Peaches_iStock

By Rich Mathieson and Christopher DiPrimio, CAIA

The post-COVID era marks a shift from decades of stagnant economic growth to a reflationary regime, characterized by positive project growth and rising structural inflation (and interest rates).

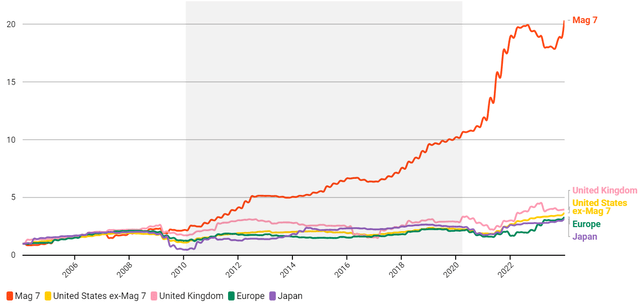

this The following series of charts illustrate the impact of this shift from a business profitability perspective. The first chart shows that in the decade following the Global Financial Crisis (GFC), before the pandemic, low levels of project growth meant that only a handful of tech companies (dubbed the “Magnificent 7”) were able to significantly increase their revenues. .

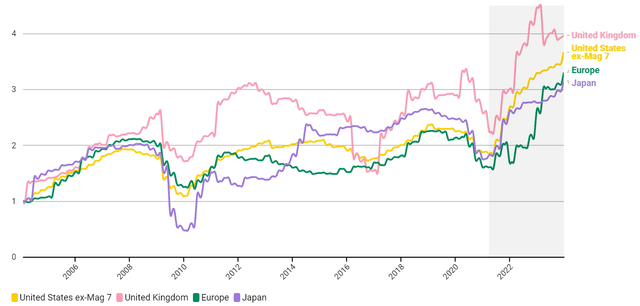

Excluding the Magnificent 7 in the second chart highlights that operating income for U.S. companies and their European and Japanese peers has been essentially flat during this period.By the time COVID-19 hit, incomes were no higher than they were in 2007 to the global financial crisis. As inflationary pressures re-emerge in the post-pandemic era, this situation has begun to change, and average company profits have now broken through to the upside.

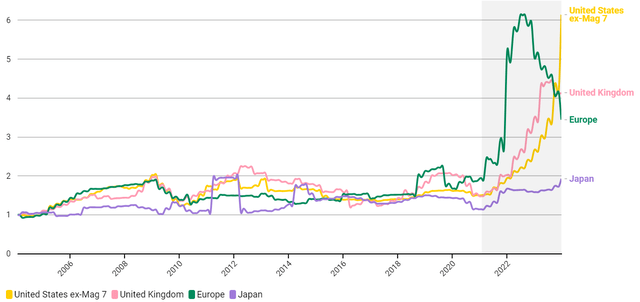

The last chart in the series shows that another important nuance of the new regime can be observed in the significantly higher cross-sectional dispersion of income.

In the decade before COVID-19, project growth stalled, limiting profit growth to a small group of U.S. tech companies (Magnificent 7)

Average operating income (rescaled on January 1, 2004)

Source: BlackRock, data from Worldscope, as of February 2024. The operating income measure for each group of companies is rescaled to 1 (as of January 1, 2004) to highlight relative differences over time from a common starting point.

Excluding the Magnificent 7, we find that after years of lackluster earnings growth for most companies, average earnings have increased in the post-COVID era

Average operating income (rescaled on January 1, 2004)

Source: BlackRock, data from Worldscope, as of February 2024. The operating income measure for each group of companies is rescaled to 1 (as of January 1, 2004) to highlight relative differences over time from a common starting point.

As average earnings across regions increase, so does the cross-sectional dispersion of firm earnings

Standard deviation of average operating income (rescaled on January 1, 2004)

Source: BlackRock, data from Worldscope, as of February 2024. The operating income measure for each group of companies is rescaled to 1 (as of January 1, 2004) to highlight relative differences over time from a common starting point.

Why does this happen? Reflation and a return to positive nominal growth could give companies with strong fundamentals more runway for profit expansion. The ability to pass on higher prices to customers varies from company to company. Additionally, some companies are better than others at capturing nominal revenue growth in bottom-line earnings. At the same time, this increased opportunity also brings challenges, such as higher capital costs and dovish policy support relative to recent decades, which may expose the vulnerability of companies with fundamental weaknesses. The result is a wider range of potential outcomes and a significant increase in investment opportunities relative to those faced by stock pickers during much of the previous cycle.

Fundamental dispersion translates into stock return dispersion

Prior to the COVID-19 pandemic, developments such as zero interest rate policy and quantitative easing both suppressed return dispersion and boosted overall stock market performance. This means that static market index exposure and beta-biased strategies generated strong absolute and risk-adjusted returns.

The higher interest rate regime now sets the stage for more modest equity beta performance and higher security dispersion, as returns are more closely tied to individual company characteristics such as earnings growth and profitability, rather than broadly benefiting from prior A “rising tide lifts all boats” macro environment.

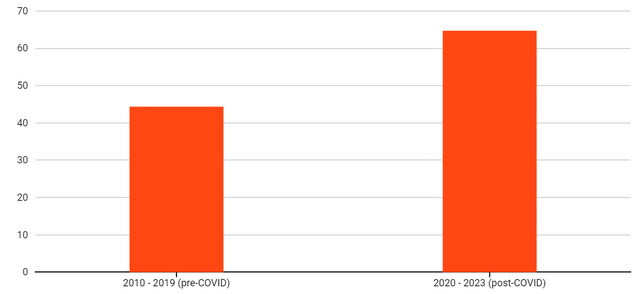

Inventory dispersion intensifies in the post-epidemic era

The difference between the average annual total return of the top half and the bottom half of the MSCI ACWI Index (%)

Source: BlackRock, data from FactSet As of December 31, 2023. Annual stock dispersion is calculated by taking the average total return of the top half of the MSCI ACWI Index’s performance (above or equal to the median) and subtracting the average of the bottom half. The inventory dispersion chart shows the average of annual dispersion observations for each period.

Diversification creates a wide range of opportunities for long/short equity investors

But the backdrop of a more challenging market beta does not represent a lack of investment opportunities. In a highly fragmented world, this means that the opportunity set is shifting towards richer environments to generate alpha through safe selection.

In addition to picking winners from the new regime, managers making long and short investments can leverage insights from security selection to leverage diversification as a source of returns. This can be accomplished by positioning a long/short portfolio to reflect differences in expected returns across the investment universe, taking long positions in expected relative winners and short positions in expected relative losers. This approach aims to generate returns across a cross-section of the market, taking advantage of performance differences between long and short holdings in an environment where absolute market returns are likely to be more muted.

Inside BlackRock Global Equity Market Neutral Fund (BDMIX), we analyze more than 7,000 global stocks daily through a data-driven process to inform our long/short portfolio positioning. Long and short investments are relatively even, and the net market exposure is close to zero, which greatly reduces the impact of market trends on performance. Instead, returns are driven by our ability to predict relative winners and losers when opportunities arise—targeting a stream of uncorrelated alpha returns. We saw this in practice in 2023, as the strategy delivered a return of 14.58% (versus the category benchmark’s return of 5.09%), with a correlation to the S&P 500 of just 0.07.1

Evolving portfolios with uncorrelated alpha

In the wake of COVID-19, economic and market dynamics have changed. Dispersion in company fundamentals and stock returns is rising, and static beta exposures may face headwinds relative to recent decades. This environment presents a wide range of opportunities for strategies such as BDMIX, which can leverage higher diversification to generate uncorrelated alpha – helping to develop new-age investor portfolios.

this postal Originally appeared on iShares Market Insights.