Jonratty Sansavang

what’s new

Another month and another record high for the major U.S. stock indexes. While the end result is much the same as in previous months, the context is markedly different.

In many ways, February This is a month of changing expectations. Stocks temporarily retreated following the release of the Consumer Price Index (CPI) in mid-February as markets were once again forced to grapple with inflation. The bond market may well have caught on, as sovereign rates and inflation breakeven points have been trending higher at the start of the month.

Expectations for the Fed also underwent significant revisions in February. Entering this month, the market has priced in six price cuts in 2024, the first in May.We are now in a position where the market is pricing in close to three drops This year, the first time was in June.

Despite rising yields, stocks continue to move higher, with major indexes returning:

- S&P 500 Index: 5.17%

- Dow Jones Industrial Average: 2.22%

- Nasdaq: 6.12%

Notably, the rally has broadened and is more reflective of stronger economic conditions. Information technology continues to lead, with industrials, consumer discretionary and materials becoming the strongest performing sectors this month. It’s also worth noting that the Russell 2000 Index and the equal-weighted S&P 500 Index (both of which are more reflective of economic activity) returned 5.52% and 3.96% respectively this month. This relative strength is also reflected in high-yield bond spreads, which remain near multi-year lows despite rising Treasury yields.

The question, then, remains one of risk reward in financial markets. As the economy remains resilient and some of the strength we see in the stock market extends to other areas, it can be easy to ignore the warning signs we continue to see on the economy. However, inflation suggests upside risks remain, and this comes against a backdrop of expensive equities and spreads near lows. We continue to believe that such an environment requires a somewhat defensive yet opportunistic approach to the market.

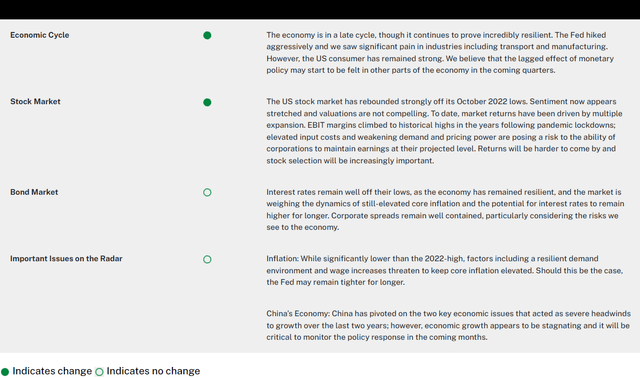

our opinion

We have always believed that as the economic cycle progresses, a soft landing is not possible. Historical evidence shows that the Fed has never been able to bring inflation down from the levels we have seen without causing significant economic hardship. If the Fed begins significant rate cuts this year, we believe it will likely be in response to adverse economic outcomes or external shocks. A slowdown in the economy could hit corporate profits hard, prompting the Federal Reserve to cut interest rates. However, the continued resilience of the U.S. economy and the downward trend in inflation increase the likelihood of a more benign outcome.

Given the above, the market may have to reprice the outlook in terms of higher yields, rising uncertainty and weaker earnings. While markets are often forward-looking, recessions are often not priced in until they are imminent.

With this in mind, we place a strong emphasis on risk management and adopt a defensive strategy within our core portfolio.

Industry Insights: What will go well in 2024?

2023 has been an eventful year, and 2024 will be no less. So, what will go well this year?

Every sector has its highlights, hear directly from our analysts as they share the opportunities emerging this year given the current market and economic environment, including life sciences/healthcare, capital goods, fixed income, technology , services and consumer goods.

Read about the opportunities below: Industry Insights: What will go well in 2024?

our opinion

Source: Bloomberg

Editor’s note: Summary highlights for this article were selected by Seeking Alpha editors.