Steve Jennings/Getty Images Entertainment

The tech bubble is back, or at least the signs of it are back. Although Cloudflare (NYSE:NET) has given up some of its post-earning gains, but is still more than 50% higher than a few months ago, and its valuation is difficult to determine. Prove legal. The company continues to deliver industry-leading revenue growth and is showing signs of strong adoption of its zero-trust products. However, with the stock trading at 20 times this year’s sales, I don’t think the stock offers a sufficient margin of safety given aggressive consensus forecasts and an aggressive valuation relative to those forecasts. NET remains one of the fastest-growing names in tech, but valuation matters. Despite the momentum, I recommend readers avoid this stock.

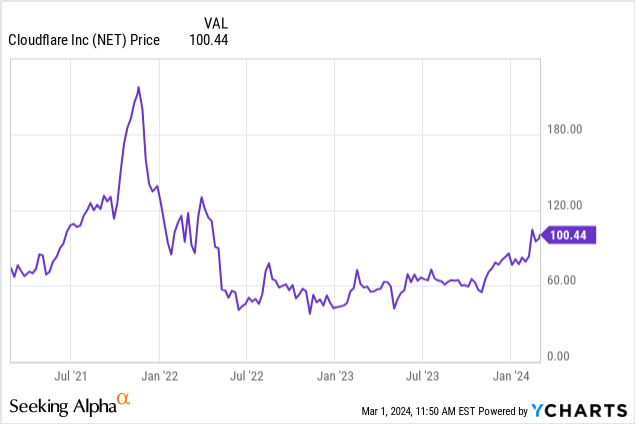

Net share price

NET has been fully involved in technology recovery – and more – and most recently The surge even surprises me, given that the stock wasn’t cheap prior to its latest rally.

I last covered NET in December, when I explained why I was downgrading the stock’s valuation rating. The stock has since risen another 25%, but I’m not convinced the latest profit results warrant such a move.

Net Equity Key Metrics

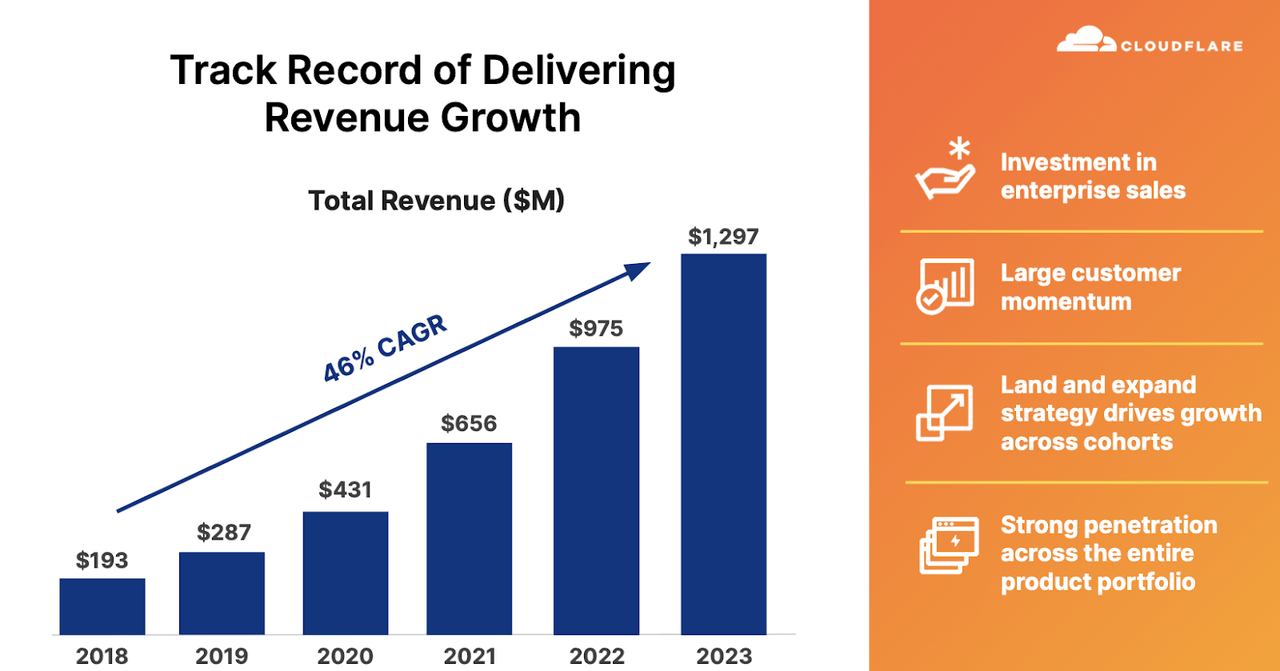

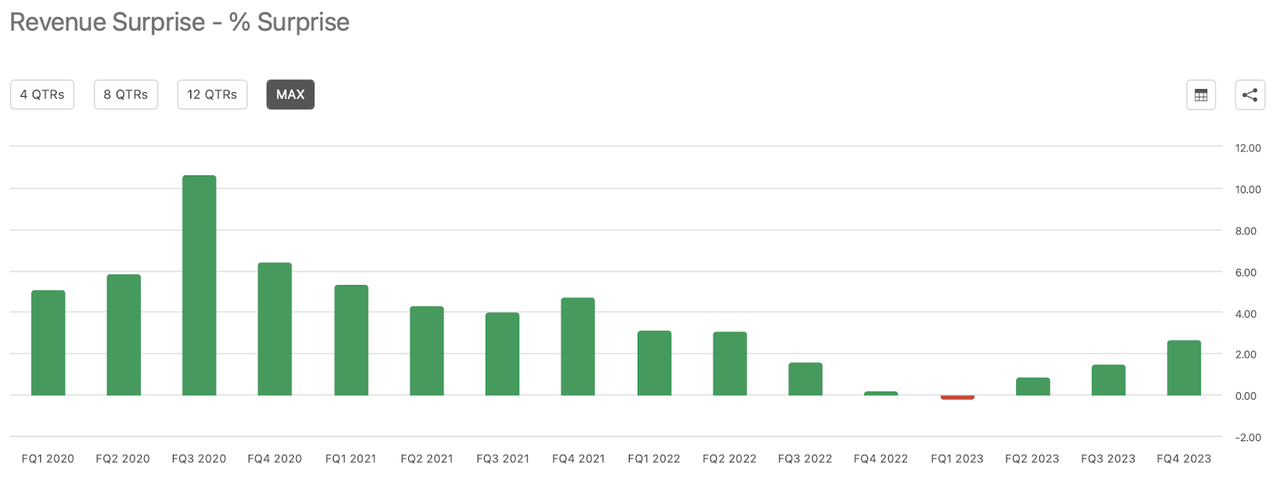

In the latest quarter, NET’s revenue increased 32% year-over-year to $362.5 million, far exceeding expectations of $353 million. This is a strong performance in the past year, with revenue increasing by 33% year-on-year.

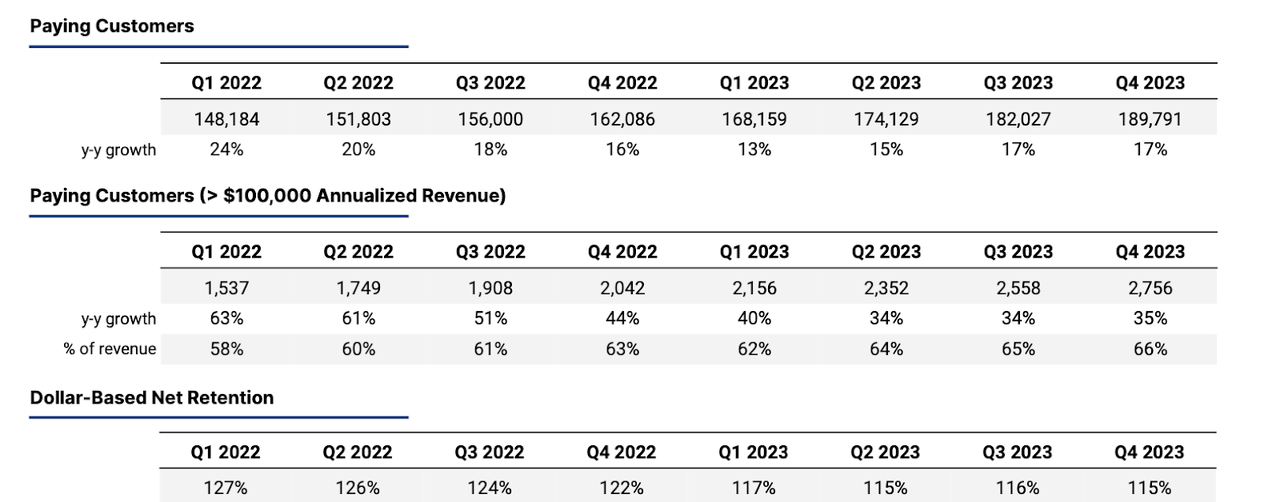

Q4 2023 Demo

NET’s customer count grew sequentially and year-over-year, but net retention in dollar terms continued to be sluggish at 115%. While many companies would be willing to fight for such a DBNRR, NET stock arguably needs a more aggressive growth rate.

Q4 2023 Demo

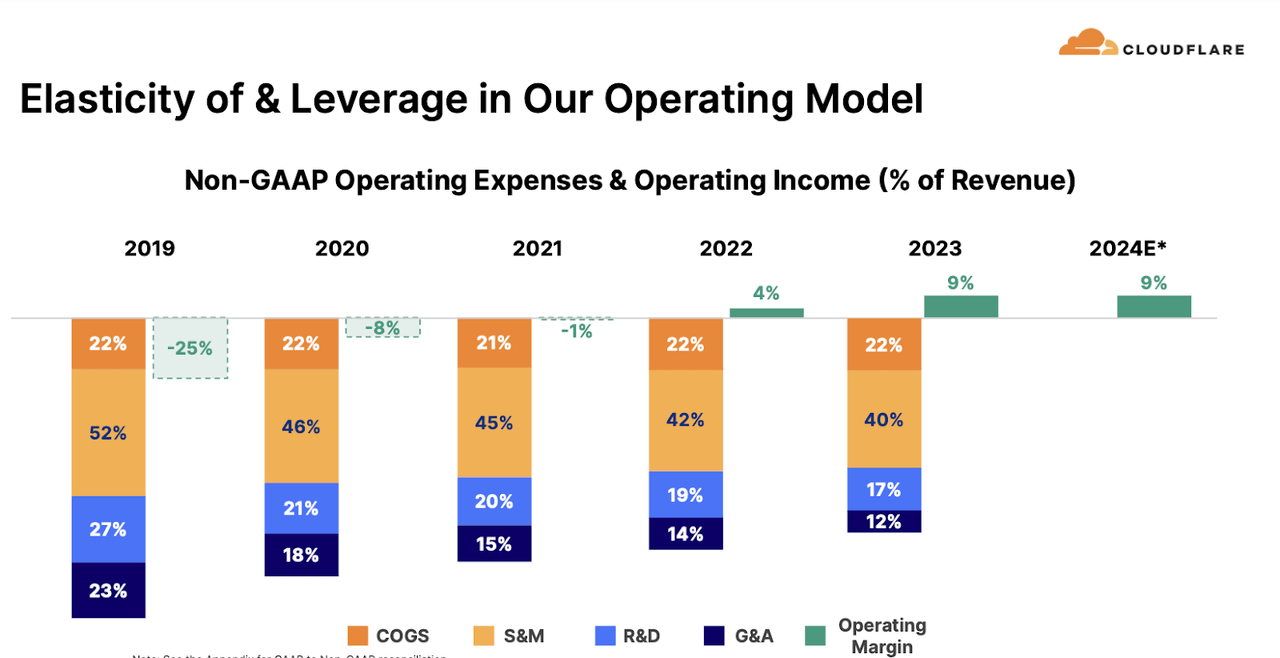

NET generated $39.8 million in non-GAAP operating income, beating estimates of $29 million. The company delivered solid earnings growth in 2023 but, unlike many peers, is not currently guiding for further margin expansion in 2024.

Q4 2023 Demo

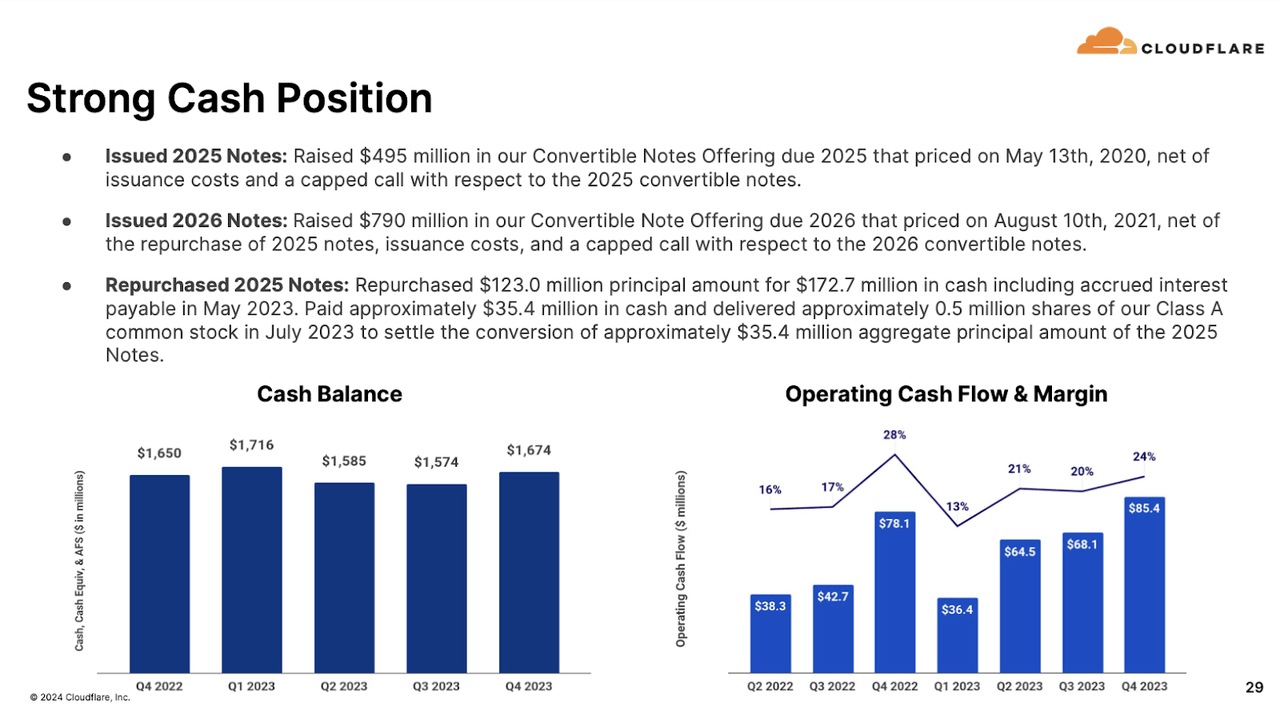

NET ended the quarter with $1.7 billion in cash and $1.3 billion in convertible notes. These convertible notes mature in 2026 and carry an interest rate of 0%. This means that despite its meager net cash balance, NET is likely to enjoy strong net interest income over the next few years.

Q4 2023 Demo

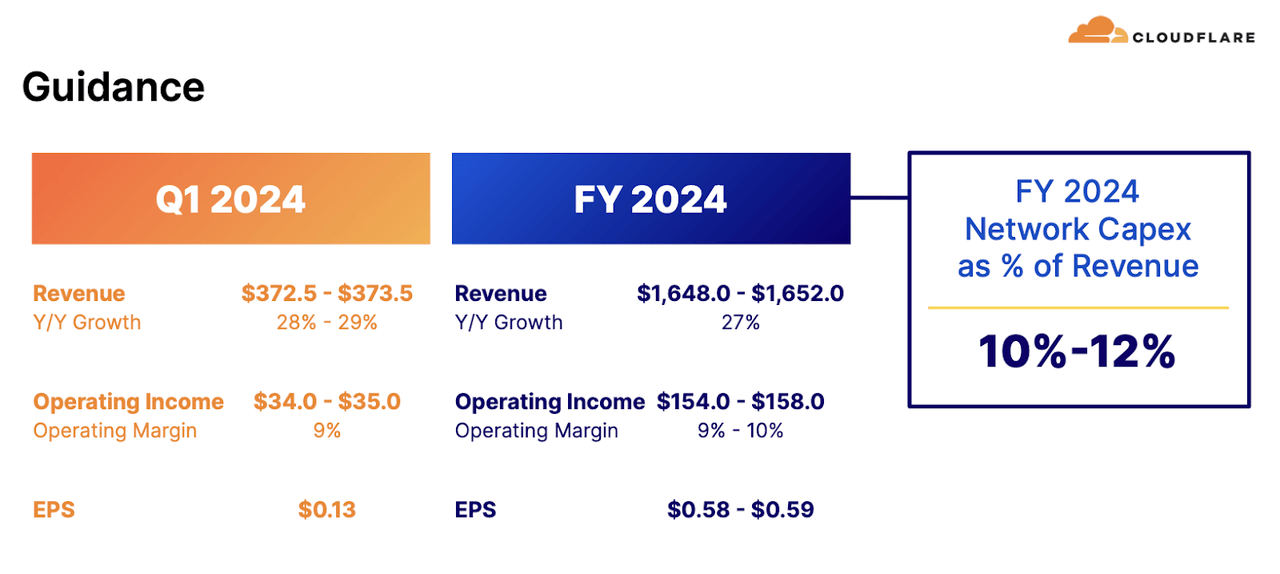

Looking ahead, management expects first-quarter revenue to increase 29% year over year to $373.5 million, with an operating margin of 9%. Management expects full-year revenue to grow 27% annually and operating profit margin to be as high as 10% (non-GAAP). Market consensus expects NET’s first-quarter revenue to be $373.25 million and full-year revenue to be $1.66 billion.

Q4 2023 Demo

Given NET’s history of “beat and improve” mentality, I expect NET to outperform guidance and consensus expectations.

Seeking Alpha

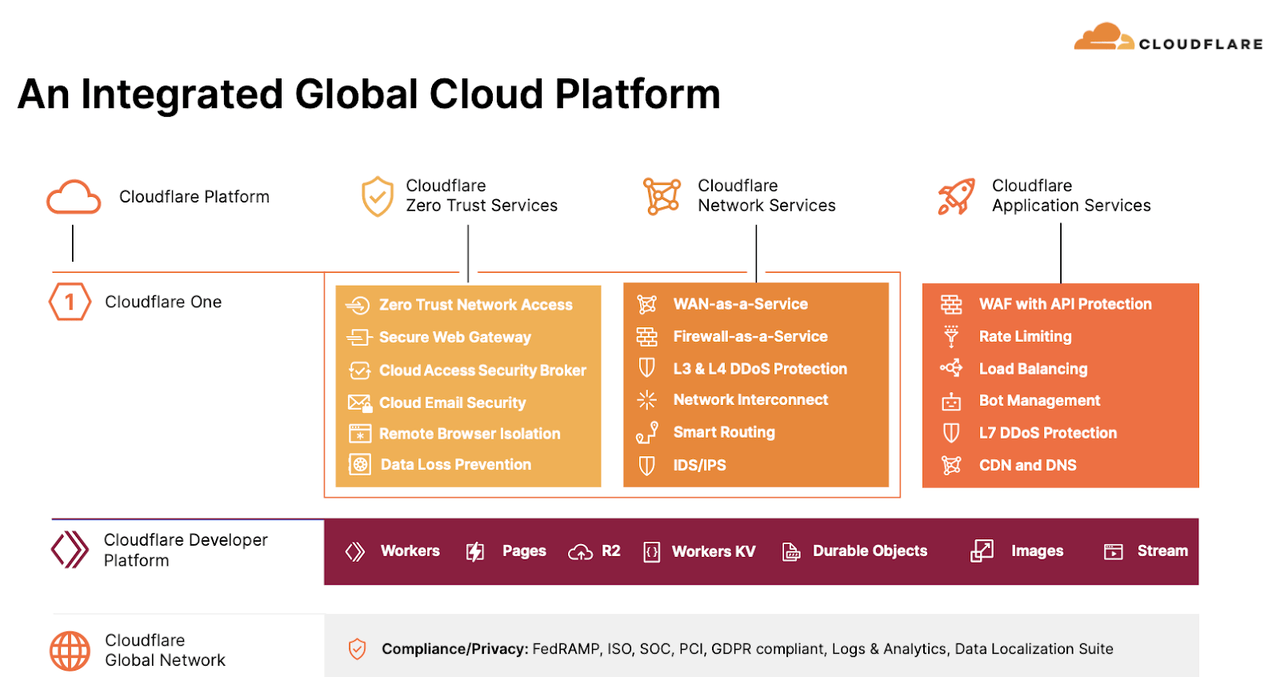

On the conference call, management noted that they had signed their largest new customer with the U.S. Department of Commerce, with a total contract value of $30 million. Perhaps it’s the deal that’s drawing the most enthusiasm from Wall Street, as management said they “believe a deal like this validates the importance of bringing together application performance, security, networking and zero-trust services on a unified platform.” ” Zero Trust is one of the company’s new products that management hopes will help continue its strong growth rate. The company also completed its largest customer renewal, with a total contract value of $60 million. Management pointed out that remaining performance obligations (“RPO”) were US$1.245 billion, an increase of 15% quarterly and an annual increase of 37%. The current RPO is US$908.85 billion, an increase of 10% from the previous quarter and an annual increase of 35%. These numbers are very impressive, but don’t necessarily mean that the full-year revenue growth guidance of 27% is conservative, as the company is targeting 45% annual RPO growth in 2022 and 40% RPO growth.

Is the net stock a buy, sell or hold?

NET is a leading content delivery network that also provides adjacent network security services.

Q4 2023 Demo

The stock has been valued higher than its peers for years and remains one of the most expensive stocks at a price-to-earnings ratio of 20 times.

Seeking Alpha

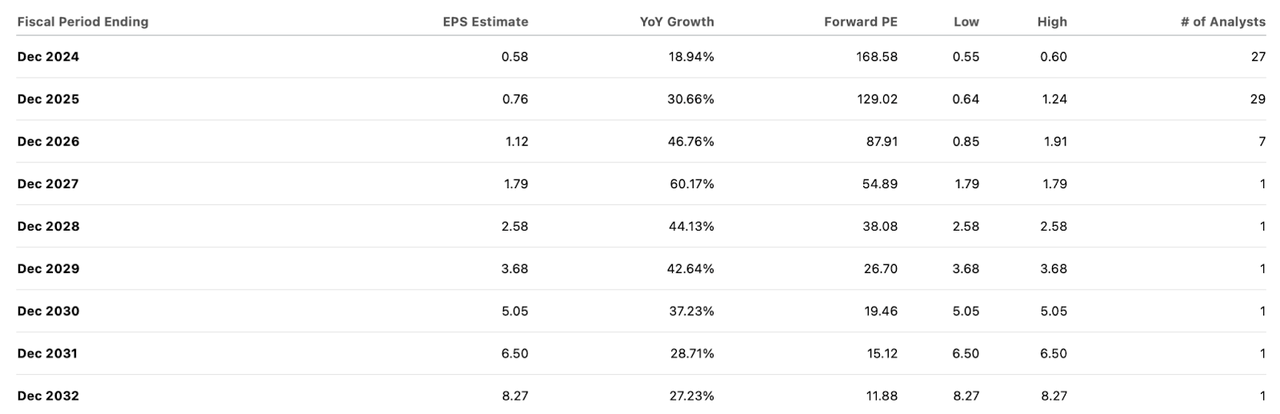

Consensus estimates suggest the company will post a net profit margin of 34% by 2032. I noticed that management’s latest guidance calls for long-term operating margins of 20%. The consensus estimate looks aggressive, and there’s no other way to split it.

Seeking Alpha

Wall Street seems optimistic that the company’s deal with the U.S. Commerce Department could validate zero trust’s growth opportunities. However, I think this optimism is fully reflected in consensus estimates, which call for a gradual deceleration over the next few years. In particular, I doubt the company can sustain the 25% to 27% revenue growth analysts expect, and doubt the company can achieve 18% annual revenue growth even through 2032. My only justification for this statement is that the law of large numbers states that growth rates should decelerate over time. Sure, the company may be able to create new products, but these new revenue opportunities are reflected in consensus estimates. I have every reason to believe NET could significantly underperform consensus estimates.

But no matter what, we still have to take the consensus estimate at face value. If we assume NET will trade at a price-to-earnings ratio of 30x by 2032, equivalent to the premium valuations of companies like Microsoft (MSFT) and Adobe (ADBE), then NET’s share price could be around $248 per share by then . This implies an annual return potential of approximately 11% over the next 8.5 years. That’s enough to beat the market, but it’s hard to accept both consensus estimates and valuation assumptions. Conversely, if we assume NET’s P/E of 25x in 2032, which still represents a premium valuation, then the annual return potential drops to 9%, which would be very consistent with the broader market’s historical returns. We saw this problem during the 2021 tech bubble – tech stocks were overly optimistic about multi-year forecasts and were trading at very aggressive valuations compared to those forecasts. While NET isn’t trading as expensive as it was back then (at one point trading at over 100x sales), its valuation is still high, which doesn’t mean the likelihood of market-beating returns from here on out is very high. high. Increasingly, I see signs of a tech bubble in NET and other stocks and urge readers to avoid lowering the return threshold in an attempt to join the hysteria. I reiterate my Avoid rating on the stock as there is insufficient evidence of an expanding P/E ratio.