grid cube

Baidu Stock (NASDAQ: BaiduThe company is trading near a one-year low even though it reported fiscal fourth-quarter profit last week that was much better than expected.Baidu continues to benefit from mid-single-digit revenue growth, free cash flow and Its most important profitability metrics – operating income and free cash flow – are growing at double-digit rates. Given Baidu’s AI potential by integrating AI capabilities into its search and cloud platforms, I still think China’s large-cap P/F ratios are too low. Although the market is now paying more attention to Alphabet (Google) — Baidu’s U.S. equivalent — and others Hot artificial intelligence gamessuch as NVIDIA (NVDA), I believe Baidu has attractive long-term re-rating potential!

Previous rating

I rate Baidu’s stock a Strong Buy after it reports third-quarter 2023 earnings – 3 Reasons to buy this growth stock ——Due to the recovery of digital marketing business and the improvement of the monetization ability of its streaming service iQiyi. In my opinion, Baidu is still seriously mispriced, and investors have not yet recognized Baidu’s core investment value: strong free cash flow. The technology company’s strong free cash flow growth and margin expansion could ultimately support a share price re-rating.

Baidu earnings per share beat expectations

Baidu’s fourth-quarter results were better than expected, but its stock price fell 8% after the earnings report was released. Baidu reported adjusted earnings per share of $3.04, $0.53 per share higher than expected, on revenue of $4.86B. However, revenue missed consensus forecasts by $19 million.

Seeking Alpha

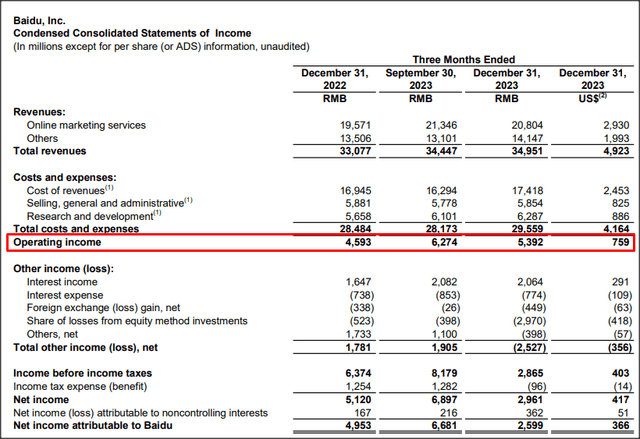

The most striking point in Baidu’s fourth-quarter financial report is that although revenue grew by mid-single digits (6%) in the fourth quarter of 2023, the company’s profits grew much faster than revenue. This is Due to the revival of digital marketing business and focus on cost control.

Baidu’s operating income in 4Q23 increased 17% year-on-year to RMB 540 million (USD 759 million)…which means that the company’s operating income is growing at almost three times the rate of Baidu’s revenue growth.

Baidu

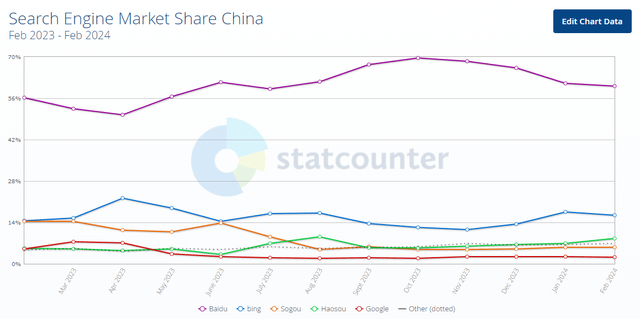

The real takeaway for investors is that the company is building on its free cash flow strength. As is the case with Alibaba (BABA) – where Jack Ma and Joe Tsai are teaching the market a lesson – Baidu has huge free cash flow profitability… as one would expect from a company with the largest online search engine in China The market share is 60% (as of February 2024).

Statistics counter

Baidu is also seeing solid free cash flow growth, and I definitely see the company returning more free cash flow to shareholders in the future as the company realizes its artificial intelligence potential. Baidu continues to invest in its artificial intelligence capabilities: CEO Robin Li said the company achieved a “monetization breakthrough” in the fourth quarter for its AI chatbot Ernie.

The AI company may double down on its efforts to monetize its own AI product, which it launched shortly after ChatGPT took the market by storm last year. Ernie is being integrated into Baidu’s search results, potentially improving conversion rates for marketers on the company’s main advertising platform. I believe that generative AI applications are the biggest lever for Baidu’s revenue and free cash flow growth in fiscal 2024 and beyond: For example, in the fourth quarter, Baidu launched a paid version of its Ernie AI-powered chatbot, priced at 59.9 Chinese yuan ($8.30) per month. Growing product usage and the scale of Baidu’s AI applications could become important catalysts, not only for the company’s revenue growth but also for its share price re-rating.

Baidu remains the most popular search engine in China, which obviously gives the tech company huge leverage in implementing its artificial intelligence products. Going forward, I expect the company to expand its AI solutions in its search and cloud businesses, which could be an incremental driver of free cash flow growth.

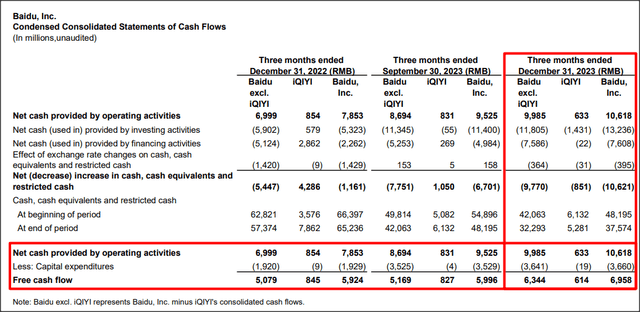

Baidu generated RMB 700 million (USD 980 million) in free cash flow in 4Q23, up 18% year-on-year. Like the company’s operating income, Baidu’s free cash flow grew at about three times the rate of revenue in the fourth quarter. Baidu’s full-year free cash flow was 25.4B yuan ($3.6B), an increase of 42% compared with the same period last year. As I discussed in my previous article on Baidu, this growth is driven by a resurgence in the digital advertising market and a strict focus on expense control. As a result, Baidu’s free cash flow margin has also improved: the technology company’s free cash flow margin was 20% in the fourth quarter of 2023 and 19% in fiscal 2023. In the same period last year, Baidu’s free cash flow margin was 18% (Q4’23) and 14% (FY2022).

Baidu

Highest free cash flow value, reasons for underestimation

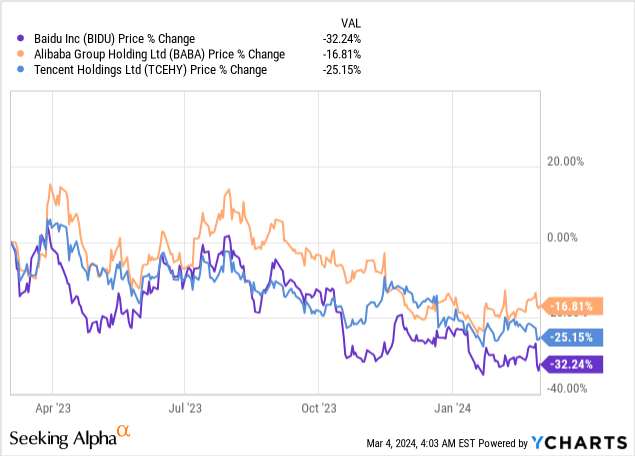

U.S. investors are deeply disappointed with the CCP’s interference in the affairs of large technology companies starting in 2020. Baidu, Alibaba (BABA) and Tencent (OTCPK:TCEHY) have all been subject to intervention by Beijing regulators, severely affecting investor sentiment. These interventions are weighing on the valuations not just of Baidu but of all major Chinese big tech companies.

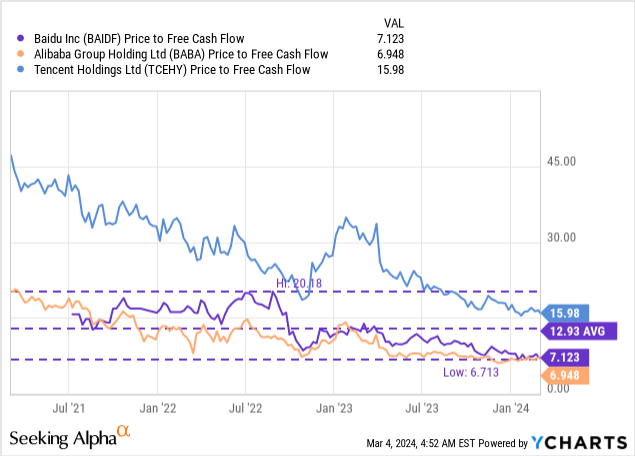

Baidu’s current price-to-earnings/free cash flow ratio is 7.1 times, while Alibaba’s is 6.9 times and Tencent’s is 16.0 times. From a valuation perspective, Baidu and Alibaba are very attractive options for long-term investors, especially those whose primary focus is the company’s ability to convert revenue into actual free cash flow. Baidu is still overly focused on its digital marketing activities, but in the long term, I believe the company will become more of an AI company, integrating AI capabilities into its core search and cloud businesses and generating revenue through AI paid services Incremental revenue growth, like Ernie Premium.

Baidu’s average P/E/FCF ratio over the past three years has been 12.9x, which means investors are getting a 45% discount today. This discount is likely due to two factors: 1) deteriorating investor sentiment towards China’s large-cap stocks (due to government intervention), and 2) a slowdown in the advertising market that also affects Chinese corporate spending in 2023. I believe Baidu could rerate to a P/FCF valuation range of 12-13x given its strength in free cash flow and AI fantasy, implying a fair value range of $175-$190 per share.

Baidu’s risks

In my opinion, Baidu’s biggest risk relates to the effectiveness and relevance of the artificial intelligence capabilities it develops. Artificial intelligence is a powerful tool, and many companies are developing their own chatbots to serve customers, increase advertiser conversion rates, and improve marketing results. Therefore, I think the search engine market is likely to become more competitive in the future, favoring those platforms that develop and deploy the most effective AI technologies. If Baidu misses the AI race, the company’s core asset, its largest digital advertising platform, could become less valuable.

final thoughts

Baidu released a strong fourth-quarter financial report last week, with revenue achieving mid-single-digit growth and KPIs such as operating income and free cash flow achieving double-digit growth. Baidu has solid earnings and, in my opinion, is valued just right given the free cash flow the company generates. The reason for the P/FCF discount is that the market currently doesn’t care much about Chinese large-cap stocks, and investors don’t really trust Chinese companies…all of which suppress Baidu’s valuation factors. However, long-term investors interested in buying shares of a large, well-run Chinese tech company with huge AI monetization opportunities might consider taking a small position in Baidu!