Douglas Rising/iStock via Getty Images

A client asked me to investigate some ETFs that he had heard were invested by members of Congress who were able to invest with inside information related to legislation.

After studying this issue, This is what I wrote to him:

You asked about ETFs that track investments by members of Congress. Because they are not subject to the same insider trading rules you and I have, some members of Congress are able to accumulate large stock market gains by predicting the market impact of legislation passed by Congress.

That’s the hook for considering these funds, but it falls flat when you read the investment strategy in the prospectus.

This is an interesting idea and may be a way to create Alpha, but the actual approach used by this strategy does There is no investment selectivity of any kind involved and no reason to expect alpha. In fact, the results do not prove that alpha is outside the range that randomness could produce.

ETFs tracking lawmakers’ investments include:

- Disruptive Abnormal Whale Democracy ETF (Bat: NANC)

- Established 02/07/23

- AUM USD 30 million

- Fee 0.75%

- Disruptive Unusual Whale Republican ETF (Bat: Cross)

- Established 02/07/23

- AUM USD 9 million

- Fee 0.75%

Advised by Subversive Capital Advisor LLC.

Both ETFs use data providers unusual whale Actively track stocks held by members of Congress.

The strategy follows Unusual Whales’ report of a past 3-year buying review of stocks currently held by 535 members of Congress. That’s it.

It actually assumes the collective wisdom of 535 people with diverse backgrounds and investing abilities who selected their own portfolios themselves (rather than relying on others), and in doing so provides particular insight into the impact of the legislation on 400 business growth and possible impact on profits. These ETFs hold 700 stocks.

The fact that these funds hold between 400 and 700 stocks suggests that the strategy is a fantasy. Of course, there aren’t that many little-known special circumstances affected by the pending legislation, and most members of Congress understand it in stock market terms.

The ETF is technically active, but in reality all they do is replicate a list of unusual whales. For this 0.75%, this is an unreasonably high fee. Their fund size is small and at that size they can even lose 0.75%, but that’s their problem, not ours. They need to subsidize their funds until they reach scale.

The method and concept lack credibility in terms of logical basis and actual results.

My conclusion is that the sponsor was simply pursuing a compelling marketing idea but completely failed to implement the idea effectively to reap the implied benefits.

Below is a selection of information from the Universal Whales report, which is the sole basis for the investment approach in these ETFs.

Unusual Whale Conference 2023 Trading Report

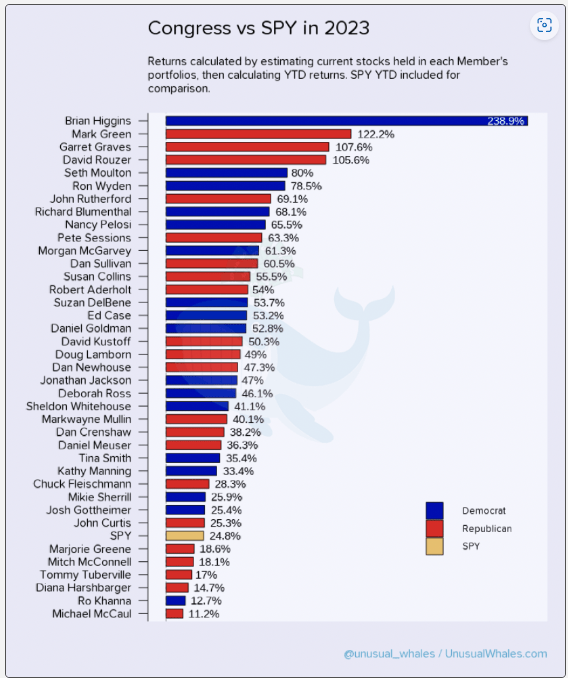

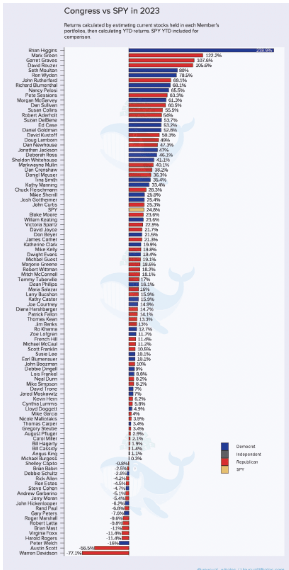

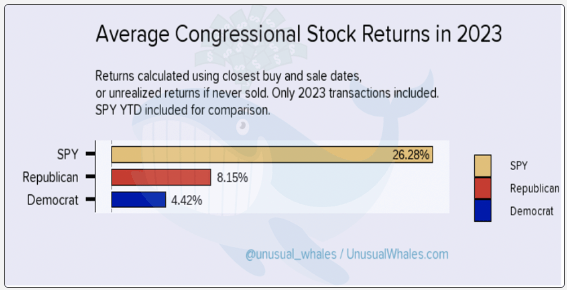

“It’s no surprise that Congress’s portfolio has beaten the S&P 500 with a 25% return year to date. Please check the warning at the end of the report… Over time, not all members may have properly disclosed their trades or portfolios. We rely on delayed and sometimes inaccurate static data to build their portfolios.”

unusual whale unusual whale unusual whale unusual whale unusual whale unusual whale

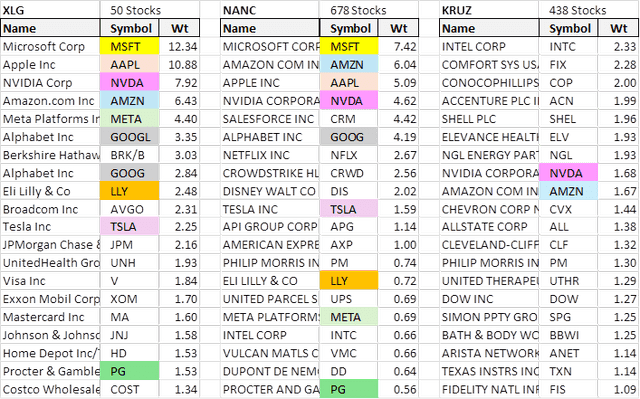

These funds each hold approximately 400 to 700 stocks. The ETF holds all stocks (excluding the minimum amount) owned by all members of the party and their families (Democrats from NANC and Republicans from KRUZ), which were purchased as early as 3 years ago.

This is where it fails. It would be foolish on its face to assume that dollar-weighted stocks with a 3-year lookback held by all members of a political party and their families represent exceptional high-level insight into the future performance of 400 to 700 stocks.

ETF staff does not perform any form of filtering or selection. They simply subscribe to a service that reports politicians’ holdings to the government, and then buy those shares in proportion to the total holdings of party members that the ETF focuses on.

It might be interesting if the headline strategy also included filters on who holds the stock, when the stock was purchased, how their involvement in legislation hinted at possible insider information, and digging into each stock’s story to try to determine the members’ reasons. Congress or his family bought it. But it is basically absurd to assume that all shares held by all members of a political party reveal some inside knowledge.

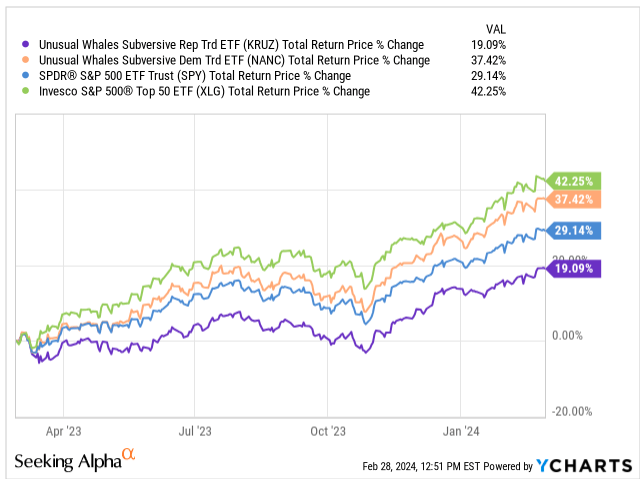

Holding just the top 50 stocks in the S&P 500 (XLG), they did not outperform the S&P 500 (XLG), while only one of the two stocks outperformed the S&P 500 (SPY).

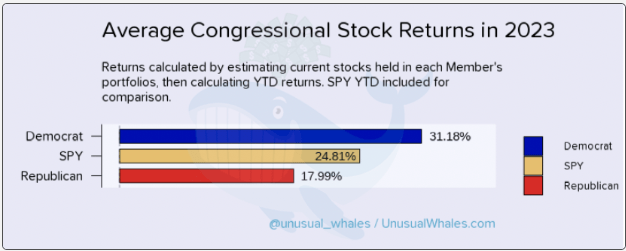

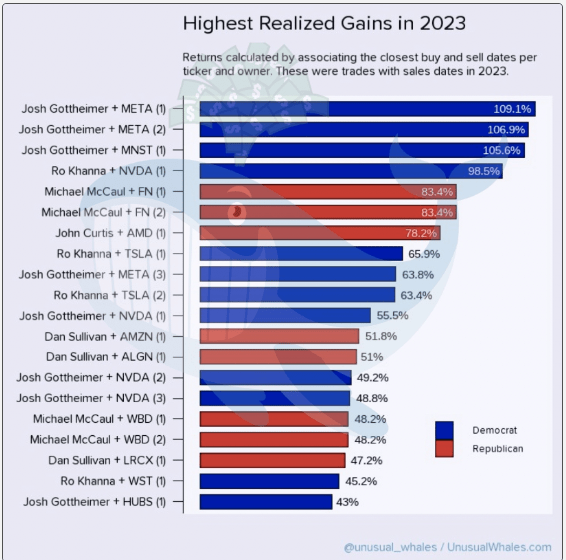

The fact that Congress as a whole has outperformed the S&P 500 could easily be dismissed as luck. Some members performed quite well (as you’d expect in any large group), and set the rest of Congress up for better returns than the S&P 500 in 2023.

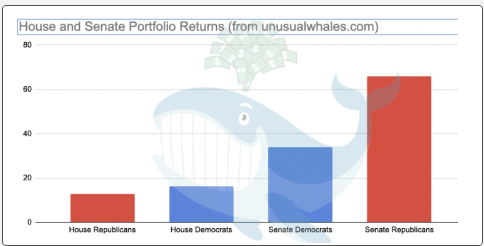

There is no backtesting of the ideas presented to demonstrate that the approach is reasonably consistent or balanced over time. Returns vary widely across members of Congress as well as between parties and institutions, contradicting the idea that special internal knowledge drives investment. In fact, these portfolios look ordinary.

Here’s how two ETFs compare to the S&P 500 and the top 50 S&P 500 indexes. The top 50 index beats all index funds (at least the Magnificent 7 effect). The S&P 500 beat one of these two ETFs.

Y chart

Here’s a comparison of the top 20 holdings in the two ETFs and XLG (top 50 in the S&P 500). Democrats outperformed the S&P 500 because their portfolios were tilted toward the top 50, but they did not beat the top 50. Republicans underperformed due to lower portfolio allocations to the top 50:

QVM Group

Stay away from these ETFs. There is no reason to expect them to add value other than by chance.