Oleksi Lisconi

investment thesis

Gigabit Cloud Technology (NASDAQ:GCT) is a misunderstood stock. The most research investors do on the name is look at the stock price and say, “It went up so much, so I missed the opportunity.”

where do i explain What is Gigabit Cloud Technology. And why I like this stock. By my estimates, Giga is priced at 9x its expected EBITDA, while growing at a CAGR of about 40%.

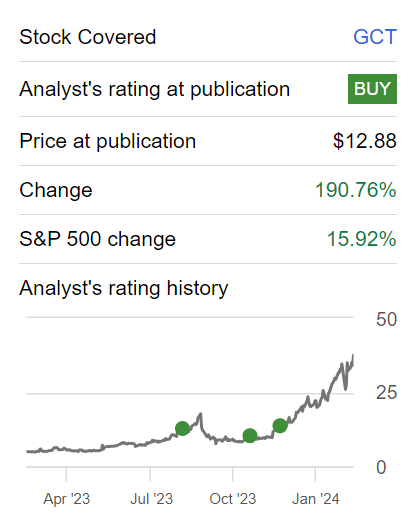

Although I have been clearly wrong in the past when proposing previous estimates:

Author’s work on GCT

I tend to believe $50 per share by summer 2025 is a reasonable target.

quick review

Back in December I said in an optimistic article,

The company has a brief argument against it. But looking at the results of Season 3, I’m completely convinced that this short thesis is wrong.

In short, GCT is priced at 5x forward EBITDA, has a clean balance sheet, and a management team that demonstrates tremendous business acumen.

This stock is worth buying.

Author’s work on GCT

In fact, I’ve been firmly bullish on this name, and I’ve seen the stock rise over 100% since I first recommended it. However, I’m still bullish.

Why Choose Gigabit Cloud Technology? Why now?

GigaCloud Technology operates a global business-to-business marketplace that connects buyers and sellers of large-scale products.

GigaCloud is like a large online store where businesses from all over the world can buy and sell products. It’s not just an ordinary online store; it’s a platform that helps with everything from finding products to paying and handling shipping. The platform is designed specifically for B-2-B businesses.

GigaCloud has a network that allows sellers and buyers to easily transact globally. Sellers (usually manufacturers in Asia) can use GigaCloud’s system to sell their products internationally without worrying about logistics. Buyers (usually resellers in the United States and Europe) can buy products at wholesale prices and sell them on other platforms.

GigaCloud makes money through various services. When transactions occur on their platform, they earn a percentage commission based on the transaction value. They also charge for warehousing (storing products), last-mile delivery (moving products to their final destination), and ocean freight (moving products across oceans).

GCT Q3 2023

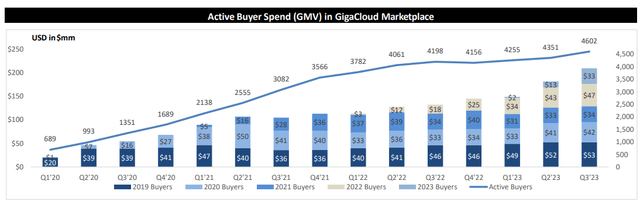

The success of their model is demonstrated by the growing number of sellers and buyers using their platform over the years.

Given this background, let’s now take a deeper look at its growth rate.

Organic growth rate 40% CAGR

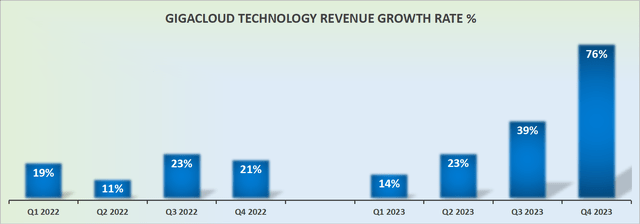

GCT revenue growth rate

Many people misinterpreted GigaCloud’s guidance and only saw a growth rate of over 70%, which means the business is significantly accelerating its revenue growth rate. This is wrong.

Giga has made two recent acquisitions, one of which, Noble House, is particularly significant and has impressive revenue figures.

However, from an organic perspective, Giga is actually growing at a very fast rate. I estimate that by 2024, GigaCloud’s compound annual growth rate will reach 40%.

Now, keep this in mind. GigaCloud’s performance in the first half of 2024 compares to a fairly comfortable comparable quarter last year. Therefore, at least in the first half of 2024, GigaCloud will achieve a very strong growth rate.

Also, consider this aspect.

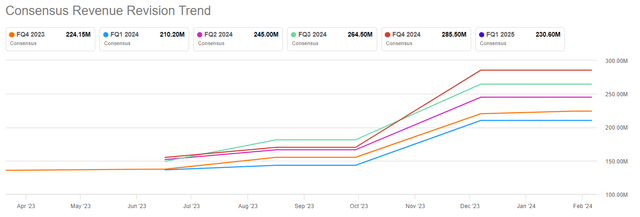

AT Premium

I’ve said on many occasions that you don’t want to go against Wall Street. You want to position yourself with sellers gushing about your company and increasing their revenue expectations.

Why? Because when things go bad, as they will at some point, you want the seller to be caught off guard and defend your stock. The last thing you want is for the seller to show up and issue a research report that basically says “I told you” Giga is a terrible company.

Investing is brutal. Investing is a game of odds. I’m wrong 50% of the time. But I know that if I start my Turning Point investing process with some thought of how much I might lose on GCT, then once I establish that framework, everything will fall into place. Especially, if the stock is cheap.

GCT stock valuation — 9x EBITDA

After acquiring Noble House and Wondersign Acquisitions, I estimate that Giga will end the fourth quarter of 2024 with approximately $130 million in cash and intangible debt. However, I realized that the larger of the two acquisitions, Noble House, was indeed unprofitable.

As a result, GigaCloud’s future profitability will not be what it was prior to this acquisition.

Still, given that the core platform is capable of achieving $30 million in EBITDA in Q3 2023, I believe GigaCloud has the potential to achieve ~$170 million in EBITDA (as a forward run rate) at some point in 2024.

This means GigaCloud is priced at 9 times EBITDA while operating with virtually no debt. Even now, it’s a great deal.

bottom line

In summary, GigaCloud operates a global B2B marketplace for large products, and its strategic acquisitions (particularly Noble House) have contributed to strong organic growth estimated at a compound annual growth rate of 40%.

While acknowledging the challenges posed by Noble House’s profitability, GigaCloud’s core platform has demonstrated the ability to generate $30 million in EBITDA in the third quarter of 2023, which bodes well for achieving $170 million in EBITDA in 2024. Given that GigaCloud is currently priced at 9x EBITDA and operates with virtually no debt, I think I’m optimistic that this is an attractive investment opportunity. My target of $50 per share by the summer of 2025 reflects my confidence in GigaCloud’s continued success and the market’s potential for further growth.