people images

If you are a long-time reader of our weekly commentary and annual outlook, you are no doubt familiar with our views on cryptocurrencies.If you are unfamiliar with our work, here is a brief summary: At this point in the 16+ This asset class has existed for years and is essentially speculation for the sake of speculation, with real-world use cases limited to underworld transactions on the dark web. Oh, it’s one way for El Salvador’s authoritarian president to cast himself as “the coolest dictator in the world.” All of this is to say, we don’t consider Bitcoin (BTC-USD) and their ilk as appropriate complements to the investment portfolios we construct around our clients’ long-term financial goals and attendant risk considerations.

add it changes

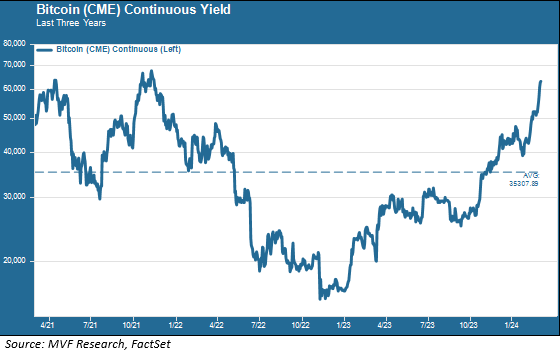

That’s not to say we don’t get asked about cryptocurrencies – we do a lot, especially In times like now, speculation is once again running high and prices are rising to near all-time highs. This is a picture of Bitcoin, the father of cryptocurrencies, from its last surge of euphoria in 2021 to the depths of despair in 2022 and back again.

That’s a big change and suggests something fundamental must have changed with the asset – right? anyone? Buller? In fact, in a fundamental sense, nothing has changed at all. No one is actually using blockchain currencies in their daily lives, except for people who attend those top conferences where the high priests of cryptocurrencies gather to spread the gospel. Thanks to other digital technologies such as contactless payment systems, paying has never been easier. Clicks, swipes, hovers, etc. – but none of these involve cryptocurrencies, which are, in fact, quite clunky when one tries to apply them to a typical trading environment.

They also do not function as any actual store of value, as their value has no tangible basis. Bitcoin enthusiasts will talk endlessly about its “scarcity value” due to the limited production of this particular currency, but this ignores the thousands of other blockchain “currencies” in the world that exist in their The really important places can be replaced by each other. The difference between Bitcoin and Ethereum (ETH-USD) and Dogecoin (DOGE-USD) and every other currency is little different than the difference between gold, silver, platinum, copper and natural gas, commodities that are actually There are uses in the real world.

Numbers rising

So, what explains these dramatic changes, especially the current apparent panic among the bulls in the cryptocurrency market? Last year, author Zeke Faux coined a phrase that became the title of his 2023 best-selling business book: “The Numbers Go Up.” This quote pretty much explains it: how a bunch of numbers “1”s and “0s” with no provable value can suddenly turn into trillions of real dollars. A group of people — not so much huge in number but huge in influence in the tech world — just want that number to go up, and hype it up until it happens. Remember the 2022 Super Bowl ad featuring A-list celebrities hyping cryptocurrencies and their lovechild in the cultural landscape, non-fungible transactions (NFTs)? But then interest rates rose, the pumpers did what pumpers usually do and sold, and the cryptocurrency crash began.

Zeke Faux’s book is subtitled “Inside the Wild Rise and Astonishing Fall of Cryptocurrencies.” Of course, now he has to update the subtitle to “…and the Wild Resurrection from the Ashes.” Although, as we noted above, the properties of blockchain currencies have not fundamentally changed, recent SEC regulations allowing Bitcoin ETFs have made it easier for ordinary people to trade them (i.e. bet on them). The FOMO meter, the only truly important factor driving cryptocurrency prices, is back in fifth gear. Now it’s just a matter of waiting for whatever happens to turn the animal spirits around again.

So what do we say when the time comes whether we will change our view on the appropriateness of cryptocurrencies as a long-term portfolio asset class? We will say that we approach any asset with an open mind and if something convinces us, we will be happy to change our attitude. There is no ideological hostility here, just a fair consideration of the pros and cons. Until this compelling case is made, though, we’ll leave Bitcoin and its ilk to those who prefer to speculate.

Editor’s note: Summary highlights for this article were selected by Seeking Alpha editors.