sweet bread factory

You might think that with all the hype surrounding artificial intelligence, semi-finished stocks would generally do well. That is, of course, until you dig a little deeper and realize that this narrative is largely driven by one stock (Nvidia, my favorite!). Semiconductor stocks other than Nvidia (NVDA) really haven’t done that much since 2021, but maybe there will be a rotation that favors them more broadly.If this is the case, then SPDR S&P Semiconductor ETF (NYSE:XSD) is a way of playing.

XSD is an investment fund designed to replicate the performance of the S&P Semiconductor Select Industry Index. The index represents the semiconductor portion of the S&P Total Market Index (S&P TMI) and tracks the U.S. stock market. The Semiconductor segment consists of companies that manufacture semiconductors, key components of many modern electronic devices.This index is an equal-weighted index that includes large, mid- and small-cap stocks from the semiconductor sub-sector.

Main features

XSD has several key functions:

-

Participate in the semiconductor sector of S&P TMI: The fund invests in market segments that include companies involved in the design, distribution, manufacturing and sales of semiconductors.

-

Tracking the modified equal-weighted index: The fund seeks to track an index that offers the potential for deconcentrated industry exposure to large, mid- and small-cap stocks.

-

strategic or tactical stance: This fund allows investors to take a more targeted strategic or tactical position than traditional industry-based investing.

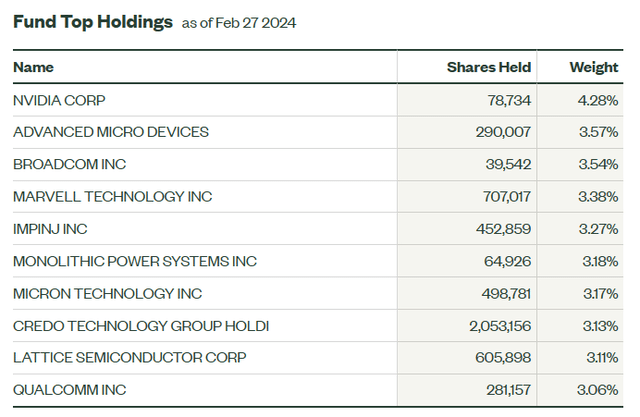

ETF holdings

The SPDR S&P Semiconductor ETF consists of a diverse group of companies from the semiconductor industry. Nvidia does top the list with 4.28%, which makes its allocation in the fund smaller than what you’d see in the cap-weighted “diversified” S&P 500 Index. This makes sense given that the index is equally weighted. Other stocks include familiar names like Advanced Micro Devices, Broadcom and Marvell.

ssga.com

Industry composition and weight

It’s no surprise, but XSD is heavily concentrated in the technology sector, with semiconductors representing all of its holdings. One big thing to keep in mind (and this is why I keep citing it) is that the fund uses an equal-weighted strategy that avoids concentration in any single security and provides unconcentrated industry exposure to large, mid, and small cap stocks Potential stocks.

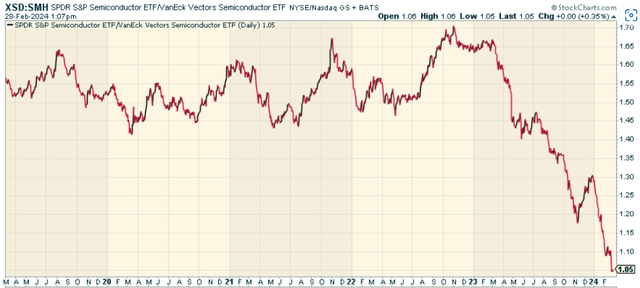

Peer comparison

Compared to other similar ETFs, XSD stands out for its equal-weight strategy and focus on the S&P TMI Semiconductor sector. That’s why the fund has lagged funds like the VanEck Semiconductor ETF (SMH). SMH’s largest shareholding is Nvidia, with a 25% shareholding. When we look at the price ratio of XSD versus SMH, it’s no surprise that this alone is why SMH performs so well.

stockcharts.com

You could say this is a feature of SMH rather than a bug. But at some point, you may want to avoid Nvidia’s concentration risks, which is why XSD is worth considering as an alternative now.

pros and cons

As with any investment, investing in XSD has its own advantages and potential disadvantages.

advantage

-

diversification: By investing in numerous companies within the semiconductor industry, the fund provides diversification, which helps reduce risk.

-

Enter a growing industry: The semiconductor industry is a key component of the technology industry and has been experiencing significant growth in recent years.

-

passive management: The fund is passively managed, meaning it seeks to replicate the performance of the index rather than actively selecting securities. This can reduce management fees.

shortcoming

-

Industry specific risks: Because this fund focuses on a single industry, it may be more volatile than more diversified funds.

-

market risk: The Fund’s investments will be affected by changes in economic conditions and market fluctuations.

in conclusion

Investing in the SPDR S&P Semiconductor ETF can provide investors with diversified exposure to key areas of the technology industry. However, as with any investment, it is important to consider the potential returns and risks involved. If you want to avoid the heavy concentration on Nvidia after such a strong performance, but still like the semifinals, this is the fund for you.

Markets are not as efficient as conventional wisdom suggests. There are often gaps between market signals and investor reactions, which help indicate whether we are in a “risk-on” or “risk-off” environment.

this Lead-lag reporting Gives you an edge in reading the market so you can make asset allocation decisions based on award-winning research. I’ll give you the signal – it’s up to you to decide whether to go on the offensive (i.e., increase exposure to risky assets such as stocks when the risk is “present”) or play defensive (i.e., lean toward more conservative assets, e.g., when the risk As bonds/cash at “closing”).