David Bayliss

Penn Entertainment (NASDAQ ticker: Penn) took another hit after the company’s fourth-quarter earnings fell short of expectations. It’s another disappointment for long-suffering stock investors – with cash flow from the company’s profitable casino assets once again crushed. Losses in speculative ventures and acquisitions. PENN made a big bet on ESPN BET, and while the company had a lot of downloads and betting activity, their profits didn’t meet expectations and the app’s rollout in the states was difficult. Payne has a problem. What’s important to us is that these issues are largely priced into the stock. The million dollar question is, are investors adequately compensated for the risk of investing in PENN at current prices? I think so, but let’s see why.

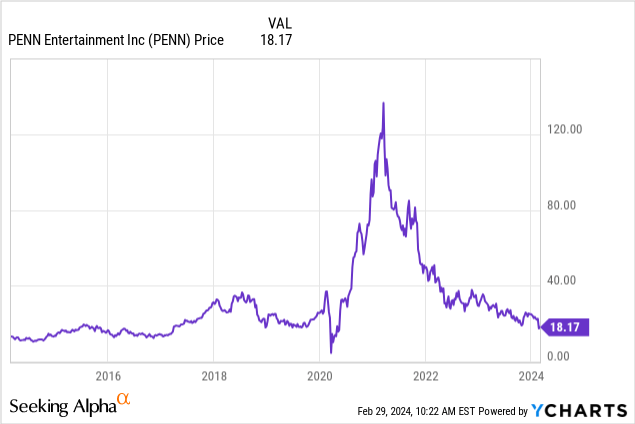

They say a picture is worth a thousand words, I found this This is even more true when looking at long-term stock charts. In the 2010s, PENN was a regional casino company with a relatively low valuation. They then decided to get into the sports betting business and eventually partnered with Dave Portnoy/Barstool Sports, which resulted in a massive increase in the stock price, driven primarily by retail traders. Now, PENN’s valuation is back to that of a regional casino company, but it’s important to note that boom-era investors were stuck with huge amounts of money, and many of them just wanted to sell the stock.

ESPN BET UPDATE: Can PENN take advantage of legal sports betting?

- Loki launches. Things are looking up for PENN in August when it announced a partnership with ESPN to create a new sports betting app called ESPN BET. I thought PENN stock was a great value at $25 at the time, with the potential to return 5x or more over the next five years. Still, the process of getting the app online state by state has been difficult. I was frustrated with the pacing.Setbacks such as Connecticut (ESPN’s home state) winning its betting license Fanatics Sportsbook and DraftKings Inc. (DKNG) and FanDuel locked up tribal licenses, meaning Connecticut’s roughly 3.6 million wealthy residents no longer participate in PENN.payne did get a license For New York (population about 19.6 million people), this is a necessary step. New York can bargain and take 51% of the revenue from sports betting operators. They are also opening in North Carolina (population approximately 10.6 million). But I’m disappointed that they didn’t push harder to get into states like Maine or Vermont.Canada is another big market that PENN is in, but they don’t seem to be monetizing it very well, even though they have paid Score Media $2 billion.Dave Portnoy news also broke last month Now working with DraftKings again. If true, he got a lot out of the non-compete, which makes Payne look bad.

- Trouble in the National Football League. Another underappreciated aspect of ESPN BET’s performance is the second half of the NFL season and the progress of the NFL playoffs. Sportsbook managers in Vegas, offshore and on big apps have repeatedly made decisions to allow massive lopsided bets on popular teams rather than changing the odds. This usually works in favor of the book, but not this year. For example, I know a sportsbook manager who had a huge imbalance in his opinion of the Chiefs in the Super Bowl. The odds for San Francisco in the computer model are around -3, which means San Francisco has about a 60% chance of winning the game. They changed course on Chiefs, charging customers double commission, but they still flocked to Chiefs. San Francisco probably should have won this game, but a bad call in overtime cost them the game and sportsbooks from coast to coast had to pay out hundreds of millions of dollars to bettors whose thought process was “Tra Viskels is the man and no one can stop him. To add insult to injury, key pillar bets surrounding the Chiefs and Taylor Swift have taken a hit, eroding profit margins. With March Madness upon us, my guess is that a lot of the money customers are making on the NFL is finally will all go back in the pocket of the book. College basketball is also interesting from this perspective, as the books often shade popular teams and the public bets heavily on them anyway. From In the long run, this doesn’t work out well for people placing bets.

- The current sports betting market is not a zero-sum game. If large states like Texas and California (see the excitement Considering Texas billionaire and former Dallas Mavericks owner Mark Cuban’s ambitions to legalize sports betting and PENN taking market share, it’s not hard to make the case that ESPN BET could become a multi-billion dollar business. The business assumptions are reasonable. There’s a lot that could go wrong for PENN, but at the current share price, there’s also a lot that can go right. For example, Gambling stocks are top performers Over time, the Australian market. Ireland-based Flutter Entertainment plc (FLUT) has returned investors about 16 times since going public in 2009. Flutter is the parent company of FanDuel. If PENN can get out of its own jam, there’s huge long-term potential here.

How much is Payne worth?

I find PENN interesting because it is once again valued like a regional casino company. The market has inherently given a negative thumbs up to sports betting operations. But when you look at the balance sheet and income statement, the situation doesn’t look so dire. For example, PENN’s book value is $21.48 per share – the stock is currently trading on the books. PENN passes all the classic liquidity tests (current assets > current liabilities, assets > liabilities, etc.). The company has a relatively heavy debt load, raising the costs of potential mismanagement.S&P Global Place PENN on negative credit rating watch following the recent earnings report. However, the casino portfolio’s underlying operating cash flow remains. If sports betting works for them, that creates a wealth of options. However, it may not need to go this far.

Activists are agitating for change. New York hedge fund HG Vora Is seeking a board seat and has approx. Accounting for 18.5% of the company’s shares. HG Walla charged PENN limits the number of board seats and strips away shareholder rights. Here’s an interesting angle – there’s EBITDA, but the company’s big investors don’t like management. This may play out in one of several ways. A proxy fight could arise as HG Vora seeks to replace the company’s management. They own about 18.5% of the financial interest in the company, so they usually only need to win over a minority of the remaining shareholders. Vora could even buy more shares if PENN’s stock price falls. Additionally, due to its smaller size, private equity can easily acquire and recapitalize PENN, freeing up operating cash flow that is tied up in the company’s debt load.

If the reason for PENN’s pessimism is that the company is profitable but has terrible management, then those same factors should make the company attractive to activists and private equity firms. I don’t know for what purpose they would buy PENN, but analyst earnings forecasts suggest PENN should be close to breakeven this year and profitable next year, and I would expect any acquisition to come at a pretty hefty premium. The current price is probably more than $30.

bottom line

With PENN trading below book value and under pressure from activists, there are ways for investors to win small amounts of PENN stock. If the trajectory of U.S. sports betting stocks over time follows the success of markets like Ireland and Australia, they too have the means to win big. PENN is very cheap, and the company’s massive debt load could cause a lot of problems, but there’s also a lot going on for them. I don’t see the need to double down here, but I still believe PENN stock is a buy for the reasons mentioned above.