Mario Tama/Getty Images News

Since their inception, Fast Retailing Group’s ( OTCPK:FRCOY ) mainline Uniqlo and off-price sister brand GU have opened stores at an impressive pace, building on the mass appeal of their “basic” clothing lines.company’s Latest financial report for the first quarter of 2024 This is another positive chapter in the story, as top-line challenges in Japan’s core business are offset by international growth. Couple that with solid cost control efforts, and you’ll once again get bottom-line results that far exceed Wall Street expectations. In the short term, monthly data shows that Uniqlo Japan’s sales will continue to face challenges, so more beats and markups still depend on costs and the speed of Uniqlo International’s store expansion.

Fundamentally, there’s nothing to fault here.In the small world of global fashion compounders, this may be the only one With its mass appeal, it has the largest potential market opportunity. So while Fast Retailing Group does not generate the highest ROE compared to major global peer Inditex (although still very respectable in the high teens as a percentage) (OTCPK:IDEXF), it makes up for this with a longer runway in high-growth Asian markets.Not surprisingly, the stock scores quite high on growth and profitability (according to SeekingAlpha’s Quantitative Ratings).

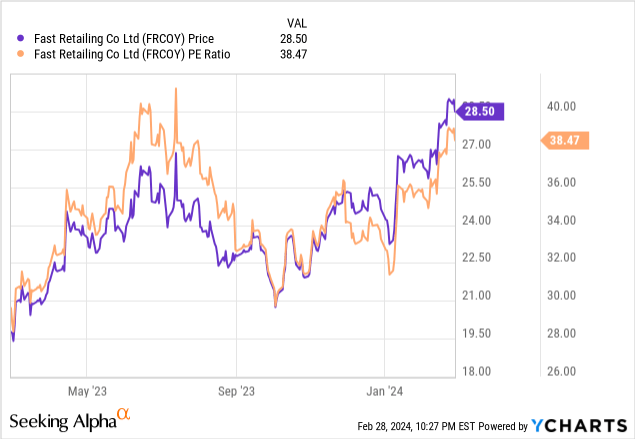

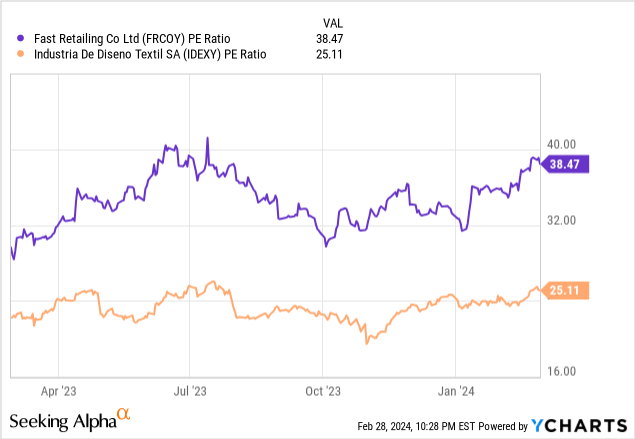

Still, as I’ve highlighted in previous coverage, the biggest risk is that investment costs are too high, and that’s especially true here. Fast Retailing is now trading at nearly 40 times earnings after shares fell more than earnings due to the re-rating, a far cry from the company’s previous track record of low 1% earnings growth, which also earned the stock an “F” Key Reasons SA Assessment Scorecard Rating. As Japan also prepares to move away from ultra-loose monetary policy, Maybe as soon as April, high-priced stocks like Fast Retailing are likely to be attacked first. I will wait and see until there is a meaningful pullback.

Profitability is strong across the board

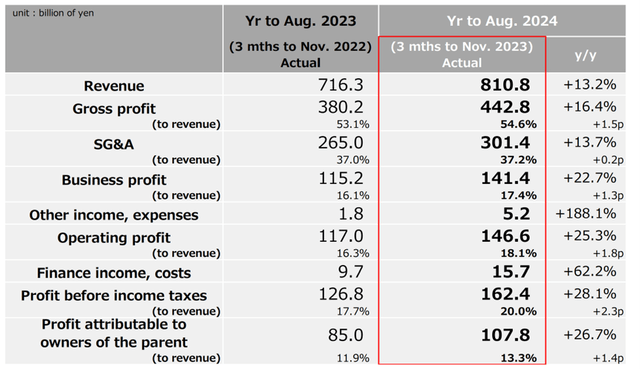

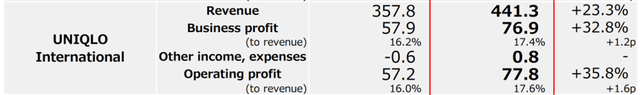

Fast Retailing Group’s first-quarter results were much better than expected, defying concerns about rising inflation/slowing growth. To recap, overall growth in operating profit and profit attributable to shareholders increased 23% and 27% respectively year-over-year, exceeding Wall Street expectations. As expected, Uniqlo International is the revenue growth engine; however, this time, not only the higher-growth Asian markets, but also Western markets also contributed. Regardless, Uniqlo’s ability to grow amid a challenging international backdrop bodes well for its near-term prospects.

Fast Retailing

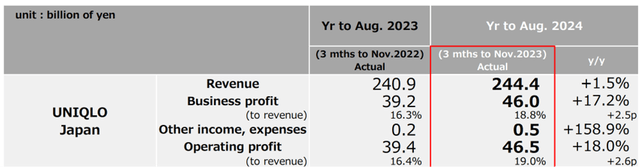

Perhaps even more impressively, Uniqlo Japan found enough profit leverage to achieve equally impressive high-double-digit business profit growth. Cost control is key – better order management can help insulate profits from spot USD/JPY fluctuations. Gains from other measures, such as merchandise development and SG&A cost discipline, also helped and should be sustained in the coming quarters. Uniqlo Japan’s gross profit margin fluctuated about 270 basis points year-over-year to 52.2%, which is still a very solid result, although favorable base effects also helped (mainly due to large currency fluctuations in the first quarter of fiscal 2023).

Fast Retailing

Keep moving forward Japan

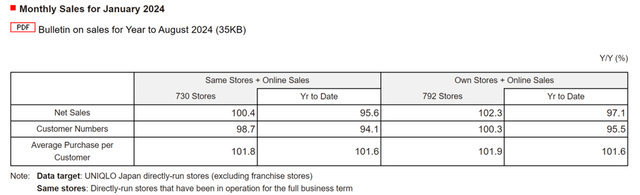

Heading into the fiscal second quarter, expect another round of consistent earnings revisions — not just evidence of more growth for Uniqlo International, but also the resilience of Uniqlo Japan, which increasingly prioritizes margins Due to the slowdown in revenue. That is to say, monthly sales report Things weren’t too bad for Uniqlo Japan, with same-store and online sales up slightly year-on-year (year-on-year spending up 1.8%; traffic down 1.3%) despite warmer-than-usual weather in December/January. In comparison, Japanese retailer Ryohin Keikaku’s ( OTCPK:RYKKF ) apparel business has been hit much harder (Sales fell about 10% in January), a situation exacerbated by inventory shortages. If possible, the profit margin growth achieved by Uniqlo Japan in the first fiscal quarter will also be extended to the second fiscal quarter, and I do not rule out high double-digit profit growth again.

Fast Retailing

Maintaining international momentum as a growth engine

Although Uniqlo Japan’s performance may have a certain degree of impact, the future profit path depends largely on the growth of Uniqlo International. Although the company’s main overseas growth market, China, has not rebounded as quickly as expected after the epidemic, growth remains strong. The key here is Uniqlo International’s diverse footprint, which allows it to capitalize on revenue momentum in Southeast Asia and, more surprisingly, make up for it in Western markets. So even if we see sales in China growing at a slower pace than before the COVID-19 outbreak, I’m not too worried about the long-term pace of Uniqlo’s international net store openings. As for the existing store base, there’s plenty of room for same-store sales to continue on its growth path, especially if management extends its recent success in product value into the future. All in all, 30-40% segment earnings growth (in line with fiscal Q1) is entirely achievable.

Fast Retailing

Of course, yen movements and their impact on earnings will also weigh on international income statements in the near future, as Fast Retailing’s growing overseas contribution means it has been a net beneficiary of a weaker yen (at the expense of its domestic business ). So far, the Bank of Japan has chosen a very gradual path to normalizing monetary policy even as inflation continues to rise, so I don’t expect this profit tailwind to meaningfully reverse anytime soon.

Japan’s top fashion laminating machine is priced to perfection

Fast Retailing Group’s differentiated focus on “basics” and its long growth runway (with its higher-growing end markets) make it stand out in the global fashion industry. Its long-term record of profitability is significantly higher than its cost of equity, which is also reflected in its higher fundamental score on the SeekingAlpha Quantitative Scorecard. After a strong fiscal first quarter, the company is expected to have another very solid year of earnings growth (hence its “A-” Momentum Rating), driven by contributions from Uniqlo International and the resilience of the Japanese market.

As usual, the issue here is premium valuation (an “F” rating according to SeekingAlpha Quant). After all, this is a stock currently trading at nearly 40x (Thirteen circles Higher than the world’s major peers Inditex! ), the profit base grows at a lower percentage. While I don’t deny that this is a “compound” stock that can grow to its multiples over a long enough period of time, it’s best to err on the side of caution for now.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.