Benjamin Narbiach

There are many investors trying to beat the market, and while there’s nothing wrong with that goal, it’s important to remember that investing is a marathon, not a sprint.

This means persisting own investment goals, rather than always and continuously monitoring the performance of your portfolio compared to market indexes, which can lead to unconstructive emotions such as FOMO, YOLO, and everything in between.

At the same time, investors don’t have to chase market trends and can get a lot of value and returns from off-grid names that aren’t part of the tech industry. This brings me to the Blackstone Guaranteed Loan Fund (NYSE:BXSL), I last reported in November, highlighting its good dividend payments and conservatively managed portfolio.

Since then, BXSL has performed well for investors, rising 4.8% for a total return including dividends of 7.7% It continues to show growing fundamentals since my last article. In this article, I’ll take a fresh look at the stock, provide a key update, and discuss why it remains a solid choice for high income and potentially strong returns, so let’s get started!

Why choose BXSL?

The Blackstone Secured Loan Fund is an externally managed BDC of private asset management giant Blackstone (BX), which had more than $1 trillion in AUM at the end of 2023.

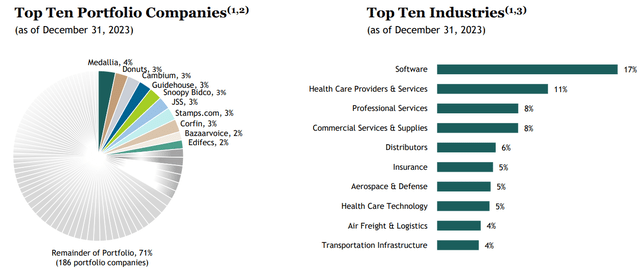

BXSL has a large investment portfolio with a fair value of US$9.9 billion spread across 196 companies. Its investment portfolio is well diversified across technology and defense industries, with no single investment accounting for more than 4% of the total portfolio. As shown below, software, healthcare and business services make up BXSL’s three major industries, accounting for 36% of the total investment portfolio.

Investor introduction

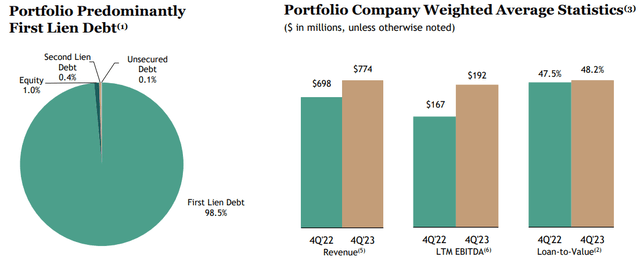

BXSL also emphasizes portfolio safety, with 98.5% of its investments in first lien senior secured debt, its portfolio companies have a conservative average loan-to-value ratio of 48%, and it benefits from higher interest rates as 99% of its investments are in debt Adopt floating interest rates.

Additionally, BXSL’s portfolio companies have solid financial performance, with LTV growing at only a modest 70 basis points year-on-year, while revenue and EBITDA grew strongly at 11% and 15% respectively, as shown below.

Investor introduction

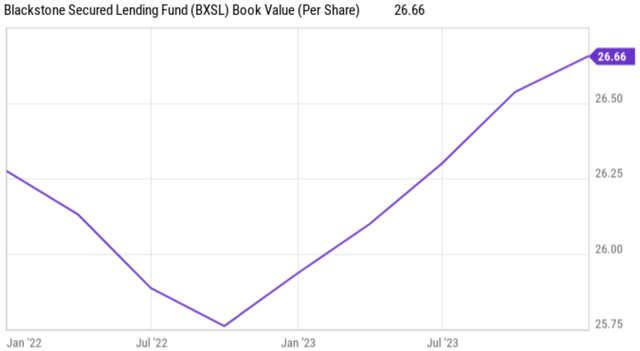

At the same time, BXSL itself also demonstrated solid operating fundamentals, with NII per share growing 1% month-on-month to $0.96, and the annualized return on equity being 14.5%. BXSL also showed good net worth per share performance, up $0.12 quarter-over-quarter to $26.66, primarily due to NII of $0.96 per share before the aforementioned regular dividend of $0.77, leaving BXSL with retained capital. As shown below, this leaves BXSL’s NAV/share price more than 1% higher than its IPO levels in early 2022.

Y chart

Importantly, BXSL’s credit performance remains strong, with minimum non-accrual rates below 0.1% at both cost and fair value, making it the lowest among publicly traded BDC peers, and only 1.5% of BXSL’s debt investments % are rated below this level. 90% of cost basis.

Going forward, BXSL is well-positioned to expand its portfolio, has a strong balance sheet, and has BBB-/Baa3 credit ratings from Standard & Poor’s and Moody’s. This is supported by $1.8 billion of available liquidity and a debt-to-equity ratio of 1.0x, well below the BDC’s statutory limit of 2.0x. It also helps that the current share price represents an 11% premium to net asset value per share, making accretive equity financing an alternative source of funding for deals other than debt.

Since the start of Q1 2024, BXSL has continued to conduct conservatively positioned financings, with first lien senior secured debt accounting for more than 98% of new financings and an average loan-to-value ratio of 41.5%, well below the 48% portfolio average noted above value. BXSL also sees healthy investment spreads on these investments, with its debt cost spread reaching 580 basis points.

Going forward, BXSL is expected to benefit from a reawakening of private equity deal volumes following the industry slowdown in 2023. Private equity dry powder reached record levels last year following strong M&A deal volume and, as noted on a recent conference call, “big brother” Blackstone’s growing pipeline:

From a market activity perspective, we see strength building, with M&A volume increasing by nearly $400 billion in the fourth quarter, up 40% year over year. We expect M&A activity to continue to increase and accelerate in 2024. Our ongoing conversations with the top financial sponsors we cover and the sell-side advisors we work with support this view.

M&A activity is expected to be driven primarily by record levels of private equity dry powder accumulation, large unsold assets held by sponsors, older legacy funds, and lower M&A activity in 2023 (54% lower than 2023). The most recent peak occurred in 2021. This expected market activity can be sustained by the prospect of lower interest rates and a continued narrowing of the bid-ask spread between buyers and sellers.

Additionally, the number of deals in Blackstone’s credit and insurance pipeline at the end of the fourth quarter doubled from the end of the first quarter. These pipeline transactions primarily represent first-lien senior secured exposures to companies and historically recession-resilient industries that we know very well.

Risks to BXSL include uncertainty about the trajectory of the economy this year, with some market observers such as JPMorgan Chase & Co.’s (JPM) chief executive saying the clear expectation is too high The economy will have a soft landing this year.

Additionally, lower interest rates could put pressure on NII/equity growth as it would reduce the fees BXSL charges borrowers on most of its floating rate debt investments. Investors should also keep in mind that as an externally managed BDC, management compensation is largely dependent on the volume of assets under management, which could lead to conflicts of interest with shareholders who should place undue emphasis on portfolio performance.

Importantly for dividend investors, BXSL currently yields an attractive 10.4% and the dividend is well protected with NII of 125% with dividend coverage, resulting in significant retained capital to grow NAV and provide Opportunistic investments provide funding. It’s worth noting that the current dividend yield is 10% higher than this time last year.

Taking all of the above into consideration, I still think the BXSL has value at its current price of $29.65. While BXSL’s share price trades at an 11% premium to NAV, it’s not necessarily cheap as an externally managed BDC, but given its 10.4% dividend yield and trading at a premium, it’s fairly obvious that BXSL is operating quite efficiently. Furthermore, looking at its forward price-to-earnings ratio of 7.7, BXSL doesn’t appear to be that expensive, especially if it can maintain current levels of profitability through its conservatively managed portfolio and low non-accrual interest rates.

Important points for investors

Overall, BXSL continues to demonstrate solid operating fundamentals and credit performance, making it an attractive investment option in the BDC space. With a strong balance sheet and high liquidity, the company is well-positioned for future growth opportunities, especially given the catalysts from big brother Blackstone’s pipeline. Additionally, BXSL’s 10.4% dividend yield and conservative investment structure make it a promising choice for dividend investors. Therefore, I believe BXSL is worth trading at a premium to its NAV, thereby enabling accretive equity financing. I maintain my “Buy” rating on BXSL.