The private equity industry is notorious for grueling 100-hour work weeks, especially for young professionals. But like any job, a company’s deal flow (and urgent, need-to-be-done-yesterday work) will always slow down at some point. Private equity professionals may sometimes ask: How do I fill my time from 9 a.m. to 6 p.m.?

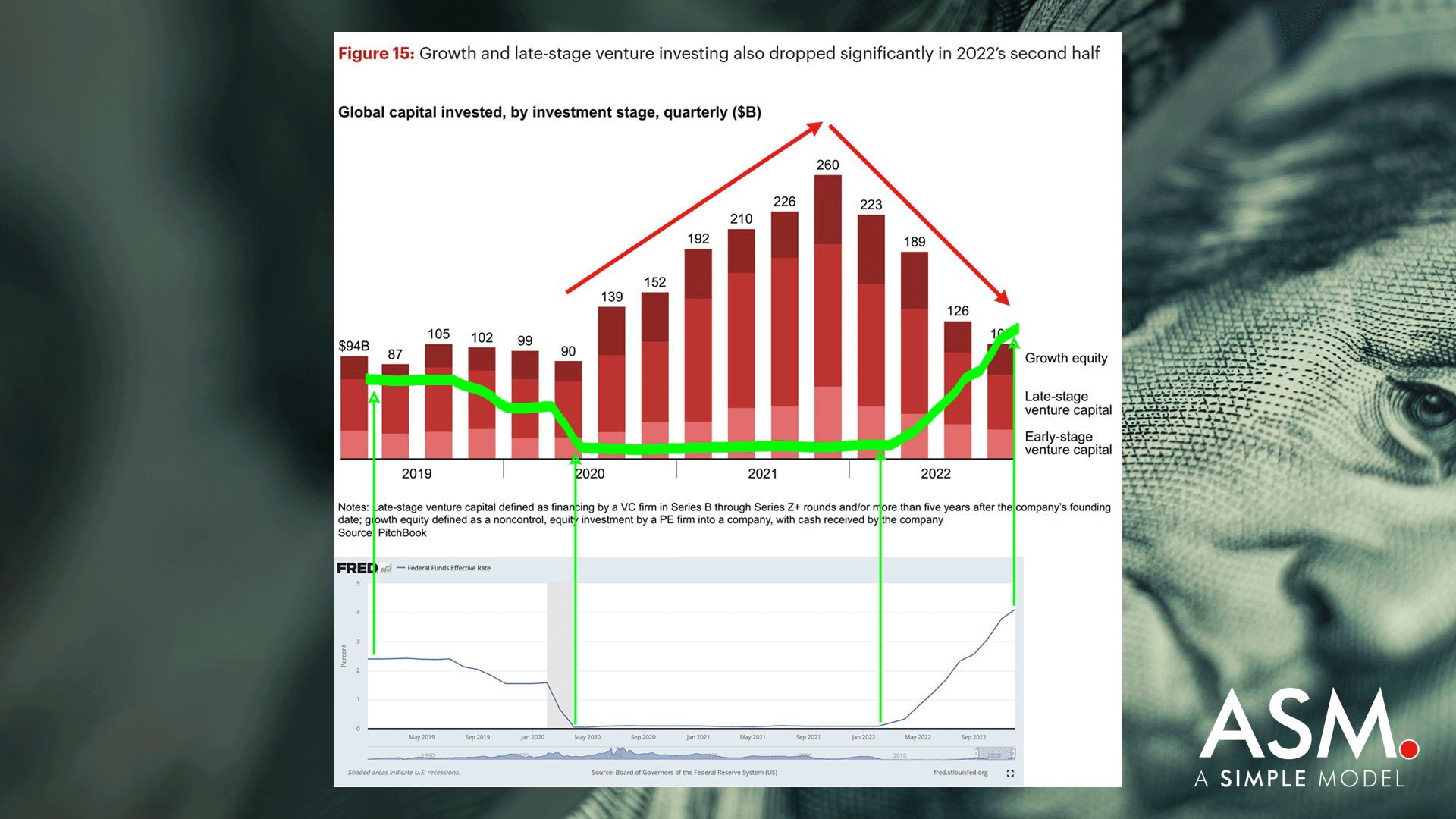

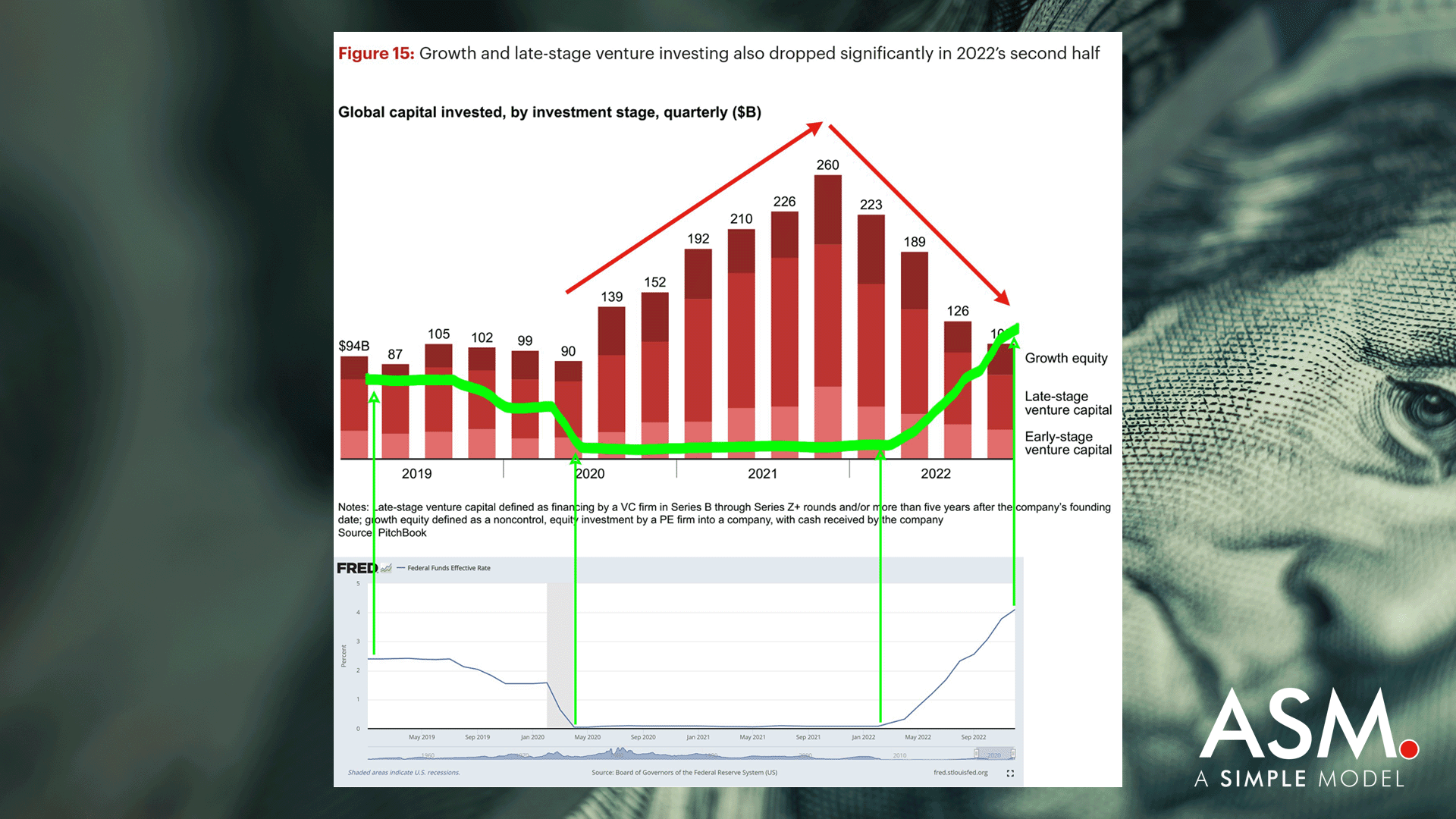

This is a timely question because since 2021’s record year, total transaction volume has been declining as interest rates and concerns about economic headwinds intensify (see Figure 1 below). However, that doesn’t mean private equity investors are resting on their laurels, because even in slow times, those who exit often miss out on opportunities that others would have loved to have taken in their absence.

Figure 1. As interest rates rise, global private equity buyouts begin to decline (Source: Federal Reserve Bank of St. Louis, Bain & Company 2023 Global Private Equity Report 2023 Global Private Equity Report | Bain & Company). This is especially true in growth and late-stage venture capital.

To prevent this from happening and give you an idea of what a “slow” work week might look like, here are four categories of activities private equity professionals often engage in when they’re not doing their due diligence and making deals.

1. Build your list

Just because urgent due diligence isn’t being done on existing targets doesn’t mean the acquisition pipeline is stalled. If anything, investors with more free time should devote more energy to finding new targets to cultivate relationships with. This is especially true when a looming economic recession or other events may prompt new growth in sales activity. The web is a big place, with an ever-growing database of databases, industry associations, and LinkedIn profiles to browse. Cold contact via email or phone can quickly establish a dialogue with new prospects, although funds over $1 billion are generally unlikely to find new deals this way.

If cold contact isn’t appropriate for a fund’s specific size and mandate, following up with a former portfolio company CEO at a new company through a Rolodex or asking a friend at a smaller firm to learn about the growth of their investments can be useful when the market picks up This is a beneficial way to open up new transaction channels. Likewise, it’s always a good idea to contact a broker or other industry expert to ask what they’re seeing in the market and whether they know of any businesses that might be interested in transacting in the near future (or even more distant future) Activity. Don’t forget, many private equity deals, especially proprietary deals, are often the culmination of years of conversations and relationship building, rather than something that happens overnight. (ASM Subscriber Course: Private Equity Transaction Sourcing Process)

Finally, many investors will use the slow period to revisit existing investment themes and consider how market or technology developments may impact which industries and/or businesses should be at the highest priority in their acquisition pipelines. For example, will the coming recession make certain industries more attractive? Or have AI tools reached a point where they can generate significant efficiencies in a certain type of business model?

2. Advance ongoing conversations

A good investor will never let conversations with preferred acquisitions go away completely, even if the business isn’t looking to sell or interest rates are too high to make a deal happen right now. Our goal is to always be the first call for property owners when they decide they are ready to accept a serious offer. An occasional phone call or meeting for coffee or lunch is a good idea, even if the “wooing” lasts for years. The key is to make sure that genuine interest and care for the individual and their business is shown during these gatherings, as no investor wants to be thought of as a vulture circling the company solely for their own benefit.

3. Focus on existing portfolio companies

When one door closes, another usually opens. If the flow of new deals slows, that could free up time to research existing portfolio companies (assuming a firm owns them). If lower volumes are due to rising interest rates or economic contraction, existing “port companies” may face market challenges at the same time, which will require the attention of almost all investors. Even when the business environment is healthy, portfolio work can often take up 50% or more of an investor’s time as new deals flow through, especially if the investor oversees multiple port companies. This time may involve meetings with management, financial planning and analysis (FP&A) activities, finding ways to improve processes, and upgrading talent.

In situations where a business is in trouble, the work may be more hands-on, involving cash flow modeling, exploring cost-cutting strategies, negotiating with creditors, and other turnaround efforts. See related posts: (1) Crisis Modeling; (2) Template Budget Revision: Downside Scenario.

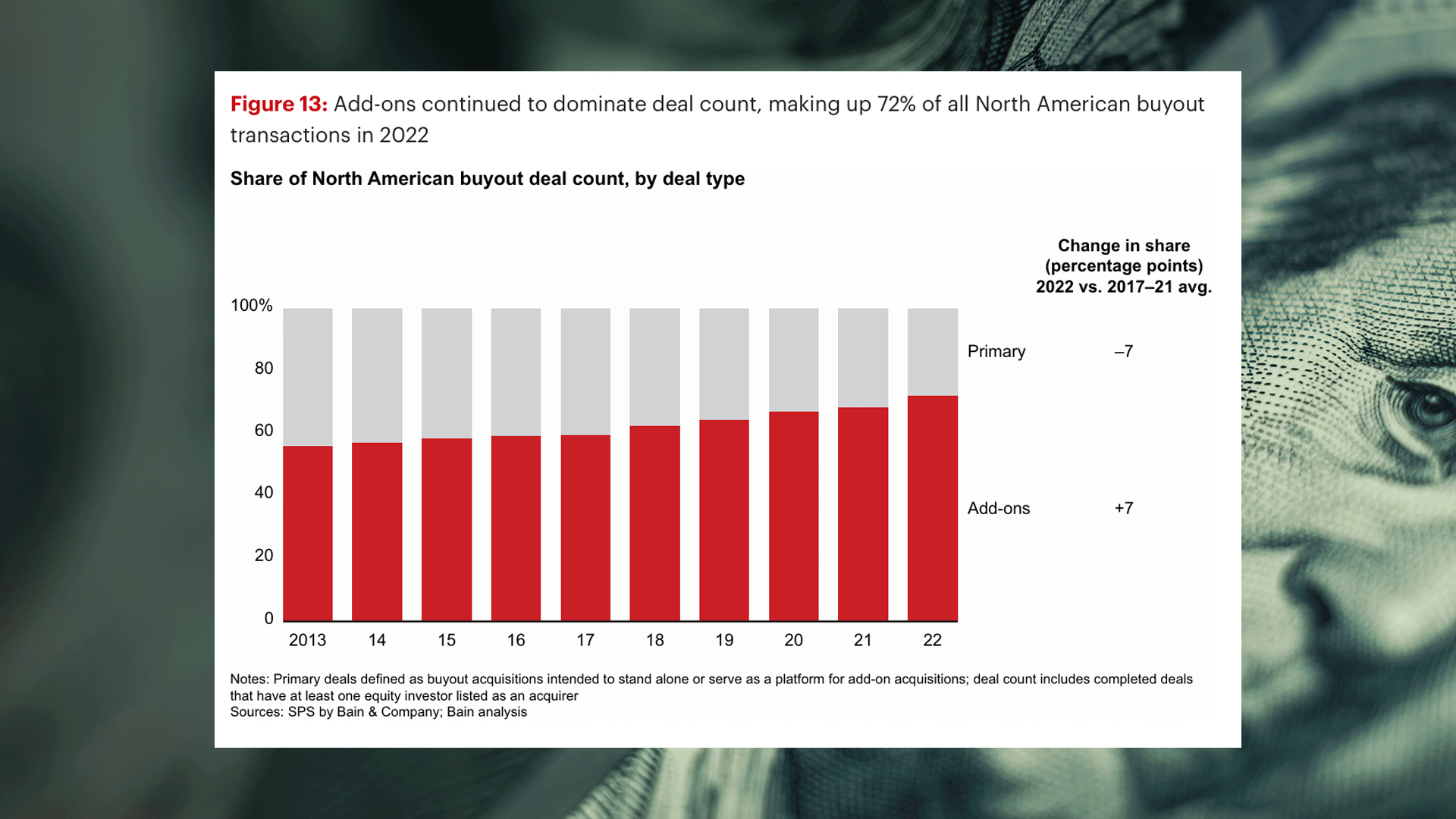

Furthermore, a slowdown in major or “platform” acquisitions does not necessarily mean a slowdown in smaller add-on deals for existing port companies. In fact, the opposite is often the case. As shown in Figure 2, add-on acquisitions have been steadily increasing as a proportion of North American acquisitions since 2013 and will reach 72% by 2022.

Figure 2. The share of North American acquisitions consisting of add-on deals is increasing from 2013 to 2022 (Source: Bain & Company Global Private Equity Report 2023 Global Private Equity Report 2023 | Bain & Company)

One reason that add-on activity may continue or even increase when larger volumes decline is that add-on activity can often be closed without the need for debt, so high interest rates may not be an obstacle. Since recessions tend to hit smaller companies hardest first, these companies may be ripe for acquisition by large private equity holding platforms looking to execute aggregation strategies.

4. Think outside the scope of authorization

As strange as it sounds, sometimes private equity is neither private equity nor equity. Subject to the authorizations set forth in the Company’s agreement with the Limited Partners, the Fund may be permitted to invest up to 30% of its resources in non-private and/or non-equity assets. This can create significant flexibility when market conditions are not conducive to what is usually the case. By expanding into public stocks, bonds, or private credit instruments, investors may find ways to keep their funds active and profitable in virtually any environment. For example, in the aftermath of the 2020 pandemic, many large private equity funds had their partners spend considerable time evaluating the debt positions of distressed companies for purchase at deep discounts to face value, a practice that allowed them to deploy dry powder At the same time, new equity investment activity is weak (in some cases, they may take over control of still attractive assets through restructuring).

in conclusion

In pursuit of private equity returns, the potential work is never-ending. But the types of jobs continue to change as opportunities ebb and flow. For those of us in the industry, especially new investors, this is a good thing. It allows you to do something different, learn new skills, and flex that alternating conceptual muscle that you miss when you just jump from one due diligence to the next. Whether that change involves developing a new thesis for a fund, cultivating new relationships with potential acquisitions, or guiding portfolio companies through difficult times, it’s just the sauce that turns private equity novices into successful veteran investors .