Pingpingz

investment thesis

Nutanix (NASDAQ:NTNX) simplifies workload management and enables smooth transition between on-premises and public cloud environments through its Nutanix cloud platform.

The business has a strong balance sheet and is essentially net neutral (meaning its position Cash and debt levels cancel each other out).after its financial Second Quarter 2024 ResultsI now update my near-term forecasts and demonstrate that despite a CAGR of around 10%, the business is still priced at just 21x forward free cash flow.

Therefore, I continue to be bullish on Nutanix.

quick review

Back in November, I said in my bullish analysis,

Nutanix is priced at about 23 times next year’s fiscal 2025 free cash flow, which ends in July 2025.If we assume, as I do, that Nutanix could grow at around 11% to 14% CAGR over the next year, that would be a very reasonable entry point for new investors to this name.

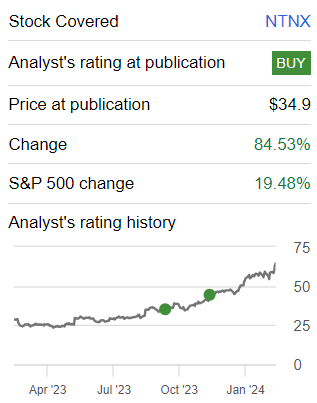

Author’s work on NTNX

As you can see above, Nutanix has gained over 80% since I recommended the stock. Going forward, I continue to believe this stock is reasonably priced and worthy of consideration.

Nutanix’s near-term prospects

Nutanix provides enterprise cloud solutions, the Nutanix Cloud Platform, enabling organizations to adopt a consistent cloud operating model. Initially focused on hyperconverged infrastructure, Nutanix has transformed into a software-centric company offering comprehensive hybrid cloud solutions.

Their platform simplifies workload management, supports diverse applications, and facilitates smooth transitions between on-premises and public cloud environments.

Next, Nutanix’s commitment to a hybrid multi-cloud operating model, coupled with its focus on digital transformation and infrastructure modernization, resonates well with enterprises prioritizing these initiatives.

Recent customer wins include a global automotive technology provider in EMEA, a North American hedge fund and a global airline in EMEA, all demonstrating the tangible value Nutanix brings to diverse industries.

While Nutanix is poised for growth, it’s worth noting that it’s not immune to challenges. Nutanix acknowledged the lengthening of average sales cycles, something many tech companies have reported recently.

Additionally, while Nutanix’s GPT in-a-Box product has generated interest and wins, Nutanix reminds investors that it’s still early days and volumes are still relatively small. Indeed, while the potential for generative AI solutions is exciting in the long term, their near-term adoption will take more time.

With this background in mind, let’s now delve into the basics of Nutanix.

Nutanix’s CAGR steady in the mid-teens

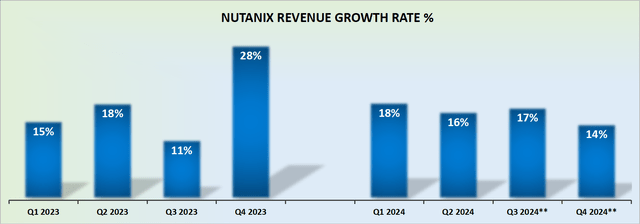

NTNX revenue growth rate

Nutanix is in its mid-teens growth phase. For many investors, this is a very attractive growth rate. In fact, this is a company that can continue to grow at high-teens CAGR over a long period of time.

This is slow enough that it doesn’t require heroism every season, but fast enough that it still provides a pretty attractive growth rate.

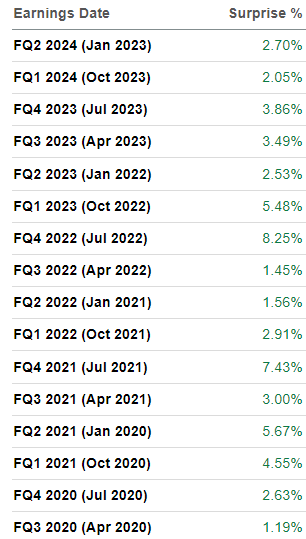

Additionally, consider the table below.

AT Premium

What you see above is a company with a long history that has slightly topped Wall Street estimates by about 2% in almost all of its recent quarters. In other words, this is a well-managed company that’s growing at a decent rate, but most importantly, it knows how to manage analyst expectations.

Furthermore, given that Nutanix’s expected revenue has reached approximately $2.5 billion, the company is considered large enough and stable, yet still growing at a fair rate, to interest most investors.

Having said that, this isn’t even where the bull cases are found. We discuss this aspect next.

NTNX stock valuation — 21x forward free cash flow

Nutanix’s free cash flow margin just reached 29% in the second fiscal quarter of 2024. Yes, that’s slightly higher than the 26% free cash flow reported last quarter, so investors aren’t necessarily expecting Nutanix to deliver a “new baseline” of free cash flow margins in fiscal Q2 2024, but this still shows What Nutanix can deliver in a timely manner.

In fact, I think Nutanix has the potential to achieve 30% free cash flow margins as a leader over the next 12 months.

Note that this is well above Nutanix itself’s current guidance, which targets a free cash flow margin of 22% for fiscal 2024.

But my point is, that has nothing to do with Nutanix’s current guidance. Nutanix’s numbers are undoubtedly conservative. But consider Nutanix’s capabilities in terms of delivery times.

Therefore, I think Nutanix will deliver about $750 million in free cash flow at the forward run rate at some point over the next 12 months.

That leaves Nutanix priced at 21 times forward free cash flow. The valuation is very reasonable for what is being offered.

bottom line

Overall, my bullish stance on Nutanix remains strong, driven by its proficient handling of workload management and attractive valuation.

Its financial report for the second quarter of 2024 showed a strong free cash flow margin of 29%, highlighting its financial strength. Although Nutanix’s compound annual growth rate remains around 10%, it’s priced at an attractive 21x forward free cash flow.

Nutanix’s strategic wins and commitment to a hybrid multi-cloud model position it for continued growth despite challenges such as extended sales cycles and early AI adoption.

I reiterate my bullish recommendation on this stock.