Miscellaneous Photography

Back in April 2023, I found myself quite optimistic about the logistics business Hongbei Company (NASDAQ:ARCB). The company is known for providing freight services and other logistics solutions to customers throughout North America, Consistently outperforming since I started I’ve written about it before May 2021. While the S&P 500 fell 1.5%, the company’s shares rose 10.9%. Even with this difference in returns, I still find the shares attractively priced. This leads me to maintain a Buy rating on the company to reflect my view that the stock will likely continue to outperform the market for the foreseeable future.

Today, almost a year later, I must say that the stock has performed beyond even my own expectations.Since the article was published, S&P 500 index rose 22%. In comparison, ArcBest grew 54.7%. Interestingly, this is happening at a time when some of the company’s underlying performance has actually weakened. For the full year of 2023, revenue, profit and cash flow have all declined compared with the same period last year. On the other hand, there are still some bullish factors that deserve investors’ attention. First, the company has a net cash position, not a net debt position.In addition, at the same time 2023 Although weaker than in 2022, profits in the final quarter of the year are starting to show some bright spots. The bottom line is that the stock, while not as cheap as it once was, doesn’t look outrageously priced. All things considered, this makes me think there might be some additional benefits. But since the potential for additional upside relative to the broader market is likely to be minimal, I think it would be prudent to downgrade the company to “Hold” at this time.

Recent interesting results

On February 6, ArcBest’s management team announced its financial performance for the last quarter of fiscal year 2023. But before we discuss the quarter’s results specifically, let’s talk about 2023 overall. Because if we look at it from a full year perspective, at first glance, the situation is rather unappealing. In 2023, revenue will total $4.43 billion. That’s down 12% from the $5.03 billion generated in 2022. To truly understand this decline, we should touch upon the company’s two operating segments.

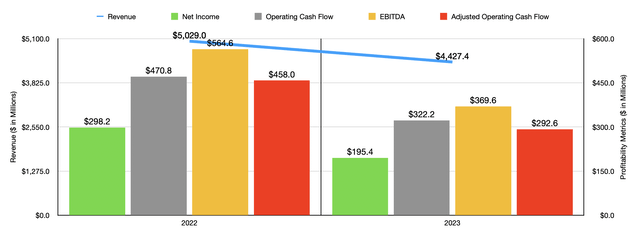

Author – SEC EDGAR Data

First and foremost, we have the asset-based part of the business. This part of the business provides less-than-truckload (less-than-truckload) services to corporate customers. It does this through ABF Freight’s motor carrier business. Simply put, this segment is in the business of providing transportation services for general commodities, which management considers to include essentially all freight except hazardous waste, hazardous explosives, and a few other niche categories. Specific goods transported also include food, textiles, chemicals, plastics, wood, machinery, etc.

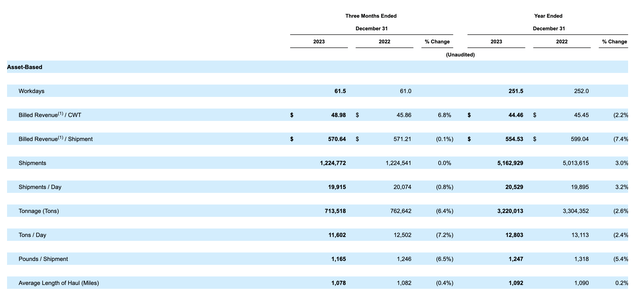

arc best

During the year, revenue related to the segment fell to $2.87 billion, compared with $3.01 billion reported a year ago. This decline can be attributed to several factors. First, construction revenue per shipment was down 7.4%, with construction revenue per hundred weights down 2.2% from the same period last year. This decline occurred despite a roughly 3% increase in shipments. When you consider that total daily tonnage fell by 2.6%, this means that the company is moving less cargo overall but increasing frequency.

arc best

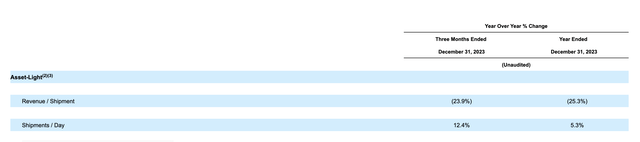

While revenue associated with this segment fell slightly, the real pain came from the asset-light segment. This part of the company essentially provides customers with integrated logistics solutions from a single source. Simply put, customers using these services may have transportation needs that require multiple routes or multiple modes of transportation. ArcBest solves this problem by handling these complexities for customers, sometimes even turning to third parties to facilitate said functionality. Unfortunately, things haven’t been going well for this segment this year. The segment’s revenue fell to $1.68 billion from $2.14 billion. Although daily shipments in this segment grew by 5.3%, revenue per shipment fell significantly by 25.9%. Management said the pain experienced by the unit was the result of changes in the business mix resulting from softer market conditions.

As revenue fell, the business’s profits also took a hit. Net profit will increase from US$298.2 million in 2022 to US$195.4 million in 2023. Other profitability indicators followed a similar trajectory. Operating cash flow fell to $322.2 million from $470.8 million. If we adjust for changes in working capital, our funding would decline from $458 million to $292.6 million. Finally, the company’s EBITDA fell from $564.6 million to $369.6 million.

Despite business issues throughout the year, the final quarter improved. Revenue did continue to decline, falling from $1.16 billion to $1.09 billion. The first good news concerns the asset-based segment. Revenue in the final quarter of 2023 was still down year over year, but only by 0.2%. Shipments were essentially flat, with tonnage transported down 6.4%. This resulted in a 7.2% decline in tonnes per day. But revenue per hundredweight increased 6.8%. Even in the asset-light space, the company sees a glimmer of hope. Although the revenue per shipment still decreased by 23.9% year-on-year, the daily shipment volume increased by 12.4%. It’s clear that demand has increased recently.

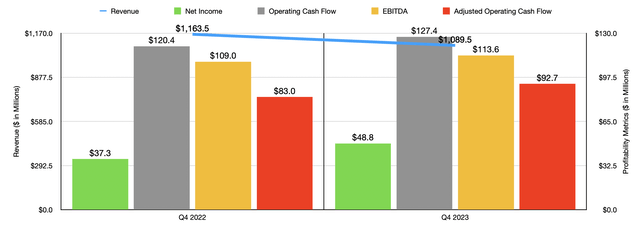

Author – SEC EDGAR Data

When looking at the bottom line of the business, even more good news can be seen. Net profit increased from US$37.3 million to US$48.8 million. Despite lower sales, ArcBest benefited from operating expenses falling from 95.7% to 94.1% of revenue. When spread over the revenue the company generated in the final quarter of the year, this represented a $17.4 million increase in pre-tax profits. The company also benefited from a jump in interest and dividend income to $4.1 million from $2.3 million. Interestingly, in the operating expense category, the improvement came despite significant increases in salaries, wages and benefits. However, the company’s fuel, supplies and expenses fell to 11.9% of sales from 13.7%. At the same time, transportation costs for renting and buying fell from 13.1% to 9.4%. As you can see in the chart above, the same story holds true for other profitability metrics during the quarter compared to the same period a year ago.

Turning to 2024, management warned investors that they will continue to see economic weakness. This includes both sides of the company. Still, the company intends to allocate significant capital for capital expenditures, ranging from $325 million to $375 million. Sometime last year, I wrote an article about the now-defunct Yellow Corp, detailing how it provided some players in the trucking industry with the opportunity to buy assets on the cheap. Management does seem to be taking advantage of this. In January of this year, for example, the company purchased three facilities owned by the company for a total of $30 million. They also spent $8 million to purchase a lease on another facility the company had been operating. I like to see long-term trends like this, especially during periods of industry weakness.

Author – SEC EDGAR Data

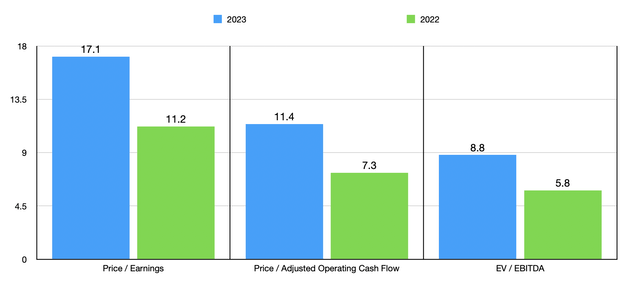

In terms of valuing the company, I’d like to point you to the chart above. Especially on an EV to EBITDA basis, ArcBest’s absolute pricing looks attractive, aided by a net cash position of $101.1 million. I then compared the company to five similar companies, as shown in the table below. Only one company is cheaper on a price-to-earnings basis. Four of the five are cheaper when looking at price to operating cash flow ratios, and three of the five are cheaper when it comes to the EV approach to EBITDA.

| company | price/yield | Price/Operating Cash Flow | Enterprise value/interest, tax, depreciation and advance profit |

| arc best | 17.1 | 11.4 | 8.8 |

| Martin Transport (MRTN) | 22.1 | 9.5 | 9.2 |

| WERN Enterprises (WERN) | 22.7 | 5.7 | 7.8 |

| Heartland Express (HTLD) | 69.3 | 5.5 | 6.6 |

| XPO Corporation (XPO) | 74.8 | 20.8 | 19.7 |

| Universal Logistics Holdings (ULH) | 9.6 | 3.2 | 6.1 |

take away

ArcBest may be struggling to some degree from an operating perspective, but the company’s bottom line has improved. The stock looks quite attractive on an absolute basis, although relative to similar companies it’s probably around fair value or slightly higher. I do like to see the longer-term initiatives management is making, such as asset purchases and capital allocation from organic means. When you combine all these items together, it gets quite complicated. One thing I’ve learned about investing is that if something isn’t an obviously attractive prospect, it’s probably best to take a more cautious approach.