good thanks to several summer blockbusters, the stock price fell when management announced its latest stock offering. I warned investors that things would only get worse, and AMC shares have fallen more than 40% since then, while U.S. markets have risen to new highs almost every week.

AMC announces fourth-quarter revenue exceeds $1.1 Billion. This number is about $50 million higher than the market, but I should point out that the company has only missed twice in the past 5 years. Adjusted loss per share was 54 cents per share, up 11 cents from the same period last year, and the company hasn’t posted a loss since the last quarter of 2020. Of course, we have to realize that the diluted share count more than doubled year-over-year, which helped spread the huge losses across more shares. The company reported an adjusted loss of nearly $319 million in 2023, despite annual revenue increasing by more than $900 million annually to more than $4.8 billion.

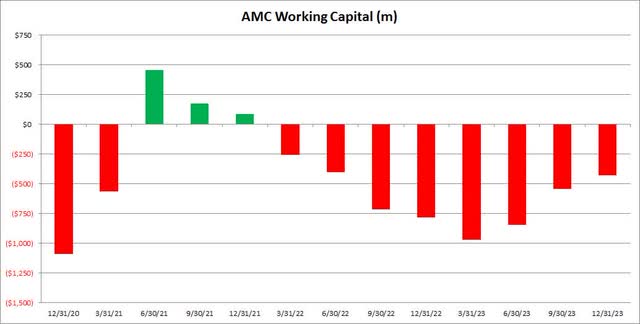

AMC’s main problem is that the pandemic has crippled its theater business. Things haven’t recovered as quickly as hoped thanks to the rise of streaming services, which have given consumers more access to content outside of theaters. AMC could only survive by paying down a lot of debt and selling a lot of stock, while huge losses and cash burn continued. In the fourth quarter, the company burned through approximately $150 million in cash, although its actual cash balance increased from the previous quarter due to the financing mentioned above. In the short term, the balance sheet is still under certain pressure, as shown in the chart below, and working capital is still suffering significant losses.

AMC working capital (Company profit report)

The company’s CEO declared in its earnings report that it had nearly $900 million in cash reserves at the end of 2023, a sign of strength. However, negative working capital means you have more liabilities due within the next 12 months than you have current assets. AMC has also burned US$440 million this year, and the domestic box office will also reach a very slow start due to a writers strike and a weak film lineup in the first season.

In addition to its poor working capital position, AMC has more than $4.55 billion in long-term debt on its balance sheet as of 2023. Nearly two-thirds of this is due to mature in 2026, and there is currently no clear path to the ability to repay the debt. Refinancing is certainly an option, but a likely strategy is continued equity financing. AMC’s prior use of preferred shares (“APE”) helped to some extent, but the APE to AMC conversion was a key reason why Class A shares outstanding increased from approximately 52 million to 260 million last year. Before the pandemic, the Class A population was only about 5 million (adjusted for reverse allocation).

AMC trades like a distressed asset in terms of valuation. The stock was trading at 0.27 times expected 2024 revenue when it reported Wednesday, while rival Cinemark (CNK) traded at 0.87 times. Currently, Cinemark also has some debt, but it also has positive working capital, profits, and positive free cash flow. AMC analysts believe the stock is worth $6.22 in this week’s report, but the average price target continues to trend lower on a quarter-to-quarter basis.

With another quarter of cash burn on the books and a working capital deficit of over $429 million, I continue to rate AMC stock a Sell today. I expect at least one more significant stake sale plan in the next few quarters, each becoming more dilutive as the stock price approaches all-time lows. I can’t consider a Hold rating until the company significantly reduces its debt and shows it can generate positive cash flow. Ultimately, AMC’s fourth-quarter results showed that the company’s financials remain deeply troubled, and we could easily see new lows and perhaps another reverse split before everything finally gets back on solid footing.