Afternoon pictures

Four years ago, the market was in absolute free fall. Markets are already feeling the reality of the pandemic’s human impact, with global stock markets falling by multiple percentage points every trading day. As markets do, the discounting effect occurs through: However, in late March 2020.

Even though the worst toll from COVID-19 is months away, stocks are bottoming out. From this perspective, analyzing ETF performance charts may seem cliché, but people’s financial lives were also at stake at the time. Now, with U.S. stocks hitting record highs and foreign stocks hitting their highest levels since April 2022, times feel very different for investors.

Today, I take another look at the WisdomTree U.S. High Dividend Fund ETF (NYSE:DHS).I have had a Buy rating on this factor ETF for several quarters, and I assert that I am holding on This is still a solid move. While U.S. stocks overall have underperformed since the start of last year, their valuations and prime yields remain compelling factors. However, I will highlight one problematic point on the chart.

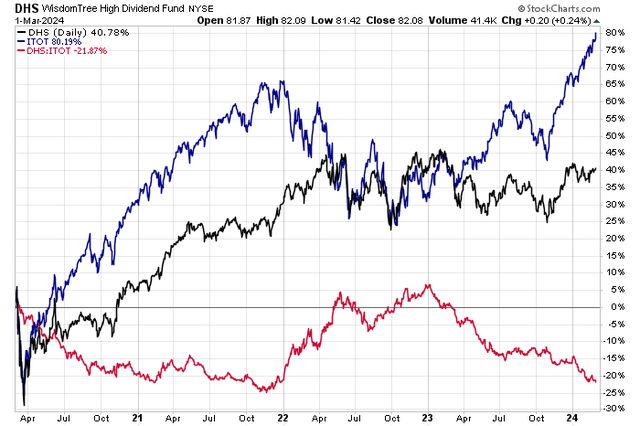

DHS: Lower relative returns since early 2023 as large caps outperform, near relative support

Stockcharts.com

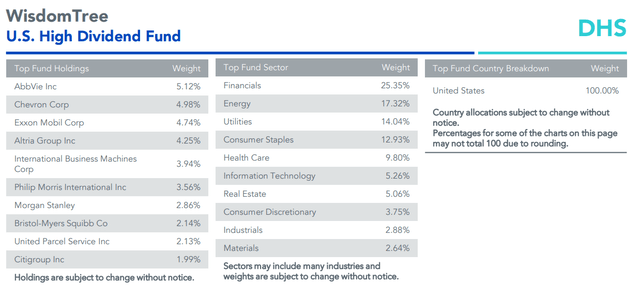

For background and basis wisdom TreeThe Department of Homeland Security seeks to track the investment results of high-dividend-yielding companies in the U.S. stock market. Investors can use this ETF to invest in domestic stocks of high-yield companies of different market capitalizations in a targeted manner. The fund can also be used in alternative value strategies to achieve the dual needs of growth potential and income returns.

DHS is a small fund with only $1.1 billion in assets under management as of March 1, 2024. It pays a trailing 12-month dividend yield of 4.3%, and the ETF has a low to mid-range annual expense ratio of 0.38%. Share price momentum has been lackluster of late, but I think DHS could emerge as a high-dividend winner in the category as sentiment shifts from strictly favoring large-cap stocks to other sized companies. Seeking Alpha’s risk rating is on the soft side at C+, but liquidity metrics are healthy given the ETF’s historical volume conditions and a low median 30-day bid/ask spread of four basis points.

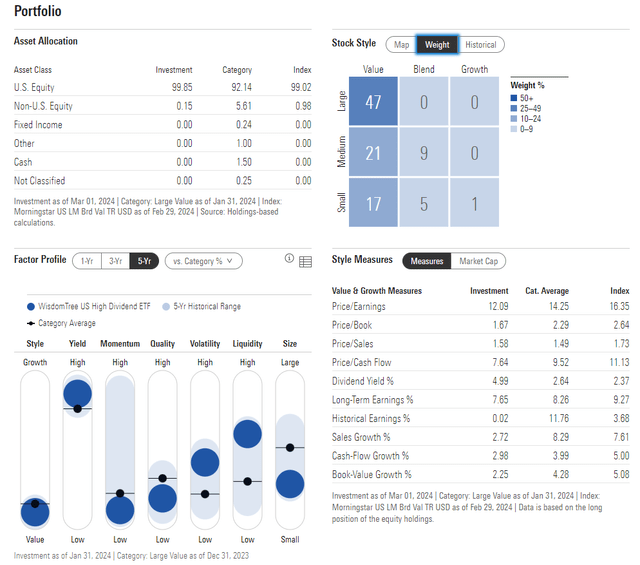

What sets DHS apart from other domestic high dividend ETFs is that this fund has ample SMID cap exposure. Morningstar’s three-star Bronze-rated portfolio is allocated just 47% to large-cap stocks, with 30% in U.S. mid-cap stocks and 23% in small-cap stocks.

DHS: Portfolio and Factor Overview

Morningstar Corporation

Given the strength of the largest U.S. stocks in recent months, its performance has lagged some of its high-dividend ETF peers, such as the Vanguard High Dividend Yield ETF (VYM) and the Schwab U.S. Dividend Stocks ETF (SCHD). However, all three funds are value-oriented rather than growth-oriented. If market performance continues to expand as 2024 approaches, DHS and its peers could become attractive places to allocate capital.

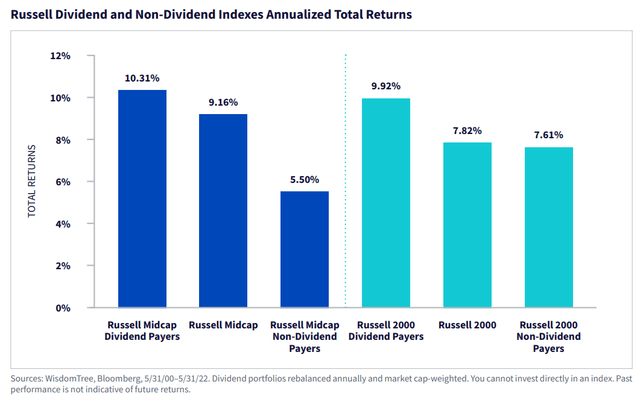

I assert that once underperforming SMID stocks may lead the way as bull participation expands. This will be a boon for DHS, considering its weighted average market cap is in the mid-cap portion of the style box. As the chart below shows, mid-cap dividend stocks have delivered strong returns since 2000, outperforming Russell mid-cap non-dividend-paying stocks, according to WisdomTree.

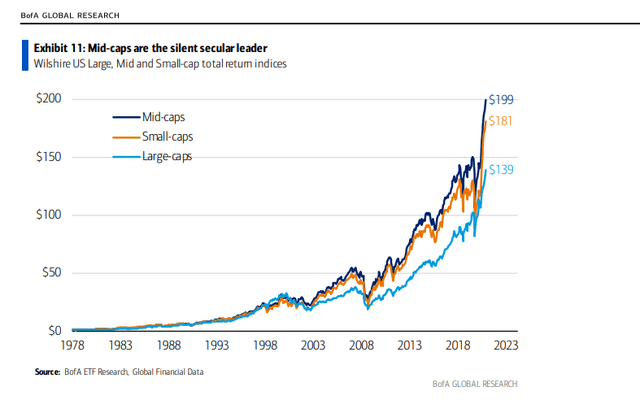

Looking at the bigger picture, mid-cap stocks have generated alpha compared to the Russell 2000 small-cap index. As much as I like to say, investors should stop ignoring mid-caps – historically there’s always been a big versus small debate on financial TV when mid-caps have outperformed.

Russell Midcap Dividend Payers Have Outperformed Since 2000

wisdom Tree

Mid-cap stocks generate the best long-term returns

Bank of America Global Research

Digging deeper into the portfolio, DHS has a whopping 25% weighting in the cyclical financials sector. With this market segment breaking new highs since early 2022, there’s reason to think the momentum in the value space may be here to stay. Additionally, last week’s rise in oil prices to $80 (a four-month high) could benefit the Department of Homeland Security (DHS)’s 17% high in the energy sector.

On a less optimistic note, utilities are the worst-performing sector so far this year, and DHS is certainly hurt by its nearly 10 percentage point overweight in this rate-sensitive sector. Tech stocks make up only 5% of DHS, so they will trend very differently than the S&P 500 or even other high-dividend funds. Overall, DHS currently trades at just 12.3 times forward earnings. Compare that to the S&P 500’s high estimated P/E ratio of 20+.

Department of Homeland Security: Increased holdings in finance, energy, and utilities

wisdom Tree

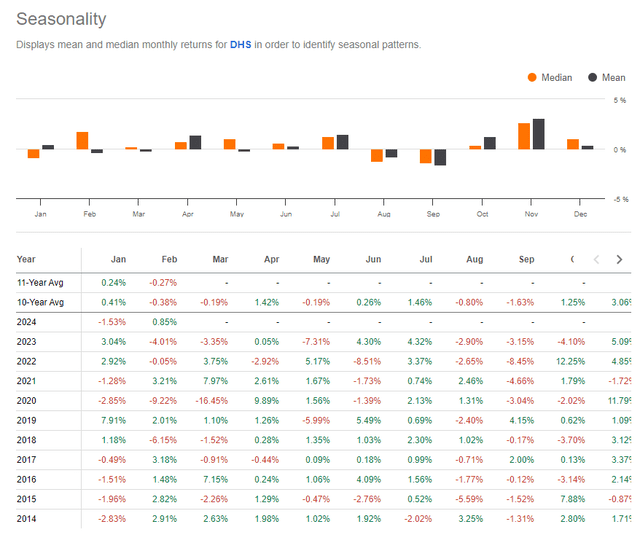

From a seasonality perspective, DHS tends to release mixed returns in the coming months. Returns between March and May have been essentially flat over the past decade, with most of the fund’s total returns not being realized until the fourth quarter.

DHS: Seasonal trends mixed in second quarter

Seeking Alpha

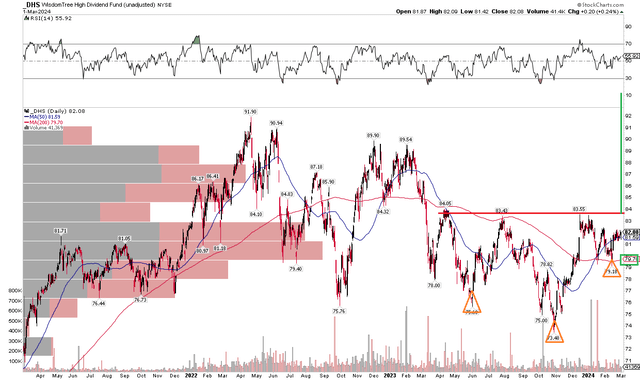

Technical points

DHS’s technical chart faces challenges amid low valuations and high yields as market trends may shift toward cyclical stocks. Note that the key resistance levels in the chart below are in the $83 to $84 range. I’d like to see the fund break above that polarity point. If it does, it will trigger a bullish inverse head and shoulders reversal pattern. Based on the height from the head ($73.48) to the neckline (nearly $84), increase the price target to approximately $94 (all-time high) and add that range to the top of the neckline.

Currently, the trend for DHS remains a battle between bulls and bears as the 200-day moving average remains flat. Additionally, the RSI momentum indicator at the top of the chart shows moderate price strength of late. Finally, with heavy volume and prices as high as $90, a continued rise is possible, but the onus will be on the bulls to address the massive indirect supply issues.

Overall, DHS faces technical issues due to significantly negative alpha compared to the broader market and some high-dividend ETF peers.

DHS: Key resistance near $84, bullish head and shoulders bottom pattern in play

Stockcharts.com

bottom line

I reiterate my Buy rating on DHS. Currently trading at just 12 times forward earnings and with a heavy portfolio holdings of value and cyclical stocks, the fund could be a good place to allocate as the large-cap shift continues.