FG Trade Latin

Continuing Education Fund Overview

Sprott Physical Gold and Silver Trust (NYSE:CEF) is a closed-end fund that invests in gold and silver. The metals are all allocated to and held at the Royal Canadian Mint.Typically, the mix is approx. 2/3 is gold and 1/3 is silver.

I first covered CEF here about a year ago, and it’s a great starting point for those unfamiliar with the fund. Key facts include a MER of 0.49% and a redemption feature that allows exchange for physical assets. Exchange functionality helps CEFs be less likely to trade at a significant discount to net asset value like other closed-end funds. However, currently, CEF has a modest discount of 5%. I think this discount, along with the features mentioned, is an attractive way to gain exposure to gold and silver.

Gold and silver underperform in 2023, market sentiment in 2024

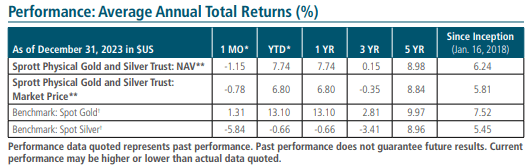

I was bullish on CEF this time last year, but it has only gained a few percentage points since writing at that time. Over the last year, precious metals have lacked the impetus of the Federal Reserve to cut interest rates and failed to break through new higher ranges.

The industry started promisingly last year. While silver is essentially flat, gold still has good returns in 2023.

CEF fact sheet on the Sprott home page

Last year, investors’ attention was entirely focused on the S&P 500, Nasdaq, and Bitcoin’s massive returns.

Now we may be approaching the Fed’s rate-cutting cycle. Gold prices hit new highs despite uncertainty. At the same time, there has been little fanfare about it. This means there is plenty of room for investors who were underweight precious metals to suddenly become active buyers.

Let’s examine a number of signals that suggest very low interest in the sector, setting up a bullish pattern when this eventually changes. This is an unusual situation given that gold just hit an all-time high.

The U.S. stock market is the only game in town

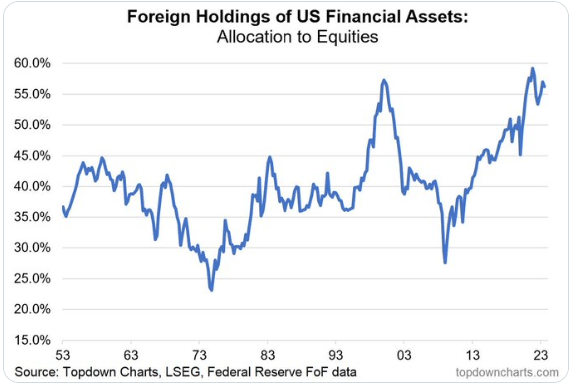

It’s hard for precious metals to win over investors when global funds are so focused on performance risk and exposure to U.S. equities.

Top-down chart, LSEG, Fed FoF data

The last time foreign investor allocations to U.S. stocks reached such extreme levels was during the start of a decade-long bull cycle in precious metals.

Can Bitcoin surpass gold?

Another asset that has once again caught the attention of investors and hit record highs last year is Bitcoin.

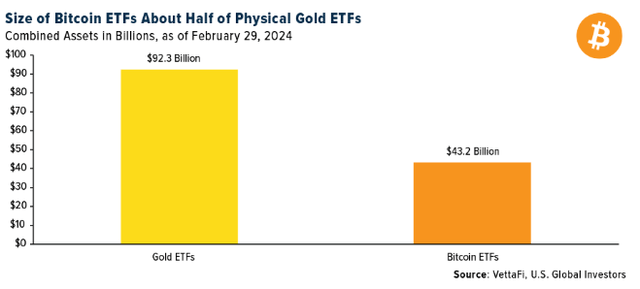

It has long been compared to gold, and the amount of flows it has captured in recent years is staggering.

Last month, the trend reached fever pitch.Despite just getting started this year, U.S. Bitcoin ETFs have already reached Half of Physical Gold ETFs In the U.S.

VettaFi, American Global Investors

One can only imagine that if flows to Bitcoin cool down to some degree soon, we could see a potential shift in gold ETF flows.

Although gold prices are currently hitting new highs, Capital outflows continue at the beginning of 2024. The World Gold Council reports that “Global gold ETFs kick off 2024 with capital outflows in eighth month, led by North American funds”.

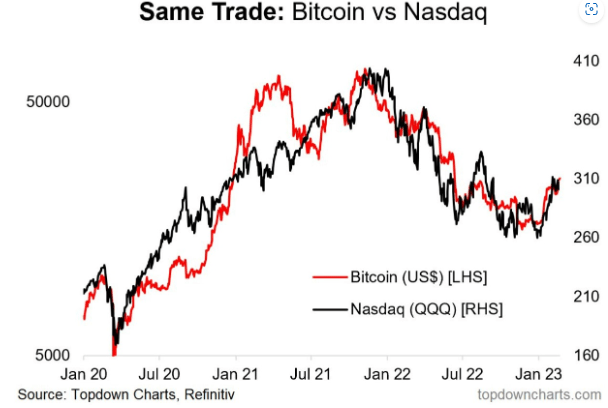

Of course, Bitcoin bulls may believe that this relative liquidity trend will continue. I don’t want this article to be entirely a gold vs. Bitcoin debate, I just want to point out Bitcoin’s correlation with the Nasdaq in recent years.

Top-down chart, Refinitiv

For investors who are wary of the future of the Nasdaq, CEFs may be a better fit for the portfolio right now.

Gold holdings are collapsing

Further evidence of the lack of bullish sentiment in precious metals is Gold holdings have plummeted dropped to its lowest level in more than five years.

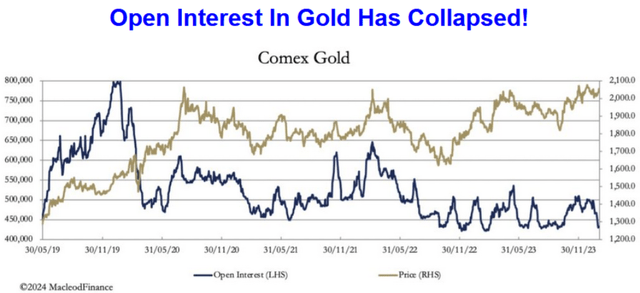

MacLeod Finance

The significance of the chart above is that this is the first time since gold hit the $2,000 level in 2020 that open interest has fallen to such low levels. To quote the above article, “Yesterday’s preliminary figure was 412,506 contracts, the lowest in four years. In fact, this is the lowest level since December 2018, when gold prices fell below $1,200.The level of disinterest today is similar to that then, before the 20-month bull market phase that pushed the price to $2,074”.

Silver market sentiment is weaker than gold

In recent years, silver prices have continued to lag behind gold prices. If gold can attract more headlines about consolidating its new highs well above $2,000 levels, then this should draw more attention to silver.

almost One-third allocated to silver CEFs CEF holdings make them an efficient way for investors to obtain appropriate exposure to gold and silver.

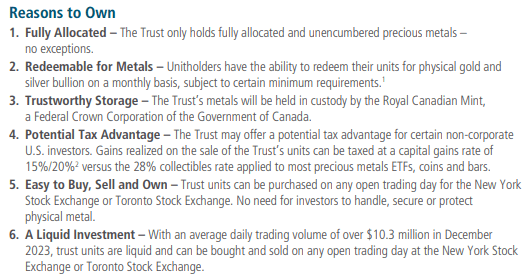

To elaborate on this, I encourage readers to refer to Latest CEF Fact Sheetwhich lists valid reasons for owning it.

Here’s a quick summary:

CEF fact sheet on the Sprott home page

Will silver be cheap in 2024?

Silver appears poised to return to its historical relationship with gold prices, which means silver is cheap in comparison.

It is not difficult to imagine that the gold/silver ratio will move towards the 65 area as shown in the chart below. This means that with gold prices unchanged, silver prices will be about 40% higher than current levels.

goldprice.org/gold-price-charts/all-data-gold-silver-ratio-history

Of course, one could simply invest in silver only and hope for even greater upside potential. However, there is no guarantee that the relationship will recover, and getting the timing right can be challenging. Gold and silver also have a variety of different drivers of price movement; therefore, I think CEFs are a good balance for a portfolio.

Silver Price Outlook 2024

This article gives a reasonable explanation Silver Underperforms Gold in 2023. Despite other headwinds, central bank buying was more prominent in supporting gold prices last year.

Nonetheless, I think it is prudent to retain some silver exposure in a portfolio. As mentioned in the above article, the long-term demand/supply dynamics still look favorable. Another factor worth noting in this article is how silver has suddenly surged and outperformed gold in certain circumstances. to quote,”Because silver trades a thin market, its price can and does rise or fall by a greater percentage than gold.Therefore, if any major world disaster were to occur, demand for physical silver denominated in bullion would surge almost immediately – as we saw early in the pandemic in 2020 and again in March 2023”.

Therefore, I think silver is a great risk/reward portfolio diversifier in an increasingly uncertain world.

Signs of lack of interest in precious metals from other investors

Finally, some other quick observations about the bullish setup in precious metals. That said, people don’t typically get excited about an asset class breaking new highs.

- Gold stock prices remain extremely depressed compared to the underlying price of gold.

- it is Central bank purchases of gold in 2023 And not the typical investor, as inflows into gold ETFs remain weak.

- stories around Gold demand from investors outside the West Still positive, but generating little interest from other local media.

- I don’t think other recent accumulators have gotten a lot of attention.I mean for example Druckenmiller bets on two of the biggest gold producersand plans Elliot Management Company Find mining assets worth over $1 billion including precious metals.

- CEF trades at a 5% discount to NAV, and history shows it can trade at NAV during bull markets in precious metals where sentiment is strong.

CEF risk

My optimism here may be wrong, and may well be similar to the situation in my last article on CEF almost a year ago.

What happened thereafter could be described as a “soft landing” or “Goldilocks” economic scenario for financial markets. If this sentiment persists, as it did last time I covered CEF, there will likely be better gains elsewhere in other asset classes.

The difference from then, however, is that many “risk” assets, such as U.S. stocks and Bitcoin, have outperformed. It can be said that such outstanding performance is partly due to the expectation of such a soft landing.

If the U.S. economy lives up to those expectations, there could easily be some disappointment if the Fed doesn’t cut interest rates as the market hopes.

In this case, we may also see a weakness in CEF, but it may not be as vulnerable. Its gains have been nowhere near as high as those of other assets grabbing all the media attention. Gold now looks more resilient, supported by safe-haven buying, particularly from overseas central banks.

in conclusion

Big U.S. tech stocks and Bitcoin hit all-time highs, grabbing all the attention. Gold is “quietly” doing this, and silver has a lot of potential to follow. As this story attracts more headlines, CEF remains an attractive buying opportunity to capture further gains in gold and silver prices in 2024.

FOMO investing is already playing out in other asset classes, and it’s possible to see it in gold and silver in the future. If so, it seems there are plenty of investors on the sidelines who could soon become future buyers of the precious metal.