Violka08/iStock via Getty Images

Bitcoin (BTC-USD) is back above $60,000. Roughly seven weeks after the US spot ETF was approved, the token has posted six months of gains, with returns ranging from low to high of 157% since September 2023. With Bitcoin rising like this, stock market investors often look for stock-based ideas that will benefit from such moves.

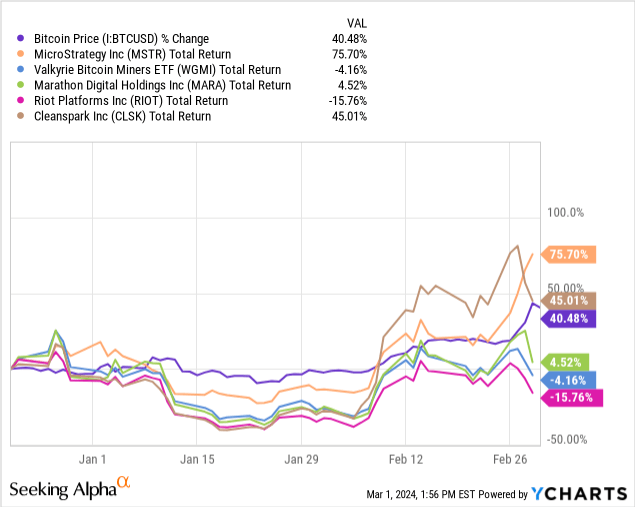

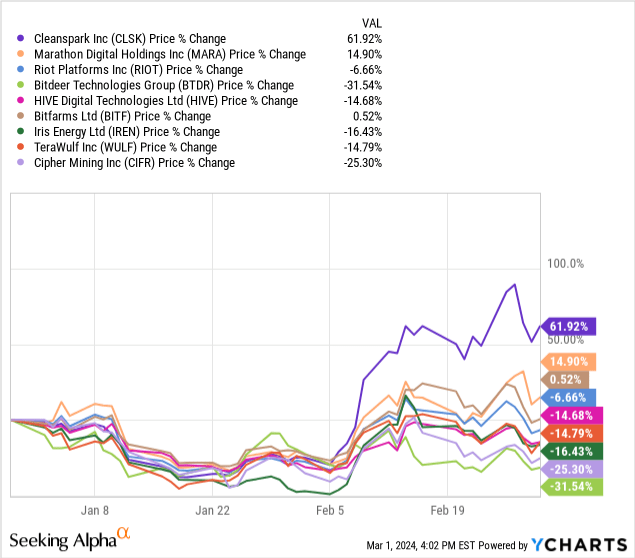

Late last year, I called MicroStrategy (MSTR) a “Strong Buy” and made it my entry into Seeking Alpha’s top long-term idea for 2024. Since that article, MSTR is up 76% and has no problem outperforming Bitcoin’s equally impressive 40% return. Many of you who have followed my work on this site over the past few years no doubt know that I have also been bullish on a number of Bitcoin mining stocks. Since MSTR article, clean spark (CLSK) is the only one of the top 3 miners by market capitalization that still beats BTC — although that advantage has fallen back quite a bit since February 27.

While I’m still definitely long CLSK personally, I did recently downgrade the stock to “Hold” from “Buy.” In this article, I will outline why I think the Valkyrie Bitcoin Miner ETF (Nasdaq: WGMIDespite the resurgence of Bitcoin and many miners, Bitcoin is still holding.

Fund objectives and details

Unlike the recently approved spot Bitcoin ETFs or the futures ETFs that have been on the market for years, the Valkyrie Bitcoin Miner ETF does not have direct exposure to BTC or BTC derivatives such as futures contracts. Instead, the fund focuses entirely on total returns from the miners and hardware providers that power the network of computers that give Bitcoin its value. from WGMI Prospectus summary:

The Fund is an actively managed exchange-traded fund (“ETF”) that invests at least 80% of its net assets (plus borrowings for investment purposes) in the following securities: Companies that derive at least 50% of their revenue or profits from Bitcoin mining operations and/or provide specialized chips, hardware and software or provide other services to companies engaged in Bitcoin mining.

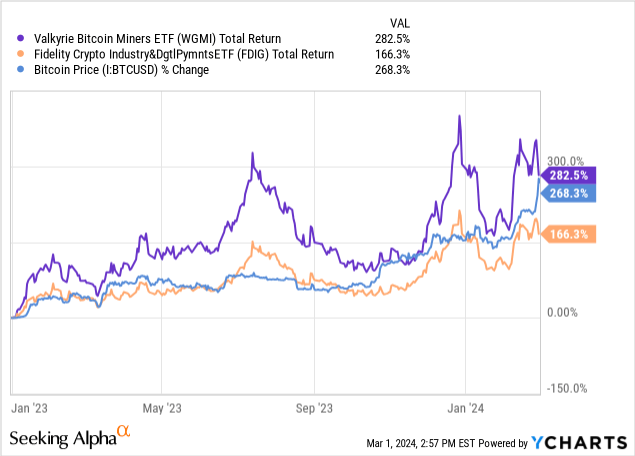

The boldface in the quote above is my own emphasis, and we will explore this idea further later. But as a thematic fund, WGMI seems to be the closest thing to a pure Bitcoin mining ETF I’ve ever seen. For comparison, I’ll use the Fidelity Crypto Industry & Digital Payments ETF (FDIG) as the primary peer, based on AUM and the fact that 8 of the fund’s top 10 holdings are Bitcoin miners.

| wGMI | FDIG | |

|---|---|---|

| AUM | $111.32 million | $96.29 million |

| yield | 0.32% | 0.18% |

| expense ratio | 0.75% | 0.39% |

| top 10% | 84.11% | 71.35% |

| Position | twenty three | 44 |

| turnover | 74% | 55% |

Source: Seeking Alpha

From the table above we can see that WGMI has a higher turnover rate and the positions are about half that of FDIG. The fund pays a slightly higher yield, but that yield is largely offset by a higher expense ratio. If we use the beginning of 2023 as a starting point, we can see which funds have performed better since miners generally bottomed out at the end of 2022:

The returns for WGMI have been explosive, to say the least. With total returns of over 300% at times since the end of 2022, there is no doubt that WGMI has outperformed FDIG by a significant margin at times, and even outperformed Bitcoin at times. As the saying goes, past performance is no indicator of future rewards. Before we go any further, I think it’s important to discuss the core issues surrounding Bitcoin mining as a fundamental business model.

mining industry

For those of you who have been following my work for a while, please excuse me as this entire section is essentially a review for many of you. That being said, Bitcoin’s recapture of $60,000 has brought renewed enthusiasm to investors and speculators who may be less familiar with the supply and demand mechanics of Bitcoin’s halving cycle. In order to be more thorough for people entering the game today, I think it’s important to clarify how the Bitcoin network incentivizes transaction verification.

In part, Bitcoin’s value comes from the idea that it is the native unit of a decentralized and distributed digital ledger. The ledger is protected by a network of computers, or “miners,” that verify transactions between users on the decentralized ledger. While it is known that the fixed supply of BTC currency is 21 million coins, the circulating supply of this cap is approximately 19.6 million coins. The remaining 1.4 million BTC that have not yet been circulated will be rewarded to miners through currency issuance when new blocks are created on the chain.

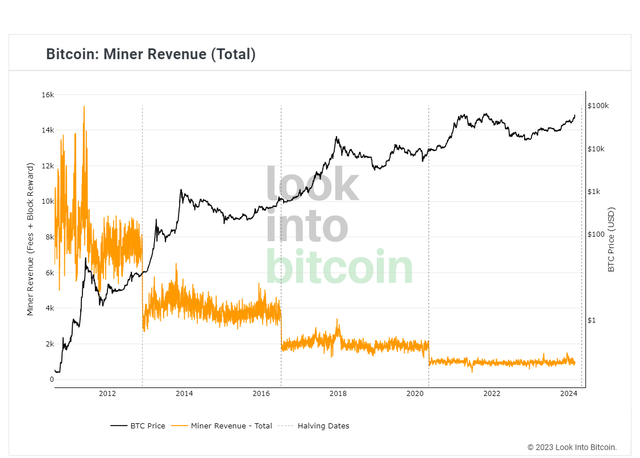

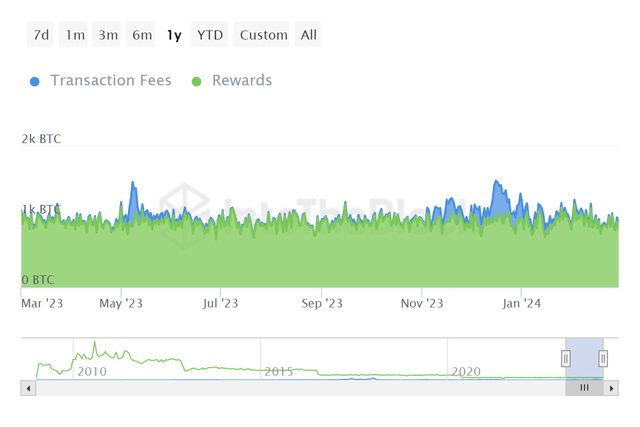

miner income (Learn more about Bitcoin)

Every four years, the number of Bitcoins awarded to miners through these blocks is cut in half. This is called the “halving cycle” or “halving.” As of article submission, the latest halving is less than two months away. This means that, all things being equal, miner revenue in Bitcoin terms will be cut in half by the end of April. In the past, as fewer Bitcoins were mineable and supply tightened, the market repriced Bitcoin higher, thus alleviating the shortage of Bitcoin-denominated rewards. However, when the mania for Bitcoin subsides, the price falls back, and miner revenue in U.S. dollars declines with it.

Miner income details (Enter the block)

Another thing to consider is that transaction fees could theoretically become a more meaningful part of miners’ revenue in the long run. Bitcoin’s transaction throughput per second is notoriously low, and during periods of higher network usage, transaction fees can spike to $20-30 per transaction, which we witnessed over the course of about three months last year. situation. While this may undermine Bitcoin’s ability to serve small dollar transactions at the network’s base layer, high fees are actually a very good thing for miners because in addition to new coin issuance, it also provides to supplement income streams.

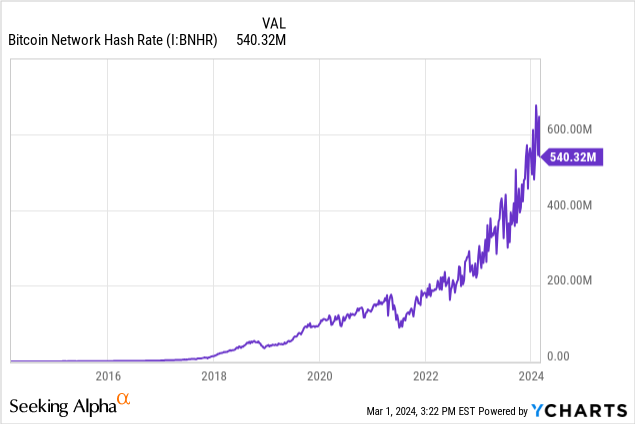

The last thing to consider is the global hash rate. When the fiat price of BTC is higher, there is usually more computing power competing for BTC block rewards. Despite the surge in computing volume, token issuance remains constant during the every four-year halving cycle. Therefore, if transaction volume does not increase in the future, or if the price of the coin basically increases forever, mining Bitcoin is a risky and cyclical business, and Bitcoin returns have historically decreased over time.

Wagmi Holdings

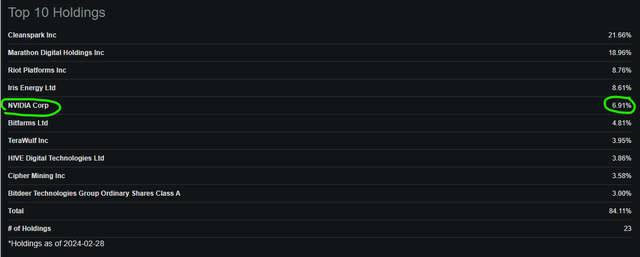

There are about two dozen public Bitcoin miners on the stock market, and it seems to me that many of them simply won’t survive when the block reward is halved. Given the small number of listed mining companies, it’s not surprising that the top 10 holdings we observe in the Valkyrie Mining Fund are as high as 84%. Somewhat surprising is NVIDIA’s (NVDA) reveal:

WGMI Top 10 (Seeking Alpha)

I don’t think I need to spend too much time on NVIDIA because it’s one of the most well-known stocks on the planet right now, and demand for the company’s GPUs has continued to grow over the past year as the data center and data center battles . Artificial intelligence models are firing on all cylinders. GPUs were once widely used for cryptocurrency mining. But with the advent of Bitcoin ASIC machines and Ethereum’s (ETH-USD) proof-of-stake migration, NVDA’s inclusion in the fund is a bit of a headache. Especially given the higher turnover and larger expense ratio. That said, referring again to the prospectus summary, Valkyrie only needs to allocate 80% to its Bitcoin mining-specific business.

The rest of the stocks in the top ten make a lot of sense to me. I particularly like CleanSpark and Marathon Digital (MARA) at the top of the list because I think these stocks will outperform most sectors if the mining industry profits post-halving. But there are several stocks here that I think will underperform the market as well.

risk

Personally, I think ETFs could be an effective way to swing trade the cyclical nature of Bitcoin. However, I’m not sure WGMI makes sense for most cryptocurrency and cryptocurrency-related investors. I think this industry is not as simple as it seems. For example, companies like Iris Energy (IREN) and CleanSpark (CLSK) have very different approaches to financial management. IREN sells all products every month, regardless of price. CLSK attempts to be more speculative in BTC management. By the end of the year, one strategy will work better than the other. I won’t claim to know exactly which one, but I suspect the full-year returns for these companies will be significantly different.

generalize

The approval of spot ETFs significantly changes the way we previously understood Bitcoin cycles.The coin has rallied to new highs multiple times in the past back Halving event.What we’re seeing now seems to be investors continuing to push for the halving, with Bitcoin still thousands of dollars away from its all-time high forward Halved in April. Miners have been the main beneficiaries of the rally, with many gaining more than 20% last month. However, there have been few real winners so far this year, and returns have been mixed among the companies in WGMI’s top 10:

If mining had more than 5-10 underlying stocks on the public market, I would aspire to an ETF like WGMI. But in this case, I believe stock pickers will do better in individual stocks than in ETFs. Over the past year or so, I’ve liked the idea of desiring certain miners more directly than Bitcoin for leveraged returns. Miners are great for trading. But over time, directly craving Bitcoin is the better investment.